How Fractional Ownership Works in Tokenized Real Estate

Fractional ownership real estate is no longer a theoretical concept. Thanks to tokenized real estate investing, investors can now buy and sell property tokens fractional to their budget, unlocking access to prime assets that were once the exclusive domain of institutional players. Blockchain property investment is transforming the fundamentals of how wealth is built and diversified in the real estate sector.

Tokenization: The Mechanics Behind Fractional Ownership

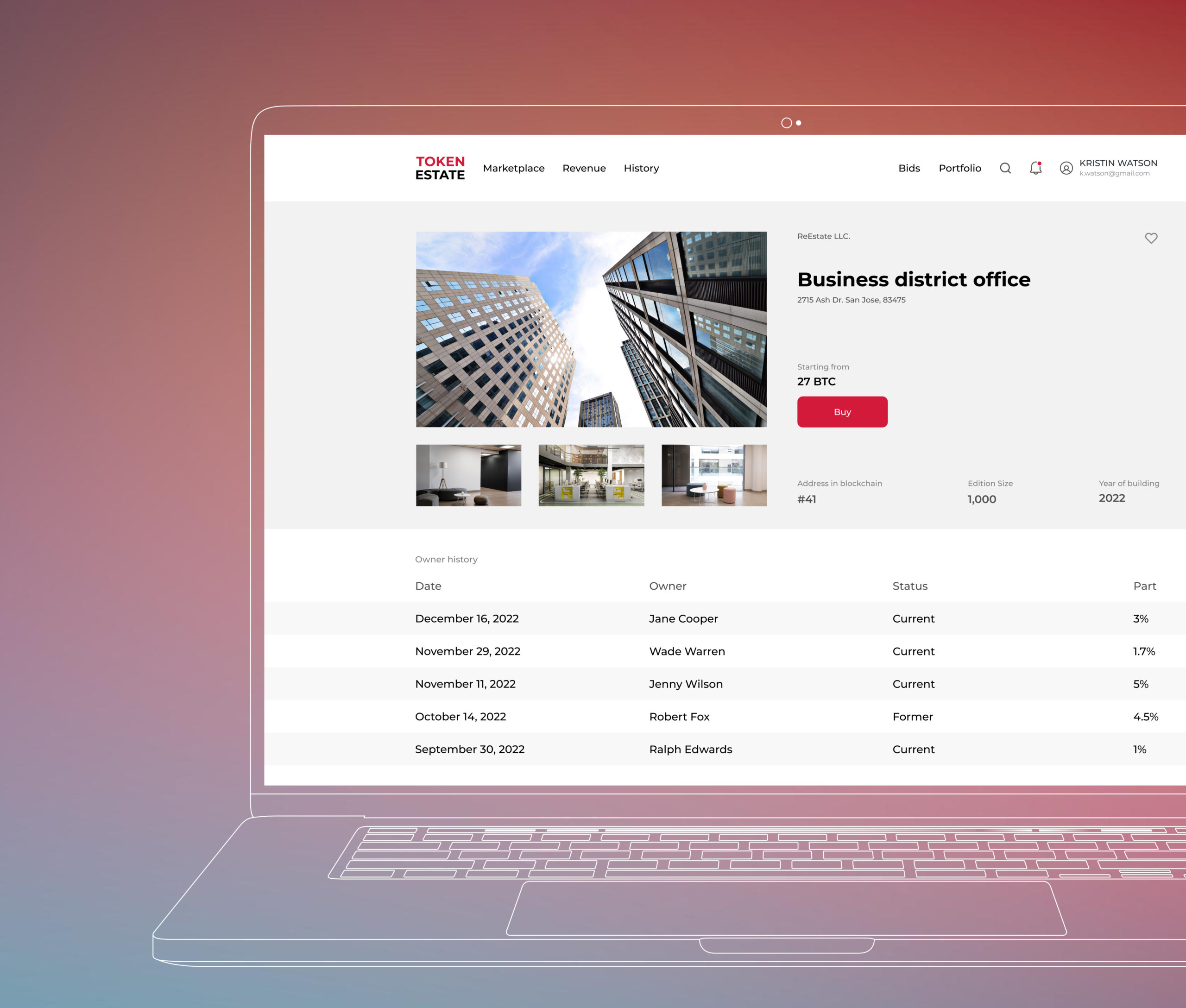

At its core, tokenization divides a physical property into a set number of digital tokens. Each token represents a proportional share of the asset’s total value. For instance, if a commercial building is valued at $1 million, it can be split into 1,000 tokens at $1,000 each. Investors are then able to purchase as many tokens as they wish, directly correlating their investment with ownership percentage.

