How Real Estate Tokenization Increases Liquidity for Global Investors

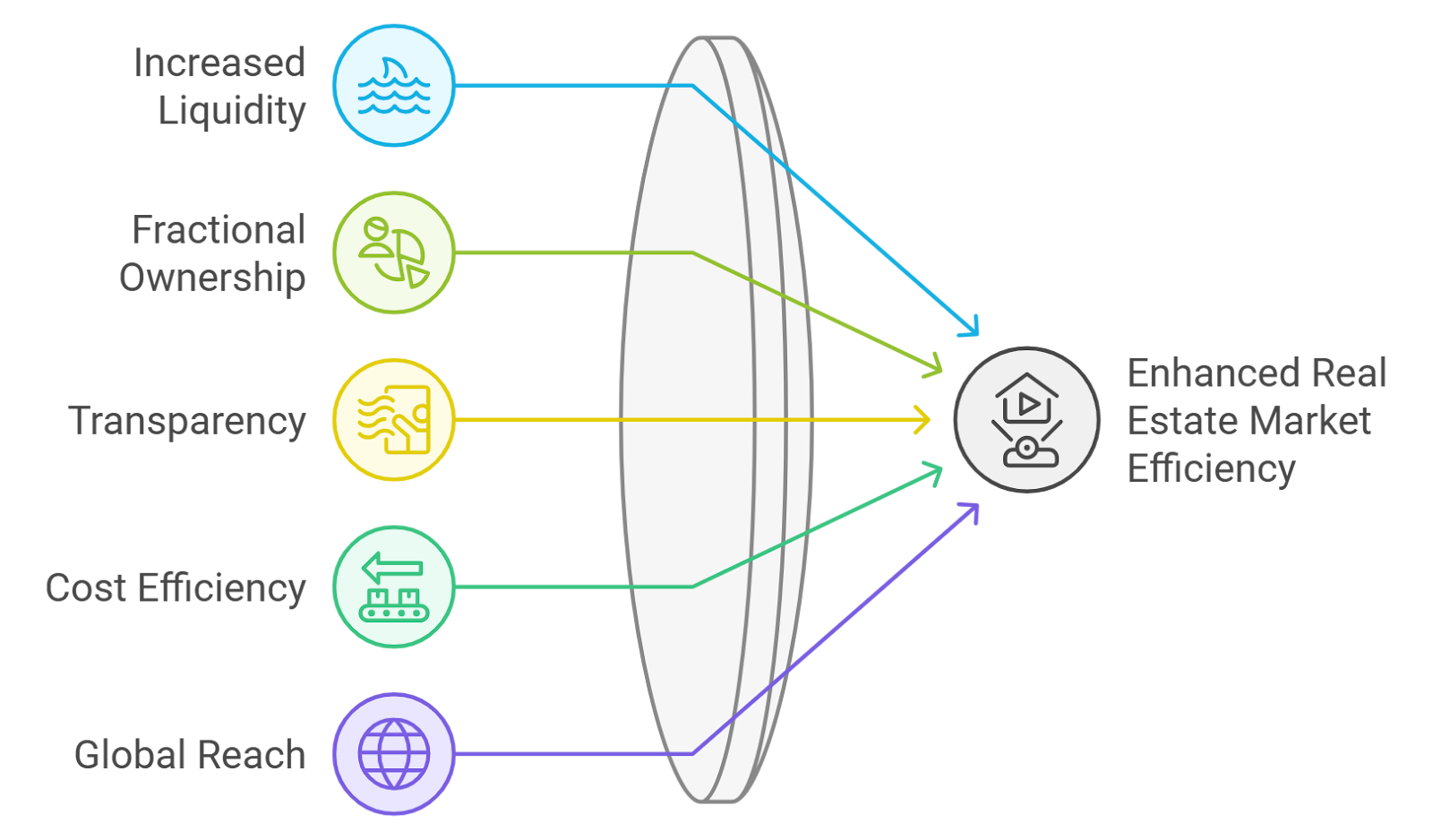

Real estate has long been considered a cornerstone of wealth, but its illiquidity has historically limited access for many investors. The emergence of real estate tokenization is fundamentally changing this paradigm, offering unprecedented liquidity and accessibility to a global investor base. By converting physical properties into digital tokens on blockchain networks, real estate is being transformed from a traditionally illiquid asset class into one that can be traded with the speed and flexibility of equities.

Fractional Ownership: Lowering Barriers and Unlocking Capital

The core innovation behind property tokens liquidity is fractional ownership. Tokenization divides real estate assets into smaller, tradable units, tokens, each representing a share of the underlying property. This approach allows investors to purchase fractions rather than entire properties, dramatically reducing the financial threshold for entry. For example, a $5 million commercial building can be split into 5,000 tokens valued at $1,000 each. This not only democratizes access but also enables capital to flow more freely into the market.

This model benefits both sides: property owners gain access to a wider pool of investors and can unlock trapped equity without selling full ownership, while investors can diversify across multiple assets without overexposing themselves to any single property. The resulting liquidity injection is significant compared to traditional real estate investment vehicles.

