How Tokenized Real Estate is Revolutionizing Global Property Investment

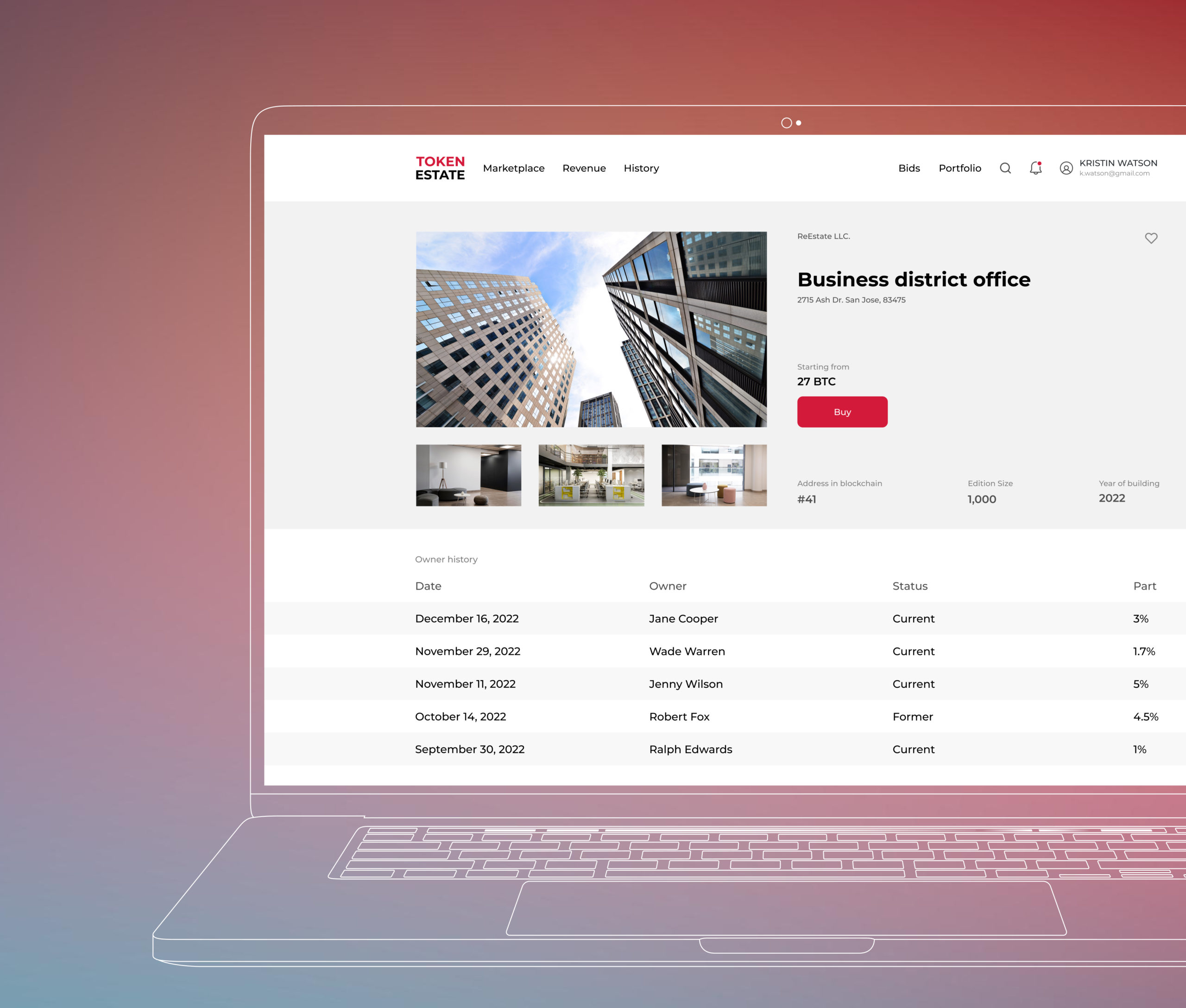

Imagine a world where owning a slice of prime Manhattan real estate or a bustling Tokyo apartment block is as simple as buying stock in your favorite company. This is not a distant dream, but the reality being shaped by tokenized real estate. By converting property rights into digital tokens on blockchain platforms, investors can now purchase fractional interests in physical assets with unprecedented ease and security.

Global Access and Fractional Ownership: The New Investment Frontier

The traditional barriers to global property investment: high capital requirements, illiquidity, and geographic limitations, are rapidly dissolving. Tokenization enables fractional ownership of real estate, allowing investors to buy into properties with as little as $50 or $100. Platforms such as RealT and Lofty have already made this possible, opening doors for individuals worldwide to diversify their portfolios with tangible assets previously reserved for institutional players.

