How Blockchain is Revolutionizing Real Estate Tokenization for Global Investors

Blockchain technology is rapidly transforming the real estate sector, enabling a new paradigm: real estate tokenization. By converting physical property assets into digital tokens on blockchain networks, global investors now have unprecedented access to property markets that were once geographically and financially restrictive. This evolution is not just theoretical – it’s already happening at scale, with institutional players and major developers moving aggressively into the space.

Fractional Ownership: Lowering Barriers for Global Investors

Traditionally, investing in real estate required substantial capital outlays and direct ownership of entire properties. Tokenization changes this fundamentally by dividing assets into smaller, tradable digital units known as property tokens. These tokens represent fractional ownership of a building or its income stream, allowing investors to participate with much lower minimum investments than ever before.

This democratization of access is especially significant for global investors. No longer limited by regional legalities or high entry costs, individuals from any jurisdiction can now diversify their portfolios with international real estate exposure. As highlighted by NGCIF, tokenization empowers participation in prime property markets without the need for direct ownership or local intermediaries.

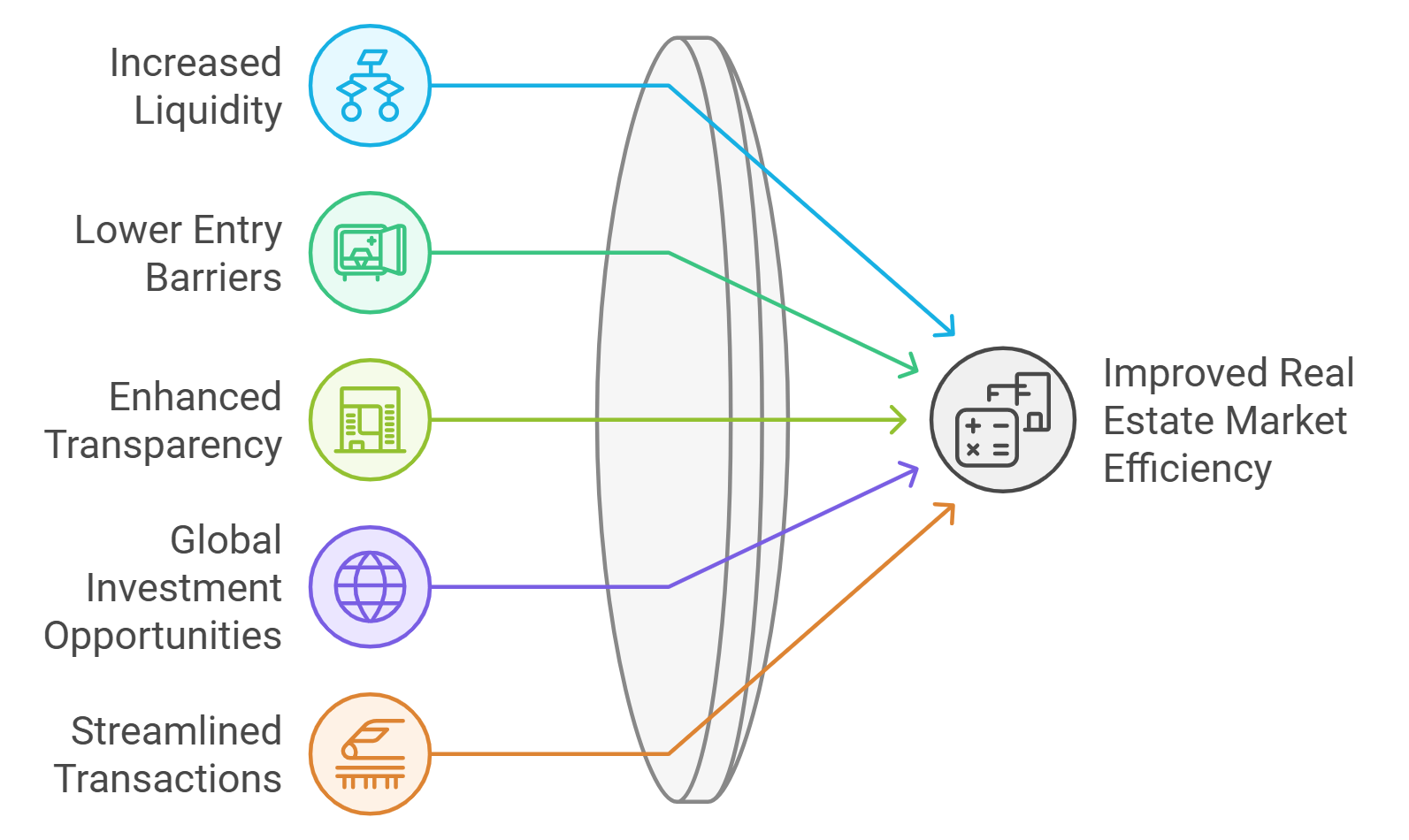

Key Benefits of Blockchain Real Estate Tokenization

-

Fractional Ownership & Accessibility: Blockchain tokenization divides real estate assets into digital tokens, enabling fractional ownership. This lowers investment thresholds and allows a broader range of global investors to participate in property markets.

