How Fractional Ownership via Real Estate Tokenization Is Changing Property Investment in 2025

It’s 2025, and the real estate investment landscape looks nothing like it did just a few years ago. Thanks to fractional ownership via real estate tokenization, property investing is no longer reserved for those with six-figure capital or insider connections. Instead, blockchain-powered platforms are letting everyday investors buy property tokens for as little as $50, participate in global markets, and enjoy daily rental yields – all with a few clicks.

Tokenization: Turning Property into Liquid Digital Assets

The concept is elegantly simple but technologically transformative. Tokenization converts real estate assets into digital tokens on a blockchain. Each token represents a fractional share of the underlying property, whether it’s a Miami duplex or a London office suite. Investors can buy, sell, and trade these tokens much like stocks or cryptocurrencies.

This shift is more than hype. In mid-2025, the tokenized real estate market is valued between $10, 15 billion globally, with projections suggesting up to $4 trillion in assets could be tokenized by 2035 (source). The United States leads in adoption (60% of issuance), but Europe and Asia are quickly catching up.

Lower Barriers: Invest in Real Estate from Just $50

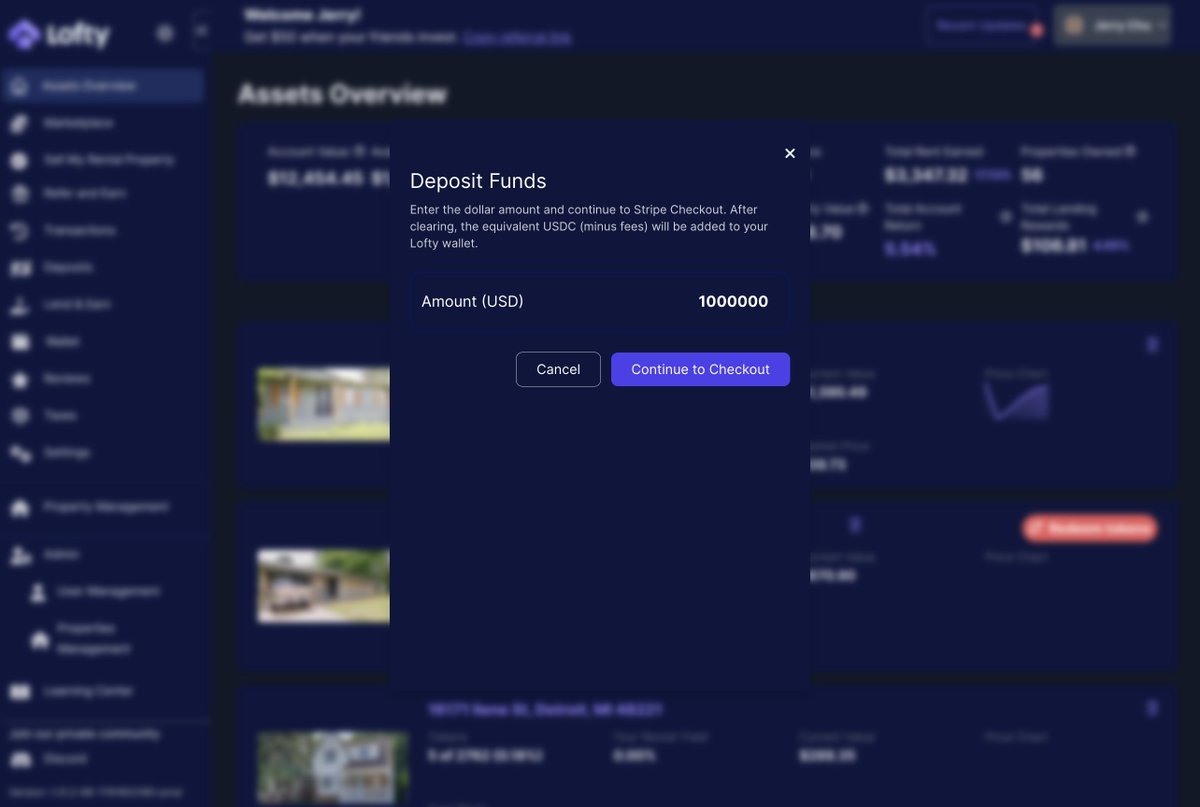

Historically, direct real estate investment demanded deep pockets – think $500,000 or more to own an entire property. Now, leading platforms like RealT and Lofty AI let investors start building portfolios with as little as $50 per tokenized share. This dramatically lowers the entry barrier for individuals who want exposure to rental income and long-term appreciation without owning whole buildings.

RealT, for example, specializes in U. S. residential properties and distributes daily rental income directly to token holders through transparent blockchain records. Lofty AI, built on Algorand, combines AI-powered analytics with smart contracts for automated income distribution – making passive income truly hands-off.

