How Real Estate Tokenization is Democratizing Access to Global Property Investment

Imagine a world where anyone, anywhere, can invest in prime real estate with just a few clicks and as little as $50. That world is no longer a distant dream – it’s the reality being shaped by real estate tokenization. By leveraging blockchain technology, property ownership is being divided into digital tokens, unlocking unprecedented access to global real estate markets for everyday investors.

Fractional Ownership: Breaking Down the Barriers

Traditionally, investing in real estate meant hefty down payments, complex paperwork, and long holding periods. These barriers kept most people on the sidelines. But with fractional property ownership, tokenization divides assets into smaller units – or tokens – each representing a share of the property. Platforms like RealT and Lofty have lowered entry thresholds to as little as $50 per investment, making it possible for students, young professionals, and small business owners to participate alongside institutional investors.

This isn’t just about easier access; it’s about real democratization. No longer do you need vast sums or privileged connections to build a global property portfolio. Tokenized real estate platforms are giving power back to the people.

Liquidity and Flexibility: 24/7 Markets for Real Estate

If you’ve ever tried to sell an investment property, you know it can take months (or even years) to close a deal. Tokenized assets change this paradigm by introducing secondary markets where property tokens can be bought and sold around the clock. Platforms like tZERO and Blockimmo have created 24/7 marketplaces that provide liquidity solutions never before seen in real estate.

This means investors aren’t locked in for years; they can exit positions quickly if their financial needs or market views change. The ability to trade tokens globally also brings in more buyers and sellers, further enhancing liquidity – a game-changer for both new entrants and seasoned pros.

Key Benefits of Tokenized Real Estate Platforms

-

Global Investment Opportunities: Blockchain-based platforms eliminate geographical barriers, enabling investors worldwide to participate in real estate markets. This fosters a truly global investor base and injects capital into diverse markets.

-

Transparency & Security: Blockchain technology ensures every transaction is recorded on a secure, immutable ledger. This increases trust and reduces fraud, as seen on platforms like Multibank Group and Tauvlo.

-

Rapid Market Growth: The tokenized real estate market was valued at $24 billion in 2024 and is projected to reach $80-100 billion by 2028, reflecting growing adoption and regulatory support worldwide.

-

Notable Industry Developments: Major players like Seazen Group and Multibank Group are pioneering tokenization initiatives, signaling mainstream acceptance and expanding opportunities for global investors.