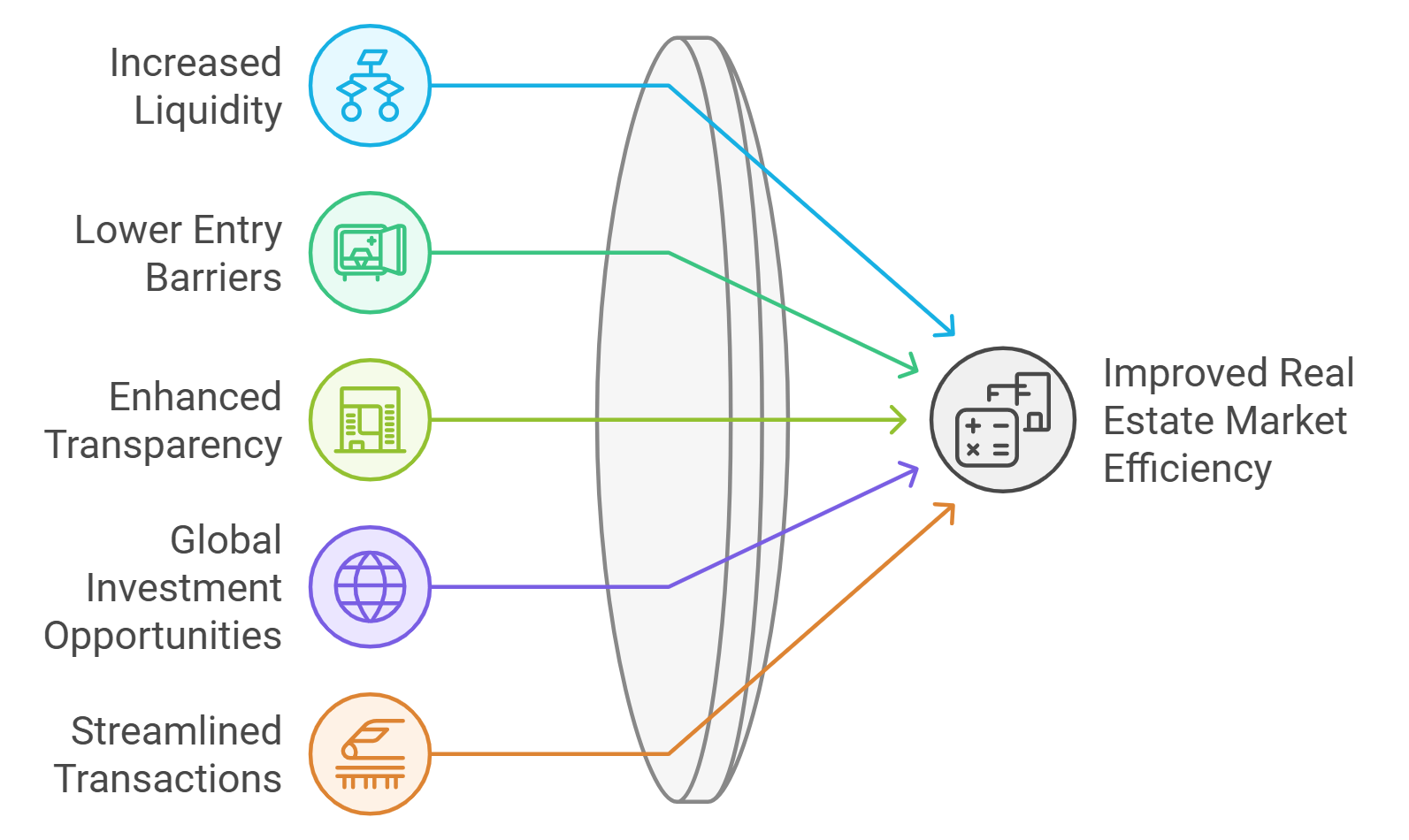

This shift is more than just technological; it’s philosophical. By democratizing access, tokenized real estate fosters a diverse investor base and encourages cross-border participation. As Deloitte projects, the market for tokenized real estate could surge from under $0.3 trillion in 2024 to an astonishing $4 trillion by 2035, a compound annual growth rate of 27%. The implications are profound: increased liquidity, reduced transaction costs, and enhanced transparency are quickly becoming the new normal in property markets.

