How Tokenized Real Estate Lowers Barriers for Global Investors

Imagine a world where you can invest in a slice of a luxury apartment in London, a beachfront villa in Bali, or a bustling co-working space in New York – all from your laptop, no matter where you live. This isn’t tomorrow’s promise: it’s the reality being delivered by tokenized real estate. By leveraging blockchain technology and fractional property ownership, global real estate investment is finally breaking free from its old constraints.

Fractional Ownership: Breaking Down Million-Dollar Barriers

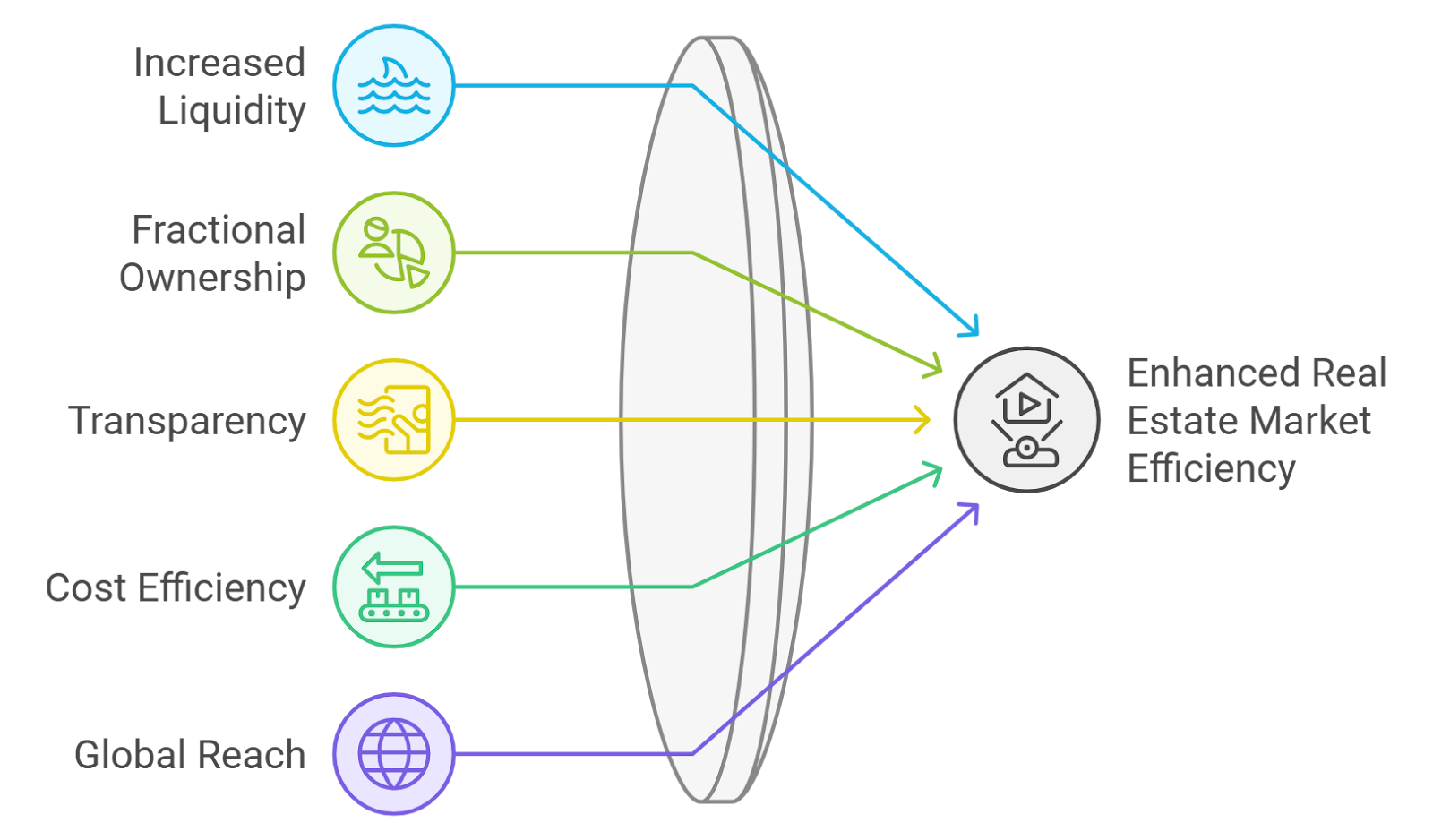

For generations, real estate was synonymous with high capital requirements and lengthy paperwork. The dream of owning property felt out of reach for most individuals, especially when prime assets carried million-dollar price tags. Tokenization is changing that narrative at its core. Today, instead of needing $1 million to buy an entire property outright, investors can purchase fractions, or tokens – for as little as $100 each. This seismic shift is democratizing access and empowering everyday investors to build wealth through global real estate.

