How Fractional Ownership with Tokenized Real Estate is Making Property Investment Accessible for $100

In 2025, the real estate investment landscape is being fundamentally reshaped by fractional real estate ownership powered by tokenization. The core innovation? Property investment is now accessible for as little as $100. This seismic shift is not just a technological evolution; it’s a democratization of an asset class that was historically reserved for high-net-worth individuals and institutional players. Thanks to advances in blockchain, compliant tokenized assets, and robust real estate tokenization platforms, the barriers to entry are lower than ever.

Tokenized Property Investment: The $100 Entry Point

Traditional real estate required deep pockets and patience. Minimums often ran into the tens or hundreds of thousands, with liquidity events measured in years. Today, blockchain real estate $100 offerings are emerging as the new norm. Platforms like Arrived, FracEstate, and MetaWealth allow investors to buy fractional shares of residential and commercial properties starting at precisely $100, no more, no less. This price point is consistent across leading providers, making it an industry standard for accessibility.

The mechanics are elegantly simple but technologically sophisticated. Properties are divided into digital tokens, each representing a proportional claim on income and appreciation. Investors can purchase these tokens on regulated marketplaces, gaining exposure to rental yields and capital growth with minimal upfront capital.

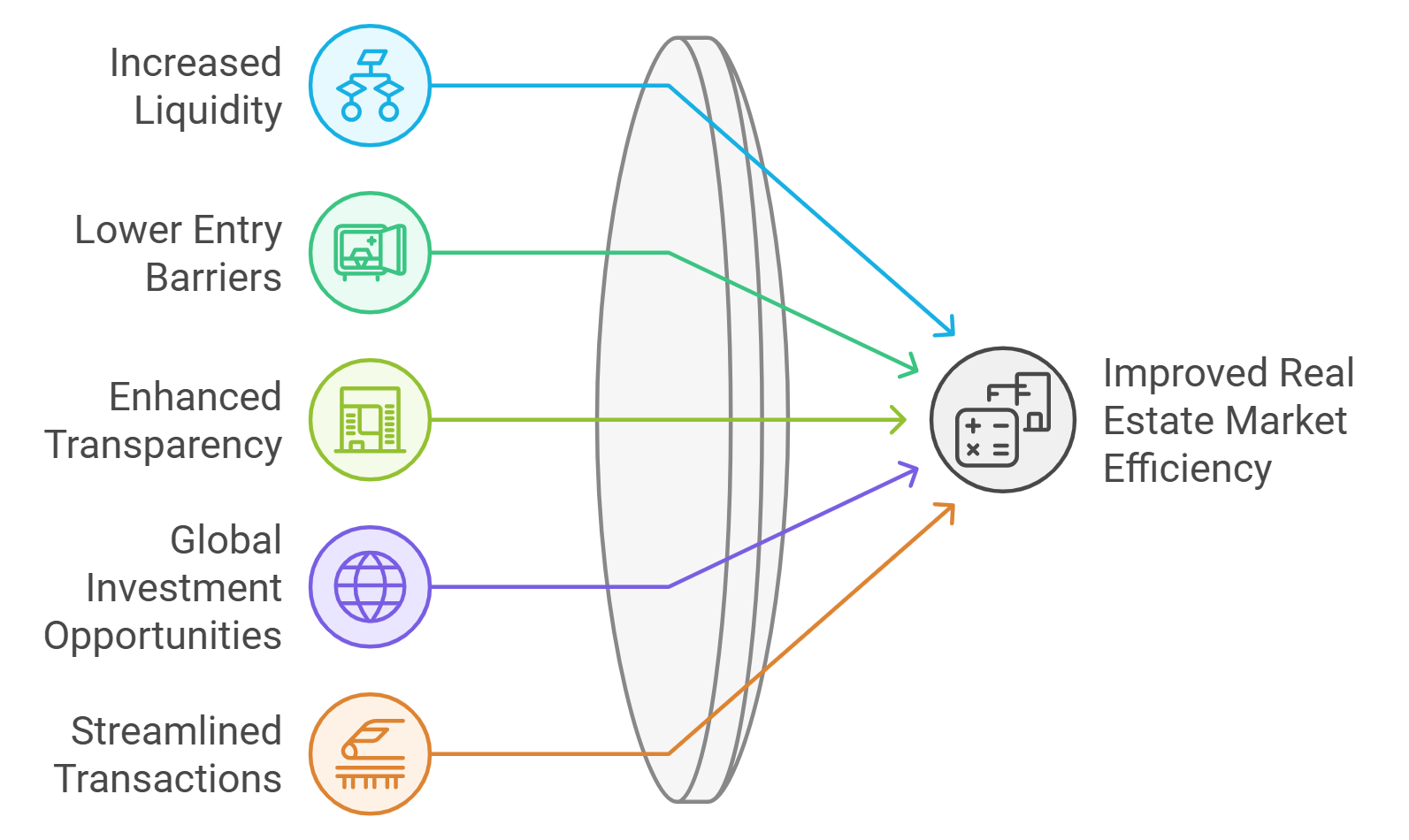

Key Advantages: From Liquidity to Diversification

Key Advantages of Tokenized Fractional Real Estate

-

Lower Entry Barriers: Invest from $100 — Platforms like FracEstate, RealT, and MetaWealth allow individuals to start investing in real estate with as little as $100, breaking down traditional capital requirements.

-

Increased Liquidity via Secondary Markets — Tokenized assets can be traded on secondary marketplaces, enabling investors to buy or sell property shares quickly compared to the lengthy process in traditional real estate.

-

Global Accessibility — Platforms such as RealT and MetaWealth offer global access to real estate markets, allowing investors from different countries to participate in property ownership seamlessly.

