How Fractional Tokenization Is Making Global Real Estate Accessible to Small Investors

Fractional real estate tokenization is rapidly transforming the investment landscape, making global property ownership accessible to a new class of small investors. By leveraging blockchain technology, properties are divided into digital tokens, each representing a fractional share of the underlying asset. This innovation is dismantling traditional barriers to entry and enabling a more inclusive, liquid, and transparent real estate market.

Tokenization: Lowering the Barriers to Real Estate Investment

Historically, direct real estate investment has been the domain of high-net-worth individuals and institutional players. The capital requirements to purchase even a modest property in major markets often run into hundreds of thousands of dollars. Fractional tokenization flips this model on its head. Today, platforms like RealT allow investors to gain exposure to property markets with as little as $50. This seismic shift means that anyone with modest savings can participate in the upside of global property appreciation and rental income streams.

Each token on a blockchain-based platform represents a legal claim to a portion of the property or a share in an entity that owns it. As a result, investors receive proportional benefits such as rental distributions and capital gains. This model not only democratizes access but also encourages broader diversification across multiple properties and geographic regions.

Enhanced Liquidity and Trading Flexibility

One of the most persistent challenges in real estate has been its illiquidity. Traditionally, buying or selling property could take months due to legal checks, financing, and negotiation. Tokenized assets, however, can be traded on blockchain-based platforms in near-real time. Investors now have the flexibility to buy or sell their property tokens quickly, responding to market signals without being locked into long holding periods.

This increased liquidity is a game changer for small investors who may need quicker access to their capital or wish to rebalance their portfolios dynamically. It also opens the door for new financial products, such as secondary markets for property tokens, further enhancing the ecosystem’s efficiency.

Global Reach and Cross-Border Participation

Blockchain’s borderless architecture is unlocking global property investment opportunities for retail investors. Regulatory innovators like Dubai have already demonstrated how government-backed platforms can facilitate fractional sales under clear legal frameworks. In mid-2025, two luxury Dubai properties were sold via blockchain tokens to buyers from over 35 countries, underscoring the growing trust and international demand for cross-border real estate tokens.

