How Fractional Ownership is Revolutionizing Real Estate Investing with Blockchain Tokenization

Imagine owning a slice of a luxury hotel in Aspen or a rental property in Detroit, all from your laptop, with just $50. This isn’t a future dream – it’s happening right now, thanks to fractional real estate ownership powered by blockchain tokenization. The barriers that once made real estate investment exclusive to the wealthy and well-connected are rapidly dissolving, replaced by digital innovation and global accessibility.

How Blockchain Tokenization is Democratizing Real Estate

Traditional real estate investing has always required significant capital and patience. Properties are expensive, transactions are slow, and liquidity is almost nonexistent. But with blockchain property tokens, everything changes. Tokenization divides high-value properties into thousands of digital shares (tokens), each representing fractional ownership. For example, a $500,000 property can be split into 10,000 tokens at $50 each – letting investors buy as many or as few as they want.

This model brings three seismic shifts to the market:

Key Benefits of Blockchain-Powered Fractional Property Investment

-

Accessible Real Estate Investing: Blockchain tokenization allows investors to buy fractional shares of high-value properties, making real estate investment possible with as little as $50 per share—no need for large upfront capital.

-

Enhanced Liquidity: Unlike traditional property investments, tokenized real estate can be traded quickly and easily, giving investors the flexibility to buy or sell shares much like stocks.

-

Global Participation: Platforms like RealT enable anyone worldwide to invest in U.S. rental properties, democratizing access to international real estate markets.

-

Transparent & Secure Transactions: Blockchain ensures tamper-proof ownership records and automates processes with smart contracts, reducing fraud and increasing trust.

-

Lower Transaction Costs: By removing intermediaries and automating transfers, tokenized real estate platforms reduce fees and administrative overhead, maximizing investor returns.

-

Proven Real-World Success: The St. Regis Aspen Resort tokenized 18.9% of its property, issuing 18 million digital tokens at $1 each, allowing accredited investors to own a piece of a luxury resort.

-

Ongoing Innovation: Major developers like Seazen Group are exploring tokenization, signaling strong momentum and future growth for blockchain-based real estate investment.

First, accessibility: Now anyone with $50 can invest in prime real estate globally. Second, liquidity: Tokens can be traded quickly on secondary markets, similar to stocks. Third, transparency and security: Blockchain ledgers keep ownership records tamper-proof while smart contracts automate rent payouts and transfers without intermediaries.

