How Fractional Property Tokenization Works: Transforming Real Estate Investment with Blockchain

Imagine a world where you can invest in a luxury hotel in New York, a beachfront condo in Miami, or an office block in London – all without needing millions in the bank or jumping through endless hoops. Fractional property tokenization is making this vision a reality, opening doors to real estate markets once reserved for the elite. By leveraging blockchain technology, anyone can now own a slice of prime property and enjoy the benefits of real estate investing with unprecedented flexibility and transparency.

What Is Fractional Property Tokenization?

At its core, fractional property tokenization is the process of dividing ownership of a physical asset – like an apartment building or shopping center – into digital tokens on a blockchain. Each token represents a fractional share of the underlying property, allowing investors to buy, sell, and trade these shares just like stocks or cryptocurrencies. This approach transforms how we think about real estate investment, making it more accessible, liquid, and borderless than ever before.

The concept isn’t just theoretical: platforms like RealT have already tokenized over 700 properties across the U. S. , enabling global investors to earn daily rental income paid out in cryptocurrency. Even iconic assets like the St. Regis Aspen Resort have been brought on-chain through fractionalization (learn more here).

How Does Tokenized Real Estate Investing Work?

The journey from bricks-and-mortar to blockchain follows a clear path:

Key Steps in Fractional Property Tokenization

-

Asset Selection and Valuation: The process begins with choosing a suitable property and conducting a thorough market valuation to determine its worth. This step ensures the asset is viable for tokenization and attractive to potential investors.

-

Legal Structuring and Compliance: Legal entities are established and regulatory requirements are addressed to ensure the tokenization process aligns with local laws. This may involve forming special purpose vehicles (SPVs) or trusts to hold the property.

-

Token Creation: The property’s value is divided into digital tokens, with each token representing a fractional ownership stake. These tokens are typically created using established blockchain standards such as Ethereum’s ERC-20.

-

Blockchain Integration: The tokens are issued on a secure blockchain platform, ensuring transparency, immutability, and traceability of all transactions. This step leverages smart contracts to automate processes and enforce rules.

-

Investor Onboarding and KYC: Prospective investors undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to comply with regulations before purchasing tokens.

-

Token Distribution and Trading: Tokens are distributed to investors, who can then buy, sell, or trade their fractional ownership on supported digital asset platforms or secondary markets, such as RealT.

-

Ongoing Management and Reporting: Investors receive updates, rental income, and reports proportionate to their token holdings, with all transactions recorded transparently on the blockchain.

- Asset Selection and Valuation: A real-world property is carefully chosen and appraised by professionals.

- Token Creation: The total value of the asset is divided into hundreds or thousands of digital tokens.

- Blockchain Integration: These tokens are issued on a secure blockchain network, where every transaction is recorded immutably.

- Investor Participation: Investors purchase tokens directly or through secondary marketplaces, gaining rights to rental income and appreciation proportional to their holdings.

This model dramatically lowers entry barriers: instead of needing $500,000 and for direct ownership, you can start with as little as $50 or $100 per token depending on the platform. Plus, selling your stake becomes as simple as transferring tokens on-chain – no lengthy paperwork or waiting months for buyers!

