How Fractional Ownership and Tokenized Real Estate Are Making Global Property Investment Accessible

The traditional real estate market has long been characterized by high entry barriers, limited liquidity, and a lack of transparency. For most global investors, direct property ownership has remained out of reach due to capital requirements, local regulations, and cumbersome transaction processes. However, the emergence of fractional ownership real estate and tokenized property investment is quietly but fundamentally changing this paradigm.

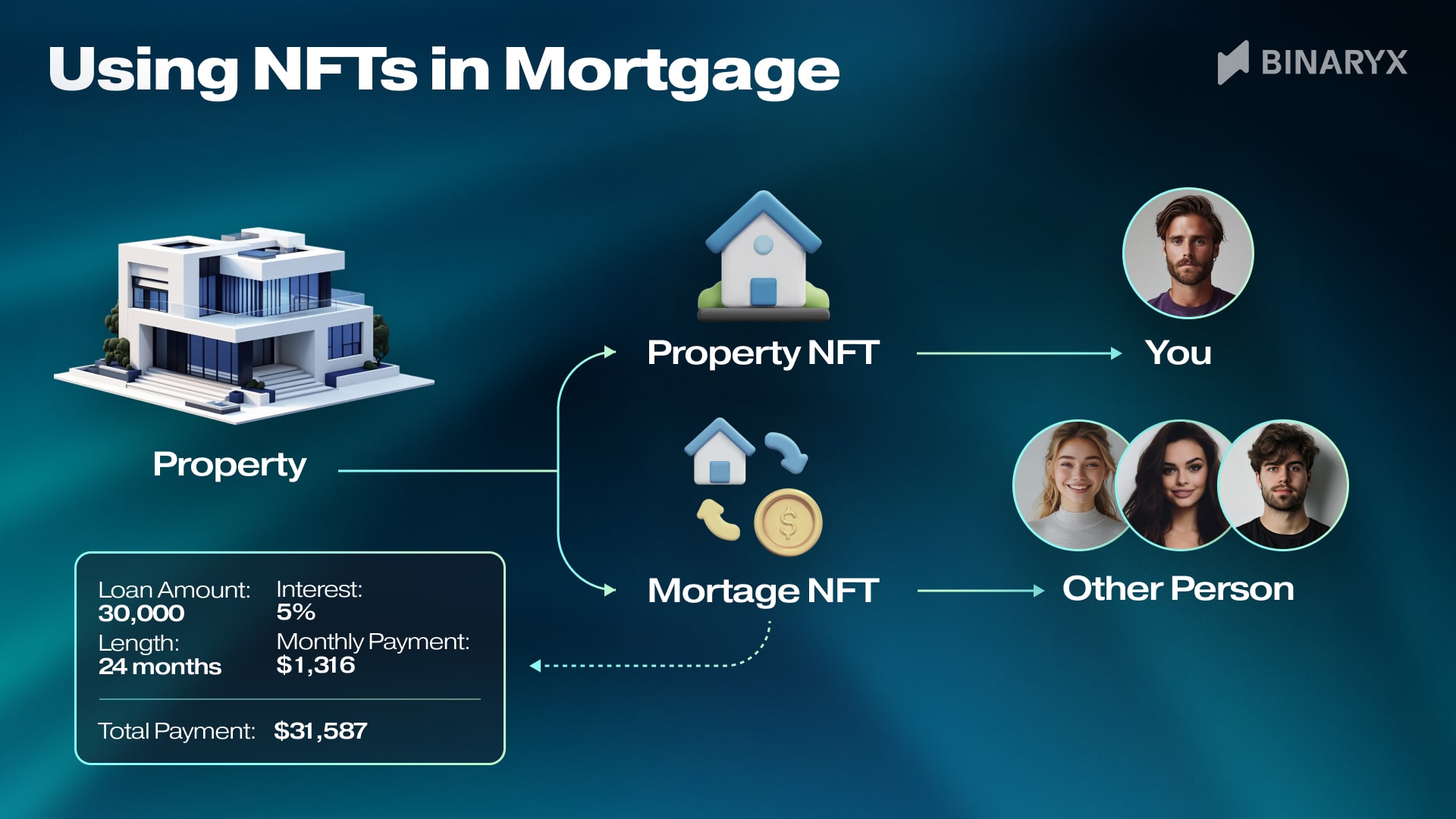

Fractional ownership divides a single high-value asset into smaller shares, making it possible for multiple investors to participate in an asset class that was previously reserved for institutions or high-net-worth individuals. When combined with blockchain technology through tokenization, these shares become digital tokens that can be bought, sold, or traded online. This shift is not just theoretical – it is actively reshaping how individuals access global real estate markets.