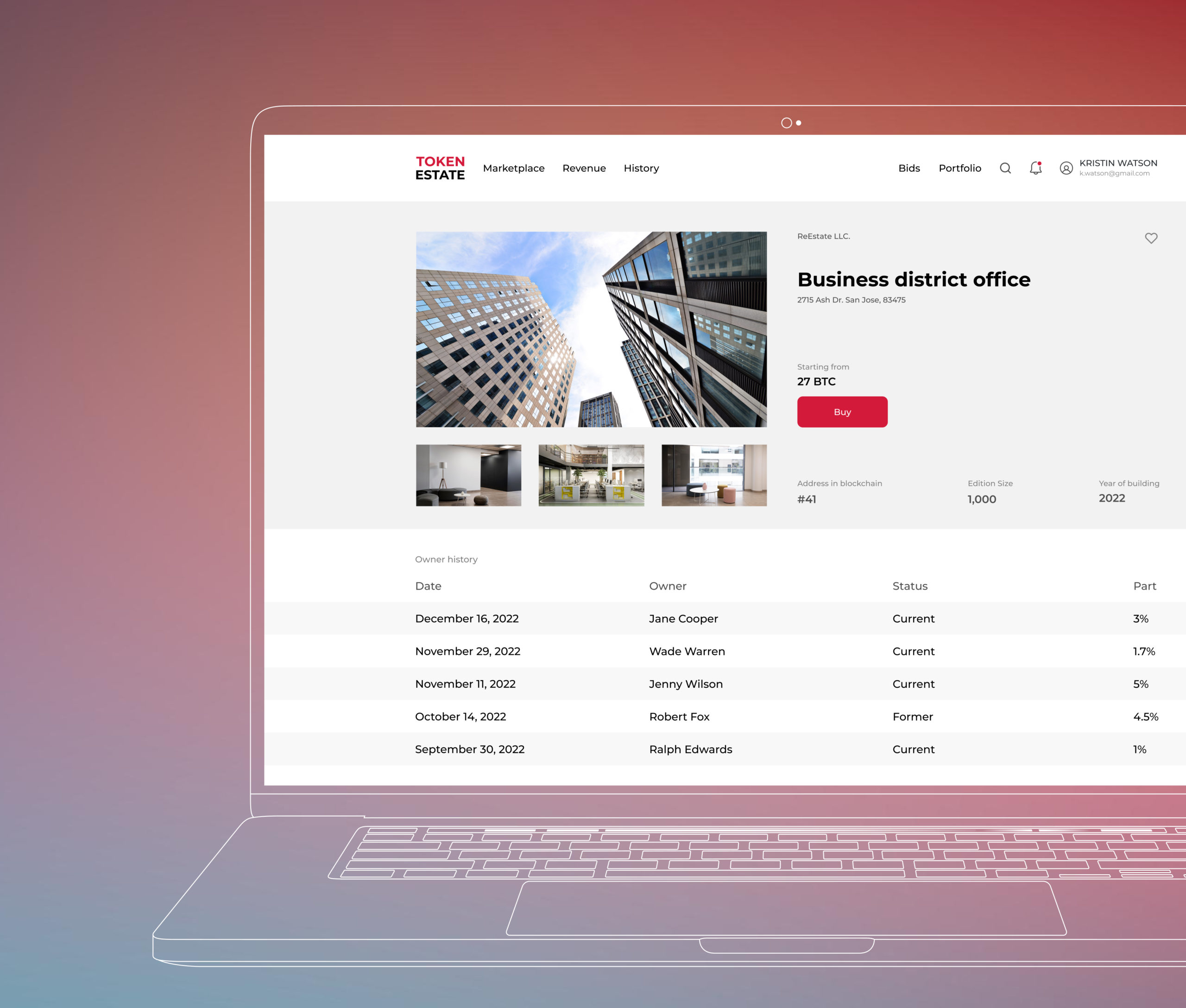

The Rise of Tokenized Real Estate Investing Platforms

The explosion of real estate tokenization platforms is fueling this revolution. Companies like RealT have already tokenized over 535 U. S. properties worth more than $101 million – each share offering passive income from rental yields directly to investors’ crypto wallets. The St. Regis Aspen Resort famously issued 18 million tokens at $1 each for accredited investors to own part of their luxury resort experience.

The momentum isn’t limited to the United States either. In China, Seazen Group is exploring digital asset tokenization for its vast property portfolio, signaling that this trend is truly global.

The Mechanics Behind Fractional Ownership: How It Works

The process starts with a trusted platform digitizing a property’s ownership structure onto the blockchain. Each token corresponds to a specific fraction of the underlying asset – whether that’s an apartment building or commercial space. Investors purchase these tokens using fiat or cryptocurrency through compliant onboarding processes.

Smart contracts then automate everything from rent collection and distribution to buy/sell transactions and even voting rights on major decisions related to the property.

This seamless integration not only boosts efficiency but also slashes costs by removing traditional intermediaries like banks and brokers from the equation.

For investors, this means greater control and agility. Instead of tying up large sums in a single asset, you can now diversify across multiple properties, cities, and even countries. Want to balance your portfolio with both luxury hospitality and affordable housing? It’s as simple as acquiring different blockchain property tokens, no jet-setting or mountains of paperwork required.

Real-World Impact: Passive Income and Portfolio Diversification

The most exciting outcome of fractional property investment blockchain is the ability to generate passive income from real estate crypto. Rental payments are distributed automatically by smart contracts, landing directly into your digital wallet. This democratizes not just access to ownership, but also to the cash flow that real estate is famous for.

Consider the RealT model: With over 535 tokenized U. S. properties valued at more than $101 million, thousands of global investors are now earning rental yields from American real estate, often without ever setting foot on U. S. soil. The St. Regis Aspen Resort’s $1 tokens offered a similar opportunity for luxury property exposure at a fraction of the traditional cost.

Would you invest in tokenized real estate if you could start with just $50?

Blockchain tokenization now allows anyone to buy fractional shares of high-value property, making real estate investment more accessible and liquid than ever before. With secure, transparent ownership and automated transactions, would you take the leap into property investing for as little as $50?

This shift is also transforming the way wealth is built and preserved. Instead of being locked out of high-value markets, everyday investors can now participate in, and benefit from, the same assets that have historically fueled generational wealth.

Challenges on the Road Ahead, and Why Optimism Prevails

No revolution comes without hurdles. Regulatory frameworks are still evolving worldwide, technological integration requires robust security measures, and mainstream acceptance will take time. However, every successful case study, from RealT’s thriving platform to Seazen Group’s ambitious digital asset plans, proves that momentum is on our side.

Platforms are responding with enhanced compliance tools and user-friendly onboarding processes designed to make participation safe and seamless for all investor types. As these solutions mature, expect adoption to accelerate even further.

The Future Is Liquid: Where Tokenized Real Estate Goes Next

The vision for tokenized real estate investing is bold, a world where anyone can build a diversified property portfolio as easily as they trade stocks or crypto today. Imagine instant liquidity for what was once an illiquid asset class; imagine voting rights on property management decisions; imagine new forms of global collaboration between investors spanning continents.

This isn’t just optimism, it’s already happening. With each new platform launch and regulatory milestone achieved, we move closer to a reality where opportunity truly knows no borders or minimums.

Top Trends in Blockchain-Based Real Estate Investing

-

Fractional Ownership via Tokenization: Blockchain allows high-value properties to be divided into digital tokens, enabling investors to buy affordable shares—such as $50 per token for a $500,000 property—dramatically lowering the entry barrier.

-

Increased Liquidity and Flexibility: Tokenized real estate assets can be traded quickly and easily, similar to stocks, offering investors the ability to buy, sell, or adjust their holdings with unprecedented speed and flexibility.

-

Automated Transactions with Smart Contracts: Smart contracts on the blockchain automate ownership transfers, rental income distribution, and transaction settlements, reducing reliance on intermediaries and cutting costs.

-

Real-World Adoption by Leading Platforms: Companies like RealT have tokenized over 535 U.S. properties valued at over $101 million, while the St. Regis Aspen Resort issued 18 million tokens to offer fractional ownership to accredited investors.

-

Global Expansion and Institutional Interest: Major developers such as China’s Seazen Group are exploring tokenization, establishing digital asset institutes to assess converting real-world assets into blockchain-based tokens.

-

Enhanced Transparency and Security: Blockchain’s tamper-proof records ensure secure, transparent tracking of property ownership and transactions, boosting investor confidence and regulatory compliance.

-

Ongoing Regulatory Developments: Jurisdictions worldwide are actively developing frameworks to address tokenized real estate, paving the way for broader adoption and innovation in the sector.

If you’re ready to explore this dynamic frontier, whether for passive income or portfolio growth, the time has never been better to get involved. The next wave of wealth creation is unfolding right now at the intersection of blockchain technology and real-world property ownership.