How Fractional Ownership via Real Estate Tokenization Unlocks Global Property Investment

Imagine being able to invest in a slice of a luxury Miami condo or a bustling Bangkok office tower, all from your laptop and with as little as $50. This is not some distant vision – it’s happening now, thanks to fractional real estate ownership powered by blockchain tokenization. The commercial real estate sector is finally embracing this technology, opening doors for global investors like never before.

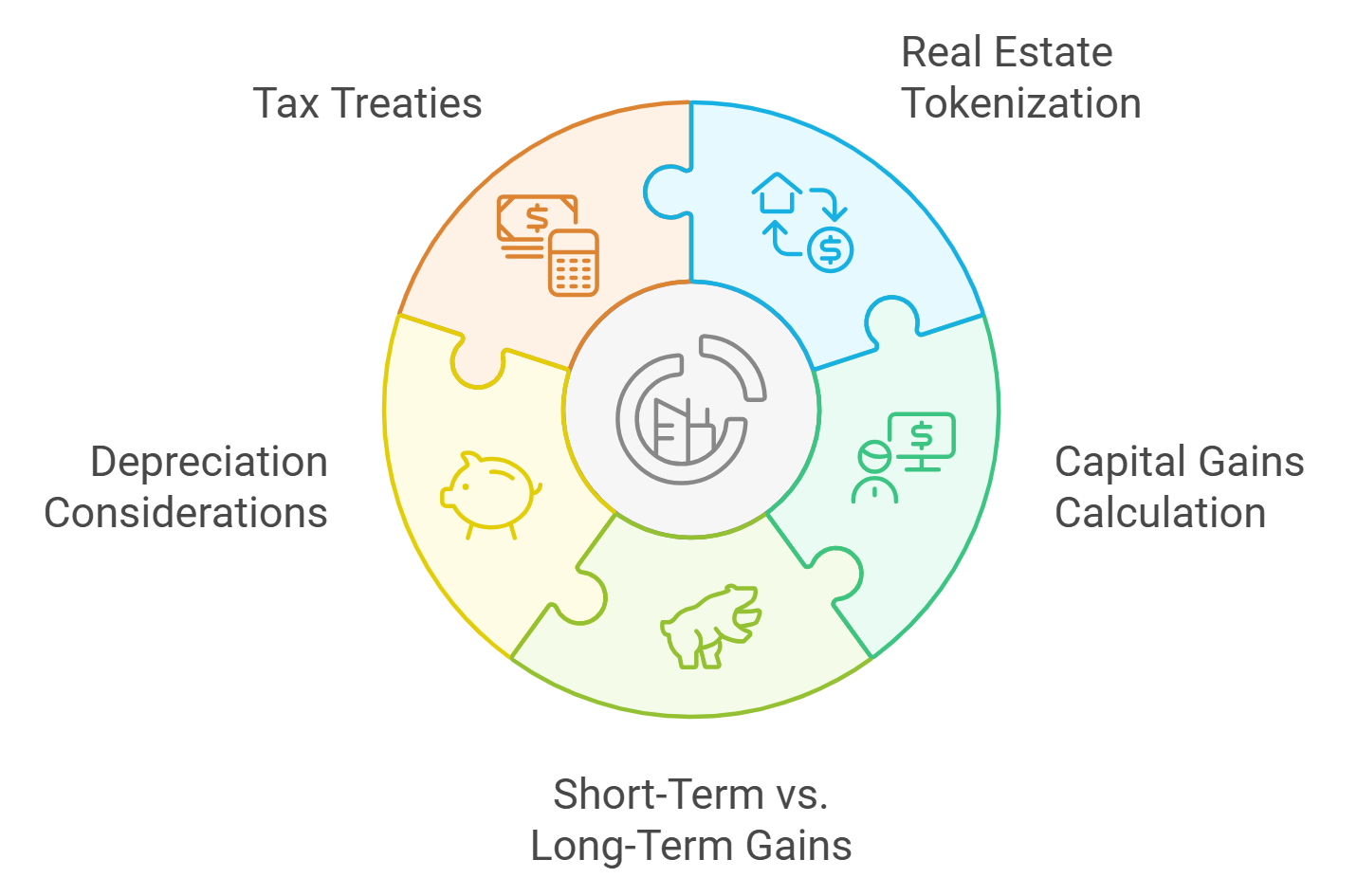

What Is Real Estate Tokenization?

