How Blockchain Tokenization is Transforming Real Estate Liquidity for Global Investors

Imagine buying a slice of a Manhattan skyscraper or a luxury villa in Dubai, all from your smartphone and with just a few clicks. Blockchain real estate investment is making this possible by breaking down the traditional barriers to entry and transforming how global investors access property markets. The secret sauce? Tokenization.

Breaking Down Real Estate Tokenization: What’s Actually Changing?

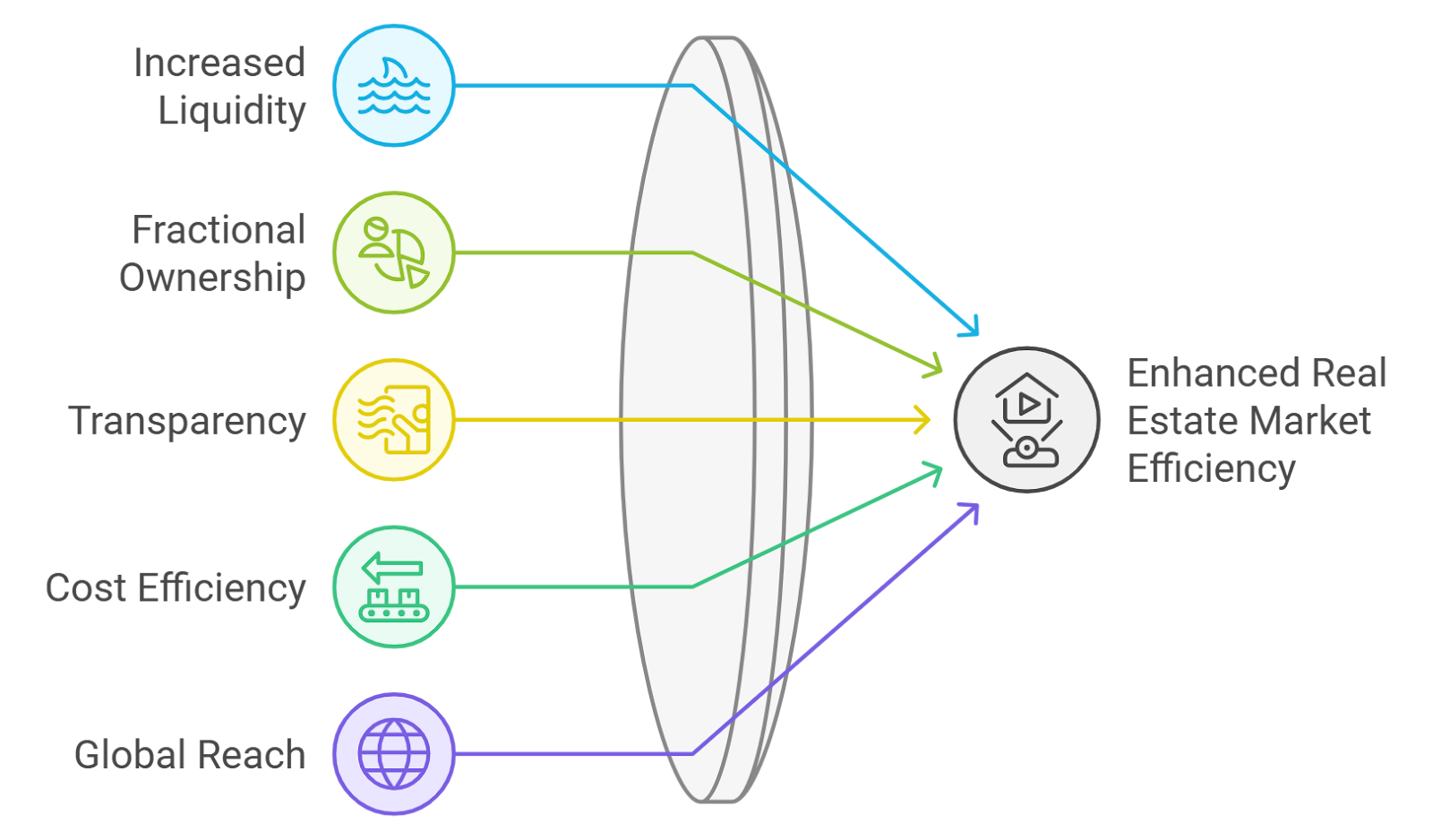

Real estate tokenization is the process of converting ownership rights in physical property into digital tokens on a blockchain. Each token represents a fractional share of the underlying asset, enabling investors to buy, sell, or trade their holdings much like stocks or cryptocurrencies. This shift is more than just technical jargon – it’s fundamentally reshaping how we think about property ownership, liquidity, and accessibility.

Traditionally, real estate has been one of the most illiquid asset classes. Selling property often means months of paperwork, due diligence, and negotiation. But with tokenized real estate platforms, you can list your stake on a secondary market and potentially exit your position in days – or even hours – rather than months. This is game-changing for both institutional players and everyday investors.

“Tokenization not only enhances accessibility to real estate investments but also improves liquidity and transparency within the sector. “ – EY

The Liquidity Revolution: From Locked-In Capital to Fluid Markets

The core advantage driving excitement around property token trading is liquidity. By allowing fractional real estate ownership through blockchain tokens, investors are no longer locked into long holding periods or forced to sell entire properties just to realize gains. Instead, they can trade portions of their investment as market conditions change.

