How Tokenized Real Estate Offers Yield and Liquidity: Case Studies from Leading Platforms

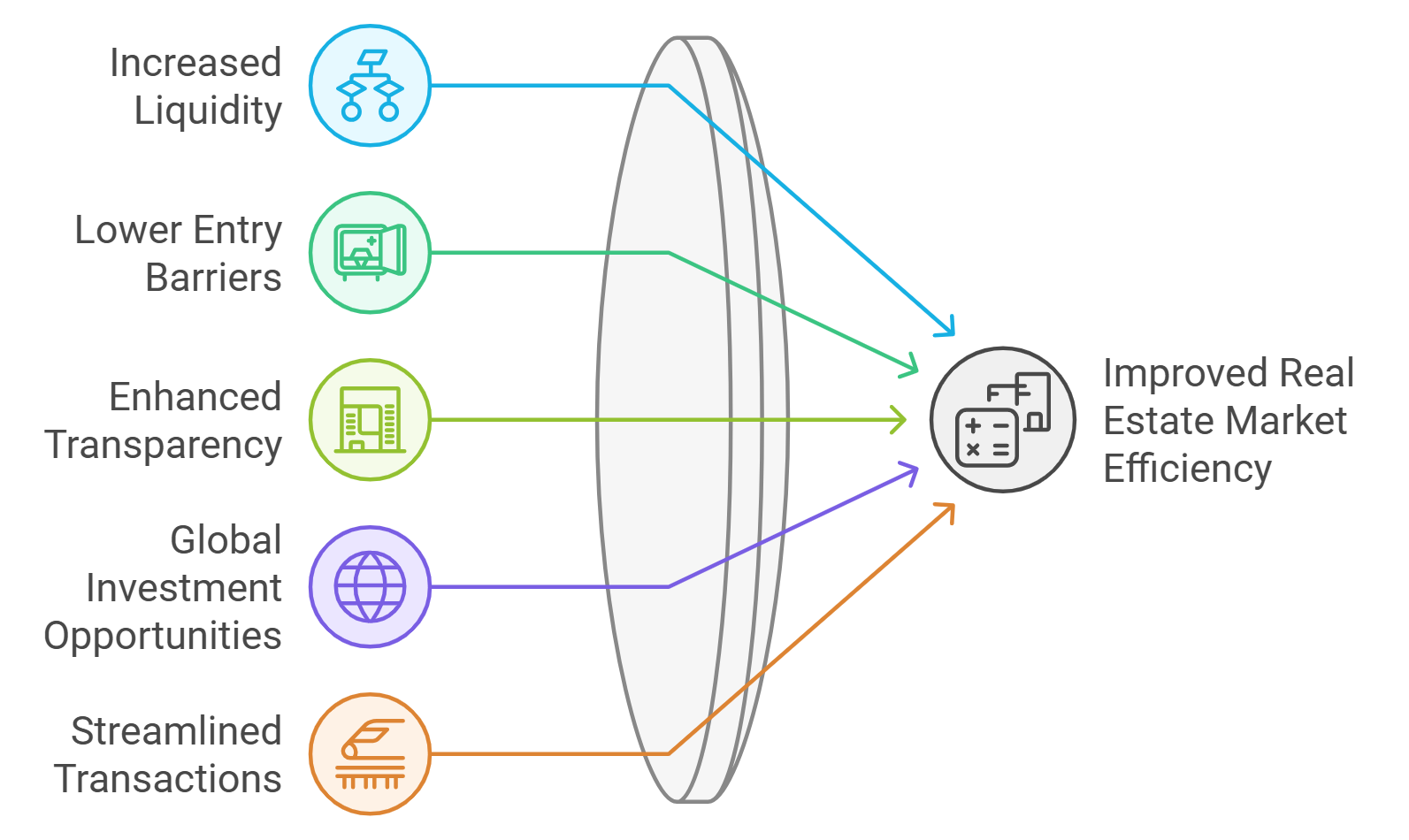

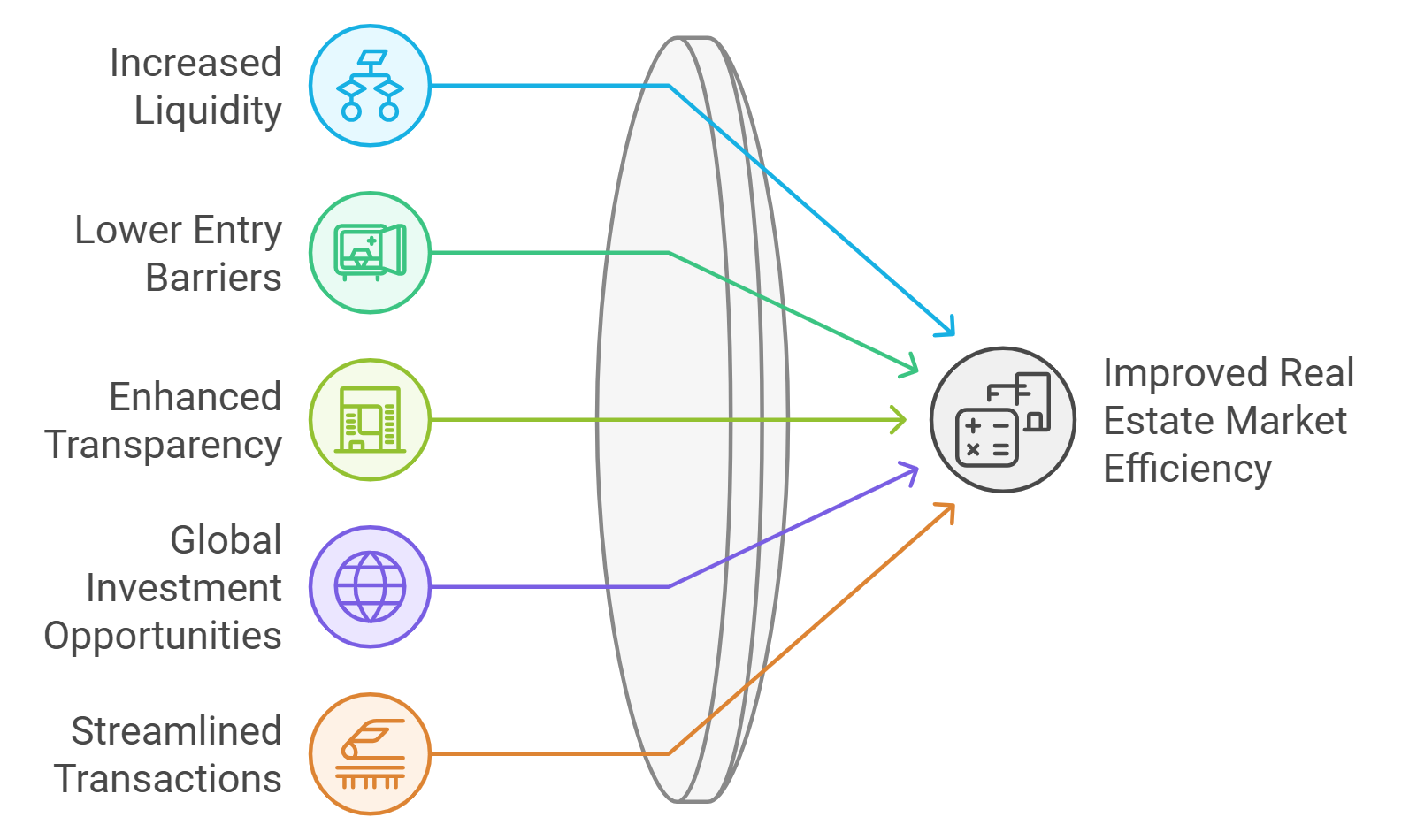

Tokenized real estate is rewriting the rules for property investors. By converting physical assets into blockchain-based tokens, these platforms deliver two game-changing benefits: yield from rental income and liquidity through secondary market trading. Forget the old days of six-month sales cycles and sky-high minimums – with tokenization, you can tap into global real estate markets in minutes and for as little as $50. Let’s break down how three leading platforms are executing this vision in the real world.

RealT: Fractionalized U. S. Rental Properties with On-Chain Yield

RealT has become a benchmark for fractional property ownership on blockchain, especially across U. S. rental markets. Here’s how it works: each property is divided into hundreds or thousands of ERC-20 tokens, with ownership starting at just $50 per token. Investors receive their share of rental income directly to their digital wallets – often paid out daily, not monthly or quarterly like traditional REITs.

The numbers are compelling. RealT’s Detroit portfolio alone features over 300 tokenized properties, offering reported annual yields ranging from 8% to 15%. That’s not just passive income – that’s on-chain cash flow, accessible and tradable globally.

The kicker? If you want to exit or rebalance your position, you don’t have to wait months for a buyer. You can sell your tokens on supported secondary markets in minutes, injecting real liquidity into an asset class that’s been locked up for generations.

Brickblock: Commercial Real Estate Meets Secondary Market Trading

Brickblock takes a different angle by targeting institutional-grade commercial properties across Europe and beyond. Their platform lets investors buy fractional shares in premium office buildings, logistics centers, and more – all represented as digital tokens on the Ethereum blockchain.

The magic happens post-purchase. Brickblock has built a regulatory-compliant secondary market where property tokens can be traded peer-to-peer or via exchanges, slashing exit times from months to hours. This is a seismic shift for anyone used to the glacial pace of commercial real estate deals.

What does this mean for yield? Investors receive proportional rental income distributions (sometimes quarterly or monthly), while enjoying the flexibility to cash out or increase their stake as market conditions change. It’s an actionable solution for anyone seeking both steady returns and tactical agility in their portfolio.

Proptee: Instant Liquidity for European Residential Property Tokens

Proptee zeroes in on residential properties across Europe with a laser focus on instant liquidity. Each asset is split into thousands of low-cost tokens – sometimes priced under $10 apiece – making it simple for retail investors to build diversified portfolios without deep pockets.