How Tokenization Lowers Barriers and Increases Access

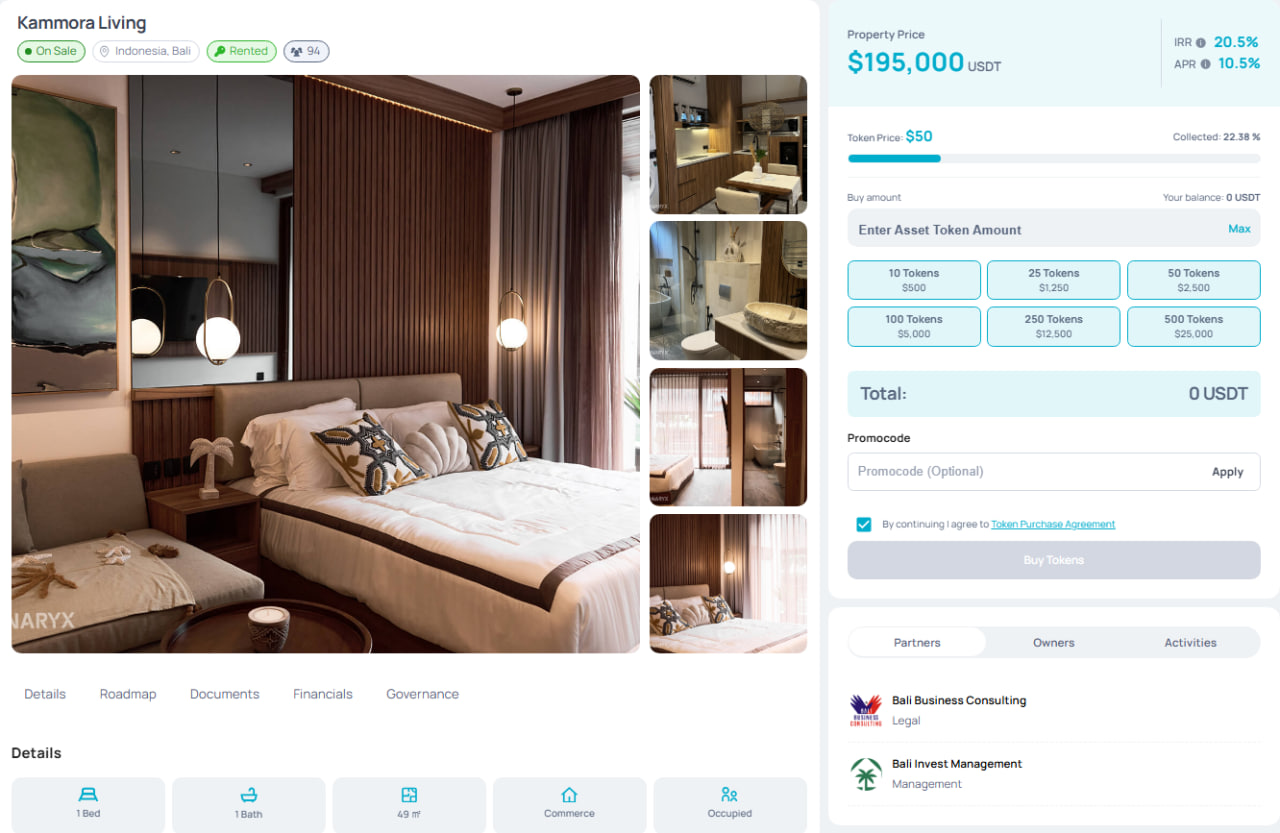

Tokenization enables investors to buy real estate tokens online, sometimes with as little as $10 or $50 per share. This democratizes access to prime properties in major cities or emerging markets worldwide. The process compresses time-to-capital for issuers and reduces operational costs by automating compliance and income distribution via smart contracts.