-

Instant Diversification Across Multiple Properties — Fractional ownership enables investors to spread capital across various properties and locations, reducing risk and enhancing portfolio stability.

-

Automated Compliance Checks — Leading platforms leverage blockchain technology to automate KYC/AML compliance, ensuring secure and regulatory-compliant transactions for all investors.

The benefits go far beyond affordability:

- Lower Entry Barriers: Anyone can invest with just $100, an unprecedented threshold in property investing history.

- Increased Liquidity: Tokenized shares can be traded on secondary markets, allowing investors to enter or exit positions far more quickly than with traditional brick-and-mortar holdings.

- Diversification: With such a low minimum investment, it’s possible to spread risk across multiple properties or even geographies, something previously only feasible for large portfolios.

- Transparency and Security: Blockchain’s immutable ledger ensures transparent ownership records and secure transactions.

- Global Reach: Investors worldwide can participate in markets previously limited by geography or regulation.

The New Players: Real Estate Tokenization Platforms Leading the Charge

The rise of tokenized property investment platforms has been meteoric. According to Deloitte Insights, tokenized private real estate funds could reach $1 trillion by 2035. But which providers are setting today’s standards?

- FracEstate (Australia): Premium properties available for $100 AUD per share.

- RealT (U. S. ): Fully-compliant U. S. rental properties with weekly income distributions; minimums start at $100 USD per token.

- MetaWealth (Europe): High-quality European assets accessible from just $100 per share via blockchain-powered transactions.

This surge in platform choice means investors can select assets that fit their risk profile, residential versus commercial, urban versus suburban, and geographic preference while maintaining full regulatory compliance (a critical factor as jurisdictions refine their stance on digital securities). For more on how fractional ownership works within this new model, see our detailed guide: How Fractional Ownership Works in Tokenized Real Estate.