Mainstream Platforms Driving Adoption in 2025

The surge in interest isn’t just driven by retail investors; institutional players are jumping in as well. Here are some standout platforms reshaping the landscape:

- Zoniqx: With its Tokenized Asset Lifecycle Management (TALM) system on XRP Ledger and Hedera networks, Zoniqx has partnered to tokenize over $100 million in institutional-grade properties this year alone.

- Propy: Blending traditional real estate processes with blockchain efficiency, Propy offers global tokenization of both residential and commercial assets – complete with KYC compliance and smart contract-powered title transfers.

- Dubai’s Government Platform: Notably, Dubai has launched an official platform targeting $16 billion worth of digitized properties by 2033, opening doors to Middle Eastern investors with entry points starting at about $540 per share.

This explosion of options means that whether you’re looking for U. S. -based rentals or international commercial spaces, there’s likely a compliant platform ready to serve your needs.

The Regulatory Landscape: Compliance Meets Innovation

No conversation about crypto real estate investing is complete without touching on regulation. In the United States, platforms like Lofty AI and RealT operate under SEC oversight – providing transparency and investor protection that builds trust across the ecosystem. Meanwhile, other regions are quickly updating their frameworks to accommodate this new asset class; Dubai’s government initiative is just one example of mainstream regulatory adoption paving the way for secure participation worldwide.

If you’re curious about how fractional ownership works under the hood or want an illustrated guide to getting started with property tokens today, check out our detailed breakdown here: How Fractional Ownership Works in Tokenized Real Estate.