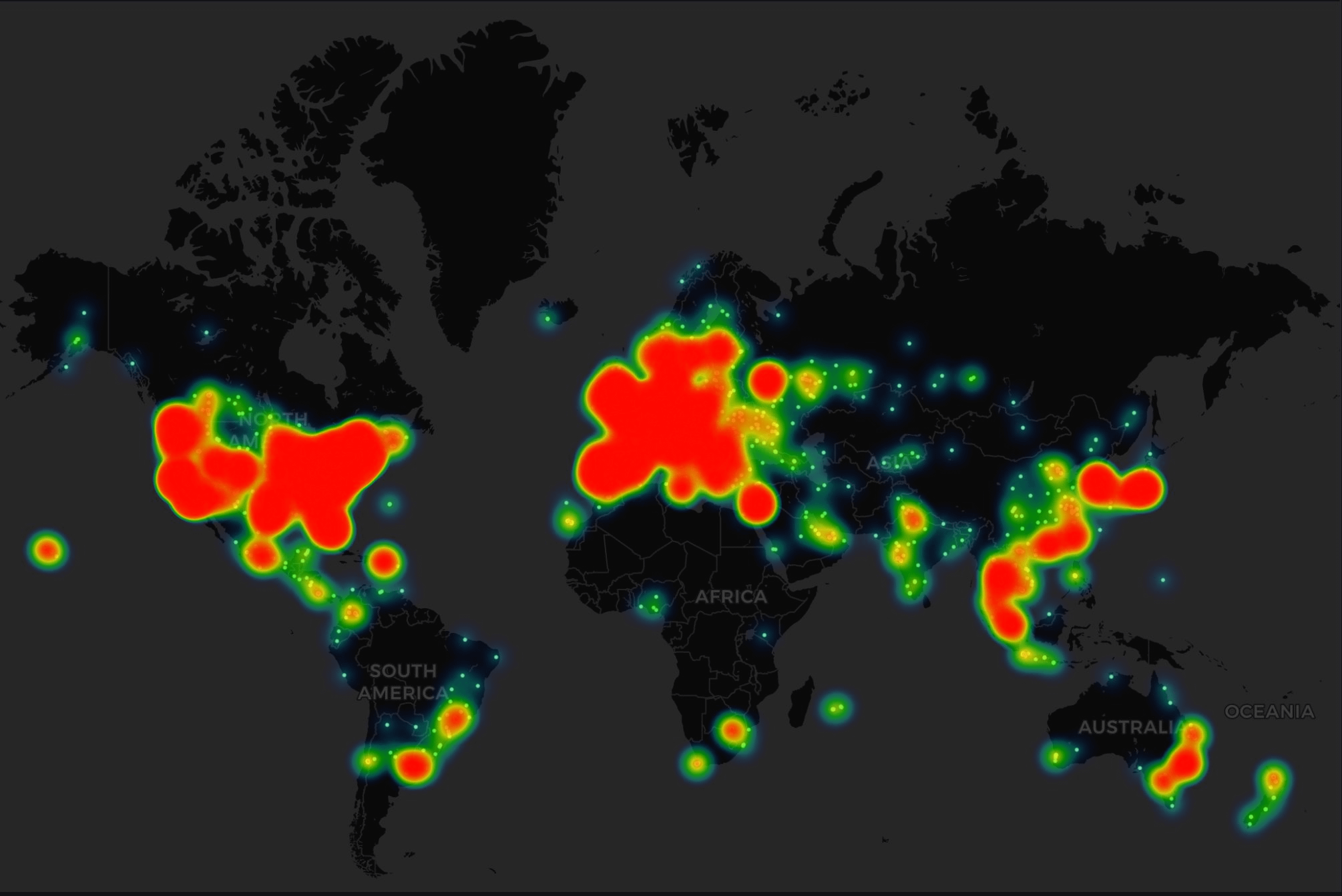

The Global Reach of Blockchain Real Estate

The impact goes far beyond local borders. Blockchain-based property tokens transcend geography, letting investors from Tokyo to Toronto participate in projects from New York to Nairobi without navigating endless paperwork or currency conversions. As highlighted by recent moves from industry giants like Seazen Group and Multibank Group, even major developers are embracing this cross-border revolution.

This new era of global real estate investment is not just more accessible – it’s more transparent too. Every transaction is recorded on an immutable blockchain ledger, reducing fraud risk and building trust among all participants.

Transparency isn’t just a buzzword in this ecosystem, it’s a foundational principle. With blockchain, every transfer of property tokens is permanently recorded, providing a clear, tamper-proof history of ownership. This level of openness is attracting not only retail investors but also institutions that have historically been wary of opaque real estate markets. The result? Enhanced trust and a more level playing field for everyone.

Market Growth: Tokenized Real Estate Surges to $24 Billion

The numbers speak volumes about the momentum behind tokenized assets. As of 2024, the tokenized real estate market reached an impressive $24 billion, up from just $1.4 billion in 2020. Analysts are projecting this figure could soar to $80-100 billion by 2028 as regulatory clarity improves and institutional adoption accelerates. This rapid growth is a testament to the demand for accessible, liquid, and transparent property investment options worldwide.

What’s fueling this surge? It’s not just technological innovation, it’s the realization that real estate tokenization unlocks new possibilities for diversification, risk management, and wealth creation on a global scale. Whether you’re looking to hedge against inflation or tap into emerging markets, tokenized platforms offer flexibility and reach that traditional vehicles simply can’t match.

Looking Ahead: A New Standard for Real Estate Investment

The ongoing embrace of tokenization by major players like Seazen Group signals that this isn’t just a passing trend, it’s fast becoming the new standard for global real estate investment. As more financial institutions integrate blockchain solutions and regulatory frameworks mature, expect even broader participation from both individual and institutional investors.