At its core, real estate tokenization transforms property ownership rights into digital tokens on a blockchain. Each token represents a fraction of the underlying asset – whether that’s an apartment building in New York or an office park in Singapore. This process enables fractional ownership, allowing investors to buy, sell, and trade small shares of high-value properties without the traditional barriers of paperwork, geography, or massive capital requirements.

The impact? Real-world assets become as easy to trade as stocks or crypto. For instance, platforms like RealT have already tokenized over 700 properties valued at more than $130 million, letting investors earn daily rental income distributions in stablecoins. And this is just the beginning – from the US and Europe to Asia, adoption is accelerating with compliant frameworks and growing institutional interest.

The Power of Fractional Ownership: Lower Barriers, Higher Access

Traditionally, investing in prime real estate required deep pockets and local connections. Now, fractional real estate ownership via tokenization has made it possible for anyone around the world to participate – no matter their budget or location. You can own 0.01% of a Manhattan skyscraper or diversify across multiple cities and asset types with just a few clicks.

This new model dramatically lowers entry costs and fosters diversification. Instead of tying up large sums in a single property, investors can spread risk across dozens of assets globally. Platforms such as Lofty AI and Brickblock are leading this charge by providing transparent access to vetted deals under regulatory oversight.

Top Benefits of Fractional Ownership for Global Real Estate Investors

-

Lower Barrier to Entry: Fractional ownership via tokenization allows investors to purchase small portions of high-value properties, making real estate investment accessible with minimal capital. Platforms like RealT and Lofty AI enable participation starting from just tens or hundreds of dollars.