This process is underpinned by blockchain technology, which guarantees transparent and immutable record-keeping. Every transaction – from initial issuance to secondary trading – is logged on-chain, reducing settlement friction and minimizing fraud risk. Smart contracts further automate processes such as rental income distribution and compliance checks, eliminating costly intermediaries and streamlining operations.

Democratizing Real Estate Investment

The impact of fractional ownership via tokenized real estate is profound: it lowers the barrier to entry, allowing retail investors to access high-value properties with relatively modest capital outlays. There’s no need for large down payments or complex mortgage arrangements; instead, anyone with an internet connection can participate in global real estate markets.

Key Benefits of Fractional Ownership via Property Tokens

-

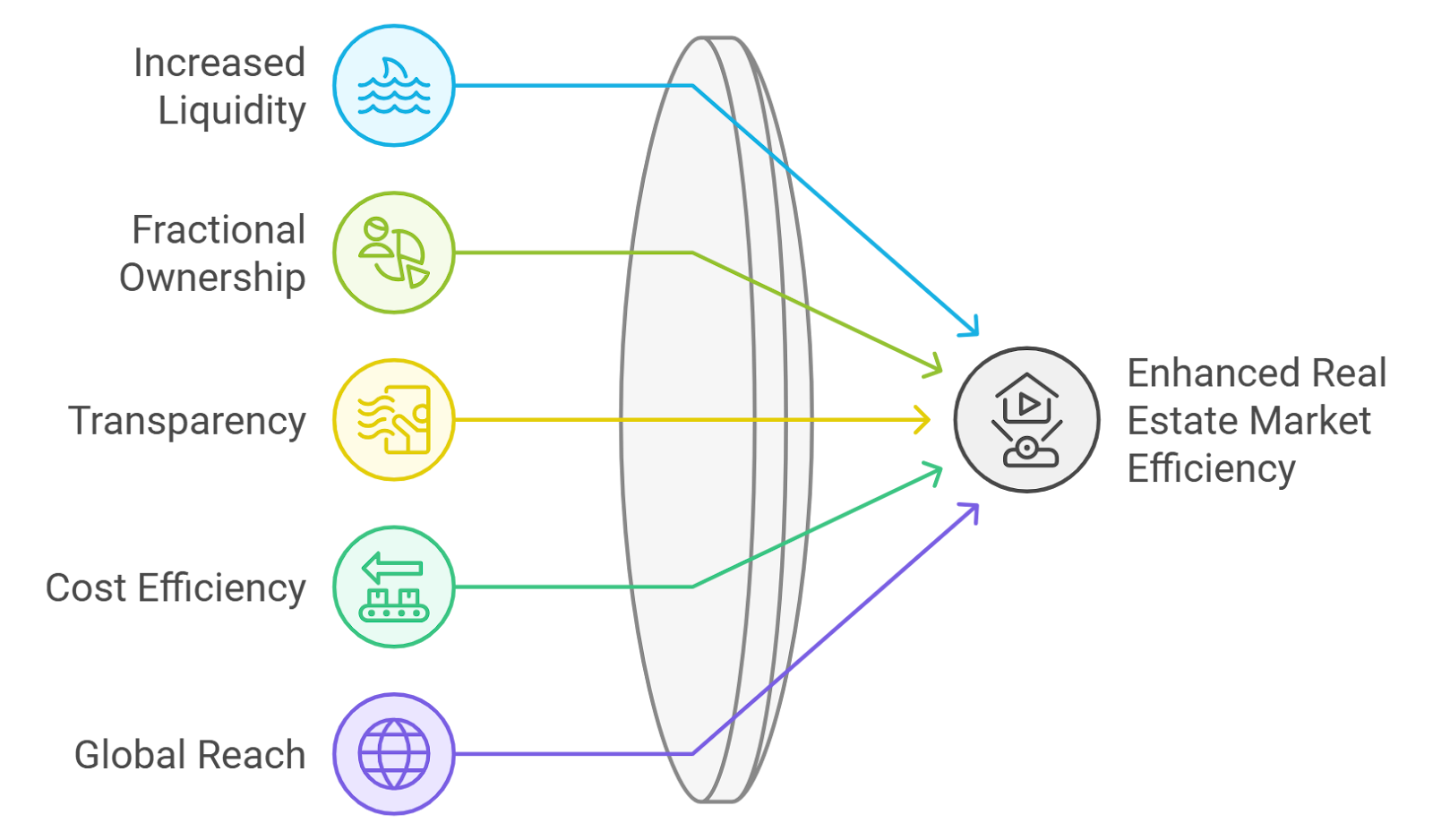

Increased Accessibility: Tokenized real estate allows investors to participate in high-value property markets with smaller capital outlays, democratizing access to assets once reserved for institutional or high-net-worth individuals.