-

Increased Liquidity via Secondary Markets: Tokenized real estate can be traded on blockchain-based secondary markets, providing investors with greater liquidity and flexibility compared to traditional, illiquid real estate investments.

-

Global Investment Without Borders: Blockchain platforms remove traditional barriers to cross-border real estate investment, allowing investors worldwide to access property markets without excessive fees or regulatory hurdles.

-

Enhanced Transparency & Security: Blockchain’s immutable ledger ensures every transaction is securely recorded and easily auditable, reducing fraud risk and increasing trust among investors.

-

Rapid Market Growth & Institutional Adoption: The tokenized real estate market is expanding rapidly, with Deloitte predicting over $4 trillion in tokenized assets by 2035. Major institutions like Goldman Sachs and BNY Mellon are entering the space, signaling mainstream adoption.

-

Notable Industry Partnerships: High-profile collaborations, such as DAMAC Group’s $1 billion deal with MANTRA in Dubai and Seazen Group’s digital asset initiatives in China, demonstrate growing momentum and innovation in real estate tokenization.

Unlocking Liquidity Through Secondary Markets

The illiquidity of traditional real estate has long been a pain point for investors – properties can take months or even years to buy or sell. Blockchain-based platforms address this by enabling secondary markets where property tokens are traded 24/7. Investors gain flexibility to exit or adjust their positions in response to market shifts or personal needs.

This increased liquidity also unlocks new strategies for portfolio management and risk mitigation. Tokens can be programmed with smart contracts that automate compliance, transfer restrictions, and even dividend distributions – further reducing friction and administrative overhead compared to legacy systems (Deloitte Insights).

Global Real Estate Markets Without Borders

The cross-border potential of blockchain real estate tokenization cannot be overstated. By eliminating many traditional intermediaries and regulatory barriers, property tokens open up investment opportunities in regions previously inaccessible to foreign capital. This borderless approach is driving structural change across the industry.

Notably, major initiatives such as Dubai’s DAMAC Group partnering with MANTRA on a $1 billion asset tokenization project underscore how serious institutional players are about leveraging blockchain’s global reach (Reuters). Similar moves by China’s Seazen Group and heavyweight financial institutions like Goldman Sachs signal accelerating adoption worldwide.

Transparency and security are critical for any investment vehicle, and blockchain delivers both through its immutable ledger technology. Every transaction – from initial token issuance to secondary market trades – is recorded and auditable. This not only reduces the risk of fraud but also streamlines ownership verification, a process that has historically been slow and opaque in real estate.

For investors, this means greater confidence in the provenance of their property tokens. Regulatory compliance can be coded directly into smart contracts, automating everything from KYC/AML checks to transfer restrictions and voting rights. The result is an ecosystem where trust is embedded in the protocol, not reliant on third-party gatekeepers.

Rapid Market Growth and Institutional Momentum

The trajectory of blockchain real estate tokenization is unmistakably upward. Deloitte’s forecast that over $4 trillion worth of real estate could be tokenized by 2035 (up from less than $300 billion in 2024) underscores the scale of transformation underway (Deloitte Insights). This growth isn’t just theoretical – it’s being driven by active institutional adoption, regulatory clarity in key markets, and a wave of new blockchain-native investment platforms.

Major projects like DAMAC’s $1 billion partnership with MANTRA or Seazen Group’s tokenization plans are only the tip of the iceberg. Financial giants such as Goldman Sachs and BNY Mellon entering the space signal that tokenized property investment is moving firmly into the mainstream (Reuters). Expect more traditional players to follow as infrastructure matures and investor demand grows.

What’s Next for Tokenized Property Investment?

The next phase will see further integration between decentralized finance (DeFi) protocols and real-world asset (RWA) platforms. Investors will be able to use property tokens as collateral for loans, participate in automated yield strategies, or even bundle diverse assets into programmable portfolios.

This convergence will likely accelerate liquidity even further while opening new avenues for innovation around risk management, governance, and cross-border settlement. For forward-thinking investors, now is the time to explore how blockchain-powered real estate can fit into a diversified global portfolio.