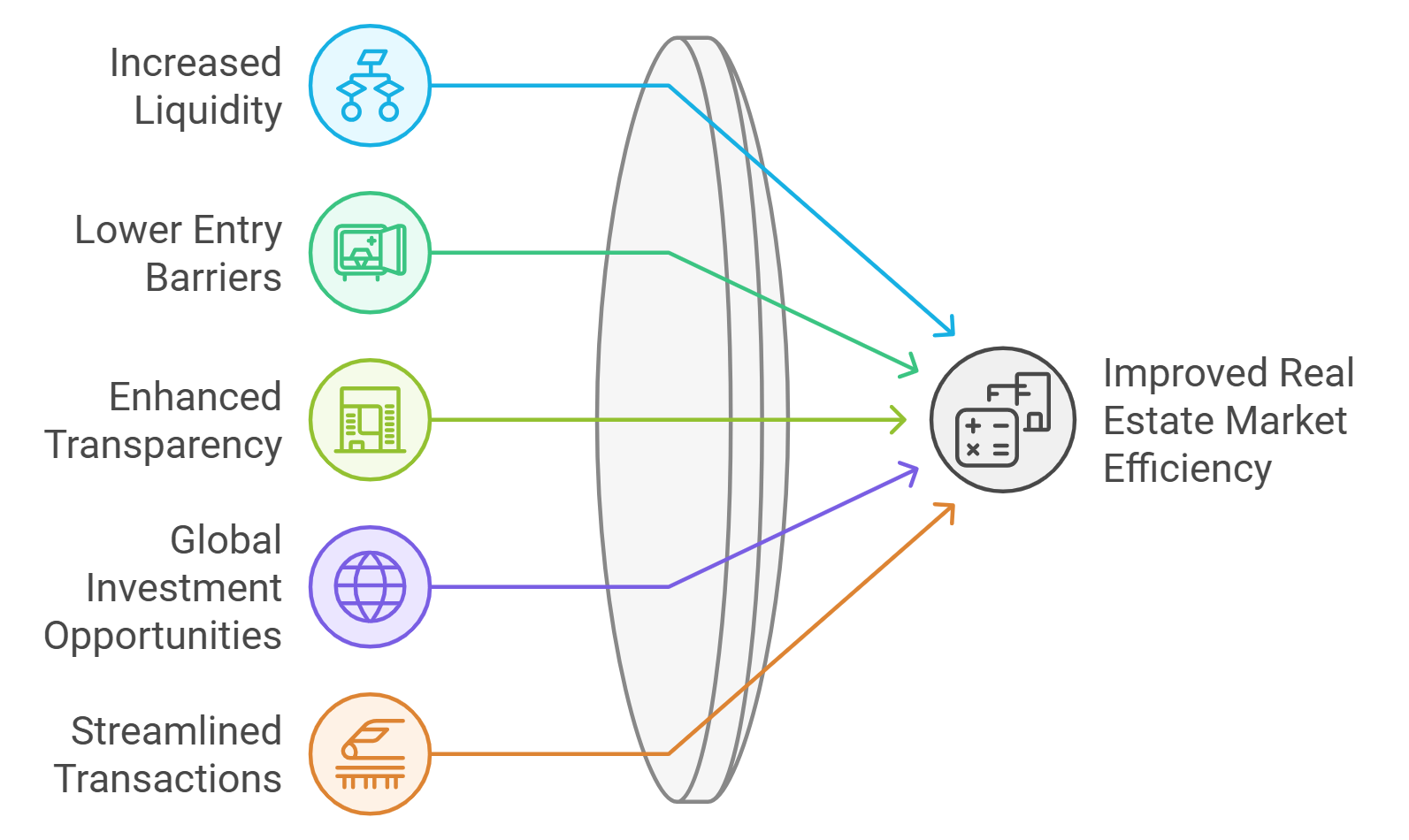

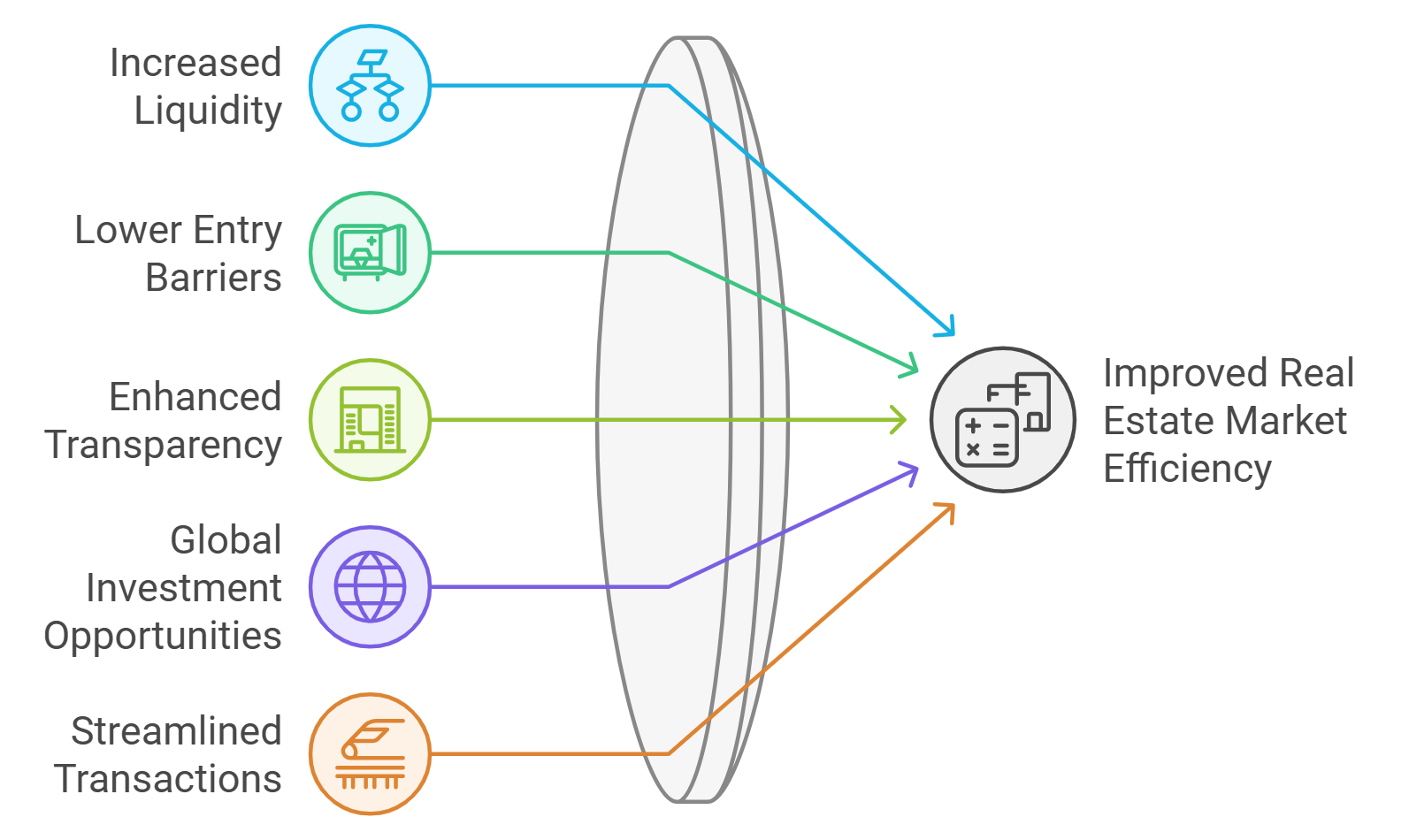

Key Benefits of Fractional Real Estate Tokenization

-

Lower Barriers to Entry: Fractional tokenization allows small investors to participate in real estate markets with minimal capital. Platforms like RealT enable investments starting at approximately $50, making property ownership accessible to a broader audience.

-

Enhanced Liquidity: Unlike traditional real estate, tokenized assets can be traded on blockchain-based platforms. This provides investors with the ability to buy or sell their fractional shares quickly, increasing flexibility and access to funds.

-

Global Investment Opportunities: Blockchain technology enables cross-border participation. For instance, Dubai has government-backed platforms facilitating fractional property sales to investors from over 35 countries, expanding access to international markets.

-

Transparency and Security: All transactions are recorded on an immutable blockchain ledger, ensuring transparency. Smart contracts automate income distribution and compliance, reducing fraud and reliance on intermediaries.

-

Diversification Opportunities: Investors can diversify by owning fractions of multiple properties across different regions and asset types, reducing risk and enhancing portfolio resilience.

-

Regulatory Considerations: While offering many benefits, tokenized real estate requires careful attention to regulatory compliance. Jurisdictions like Dubai have established clear frameworks, but investors should research legal requirements in their region before participating.