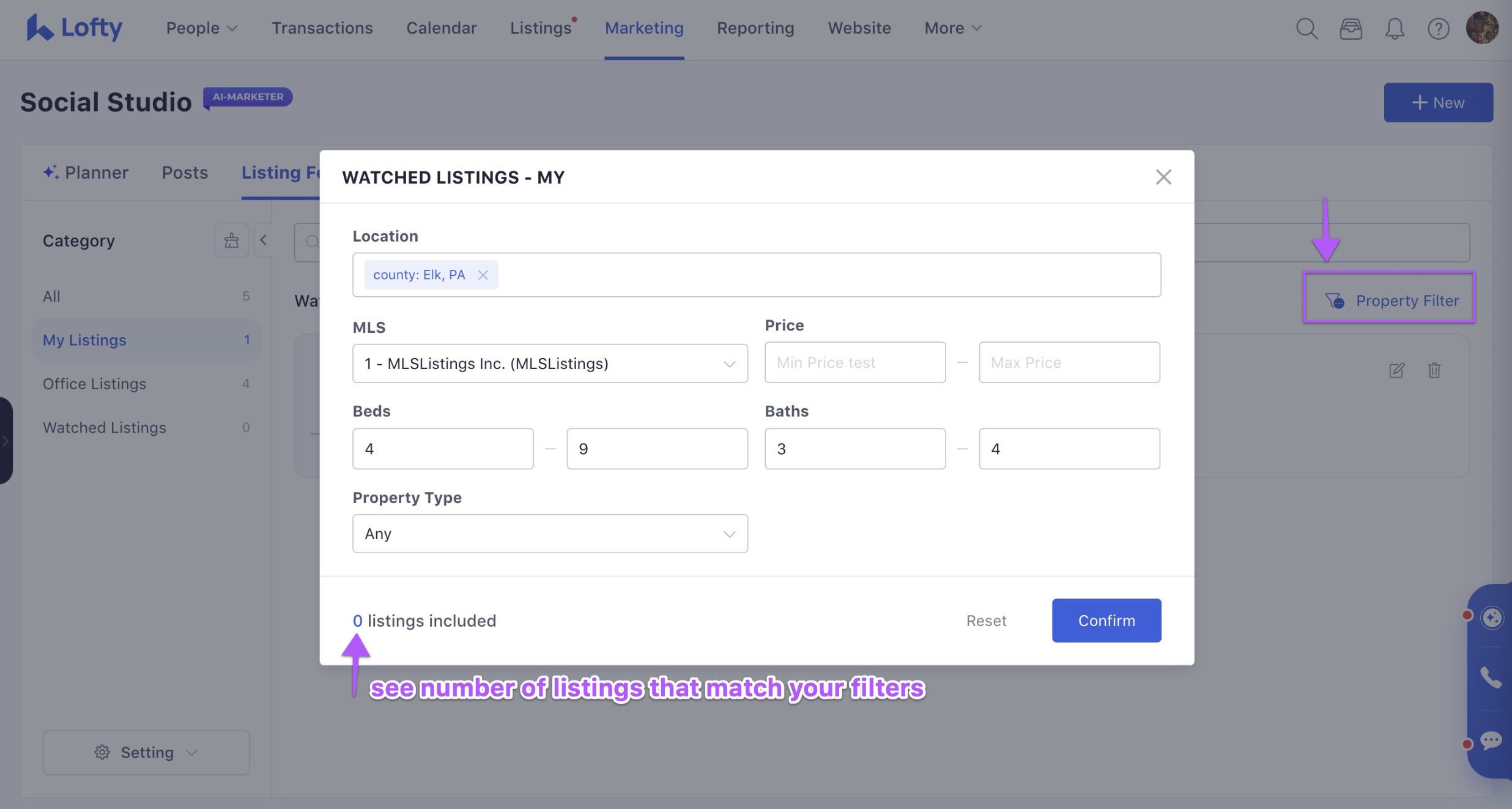

Platforms such as RealT and Lofty AI are at the forefront of this movement. RealT specializes in U. S. residential properties, allowing investors to purchase fractional shares with daily rental income distribution. Lofty AI leverages the Algorand blockchain and AI analytics to offer fractional investments in income-generating properties starting at $50 per token. These platforms make it possible for anyone, regardless of geography, to participate in rental markets that were previously inaccessible.

