How Fractional Ownership and Tokenization Are Making Global Real Estate Accessible to Small Investors

For generations, real estate investing has been the domain of the wealthy. High upfront costs, complex legal structures, and geographic boundaries kept most people on the sidelines. Today, however, a quiet revolution is underway. Fractional real estate ownership and blockchain-powered tokenization are lowering the drawbridge, allowing small investors to access global property markets with unprecedented ease.

How Fractional Ownership and Tokenization Work

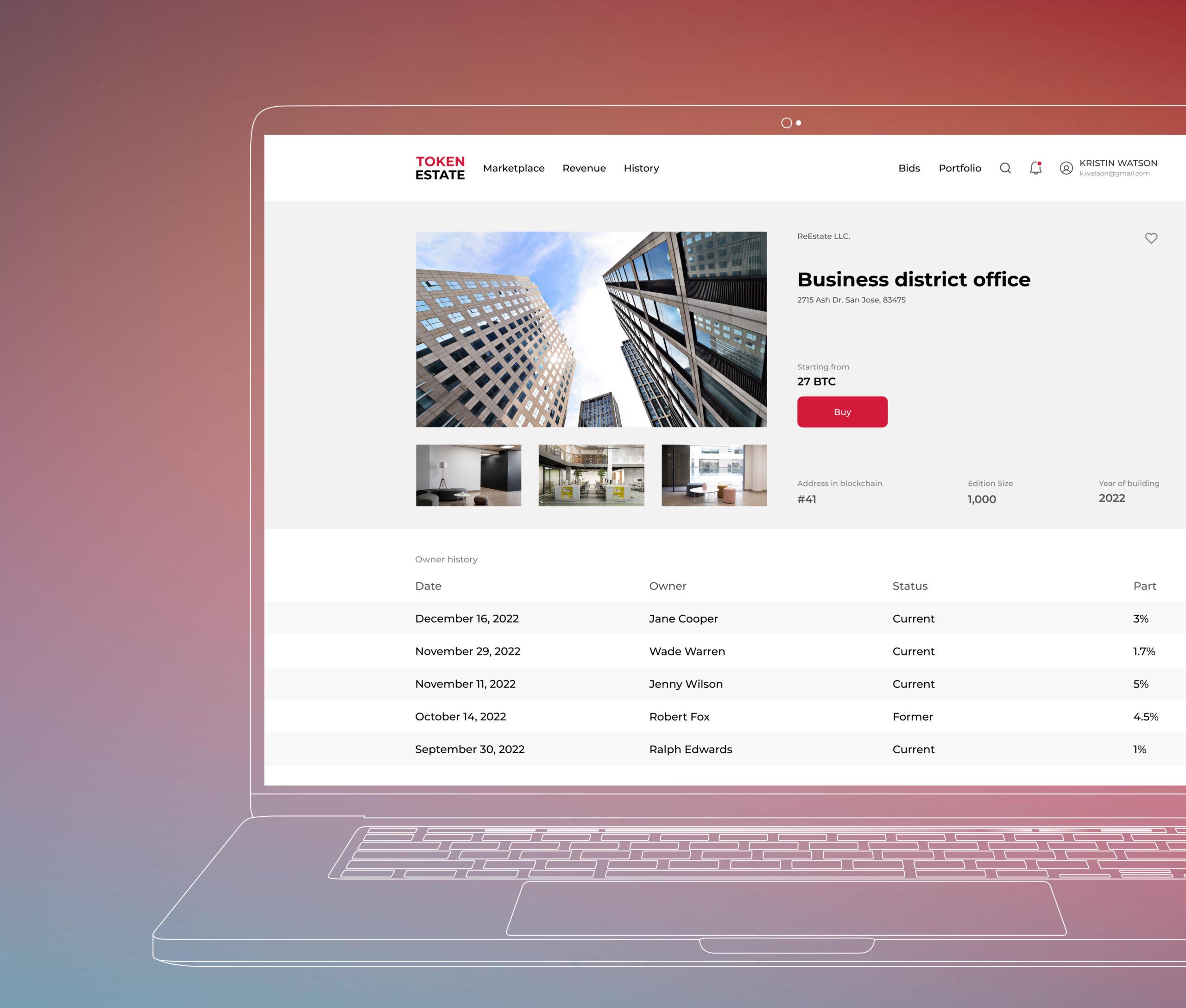

At its core, fractional ownership means splitting a valuable asset, like a building or portfolio, into smaller, tradable pieces. Tokenization takes this concept digital. By converting property shares into blockchain-based tokens, platforms enable investors to buy, sell, and trade fractions of real estate, sometimes for as little as $50. Each token represents a real, legal stake in the underlying property, tracked securely and transparently on a public ledger.

This approach is already live. For example, platforms like RealT have tokenized over 700 U. S. properties, letting investors participate in rental income and appreciation with just a few clicks. The process is not just theoretical, it’s a practical, operational shift that’s rapidly gaining traction.

Why Tokenized Property Investment Matters for Small Investors

The implications for everyday investors are profound. Here’s why:

Key Benefits of Fractional Real Estate Ownership

-

Lower Barriers to Entry: Tokenization enables small investors to purchase fractional shares of high-value properties, allowing participation with minimal capital—sometimes as low as $50 on platforms like RealT.