-

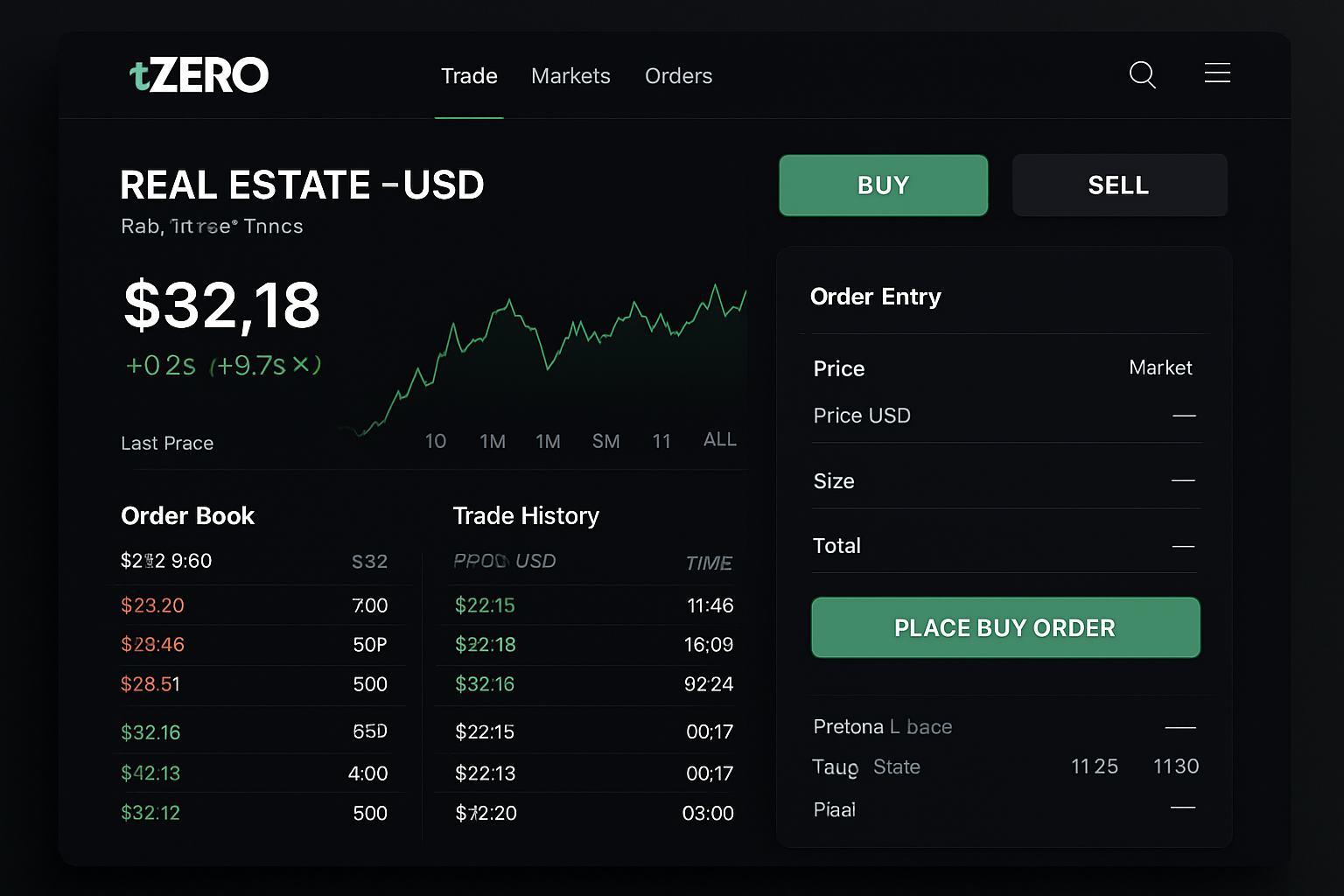

Enhanced Liquidity: Tokenized real estate assets can be traded 24/7 on secondary markets, providing investors with greater flexibility to buy or sell their shares at any time. Established platforms such as tZERO and RealT offer active marketplaces for these digital tokens.

-

Global Market Access: Investors from around the world can access tokenized real estate markets, regardless of their location or time zone. Platforms like Blockimmo and tZERO facilitate cross-border investments in properties across multiple countries.

-

Diversification Opportunities: Fractional ownership enables investors to diversify their portfolios by holding small stakes in multiple properties across different regions and asset types, reducing overall investment risk.