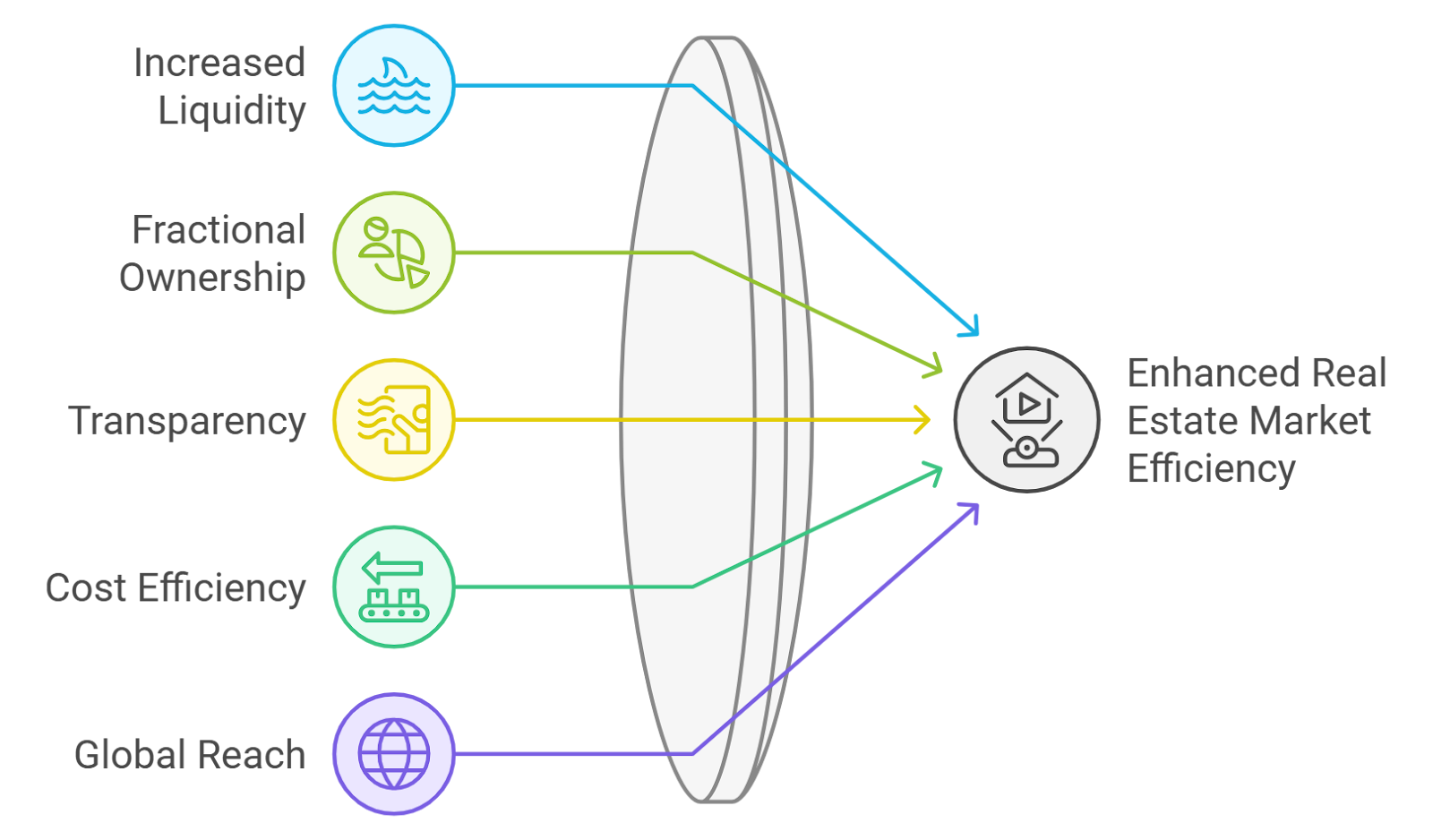

The Benefits: Liquidity, Transparency, and Global Reach

Top 5 Benefits of Investing in Tokenized Real Estate

-

Lower Barriers to Entry: Tokenization enables investors to purchase fractional shares of high-value properties, making real estate investment accessible to a broader audience. Platforms like RealT allow individuals to start investing with as little as $50, democratizing access to the real estate market.

-

Enhanced Liquidity: Unlike traditional real estate, tokenized assets can be traded on secondary markets, allowing investors to buy and sell their holdings with greater ease. Marketplaces such as tZERO facilitate the trading of tokenized real estate, providing improved liquidity.

-

Global Diversification: Tokenized real estate provides investors with access to properties worldwide, enabling portfolio diversification across different markets. Platforms like Binaryx offer investment opportunities in luxury vacation and resort properties in multiple countries.

-

Transparency and Security: Blockchain technology ensures that all transactions are recorded on an immutable ledger, reducing the risk of fraud and increasing trust. Smart contracts automate processes such as income distribution and compliance, as seen on platforms like Lofty AI.

-

Operational Efficiency and Cost Reduction: Tokenization streamlines administrative processes, reduces the need for intermediaries, and lowers transaction costs for both issuers and investors. This efficiency compresses time-to-capital and expands the potential investor base, as highlighted by industry sources like Deloitte and EY.