Real-World Impact: Case Studies from Dubai to Florida

The momentum behind blockchain real estate is not just theoretical, it’s visible on the ground. In March 2025, Dubai’s Land Department launched an ambitious project to record property titles on blockchain, integrating this technology into the city’s core infrastructure. Meanwhile, Vera Capital in the United States made headlines by tokenizing a $5.4 million office building in Fort Lauderdale in 2024. Investors could now earn annual returns of around 5% without owning the entire asset, an innovation that would have been inconceivable just a few years ago.

The trend extends to Asia as well. Kenedix’s Kolet‑1 project in Japan offered everyday investors access to a portfolio of over 460 rental homes through property tokens valued at more than $130 million. The offering raised over $63 million, clear evidence that demand for fractional ownership real estate is both broad and deep.

Key Benefits of Tokenized Real Estate for Global Investors

-

Fractional Ownership with Low Entry Costs: Investors can buy fractions of high-value properties for as little as $50 or $100, making real estate investment accessible to a broader audience and lowering the capital required to participate.

-

Enhanced Liquidity: By converting properties into digital tokens, platforms such as Kenedix and Vera Capital allow investors to trade their shares more easily, reducing the time and cost associated with traditional property transactions.

-

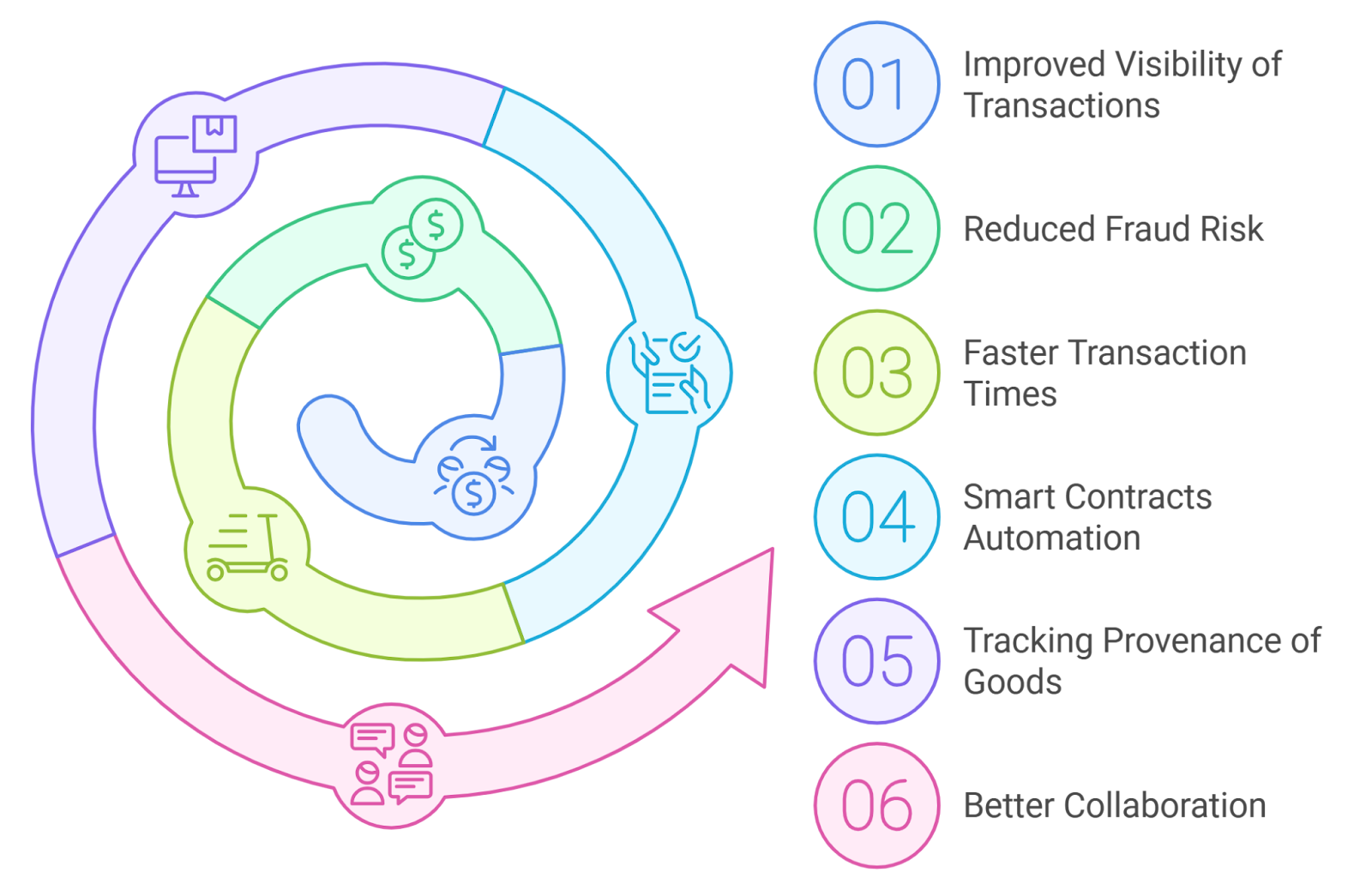

Increased Transparency and Security: Blockchain technology ensures that all transactions are recorded on an immutable ledger, providing greater transparency and reducing the risk of fraud for global investors.