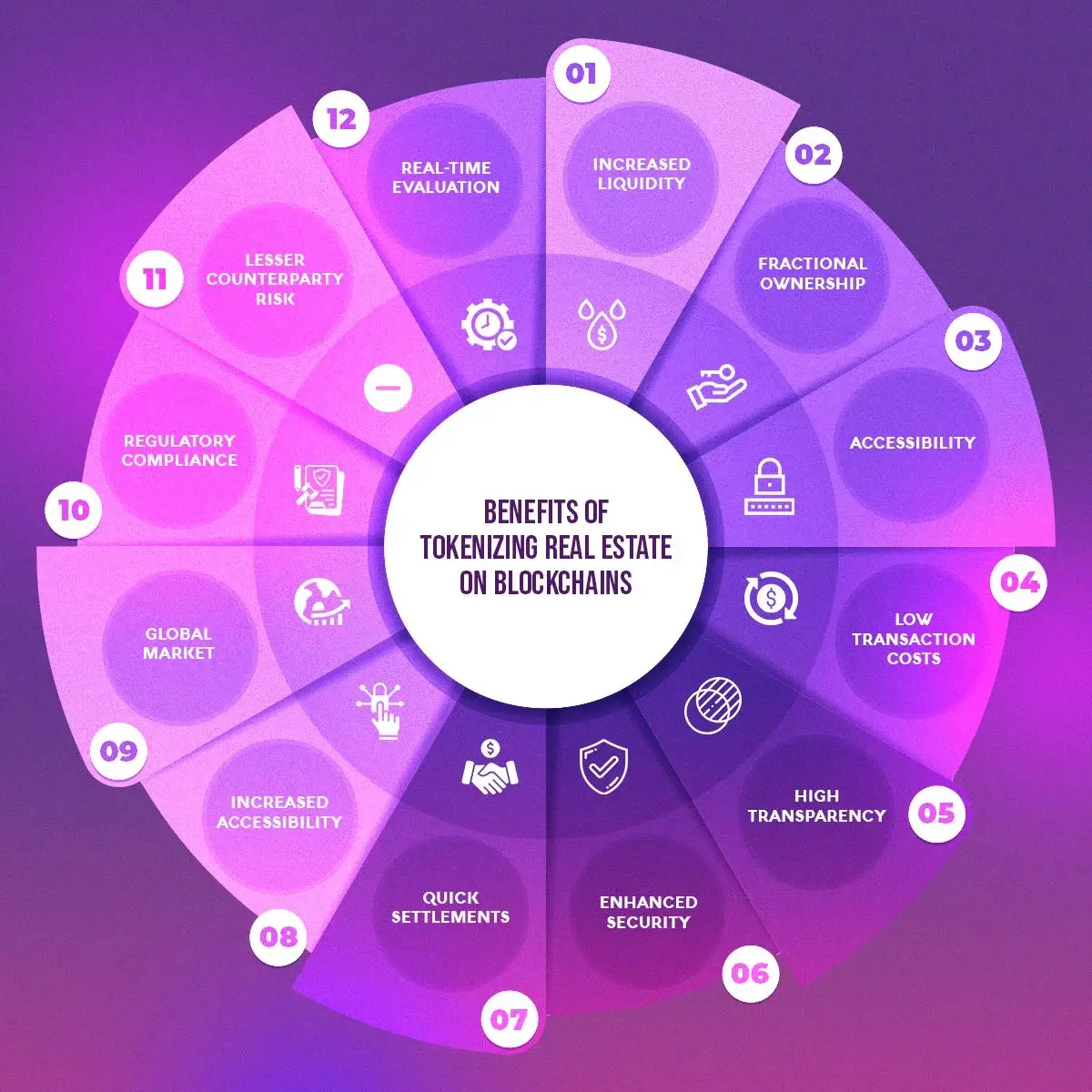

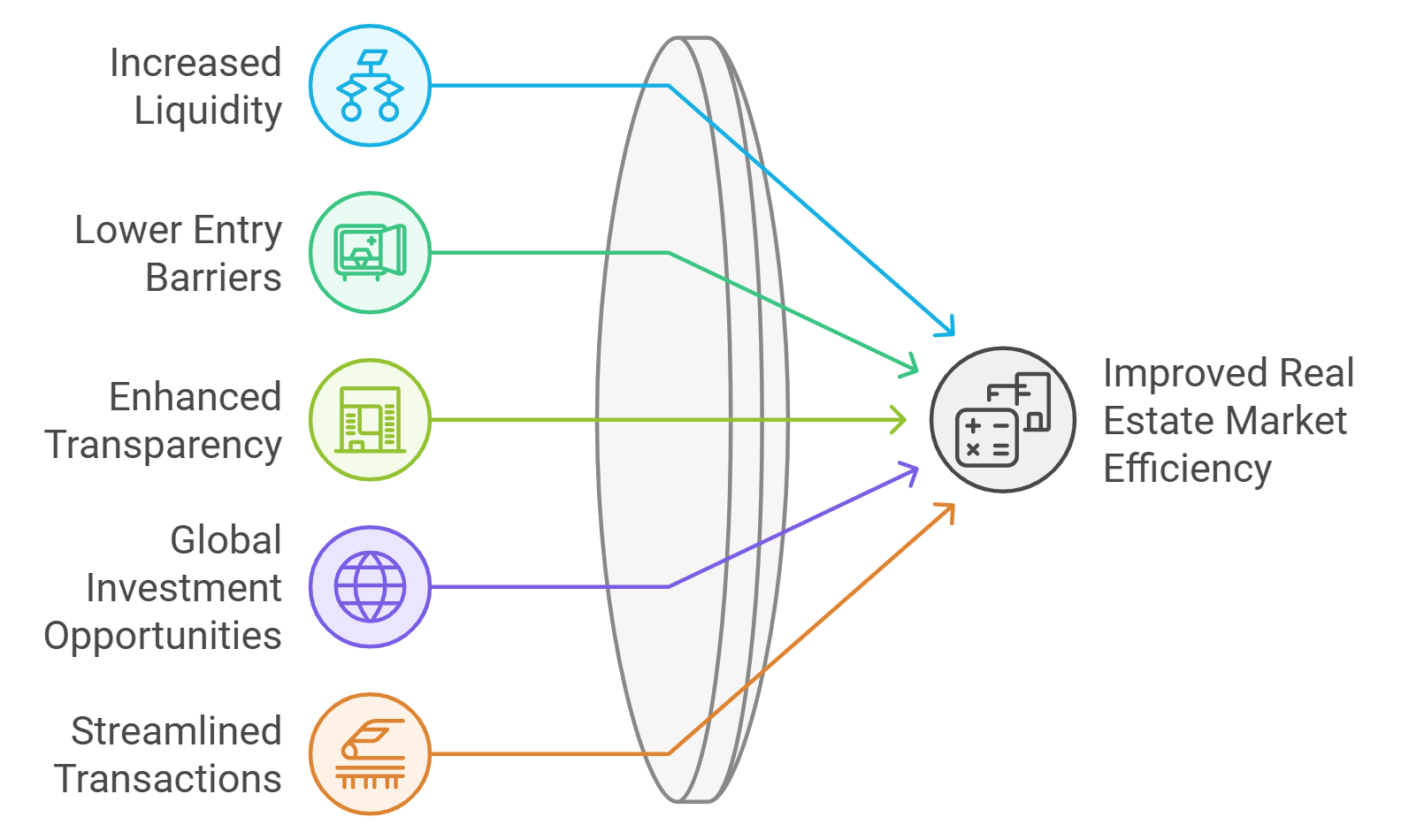

The Advantages: Liquidity, Transparency and Accessibility

The traditional real estate market has long been criticized for its illiquidity and high costs of entry. This is where blockchain property tokens shine. By digitizing ownership into tradable units:

- You gain liquidity: Trade your stake anytime on secondary markets without waiting months for deals to close.

- You unlock accessibility: With low minimums per token, anyone worldwide can diversify into real estate.

- You benefit from transparency: Every transaction is visible on-chain; smart contracts automate income distribution and record-keeping.

- You reduce risk through diversification: Spread your capital across multiple properties and geographies instead of betting everything on one asset.

Pioneers and Latest Developments in Property Ownership On Chain

The last year has seen an explosion of interest from both established developers and fintech innovators. In August 2025, China’s Seazen Group launched its Digital Assets Institute in Hong Kong to explore converting intellectual property and asset income into blockchain-traded tokens. Meanwhile, regulators are working hard to ensure investor protection while nurturing innovation – China’s securities authority recently advised brokers in Hong Kong to pause some activities as they refine policy frameworks.