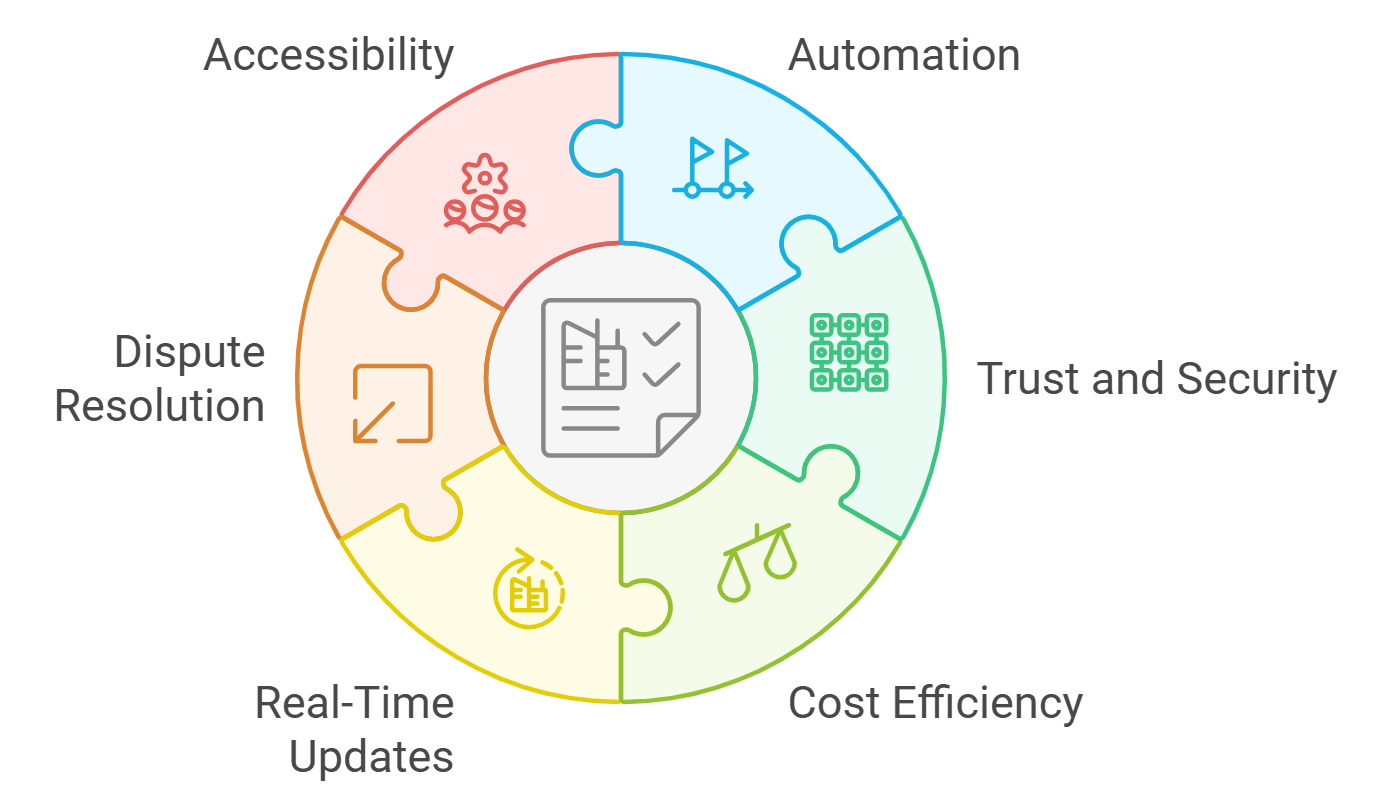

Navigating Risks and Regulatory Considerations

No discussion of innovative asset classes is complete without addressing the risks. While compliant tokenized assets offer unprecedented transparency and automation of legal processes (such as KYC/AML), there are still hurdles, regulatory uncertainty remains in some jurisdictions; technology risk exists where smart contract security is unproven; market volatility can affect both property prices and secondary market liquidity.

This makes due diligence essential. Investors should review each platform’s regulatory status (is it licensed where you live?), asset selection process (are properties independently valued?), and exit mechanisms (how liquid is the secondary market?). As always, diversification remains your best defense against unforeseen shocks, a strategy made easier than ever thanks to low minimums like $100 per property share.