This global accessibility means that an investor in Singapore can seamlessly purchase a fraction of a New York apartment or a Dubai penthouse, diversifying across markets that were previously out of reach. For more on how this technology is opening global markets to small investors, see this deep dive.

Transparency, Security, and Compliance

Another core advantage of blockchain-based real estate is the transparency it brings to transactions. Every trade, income distribution, and change of ownership is immutably recorded on-chain. Smart contracts automate processes such as rent collection and dividend payouts, reducing operational risk and minimizing the need for costly intermediaries.

However, as with any emerging technology, regulatory compliance remains a critical consideration. Jurisdictions vary in their approach to digital assets, so investors must stay informed about the legal frameworks governing tokenized real estate in their target markets. For a step-by-step breakdown of how fractional ownership works in this context, check out this resource.

Fractional tokenization is also transforming how investors approach risk management and portfolio construction. Rather than concentrating capital in a single property or market, investors can now distribute their holdings across diverse asset types and geographies. For example, a user might hold tokens representing stakes in residential apartments in Berlin, commercial offices in Singapore, and beachfront villas in Mexico – all managed from a single digital wallet.

By making diversification both affordable and operationally simple, tokenized real estate helps mitigate the impact of local market downturns or sector-specific volatility. This quant-driven approach to allocation, once the domain of institutional funds, becomes accessible to individual investors with modest budgets.