One of the most significant advances brought by global real estate tokenization is enhanced liquidity. Unlike traditional property investments, which can take months or even years to liquidate, tokenized assets can be traded on secondary marketplaces such as tZERO. This allows investors to respond quickly to market changes or rebalance their portfolios without being locked into illiquid positions.

Transparency is another core benefit. All transactions are recorded on an immutable blockchain ledger, reducing the risk of fraud and ensuring that ownership records are clear and accessible. Smart contracts further automate processes such as rental income distribution and compliance checks, minimizing the need for intermediaries while bolstering security.

Regulatory Progress and Global Adoption

The regulatory landscape for property tokenization is evolving rapidly but unevenly across jurisdictions. Dubai has emerged as a leader with its Land Department actively supporting title deed tokenization under clear frameworks. In the United States, platforms like RealT and Lofty AI operate under SEC oversight, a key factor in building investor trust and ensuring compliance.

This regulatory clarity is essential not only for investor protection but also for fostering the growth of new property tokenization platforms. As more countries establish guidelines for digital assets, expect broader adoption among both institutional players seeking custom portfolios and individuals looking to diversify globally without traditional hurdles.

Despite the momentum, the journey toward mainstream adoption of blockchain real estate investing is not without friction. Regulatory compliance remains a patchwork globally, with each jurisdiction interpreting digital assets and tokenized property rights differently. This creates operational complexity for platforms and can introduce uncertainty for investors who may not be familiar with local legal nuances. Investors should always review the specific compliance measures taken by any platform before committing capital, especially when investing across borders.

Security is another critical concern. While blockchain ledgers are inherently tamper-resistant, vulnerabilities can still exist at the smart contract or platform level. High-profile incidents in the broader crypto sector have underscored the importance of robust security audits and transparent operational practices. Investors should prioritize platforms with clear risk disclosures, regular third-party audits, and a track record of responsible management.

Investor Experience: Accessibility Meets Caution

The allure of being able to invest in real estate with $10 or $50 is powerful, but accessibility does not eliminate risk. Fractional ownership exposes investors to property-specific risks such as vacancy, maintenance costs, or changes in local market conditions, just as traditional property investment does. The difference is that blockchain-based platforms often provide more granular data and real-time performance metrics, allowing for more informed decision-making.

For those exploring this space, diversification remains essential. Rather than concentrating on a single asset or geography, investors can build custom portfolios spanning multiple properties and regions. This approach can help mitigate local shocks while taking advantage of global growth opportunities.

Tokenization doesn’t remove risk, it reframes it. You gain liquidity and access, but you must remain vigilant about platform security, regulatory shifts, and underlying property fundamentals.

What’s Next: The Road Ahead for Tokenized Real Estate

The next phase of global real estate tokenization may be defined by greater institutional involvement and further innovation in secondary markets. As major financial players begin to create bespoke portfolios using property tokens that match their investment thesis (as noted by Deloitte), retail investors will likely benefit from enhanced liquidity and price discovery mechanisms.

Ongoing advancements in smart contract automation could further streamline processes such as rental income payouts, governance voting on property decisions, or even dynamic rebalancing based on market signals. However, these innovations must be matched by continued progress in regulatory harmonization and cybersecurity best practices.

Top Tips for First-Time Fractional Real Estate Investors

-

Understand the Underlying Asset and Location: Examine the specific property, its location, and market fundamentals. Platforms like Binaryx offer international options, but due diligence on local real estate trends and legal frameworks is essential before committing funds.

-

Assess Liquidity and Exit Options: Tokenized real estate can offer improved liquidity, but check if the platform supports secondary market trading (e.g., tZERO for tokenized securities). Review the ease and speed of buying or selling your fractional shares.

-

Evaluate Fee Structures and Income Distribution: Analyze all costs, including platform fees, transaction charges, and how rental income is distributed. Platforms like Lofty AI and RealT automate income via smart contracts—verify the frequency and reliability of these payments.

-

Stay Informed About Regulatory and Security Risks: Tokenized real estate is subject to evolving regulations and potential smart contract vulnerabilities. Regularly monitor updates from official sources and choose platforms with robust security protocols and transparent communication.

For those ready to take the next step, careful due diligence is paramount. Evaluate each platform’s compliance status, security protocols, fee structures, and user experience. Consider starting with small allocations to build familiarity before increasing exposure. And above all, remember that while tokenization lowers barriers to entry, prudent risk management remains your best ally in this new era of property investment.

To learn more about how fractional ownership works in tokenized real estate, and how it is opening global markets to small investors, explore our detailed guide: How Fractional Real Estate Ownership via Tokenization Opens Global Markets to Small Investors.