Secondary Markets: Real-Time Trading for Real Estate Assets

Historically, selling a stake in real estate involved lengthy negotiations, legal hurdles, and high transaction costs. Tokenization changes this by enabling secondary market trading of property tokens. Investors now have the flexibility to buy or sell their digital shares in near real time, much like trading stocks or cryptocurrencies, rather than waiting months or years for asset disposition.

This shift toward enhanced liquidity through secondary markets is transformative. It allows for dynamic portfolio rebalancing and rapid response to changing market conditions, capabilities previously unavailable in direct property investment. The presence of regulated platforms ensures compliance and security during these transactions, further bolstering investor confidence.

Global Investment Opportunities Without Borders

The blockchain foundation of tokenized real estate directly addresses long-standing barriers to cross-border investment. By removing intermediaries and standardizing processes on-chain, investors worldwide can participate in markets that were once out of reach due to regulatory complexity or prohibitive costs. This global reach not only increases the pool of potential buyers and sellers but also enhances overall market liquidity.

Key Advantages of Global Blockchain Real Estate Investment

-

Fractional Ownership and Lower Entry Barriers: Tokenization divides real estate assets into digital tokens, enabling investors to purchase fractional shares. This significantly lowers the minimum investment amount, making high-value properties accessible to a broader range of global investors. For example, a $5 million property can be split into 5,000 tokens at $1,000 each, democratizing access to prime real estate.

-

Enhanced Liquidity Through Secondary Markets: Traditionally illiquid, real estate investments become more flexible with tokenization. Investors can buy and sell property tokens on secondary markets, allowing them to exit or adjust their positions more easily, similar to trading stocks or cryptocurrencies.

-

Global Investment Opportunities: Blockchain-based tokenization removes many cross-border barriers, enabling investors worldwide to participate in real estate markets without excessive fees or complex regulations. This opens up previously inaccessible markets to a truly global investor base.

-

Increased Transparency and Security: Blockchain technology ensures all transactions are recorded on a secure, immutable ledger. This enhances transparency, reduces fraud, and streamlines ownership verification, increasing investor confidence in the real estate market.

-

Real-World Adoption and Market Growth: The tokenized real estate market is expanding rapidly. Notably, in August 2025, Seazen Group, a major Chinese developer, announced plans to explore real-world asset tokenization. The global market is projected to grow from $3.5 billion in 2024 to $19.4 billion by 2033, at a 21% CAGR.

The result is a more open and competitive marketplace where capital flows efficiently across borders, a marked departure from the fragmented nature of traditional property markets.

Transparency and security are critical concerns for any investor considering exposure to new asset classes. Blockchain technology, the backbone of real estate tokenization, provides a robust solution. Every transaction is recorded on an immutable ledger, reducing fraud risk and simplifying ownership verification. This increased transparency enhances trust among global investors, making it easier to verify property histories and compliance with local regulations.

Tokenized real estate platforms are also leveraging smart contracts to automate processes such as dividend distribution, voting rights, and compliance checks. Automation reduces operational costs and human error while ensuring that all parties adhere to pre-established rules. For institutional investors in particular, this level of process integrity is essential for scaling investments across multiple jurisdictions.

Market Growth and Real-World Adoption

The adoption curve for real estate tokenization is steepening as more major players enter the space. Notably, in August 2025, Chinese property developer Seazen Group announced its intention to explore real-world asset tokenization, a move that signals growing mainstream acceptance (Reuters). Meanwhile, the global market for tokenized real estate is projected to surge from $3.5 billion in 2024 to $19.4 billion by 2033 at a 21% CAGR (liquidity.io).

This rapid expansion is not just theoretical, secondary market trading volumes are rising, and more platforms are securing regulatory approval for cross-border operations. As these markets mature, investors can expect greater liquidity, improved price discovery mechanisms, and increasingly sophisticated portfolio management tools tailored for blockchain real estate investment.