Tokenized Rental Income and Passive Returns

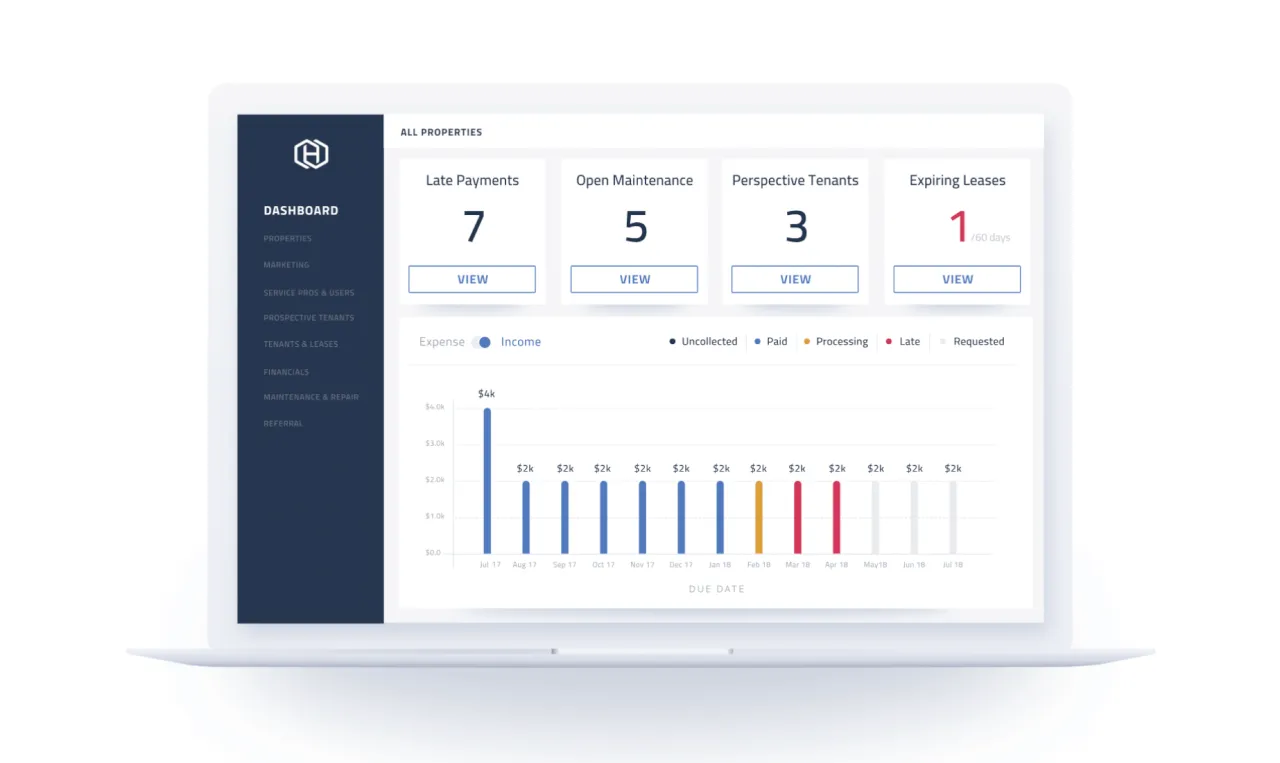

One of the most compelling features of tokenized real estate is the ability to earn rental income proportionate to token ownership. Smart contracts automatically distribute rental proceeds to token holders, streamlining the process and reducing administrative overhead. This means investors can earn passive income without the headaches of traditional property management, such as tenant screening or maintenance.

Moreover, because tokens can be traded on secondary markets, holders can realize capital gains by selling their positions if property values rise. This dual benefit of income plus appreciation is reshaping the risk-reward profile for small investors and attracting a new wave of participants to global property investment blockchain platforms.

The Road Ahead: Innovation and Regulatory Evolution

As the ecosystem matures, we can expect to see the emergence of more sophisticated real estate token trading platforms, enhanced due diligence protocols, and broader adoption by institutional players. With over $7 billion in property already tokenized and more than 1.2 million global investors participating as of mid-2025, the momentum is undeniable.

Still, the pace of innovation must be matched by regulatory clarity. Forward-thinking jurisdictions are working to define standards around investor protection, anti-money laundering, and tax treatment for tokenized assets. Investors should remain vigilant, seek out platforms with strong compliance records, and stay updated on evolving legal requirements. For an in-depth look at how fractional real estate tokenization lowers investment barriers, visit this guide.

Top Tips for Evaluating Real Estate Token Trading Platforms

-

Verify Regulatory Compliance: Ensure the platform complies with relevant regulations in both the property’s jurisdiction and your own. Look for platforms registered with financial authorities or operating under clear legal frameworks—such as Securitize (SEC-registered) or RealT (U.S.-based, compliant with local laws).

-

Review Asset Selection and Geographic Reach: Consider platforms with a diverse range of properties across multiple regions. For example, Blocksquare and Propellr provide access to commercial and residential assets in various countries, supporting global diversification.

-

Analyze Fee Structures and Minimum Investments: Compare transaction fees, management fees, and minimum investment amounts. Platforms like RealT allow entry with as little as $50, making them accessible to small investors.

-

Research Platform Reputation and User Base: Choose platforms with a strong track record and active user communities. RealT and Securitize have facilitated transactions for thousands of global investors, indicating reliability and trust.

Fractional tokenization is not just a technological upgrade – it is a fundamental reimagining of how people can participate in one of the world’s oldest asset classes. By lowering barriers, enhancing liquidity, and enabling true global participation, this model promises to make property investment as accessible and dynamic as any other asset on-chain.