The numbers speak volumes. As highlighted by leading industry sources, tokenization enables properties to be split into thousands of tradable units. A $1 million asset can be divided into 10,000 tokens worth $100 each, instantly lowering the entry threshold and opening doors for retail participation worldwide (see how fractional ownership is making global property investment accessible). This model isn’t just about affordability; it’s about giving everyone a seat at the table.

Enhanced Liquidity: Real Estate Moves at Digital Speed

The traditional real estate market is notorious for its illiquidity. Selling even a small stake in a building could take months or years, with mountains of paperwork and intermediaries slowing things down. Enter blockchain real estate: with tokenized assets, buying or selling fractional shares becomes as seamless as trading stocks or crypto.

This new liquidity means global investors can respond swiftly to market opportunities, rebalance their portfolios on demand, and exit positions without being locked in for years at a time (discover how tokenization increases liquidity for global investors). It’s no surprise that both retail and institutional players are flocking to tokenized platforms seeking flexibility that was previously unthinkable in bricks-and-mortar investing.

Global Accessibility: No More Borders for Investors

The beauty of property tokenization lies not just in lower costs but also in its borderless nature. Traditional cross-border investments are tangled with regulatory hurdles, bank delays, and currency headaches. Tokenized platforms operate globally by design, allowing anyone from Tokyo to Toronto to own fractional stakes in premium properties around the world.

This opens up massive potential for diversification and risk management. Investors can now build international portfolios without ever booking a flight or hiring local legal counsel (read more about the revolution in global property investment). The playing field has never been more level, and the future never brighter for those willing to embrace this transformation.

Transparency and trust are foundational to any successful investment, and blockchain delivers both in abundance. Every transaction, ownership record, and rights agreement is immutably recorded on-chain. This not only reduces the risk of fraud but also empowers investors to verify the legitimacy of their holdings instantly. In a world where transparency is often lacking in traditional real estate markets, tokenized real estate stands out as a beacon of clarity.

Security is equally paramount. Blockchain’s decentralized architecture means there’s no single point of failure, and smart contracts automate critical processes without human error or manipulation. For global investors, especially those new to real estate, this level of security offers peace of mind that simply wasn’t possible before.

Cost Efficiency: Streamlined Investing for Everyone

Tokenized real estate platforms eliminate many traditional costs associated with property investing. Gone are the days of endless paperwork, hefty broker fees, and opaque administrative charges. By leveraging smart contracts and digital workflows, transactions become faster, more efficient, and far less expensive for all participants.