Three Ways Tokenization Unlocks Real Estate Liquidity

-

Fractional Ownership Enables Easier Entry and Exit: Blockchain tokenization divides real estate into digital tokens, allowing investors to purchase fractions of a property rather than the whole asset. This lowers the investment threshold and lets investors buy or sell their shares on secondary markets, making real estate far more liquid than traditional ownership models.

-

Global Access Removes Geographical Barriers: Tokenized real estate platforms like RealT and SolidBlock allow investors from around the world to participate in property markets such as New York, London, or Dubai. This democratizes access, letting global investors diversify their portfolios and property owners tap into a much larger pool of capital.

-

Secondary Market Trading Creates Ongoing Liquidity: With tokenized assets, investors can trade real estate tokens on regulated digital asset exchanges such as tZERO and INX. This creates a more dynamic marketplace, enabling real-time buying and selling of property shares—unlocking liquidity that was previously trapped in traditional, illiquid real estate investments.

This new model also attracts a wider pool of participants. For example, someone in Singapore can now invest in prime London office space without ever setting foot in the UK – all thanks to blockchain-powered platforms that handle compliance and settlement globally.

Paving the Way for Global Participation

The power of real estate tokenization lies in its ability to democratize access. By digitizing assets and removing geographical friction, these platforms are opening up high-value markets like New York or Paris to investors everywhere.

This isn’t just about giving individuals more options; it’s also about empowering developers and property owners with new fundraising tools. By issuing tokens that represent shares in their projects, they can tap into global capital flows that were previously out of reach.

A Closer Look at Compliance and Security Trends (2025)

No transformation comes without hurdles. As adoption accelerates worldwide – especially under new frameworks like Europe’s MiCA regulations – ensuring compliance is top priority for every tokenized real estate platform. Standards such as ERC-3643 are emerging as benchmarks for secure transactions and identity verification on-chain.

This regulatory clarity is giving both retail investors and large institutions more confidence to participate in these markets. In fact, major players like Goldman Sachs are already experimenting with digital tokens tied to traditional assets – signaling that blockchain-based real estate isn’t just a trend but an evolving market reality.

Security is another critical pillar. Blockchain’s transparency means every transaction is verifiable and immutable, helping to reduce fraud and streamline audits. Tokenized assets are programmed with built-in compliance, so KYC/AML checks can be automated, and investor rights are enforced by smart contracts. This gives peace of mind to both property owners and buyers, especially as the ecosystem matures.

Let’s not overlook the impact on portfolio diversification. With fractional ownership now possible, investors can spread risk across multiple properties and markets for as little or as much capital as they choose. This flexibility was once reserved for institutional giants but is now accessible to anyone with an internet connection.

How Tokenization Is Reshaping Investor Strategies

The rise of tokenized real estate platforms is prompting a rethink in how investors approach property allocations. Instead of tying up large sums in a single asset, you can now build a custom portfolio that matches your risk profile and investment horizon. Want exposure to commercial towers in Tokyo, beachfront condos in Miami, or logistics hubs in Berlin? Simply buy tokens representing each asset and adjust your holdings on the fly.

Five Ways Tokenization Empowers Real Estate Investors

-

1. Enhanced Liquidity Through Fractional Ownership: Tokenization allows investors to buy and sell fractional shares of real estate, making it easier to enter or exit positions and unlocking liquidity that was previously tied up in physical assets.

-

2. Global Access to Premium Markets: By digitizing property assets, tokenization removes geographical barriers, enabling investors worldwide to access markets like New York, London, and Dubai from anywhere.

-

3. Lower Investment Barriers: Investors can participate with smaller amounts, as tokenization reduces the minimum capital required to invest in high-value properties, democratizing access to real estate.

-

4. Increased Transparency and Security: Blockchain technology records every transaction on an immutable ledger, providing investors with transparent ownership records and enhanced security against fraud.

-

5. Institutional Adoption and Regulatory Progress: Major institutions like Goldman Sachs and BNY are launching tokenized products, while regulatory frameworks such as the EU’s MiCA and ERC-3643 standards are creating a safer, more scalable environment for investors.

Secondary markets for property tokens make it easier to react to market shifts or cash out early if needed. This agility is especially valuable during periods of economic uncertainty when liquidity matters most. Institutions are taking note too, Deloitte notes that customizable portfolios built from real estate tokens are already becoming part of sophisticated investment strategies.

Challenges Ahead and What’s Next

Of course, challenges remain before blockchain real estate investment reaches its full potential. Regulatory differences between countries can complicate cross-border transactions; infrastructure for secondary trading is still developing; and investor education is key to wider adoption. But momentum is building fast, especially as more jurisdictions clarify their stance on digital assets.

The next frontier? Integration with DeFi protocols could allow property tokens to be used as collateral for loans or even staked for yield, unlocking new layers of utility beyond simple ownership.

If you’re ready to explore this space further or want tips on navigating compliance and security trends, check out our deep dive at How Blockchain Is Revolutionizing Real Estate Tokenization for Global Investors.