The standout feature? Proptee operates its own integrated exchange where users can buy or sell property tokens instantly at prevailing market prices. No waiting periods, no paperwork headaches – just pure liquidity paired with direct exposure to rental income streams from real-world apartments and houses.

This model doesn’t just open doors for small investors; it fundamentally changes how people interact with real estate as an asset class by making entry and exit frictionless.

Top Tokenized Real Estate Platforms: Yield & Liquidity

-

RealT: Fractionalized U.S. Rental Properties with On-Chain YieldRealT enables investors to purchase fractional ownership in U.S. rental properties—primarily in Detroit—through blockchain tokens starting at $50. Investors receive daily rental income directly to their digital wallets, with reported annual yields between 8% and 15%. RealT’s secondary marketplace allows for easy trading of property tokens, providing unmatched liquidity compared to traditional real estate.

-

Brickblock: Tokenized Commercial Real Estate and Secondary Market TradingBrickblock offers access to tokenized commercial real estate assets, allowing investors to buy and sell shares on a compliant secondary market. The platform supports fractional investment in high-value properties and emphasizes transparent, blockchain-based transactions to streamline ownership transfer and enhance liquidity.

-

Proptee: European Residential Property Tokens with Instant LiquidityProptee specializes in European residential property tokens, letting investors buy fractional shares and trade them instantly on its in-app marketplace. Proptee’s model delivers rental yield payouts and near-instant liquidity, making it easy for users to enter or exit positions without the delays of traditional property sales.

The Bottom Line on Yield and Liquidity

If you’re serious about maximizing tokenized real estate yield, these platforms offer actionable blueprints backed by live market performance – not theory. The combination of frequent rental payouts and rapid liquidity unlocks new strategies for both day traders looking for quick moves and long-term holders seeking steady passive income streams.

What’s really driving this shift is the convergence of blockchain transparency and real-world asset performance. Platforms like RealT, Brickblock, and Proptee aren’t just tech experiments, they’re delivering measurable results for thousands of investors worldwide. Fractional property ownership on blockchain breaks down barriers, giving anyone with a smartphone access to global real estate markets that were once the exclusive domain of institutions and millionaires.

But don’t just take my word for it. The data speaks volumes: RealT’s U. S. rental tokens boast daily cash flows, Brickblock’s commercial assets can be traded in hours rather than months, and Proptee’s instant secondary market lets you move in or out with a tap, no lawyers, no paperwork, no waiting.

Why Yield and Liquidity Matter More Than Ever

The old real estate playbook relied on patience, wait years for appreciation or hope your tenants don’t default. Tokenized models flip this script. With rental income tokenized property, you’re not just betting on future price gains; you’re collecting tangible yield right now, with the flexibility to rebalance your position whenever market conditions (or your strategy) shift.

This dual advantage is especially potent during uncertain macro cycles. When markets get choppy, liquidity is king, and tokenized platforms let you pivot without locking up capital for years at a time. That’s actionable alpha in today’s market.

Choosing Your Platform: What to Watch For

If you’re ready to dive into tokenized real estate, focus on three things:

- Yield Consistency: Look for platforms with transparent payout histories, daily or monthly distributions signal robust operations.

- Secondary Market Depth: Instant liquidity only matters if there are buyers and sellers, check trading volume before committing significant capital.

- Regulatory Compliance: Stick with platforms that prioritize investor protection and operate within clear legal frameworks (like Brickblock).

The bottom line? Tokenization isn’t a buzzword, it’s an actionable way to unlock yield and liquidity from one of the world’s oldest asset classes. Whether you’re aiming for daily cash flow or tactical trades around macro events, these platforms put powerful new tools in your hands.

Top Tokenized Real Estate Platforms for Yield & Liquidity

-

RealT: Fractionalized U.S. Rental Properties with On-Chain YieldRealT enables investors to buy tokens representing fractional ownership in over 300 U.S. rental properties, primarily in Detroit. Tokens start at just $50 and deliver daily rental income directly to digital wallets, with reported annual yields between 8% and 15%. Investors benefit from enhanced liquidity, as tokens can be traded on secondary markets, making real estate investment more accessible and flexible than ever before.

-

Brickblock: Tokenized Commercial Real Estate and Secondary Market TradingBrickblock specializes in tokenizing commercial real estate assets across Europe, allowing investors to purchase digital shares backed by real-world properties. The platform supports secondary market trading, giving investors the ability to buy and sell property tokens with ease and improving overall liquidity. Brickblock’s robust compliance framework ensures secure and transparent transactions for all participants.

-

Proptee: European Residential Property Tokens with Instant LiquidityProptee offers fractional ownership of European residential properties through blockchain-based tokens. Investors can access instant liquidity by trading property tokens on Proptee’s in-app marketplace, with investments starting from low minimums. The platform focuses on yield generation from rental income and democratizes property investment for a global audience.

The next step is yours: dig deeper into these case studies, compare platform features side by side (here’s a direct comparison guide), and decide how fractional property ownership on blockchain fits into your investment game plan. Timing is everything, so move fast when opportunity knocks.