-

Enhanced Liquidity: Property tokens can be bought and sold on digital platforms, providing liquidity in a market traditionally known for its illiquidity.

-

Transparency and Security: Blockchain technology ensures all transactions are securely recorded and immutable, offering clear ownership records and reducing fraud risks.

-

Automated Income Distribution: Smart contracts facilitate the automatic distribution of rental income and dividends to token holders, streamlining processes and reducing administrative overhead.

-

Global Participation: Platforms like RealT enable investors worldwide to own fractions of U.S. residential properties, expanding investment opportunities beyond local markets.

-

Lower Transaction Costs: By reducing the need for intermediaries and manual paperwork, tokenized real estate minimizes transaction fees and administrative costs.

Liquidity has historically been one of real estate’s biggest challenges. Traditionally, selling even a small stake in a property could take months or longer. Now, with tokenized assets traded on digital platforms, investors can buy or sell their fractions quickly – sometimes instantly – providing flexibility previously unseen in this asset class.

Case Studies: Real-World Adoption

This isn’t just hype; leading projects are already proving the model at scale:

- St. Regis Aspen Resort: In 2018, this luxury resort raised approximately $18 million by offering digital tokens representing fractional ownership (source). Investors worldwide gained exposure to prime hospitality assets without traditional barriers.

- RealT: This platform has enabled global investors to own fractions of over 535 U. S. -based residential properties with total value exceeding $101 million (source). Token holders receive rental income proportional to their shares, directly and transparently via blockchain rails.

The Strategic Investor’s Perspective

The rise of property tokens fractional in nature offers more than just accessibility; it introduces new strategies for portfolio construction and risk management. Diversification across markets and asset types becomes practical even for smaller investors who previously lacked sufficient capital for meaningful exposure across multiple properties.

Tokenized real estate investing fundamentally changes the calculus for both risk and reward. By enabling fractional ownership, investors can allocate capital across a spectrum of properties, residential, commercial, or even hospitality, within different geographies. This reduces concentration risk and increases resilience against sector-specific downturns. For macro-focused investors, the ability to respond dynamically to changing market cycles is invaluable. As liquidity improves, so does the opportunity to rebalance portfolios in response to shifts in interest rates, local regulations, or broader economic trends.

Transparency is another game changer. Every transaction, whether it’s a token purchase, a rental income distribution, or a secondary sale, is immutably recorded on-chain. Investors can audit their holdings and track property performance in real time without relying on opaque intermediaries. This data-driven approach aligns with institutional-grade expectations for compliance and reporting.

Navigating Challenges and Regulatory Considerations

No innovation comes without hurdles. While blockchain property investment offers unprecedented access and efficiency, regulatory clarity remains an evolving landscape. Jurisdictions differ widely in their treatment of digital assets and securities laws. Responsible platforms prioritize investor protection by conducting rigorous KYC/AML checks and ensuring full legal compliance, a non-negotiable for sustainable growth.

Market volatility is another consideration. Although tokenized assets are less prone to daily swings than cryptocurrencies, they are not immune from broader market sentiment or shifts in real estate fundamentals. Due diligence remains critical: investors should scrutinize underlying asset quality, platform reputation, and legal structures before allocating capital.

The Future of Fractional Ownership Real Estate

The trajectory for tokenized real estate investing is clear: increased adoption will drive deeper liquidity pools and more sophisticated financial products built atop property tokens fractional in nature. As trusted platforms like Real Estate Rwas continue to innovate with best-in-class security and user experience, we can expect broader institutional participation alongside retail investors.

Ultimately, the convergence of blockchain technology and global real estate markets signals a strategic inflection point for portfolio construction. Investors willing to embrace these new tools will be well positioned to capture value as the sector matures, and as traditional barriers continue to fall away.