-

Potential for Higher Returns: By expanding the pool of potential investors and increasing demand, tokenization can contribute to higher property valuations and competitive annual returns, as seen in Vera Capital’s 2024 Fort Lauderdale project offering around 5% annual returns.

-

Reduced Transaction Costs: Automated blockchain processes cut out intermediaries, lowering fees and making cross-border real estate transactions more efficient and cost-effective.

Navigating Challenges: Regulation and Market Maturity

No revolution comes without its growing pains. As more capital flows into property tokens, regulators are paying close attention. China’s recent move to pause domestic brokerages’ involvement in Hong Kong’s RWA (real-world asset) business underscores the need for robust legal frameworks and clear guidelines. The sector’s long-term success will hinge on how effectively these challenges are addressed, and whether technological infrastructure can keep pace with investor enthusiasm.

Despite these hurdles, there is no question that real estate tokenization is fundamentally altering liquidity dynamics. With each new project and regulatory milestone, confidence grows that tokenized assets will become a cornerstone of diversified investment strategies worldwide.

For investors, the evolution of real estate liquidity is especially compelling. Unlike traditional property transactions that can take months and involve significant legal overhead, blockchain-based platforms enable near-instant settlement and transparent record-keeping. Fractional ownership means investors can rebalance their holdings quickly, responding to market shifts with a flexibility long absent from real estate markets.

At the same time, tokenized real estate is pushing traditional players to innovate. Large asset managers and REITs are exploring partnerships with blockchain platforms, aiming to capture new capital flows and meet the expectations of a digitally native investor base. This convergence of legacy expertise and cutting-edge technology is accelerating the mainstream adoption of property tokens.

Looking Ahead: What’s Next for Tokenized Real Estate?

The path forward will be shaped by several critical factors:

Top Trends Shaping Tokenized Real Estate

-

Rapid Market Growth and Institutional Adoption: According to Deloitte, the global tokenized real estate market is projected to soar from less than $0.3 trillion in 2024 to $4 trillion by 2035, with institutional players and REIT managers like Kenedix launching large-scale token offerings.

-

Blockchain Integration in Real Estate Infrastructure: Governments and regulators are embracing blockchain, as seen with the Dubai Land Department moving property titles onto blockchain in 2025, setting a precedent for transparent and efficient property management worldwide.

-

Enhanced Liquidity and Lower Transaction Costs: Tokenization enables near-instant trading of property shares, reducing traditional barriers and costs. Examples include Vera Capital’s $5.4 million office building in Florida, which offers investors annual returns and liquidity without full asset ownership.

-

Regulatory Evolution and Emerging Legal Frameworks: As adoption accelerates, regulatory bodies are responding—sometimes with caution, as shown by the China Securities Regulatory Commission advising a pause on tokenization in Hong Kong, highlighting the need for robust legal frameworks to ensure investor protection.

-

Rising Transparency and Data Security: Blockchain-based records enhance transparency and security in property transactions, reducing fraud and simplifying due diligence for global investors.

First, regulatory clarity will be pivotal. Jurisdictions embracing clear frameworks are likely to become hubs for innovation and cross-border investment. Second, interoperability between blockchain networks could unlock even greater liquidity by allowing property tokens to trade seamlessly across platforms.

Third, investor education remains essential. As more individuals explore fractional property tokenization, understanding risks and due diligence will separate sustainable growth from speculative bubbles. Platforms that prioritize transparency, security, and compliance will set themselves apart in an increasingly crowded field.

“Diversity is the key to resilience. “ Tokenized real estate embodies this principle by allowing investors to build global, diversified portfolios with lower barriers to entry than ever before.

The numbers speak volumes: according to Deloitte’s latest forecast, the market for tokenized real estate could reach $4 trillion by 2035, up from less than $0.3 trillion in 2024. As this transformation unfolds, those who embrace innovation while respecting regulatory realities stand poised to benefit most from this new era in global property investment.