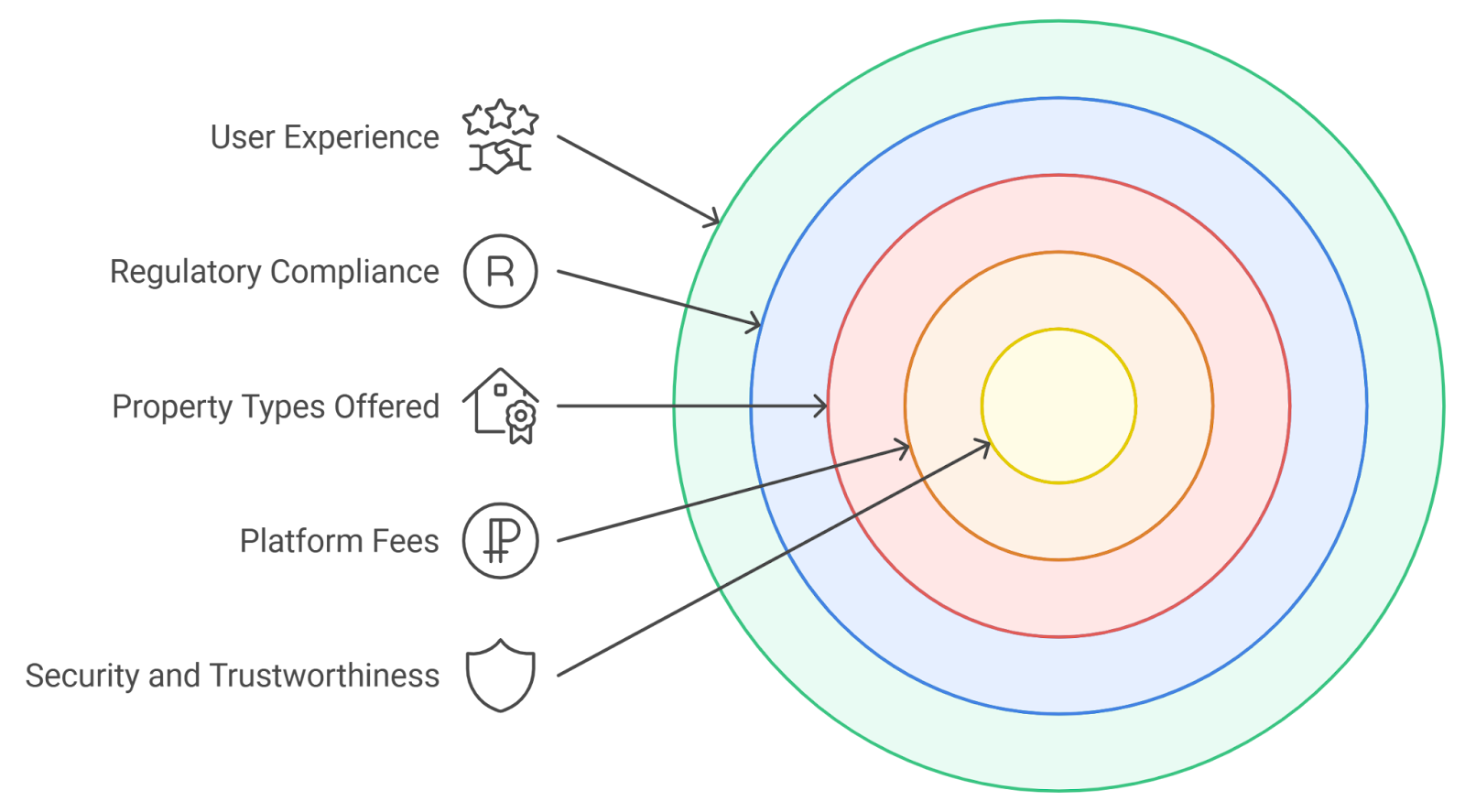

For those ready to seize the opportunity, platforms like Real Estate Rwas are paving the way forward, combining security, compliance, and user-friendly experiences to make property investment as simple as trading stocks or crypto. The barriers are falling; the future belongs to those who adapt early.

If you’re eager to learn more about how liquidity is transforming global property markets or want a deeper dive into fractional ownership mechanics, check out our in-depth guides on real estate liquidity or fractional property tokenization. The tools are here, the rest is up to your vision and ambition.