-

Increased Liquidity: Tokenized real estate assets can be traded on blockchain-based marketplaces, giving investors the flexibility to buy or sell their shares more easily than with traditional property investments.

-

Global Market Access: Blockchain technology allows investors worldwide to access real estate markets previously limited by geography, enabling portfolio diversification across different regions and property types.

-

Enhanced Transparency and Security: All transactions and ownership records are stored on a public blockchain ledger, providing clear audit trails and reducing the risk of fraud.

First, reduced entry barriers mean you no longer need six figures to get started. Blockchain platforms allow you to buy fractions of expensive properties, opening the door to anyone with modest capital. Second, increased liquidity: Unlike traditional real estate, which can take months or years to sell, tokens can be traded on secondary markets in minutes. This flexibility is a game-changer for portfolio management.

Perhaps most important is global access. Blockchain knows no borders. Investors from around the world can diversify their holdings across continents and property types, residential apartments in Miami, commercial buildings in Berlin, or vacation rentals in Bali, without ever leaving home. This borderless marketplace is helping democratize wealth creation and financial opportunity.

The Technology Behind the Transformation

The engine driving this change is blockchain, a decentralized digital ledger that records every transaction immutably. Each property is typically held in a legal entity (like an SPV), and ownership of that entity is divided into digital tokens. Smart contracts automate payouts and governance, while the public ledger ensures transparency and security. This setup reduces fraud risk and administrative overhead compared to legacy systems.

For those seeking deeper technical insights or step-by-step guides on how these platforms operate, resources like this breakdown on fractional ownership in tokenized real estate can help demystify the process.

Real-World Examples and Current Market Context

Consider the story of a small investor who, with just $50, becomes a partial owner of a multi-million dollar apartment building in Detroit. Each month, they receive their share of rental income, no property management headaches required. This is not an isolated case; it’s already happening on established platforms, and the trend is accelerating as more assets come on-chain.

Recent reports highlight that token holders can now become “micro landlords” by owning pieces of professionally managed portfolios, an opportunity previously reserved for institutions and high-net-worth individuals. As detailed in industry research, this model is not only viable but also thriving as regulatory clarity improves and technology matures.

Still, the rapid adoption of tokenized property investment is not without its hurdles. Regulatory frameworks are evolving, and oversight varies by jurisdiction. Investors must be diligent about understanding the legal status of real estate tokens in their country and the compliance standards of the platforms they use. With secondary markets for property tokens still developing, liquidity can fluctuate, especially for niche assets or in volatile economic periods.

For those weighing the risks and rewards, the most prudent approach is to research platform credibility, legal protections, and underlying property fundamentals before committing capital. As always, diversification remains key: spreading investments across multiple properties and regions can help mitigate potential downsides.

The Expanding Ecosystem: Platforms and Use Cases

The landscape of blockchain real estate investing is expanding rapidly. In addition to residential and commercial buildings, tokenization is now being applied to hospitality assets, logistics centers, and even pre-construction projects. Developers are leveraging pre-sale token offerings to raise capital from a diverse pool of global investors, accelerating project timelines without ceding full ownership control.

Major platforms are also rolling out features like automated dividend distribution, real-time reporting, and governance voting, further enhancing the user experience for small investors. These innovations are turning real estate from an illiquid, opaque asset class into a dynamic, transparent marketplace accessible to all.

Leading Platforms for Tokenized Fractional Real Estate Ownership

-

RealT: A pioneering platform that enables investors to purchase fractional shares of U.S. rental properties through blockchain-based tokens, with investments starting as low as $50. RealT has tokenized over 700 properties, offering global access and daily rental income payouts in cryptocurrency.

-

Brickken: Based in Spain, Brickken offers a platform for tokenizing real-world assets, including real estate. Investors can buy fractional ownership in properties, benefiting from blockchain transparency and global accessibility.

-

HoneyBricks: Specializing in U.S. commercial real estate, HoneyBricks allows investors to purchase fractionalized property tokens, providing access to institutional-grade assets and regular income distributions.

-

PropShare: An India-based platform that offers fractional ownership of pre-leased commercial properties. PropShare uses digital tokens to represent ownership, making high-value real estate accessible to smaller investors.

-

Fractional (now Fractal): Originally focused on tokenized real estate, Fractional (rebranded as Fractal) enables users to co-own and manage real estate assets via blockchain, with a user-friendly interface for buying and selling property shares.

As more institutional players enter the space and regulators provide clearer guidance, expect to see even greater integration of real estate tokens for small investors within mainstream investment portfolios. The trend is not just about access, but also about efficiency, transparency, and empowering individuals to build wealth on their own terms.

Practical Steps for Interested Investors

If you’re considering exploring this new frontier, start by identifying reputable platforms with a track record of compliance and strong asset management. Review due diligence materials, understand fee structures, and look for independent audits of both the technology and property portfolios. Many platforms offer educational resources, demo accounts, and community forums where you can ask questions before making your first investment.

For further reading on how these innovations are reshaping global property access, check out our in-depth guide: How Fractional Real Estate Ownership via Blockchain Is Making Global Property Investment Accessible.

Ultimately, fractional real estate ownership and tokenization are redefining what it means to be a property investor. The ability to start with as little as $50, diversify globally, and trade assets with a few clicks is opening doors that were firmly shut for generations. As technology continues to mature, expect this movement to accelerate, fundamentally changing how wealth is built and shared in the real estate world.