For those who value control and optionality, tokenized real estate’s secondary markets are a game-changer. Unlike traditional real estate syndications or REITs, where your capital may be locked for years, compliant tokenized assets can be traded peer-to-peer or on regulated exchanges. This means investors can rebalance their portfolios in response to market shifts or personal liquidity needs, without the usual friction.

It’s also worth noting that the transparency inherent to blockchain real estate $100 offerings is not just marketing spin. Every transaction, from initial purchase to income distribution, is recorded on-chain. This creates an auditable trail for both investors and regulators, reducing the risk of fraud and administrative error. As platforms compete on user experience and compliance, expect even more automation around tax reporting, dividend payments, and identity verification in the coming years.

Investor Experience: What $100 Buys You Today

What does fractional real estate ownership actually look like at the ground level? With $100, an investor can hold tokens representing shares of residential rentals in Atlanta, commercial space in Sydney, or student housing in Berlin, all at once. Rental income is typically distributed monthly or even weekly, directly to your digital wallet. Appreciation accrues proportionally as property values rise.

Some platforms offer voting rights on key decisions (like property upgrades or refinancing), giving small investors a voice previously reserved for institutional partners. Others allow automated reinvestment of dividends into new assets, compounding returns over time with minimal effort.

Comparing Leading Real Estate Tokenization Platforms (2025)

Comparison of Leading Tokenized Real Estate Platforms (2025)

| Platform | Minimum Investment | Geographic Coverage 🌏 | Asset Types 🏠🏢 | Income Frequency 💸 |

|---|---|---|---|---|

| FracEstate | $100 AUD | Australia | Residential & Commercial | Monthly |

| RealT | $100 | United States (global access) | Residential (mainly single-family homes) | Weekly |

| MetaWealth | $100 | Europe | High-quality Residential & Commercial | Quarterly |

The diversity of options is rapidly expanding. Whether you prefer U. S. -based single-family homes with weekly payouts via RealT or European commercial assets through MetaWealth’s streamlined onboarding process, there’s now an entry point for virtually every investor profile, all starting at exactly $100.

Strategic Outlook: The Road Ahead for Tokenized Property Investment

The macro trend is clear: as regulatory frameworks mature and investor education deepens, tokenized property investment will move from niche to mainstream. Deloitte projects $1 trillion in tokenized private real estate funds by 2035, a figure that underscores both pent-up demand and structural change.

Best Practices for First-Time Tokenized Real Estate Investors

-

Research Platform Compliance & Licensing: Prioritize platforms that are fully compliant with local regulations and hold appropriate licenses. Leading platforms like Arrived, RealT, and FracEstate are transparent about their legal status and investor protections.

-

Diversify Across Properties and Locations: Reduce risk by spreading investments across multiple properties, asset types, and geographic regions. Platforms such as Lofty and MetaWealth offer access to diverse portfolios starting from $50 to $100.

-

Monitor Regulatory and Tax Updates: Stay informed about evolving regulations and tax implications for tokenized real estate in your jurisdiction. Regulatory changes can impact asset liquidity and investor rights.

-

Use Secure, Compatible Digital Wallets: Safeguard your tokens by using reputable, non-custodial wallets that support the platform’s blockchain (e.g., Algorand for Lofty, Ethereum for RealT). Always enable two-factor authentication and back up your recovery phrases securely.

For those ready to take advantage of this shift today:

- Start by researching platforms’ compliance credentials and fee structures.

- Diversify your initial $100 allocation across multiple properties or regions if possible.

- Stay informed about evolving regulations in your jurisdiction, and be prepared for innovation as smart contracts automate more legal processes.

The bottom line? The days when property investment required six figures are over. Thanks to fractional ownership via blockchain-powered platforms, and the industry-standard minimum of $100: real estate is now open to anyone ready to think globally and invest strategically. For a deeper dive into how these systems work under the hood, see our technical breakdown here: How Fractional Property Tokenization Works Transforming Real Estate Investment with Blockchain.