Risks, Considerations and The Road Ahead

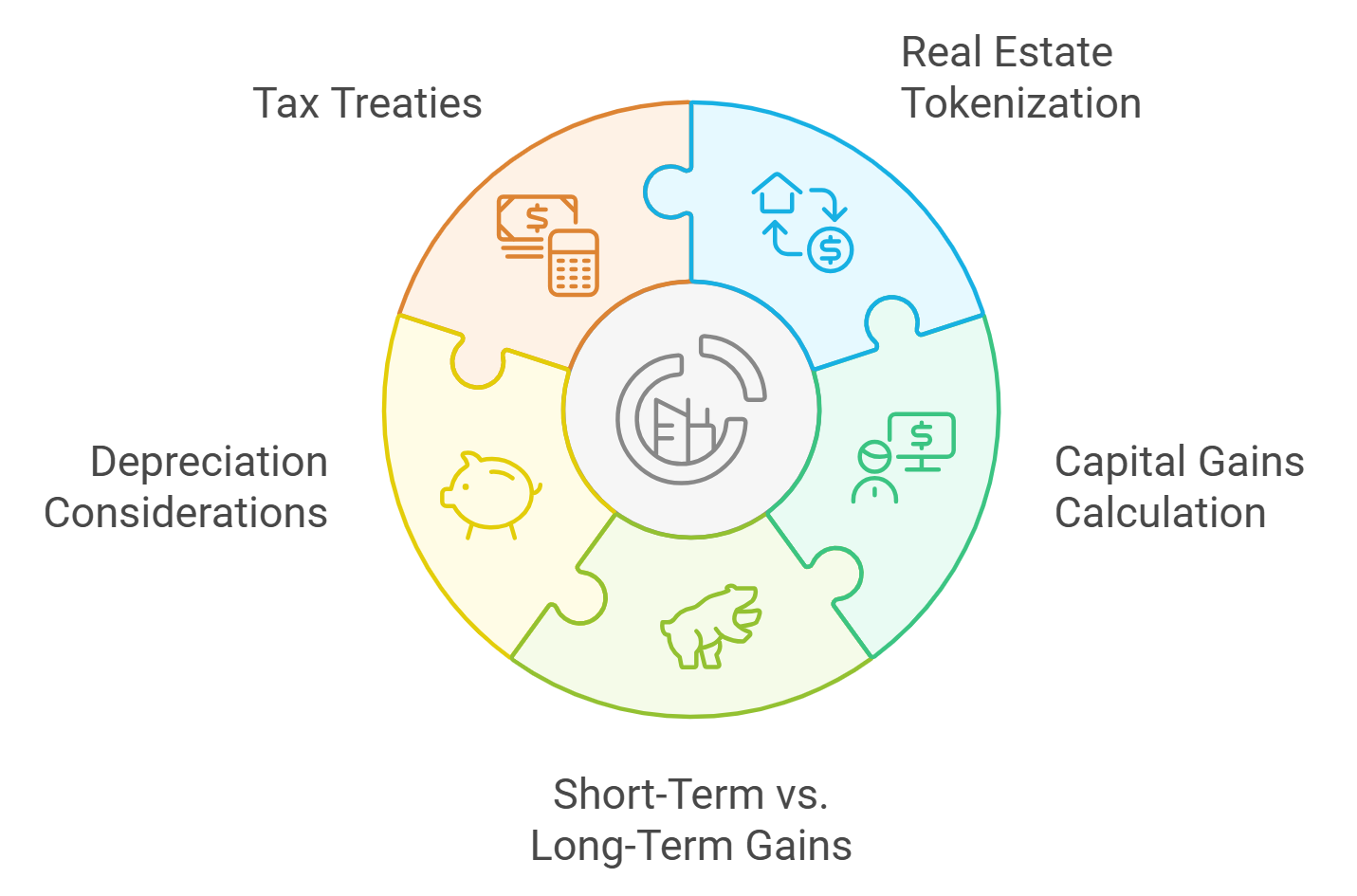

While the benefits of property tokens liquidity are compelling, it’s important to approach this emerging sector with a measured perspective. Regulatory frameworks continue to evolve across jurisdictions; compliance requirements can differ significantly between countries or even states. Due diligence on both the platform and underlying assets remains paramount.

Investors should also consider potential risks such as platform security vulnerabilities or low secondary market liquidity during early adoption phases. Thorough vetting of smart contracts and understanding custodial arrangements will help mitigate operational exposure.

Key Due Diligence Steps for Tokenized Real Estate

-

Verify the Legitimacy of the Tokenization PlatformChoose established platforms such as RealT, Property Coin, or Blocksquare. Ensure the platform is compliant with local regulations and has a transparent track record.

-

Assess Underlying Property Details and Legal StructureConduct thorough research on the physical property backing the tokens. Review property appraisals, title deeds, ownership records, and the legal entity structure (e.g., SPV, trust) used for tokenization.

-

Evaluate Regulatory Compliance and Investor ProtectionsConfirm that the tokenized offering complies with securities laws in relevant jurisdictions. Look for platforms registered with regulatory bodies (e.g., SEC in the US, FCA in the UK) and offering clear investor protections.

-

Analyze Smart Contract Security and Blockchain InfrastructureReview third-party audit reports of the smart contracts managing the tokens. Prioritize platforms utilizing reputable blockchains such as Ethereum or Polygon for enhanced security and transparency.

-

Understand Secondary Market Liquidity and Exit OptionsInvestigate if the tokens are tradable on regulated secondary markets like tZERO or OpenFinance Network. Assess trading volumes, fees, and potential restrictions on token transfers.

-

Review Tax Implications and Reporting RequirementsConsult with tax professionals to understand the tax treatment of tokenized real estate in your jurisdiction. Ensure you are aware of reporting obligations for income, capital gains, and foreign asset holdings.

-

Scrutinize Fees, Yield Projections, and Risk FactorsCarefully review the fee structure (e.g., management, transaction, withdrawal fees), projected yields, and all disclosed risks in the offering memorandum or whitepaper.

Despite these challenges, the trajectory is clear: real estate tokenization is changing how capital interacts with property markets worldwide. By lowering entry barriers through fractional ownership, enabling near-instant trading via secondary markets, and opening access to cross-border opportunities with robust transparency protocols, blockchain-based solutions are redefining what’s possible for global investors.