This dynamic landscape means that while there are challenges (like regulatory compliance), the overall momentum points toward broader adoption. As more platforms prove their security and user experience – backed by robust legal structures – expect even greater participation from both retail investors and institutions seeking custom portfolios built around their investment thesis (see how global investing is changing here).

It’s not just the big players making headlines. Everyday investors are already experiencing the power of tokenized real estate investing. Platforms now offer seamless onboarding, intuitive dashboards, and automated income distribution, making property ownership on chain as easy as managing your favorite crypto wallet. The result? A new era where passive income from global real estate is just a few clicks away and diversification is no longer limited by geography or capital.

Regulatory clarity remains a key focus as this market matures. While some regions are embracing tokenization with open arms, others are proceeding with caution to balance innovation with investor safety. For example, China’s recent regulatory pause in Hong Kong signals a careful approach but also underscores the growing recognition of blockchain’s potential to reshape asset markets worldwide.

Real-World Impact: Democratizing Wealth Creation

The ripple effects of fractional property tokenization go far beyond convenience. By lowering barriers and improving liquidity, real estate investment tokens are enabling more people to build wealth through historically stable assets. No longer must you choose between stocks and traditional real estate, now you can blend both for a truly modern portfolio.

5 Ways Fractional Property Tokenization is Changing Real Estate

-

1. Lowering Barriers to Entry for InvestorsFractional property tokenization allows individuals to invest in real estate with significantly less capital than traditionally required. Instead of buying an entire property, investors can purchase digital tokens representing small ownership stakes, making high-value assets accessible to a broader audience.

-

2. Boosting Liquidity in Real Estate MarketsTokenized real estate enables investors to buy and sell fractional ownership on secondary markets, transforming an otherwise illiquid asset class into one with greater flexibility and ease of trading. Platforms like RealT exemplify this new liquidity by allowing users to trade property tokens and receive rental income in cryptocurrency.

-

3. Enhancing Transparency and SecurityBy leveraging blockchain technology, all transactions and ownership records are securely stored on a decentralized ledger. This transparency reduces the risk of fraud and ensures that every investor can verify their stake in real time.

-

4. Enabling Global Access to Real Estate InvestmentsTokenization platforms break down geographic barriers, allowing investors from around the world to participate in real estate markets previously limited by location or regulation. For example, the tokenization of the St. Regis Aspen Resort opened up U.S. luxury property investment to a global audience.

-

5. Driving Innovation Through Real-World Examples and InitiativesMajor developments, such as the Seazen Group’s exploration of real-world asset tokenization in Hong Kong, demonstrate the growing institutional interest and potential for large-scale adoption. These initiatives signal a shift toward more innovative, tech-driven real estate investment models.

Consider this: young professionals can now allocate small amounts into commercial buildings, retirees can balance risk by spreading their capital across continents, and entrepreneurs can tap into previously illiquid equity for business growth. The future is about empowering individuals, not gatekeeping opportunity.

What’s Next for Blockchain Property Tokens?

The momentum behind fractional ownership real estate is undeniable. As platforms innovate and regulations evolve, expect secondary trading volumes to rise and new asset classes, like hotels, logistics parks, or even farmland, to be brought on-chain. This evolution will further diversify investment options while keeping transparency and security at the core.

If you’re considering your first step into tokenized property or looking to expand your digital asset portfolio, now is the time to get informed and stay ahead of market trends. The convergence of blockchain technology and real-world assets isn’t just a passing phase, it’s an unstoppable movement toward financial inclusion and smarter investing.

The bottom line: Fractional property tokenization is transforming the way we think about wealth creation, access, and global opportunity. Whether you’re an experienced investor or just starting out, embracing this innovation could be your gateway to a more flexible, transparent future in real estate.