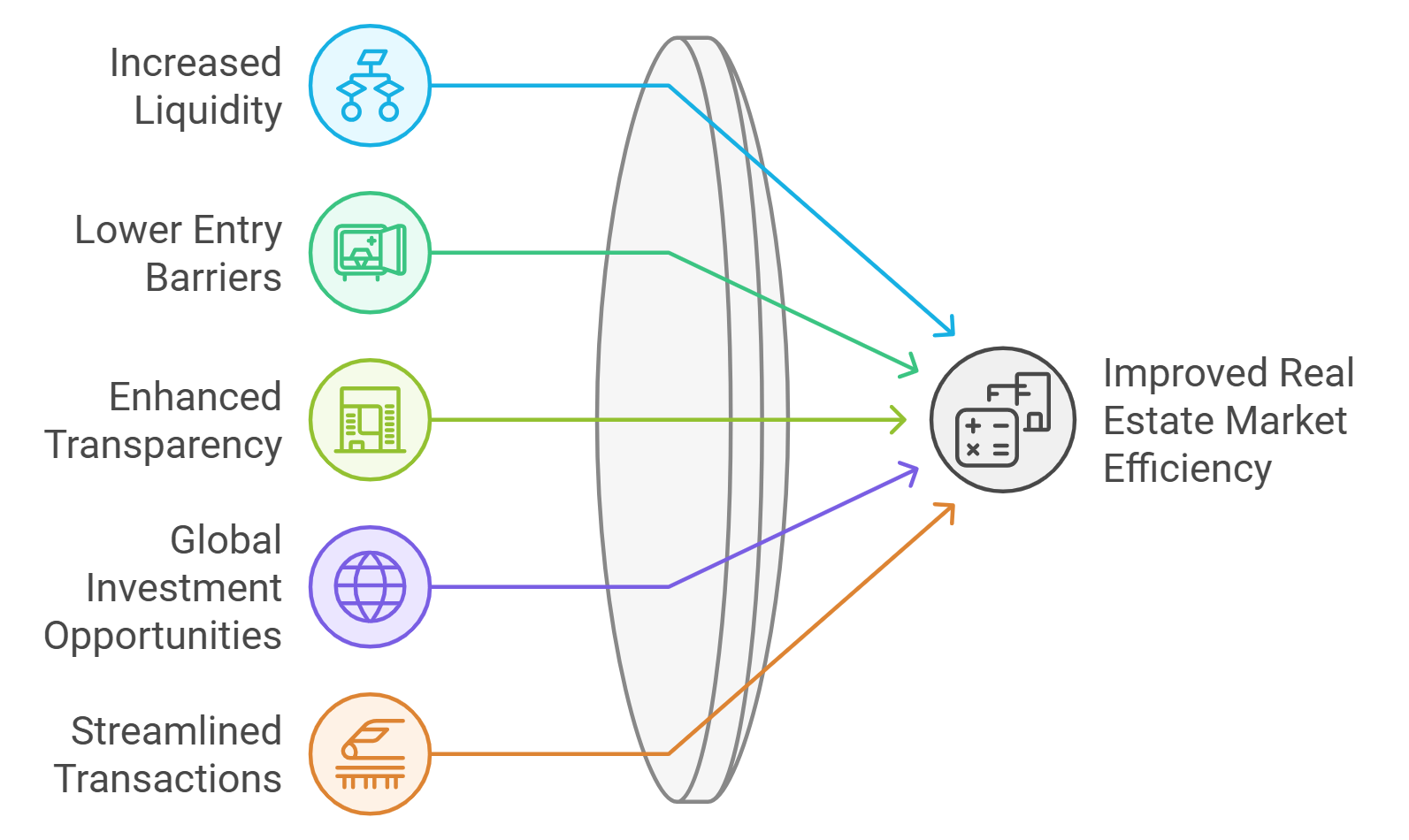

As more investors dip their toes into fractional real estate ownership, questions around liquidity, transparency, and user experience are coming to the forefront. While tokenization promises instant trades and global reach, the reality is that liquidity varies between platforms and property types. Some tokens see active daily trading, while others may have limited exit opportunities until secondary markets mature further. Still, the pace of innovation is relentless: AI-driven analytics, on-chain tenant data, and smart contract-powered governance are making it easier than ever to make informed decisions and manage risk.

Essential Benefits of Tokenized Real Estate Investment in 2025

-

Lower Barriers to Entry: Tokenized real estate platforms like RealT and Lofty AI allow investors to start with as little as $50, making property investment accessible to a much broader audience than traditional real estate.

-

Enhanced Liquidity: Unlike conventional real estate, tokenized assets can be bought and sold quickly on secondary markets. Platforms such as Lofty AI and Propy enable investors to trade their property tokens with ease, offering greater flexibility and faster access to funds.

-

Global Diversification: Tokenization platforms like Propy and Zoniqx provide access to real estate markets worldwide, letting investors diversify across different regions and property types without the usual geographic or financial barriers.

-

Transparent and Secure Transactions: Blockchain technology ensures that all transactions and property records are transparent, tamper-proof, and easily auditable. This transparency builds trust and reduces the risk of fraud for investors.

-

Automated Income Distribution: Platforms such as RealT and Lofty AI use smart contracts to automate the distribution of rental income, allowing investors to receive daily or periodic payouts directly to their wallets.

-

Regulatory Compliance and Investor Protection: Leading platforms operate under evolving regulatory frameworks, such as SEC oversight in the U.S. and government-backed initiatives in Dubai, providing investors with greater legal protection and peace of mind.

-

Fractional Ownership and Portfolio Flexibility: Tokenization enables investors to own small fractions of multiple properties, making it easier to build a diversified real estate portfolio tailored to individual risk preferences and goals.

-

Streamlined and Efficient Transactions: Platforms like Propy integrate KYC, legal compliance, and smart contract-powered title transfers, simplifying the buying, selling, and management of property investments.

Transparency is another game changer. Investors can now access granular data on properties, from tenant info to inspection reports, before buying in. This level of openness helps level the playing field for newcomers who previously had little visibility into real estate deals. Platforms like Propy and RealT are setting new standards by integrating compliance checks and automated reporting directly into their ecosystems.

Challenges Ahead: Navigating Liquidity and Market Maturity

Despite these advances, challenges remain. Liquidity, while improved compared to traditional property investment, isn’t uniform across all tokenized assets. Some tokens trade briskly thanks to high demand or strategic partnerships with exchanges; others may require patience as secondary markets develop. For many investors, this means balancing short-term flexibility with long-term vision, a dynamic more akin to early-stage crypto than blue-chip stocks.

Another consideration? Regulatory clarity. While U. S. -based platforms operate under SEC oversight and Dubai’s regulatory push signals global acceptance, cross-border transactions still face hurdles around KYC/AML compliance and taxation. As legal frameworks catch up with technology, expect smoother onboarding and broader adoption worldwide.

What’s Next for Tokenized Real Estate?

The road ahead looks promising, and busy. Market forecasts suggest that by 2035 up to $4 trillion worth of real estate could be tokenized globally, representing a seismic shift in how wealth is built and transferred (source). As platforms continue to innovate with AI analytics, instant liquidity features, and seamless cross-border compliance tools, expect even more investors, both retail and institutional, to join this digital property revolution.

If you’re ready to explore fractional ownership or want a step-by-step guide for getting started with your first property token purchase (from just $50), we’ve got you covered: How Fractional Property Tokenization Works.

The bottom line? In 2025, real estate tokenization is not just a trend, it’s a fundamental reimagining of what it means to invest in property. Whether you’re seeking passive income streams or portfolio diversification on a global scale, this technology offers unprecedented access without sacrificing security or transparency. The future of property investment is here, and it’s open to everyone willing to take that first digital step.