-

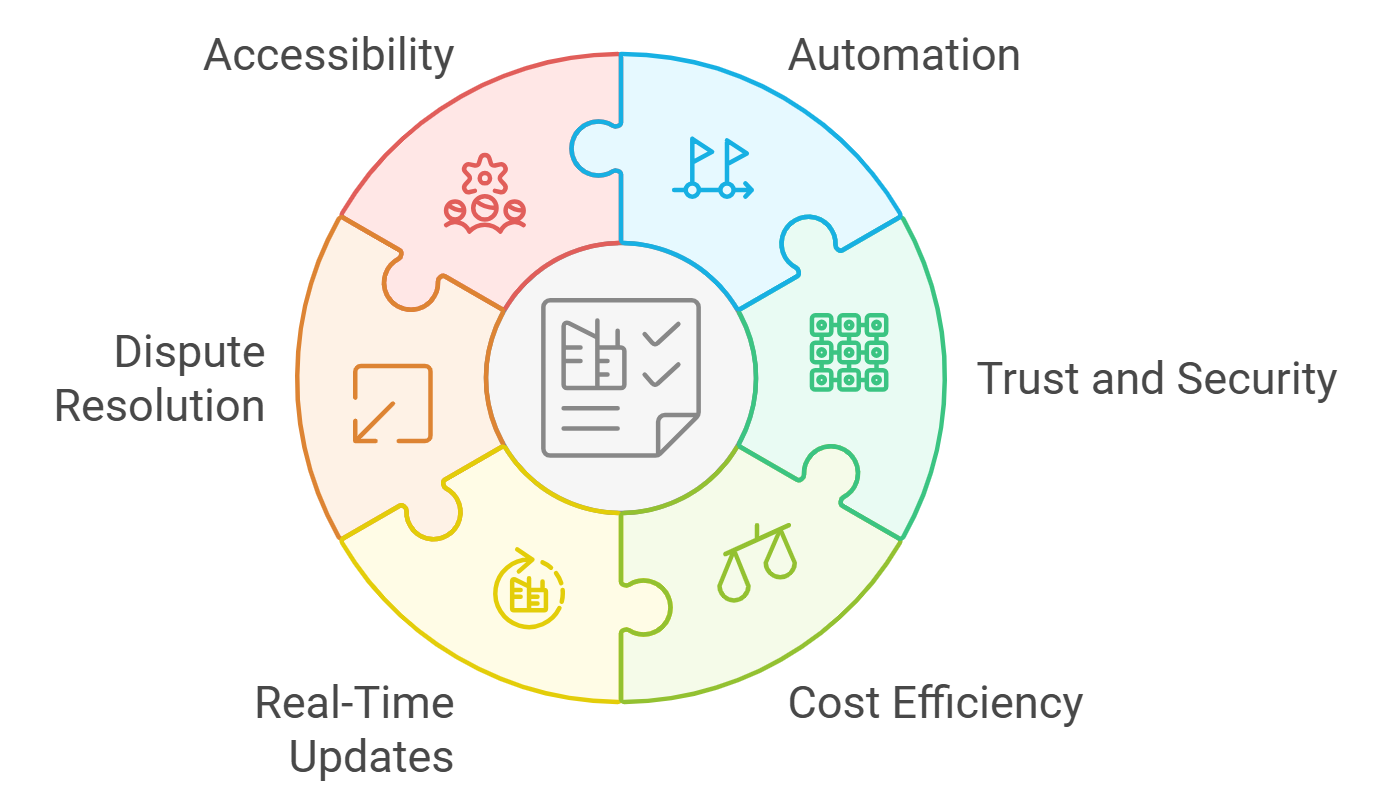

Transparent and Secure Transactions: Blockchain technology ensures transparent, immutable records of ownership and transactions, reducing fraud and increasing trust among global investors. Platforms like RealT and Lofty AI operate under regulatory oversight to enhance security.

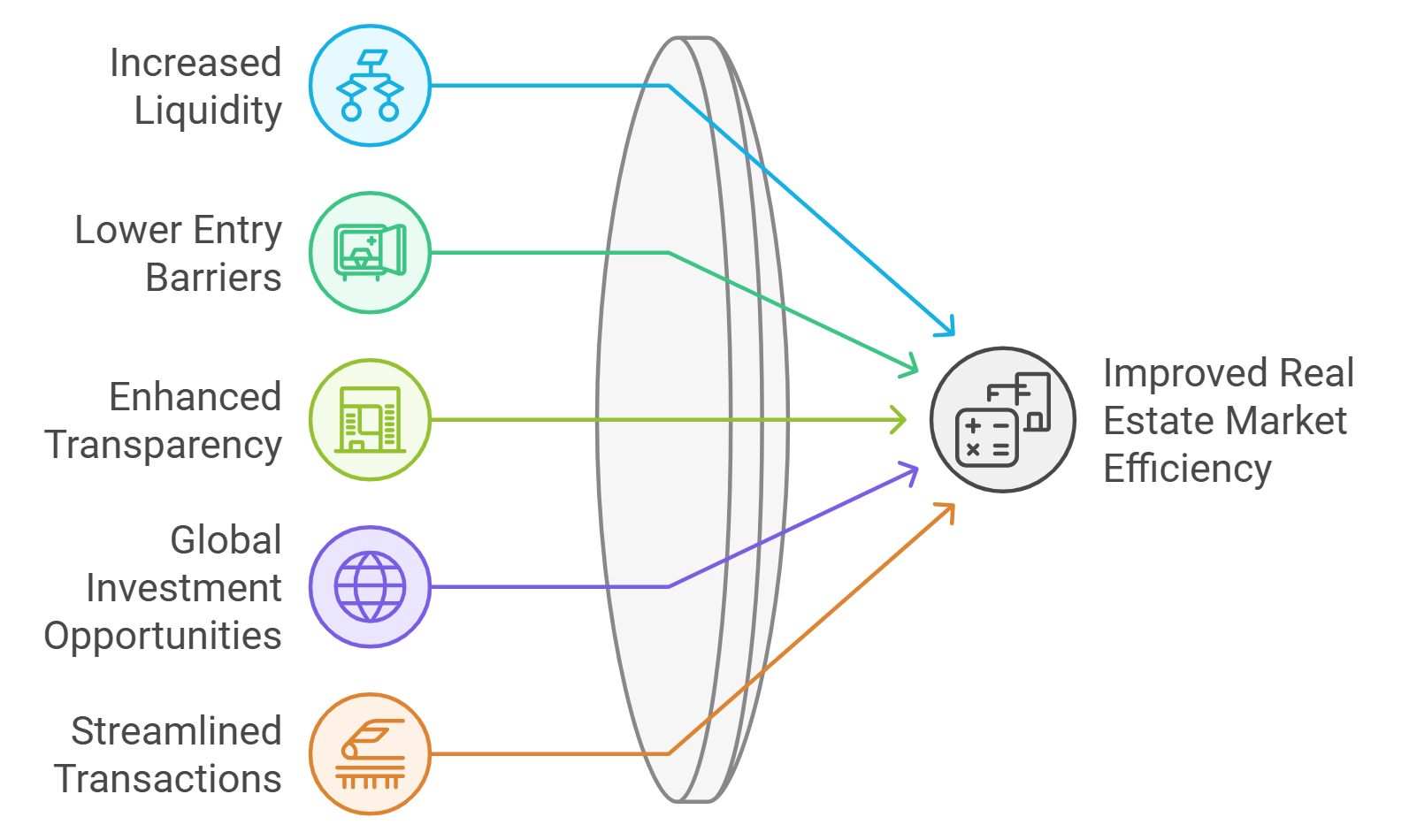

Liquidity and 24/7 Trading: The Blockchain Advantage

One of the most exciting breakthroughs is liquidity in real estate investment. Historically, selling property shares took months (if not years), but tokenized assets can be traded 24/7 on secondary markets like tZERO and RealT’s built-in exchange. This means you’re no longer locked into long holding periods – you can exit positions or rebalance your portfolio at any time.