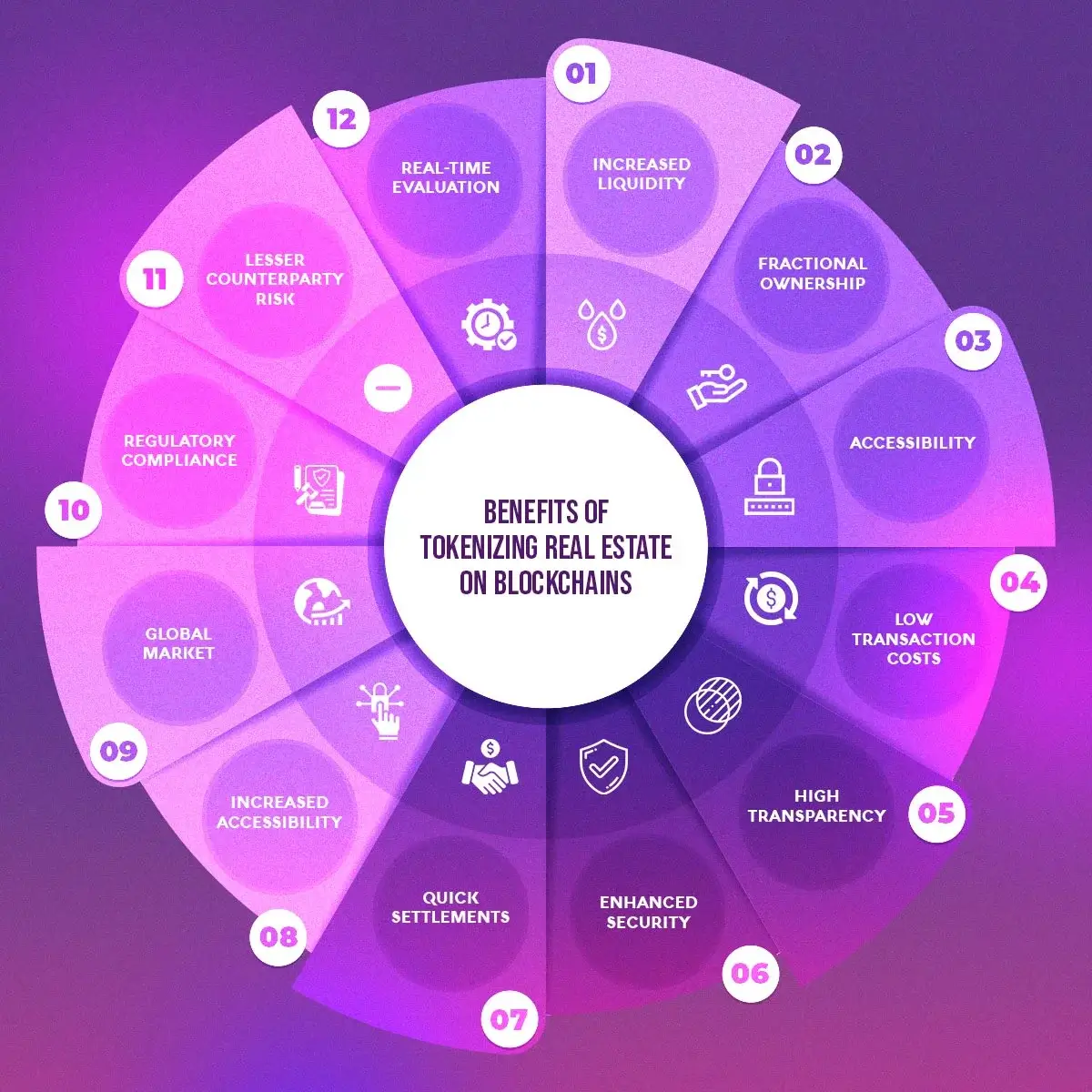

Top 5 Benefits of Tokenized Real Estate for Investors

-

Fractional Ownership & Lower Investment Thresholds: Tokenization divides properties into digital tokens, letting investors buy fractional shares. This drastically reduces the capital needed—imagine owning a piece of a $1 million property for just $100—making real estate accessible to more people than ever before.

-

Enhanced Liquidity: Unlike traditional real estate, which can take months to buy or sell, tokenized assets can be traded quickly and efficiently. Investors can buy or sell their shares on digital platforms, enjoying much faster access to their funds.

-

Global Accessibility: Tokenized real estate platforms operate worldwide, enabling investors to access and diversify into international properties seamlessly, without the usual cross-border hassles or restrictions.

-

Transparency & Security: Blockchain technology ensures that all transactions and ownership records are transparent, immutable, and secure. This reduces the risk of fraud and builds investor confidence.

-

Cost Efficiency: By eliminating intermediaries and automating processes with smart contracts, tokenized real estate significantly lowers transaction costs and streamlines the investment process.

It’s not just about saving money, it’s about unlocking opportunity. Lower costs mean more capital can be put to work in actual investments rather than being eaten up by middlemen. This efficiency is a critical factor in making global real estate accessible to a new generation of investors hungry for innovation.

The Future Is Now: How You Can Get Started

The barriers that once kept most people out of prime real estate are crumbling fast. Whether you’re an experienced investor looking to diversify globally or someone taking your first steps into property markets, tokenization puts the world at your fingertips.

Platforms like Real Estate Rwas are leading this charge by prioritizing user experience, compliance, and robust security protocols. As regulatory frameworks evolve and adoption accelerates, expect even greater innovation, and more opportunities, for those willing to seize them.

The rise of fractional property ownership, enhanced liquidity, borderless access, and blockchain-powered transparency isn’t just changing how we invest, it’s redefining who gets to participate in wealth creation through real assets. The age-old dream of owning a piece of the world is now within reach for all.