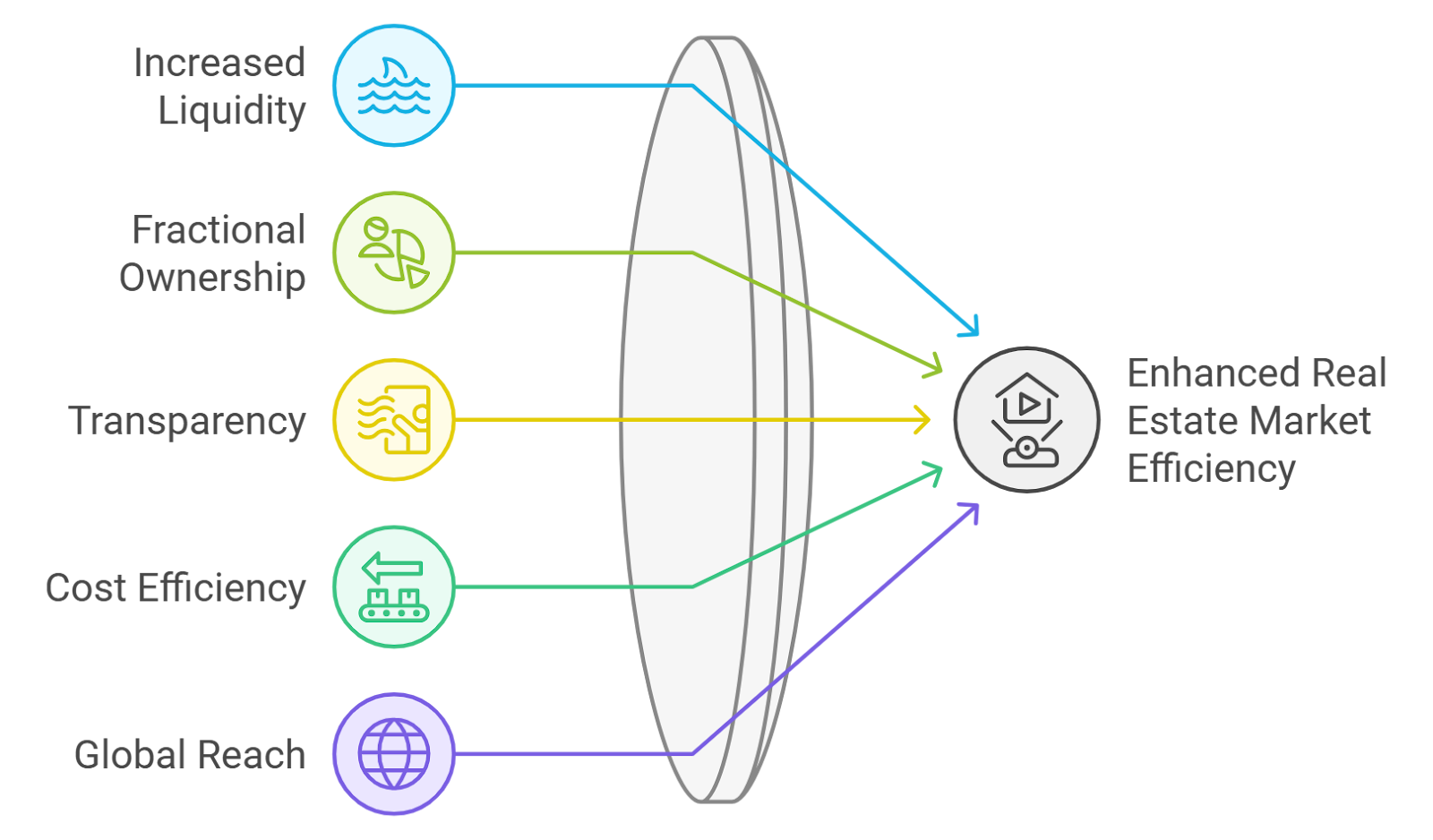

Key Trends Shaping Global Real Estate Blockchain Markets

-

Fractional Ownership and Enhanced Accessibility: Blockchain-based tokenization enables fractional ownership of real estate assets, lowering entry barriers and allowing a wider range of global investors to participate in property markets.

-

Growth of Secondary Markets and Liquidity: The emergence of blockchain-powered secondary markets for real estate tokens is transforming traditionally illiquid assets into more liquid investments, providing investors with greater flexibility and exit options.

-

Cross-Border Investment Without Traditional Barriers: Blockchain technology is democratizing access to global real estate by removing many regulatory and financial obstacles, enabling seamless cross-border property investments.

-

Enhanced Transparency and Security via Immutable Ledgers: The use of blockchain’s immutable ledger ensures secure, transparent, and tamper-proof transaction records, reducing fraud and streamlining ownership verification.

-

Accelerated Market Growth and Institutional Adoption: Major consultancies like Deloitte project that tokenized real estate could exceed $4 trillion by 2035, driven by increasing institutional participation and a shift toward digital asset management.

-

High-Profile Partnerships and Regional Initiatives: Notable developments include DAMAC Group’s $1 billion partnership with MANTRA in Dubai and Seazen Group’s tokenization initiatives in China, signaling growing institutional and regional momentum.

-

Integration with Traditional Finance: Leading financial institutions such as Goldman Sachs and BNY Mellon are launching blockchain-based digital tokens for traditional assets, bridging the gap between conventional finance and tokenized real estate.

The combination of fractional ownership, instant liquidity through secondary markets, borderless participation, and robust transparency makes real estate token trading one of the most compelling frontiers for both crypto enthusiasts and traditional investors alike. As regulatory frameworks evolve and institutional adoption continues apace, expect tokenized property investment to become an integral part of global capital flows.