The round-the-clock trading also enables true global participation. Investors from Tokyo to Toronto can access opportunities regardless of time zone or local market hours. As highlighted by recent projects in Thailand (SiriHub Tokens) and China (Seazen Group), cross-border investment flows are surging as more jurisdictions recognize the value of compliant tokenization frameworks.

The benefits don’t stop there – transparency is enhanced through blockchain’s immutable records, making it easier for investors to verify ownership and track performance without relying solely on intermediaries.

Yet, while the promise of blockchain property investment is immense, it’s important to recognize that the ecosystem is still maturing. Liquidity remains a double-edged sword: although platforms like RealT and tZERO offer 24/7 trading, many tokenized properties experience lower trading volumes compared to traditional equities. This means that while you can sell your tokens at any time, finding a buyer at your desired price may take longer than anticipated for some assets.

Regulatory clarity is also evolving. The U. S. has made significant strides with SEC-registered offerings, but global harmonization is still in progress. Countries like Thailand and India are piloting innovative tokenization projects, and China’s Seazen Group is exploring real-world asset tokenization on a massive scale. As more governments embrace compliant frameworks and standards, expect even greater cross-border participation and mainstream adoption.

Choosing the Right Platform: What to Look For

Navigating the expanding universe of real estate tokenization platforms can feel overwhelming. Here are key factors to consider before diving in:

Key Criteria for Evaluating Tokenization Platforms

-

Liquidity & Trading Volume: Assess whether the platform offers 24/7 trading and has active secondary markets. Platforms like tZERO and RealT provide ongoing liquidity, allowing investors to buy or sell tokens at any time.

-

Global Access & Investor Reach: Look for platforms that enable cross-border investments and support international investors. Blockimmo and tZERO facilitate global participation in tokenized real estate.

-

Fractional Ownership Options: Ensure the platform allows investment in small fractions of properties, lowering the entry barrier. RealT, Brickblock, and Lofty AI specialize in fractional property tokens.

-

Transparency & Reporting: Reliable platforms provide clear property data, regular updates, and transparent token economics. RealT and Lofty AI offer detailed dashboards with property performance and income distributions.

-

Asset Diversity & Market Coverage: Top platforms offer a wide range of property types and geographies. RealT features hundreds of properties in the US, while Blockimmo lists assets across Europe.

-

Security & Custody Solutions: Evaluate the platform’s approach to token security, smart contract audits, and asset custody. Platforms like tZERO and RealT implement robust blockchain security measures and third-party custody solutions.

Security should be non-negotiable – look for platforms with robust smart contract audits and regulatory compliance. Transparent reporting of property performance, rental yields, and token holder rights are essential for informed decision-making. Finally, check for secondary market access so you’re not locked into illiquid positions.

If you’re curious about how these mechanics work in practice or want examples of how investors are leveraging fractional ownership globally, explore our deep dive on how fractional property tokenization works.

The Global Impact: Building Diverse Portfolios Without Borders

The ability to buy into properties across continents fundamentally changes portfolio construction. Instead of being limited by geography or local market knowledge, investors can now allocate capital across different countries, asset types, and risk profiles – all from a single dashboard. This democratizes access to prime real estate markets that were once out of reach for most individuals.

Diversification isn’t just about reducing risk; it’s about capturing new growth opportunities as global economies shift. With fractional ownership via tokenization opening global markets, both new and seasoned investors can participate in the upside of emerging trends without overexposure to any single asset or region.

The Road Ahead: What Comes Next?

The momentum behind real estate tokenization shows no signs of slowing down as we move deeper into 2025. Institutional players are entering the space, regulatory frameworks are tightening up, and technical innovation continues apace. As liquidity improves and investor education spreads, expect transaction volumes to rise – making property tokens an increasingly attractive alternative or complement to traditional REITs and direct ownership.

If you’re ready to explore this new frontier or want more practical guidance on getting started with fractional investments, check out our guides on opening global markets through fractional ownership.

The bottom line: Fractional ownership via blockchain-powered tokenization isn’t just a technological upgrade – it’s a paradigm shift that unlocks real estate investment for everyone on a truly global scale.