How Fractional Real Estate Ownership via Tokenization Opens Global Markets to Small Investors

Imagine buying a slice of a luxury hotel in Aspen or owning a fraction of a rental property in Miami, all with just a few clicks and as little as $50. This is not science fiction – it’s the reality of fractional real estate ownership powered by blockchain tokenization. As we move into 2025, this innovative model is rapidly transforming the landscape of global property investment, opening doors for small investors who were previously locked out by high costs and geographic barriers.

How Tokenization Turns Real Estate Into Accessible Assets

Real estate tokenization is the process of converting physical property into digital tokens on a blockchain. Each token represents a fractional stake in the asset, allowing investors to buy, sell, and trade real estate just like cryptocurrencies or stocks. Instead of needing hundreds of thousands (or millions) of dollars to own an entire building, you can now purchase tokens worth as little as $1,000 – or even less on some platforms. For example, a $5 million property can be split into 5,000 tokens at $1,000 each, making high-value assets accessible to everyday investors.

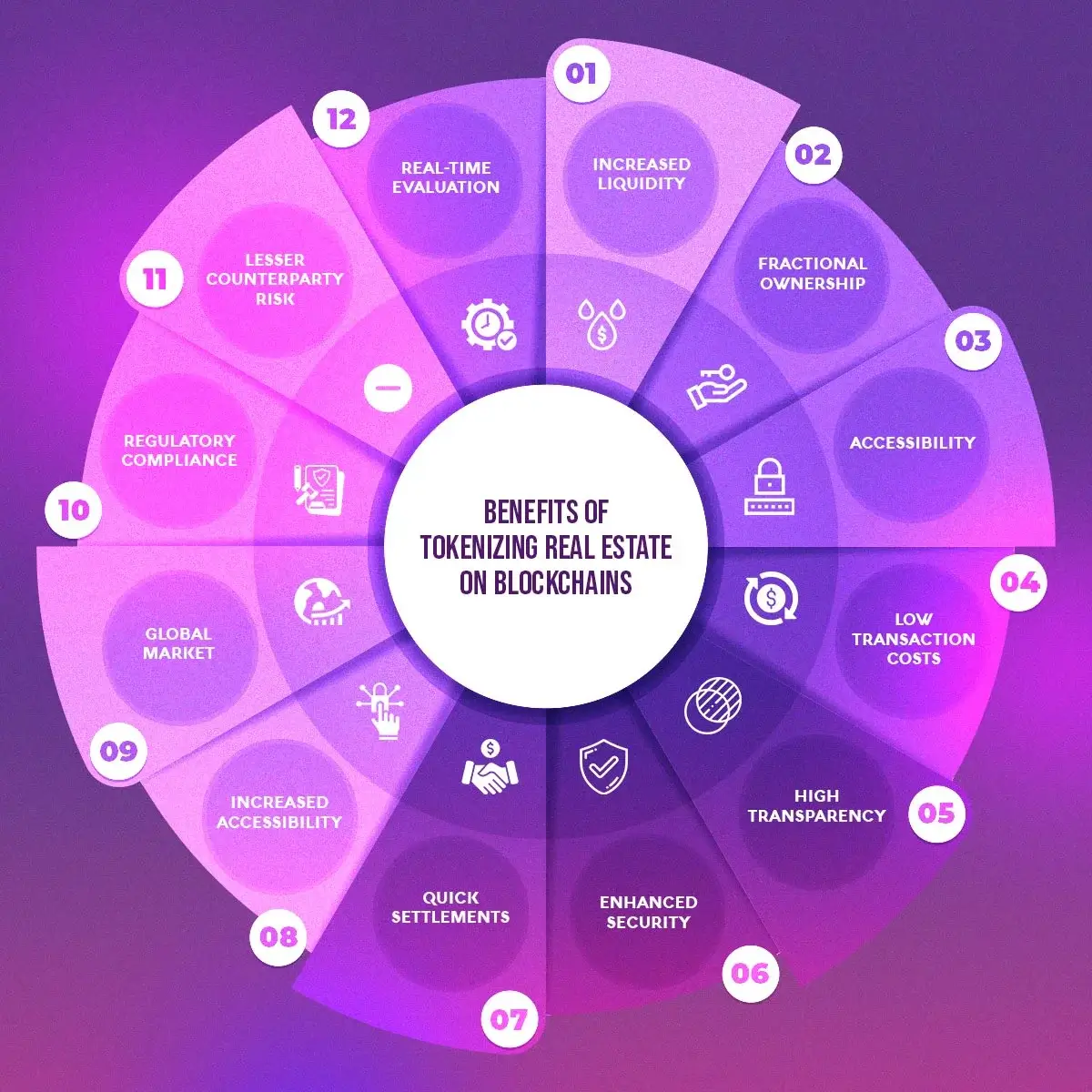

This shift isn’t just about affordability. Tokenized real estate offers:

Top Benefits of Tokenized Fractional Real Estate Ownership

-

Lower Barriers to Entry: Tokenization divides high-value properties into affordable digital tokens, enabling small investors to participate in real estate with minimal capital. For example, a $5 million property can be split into 5,000 tokens at $1,000 each, making global property investment accessible to more people.

-

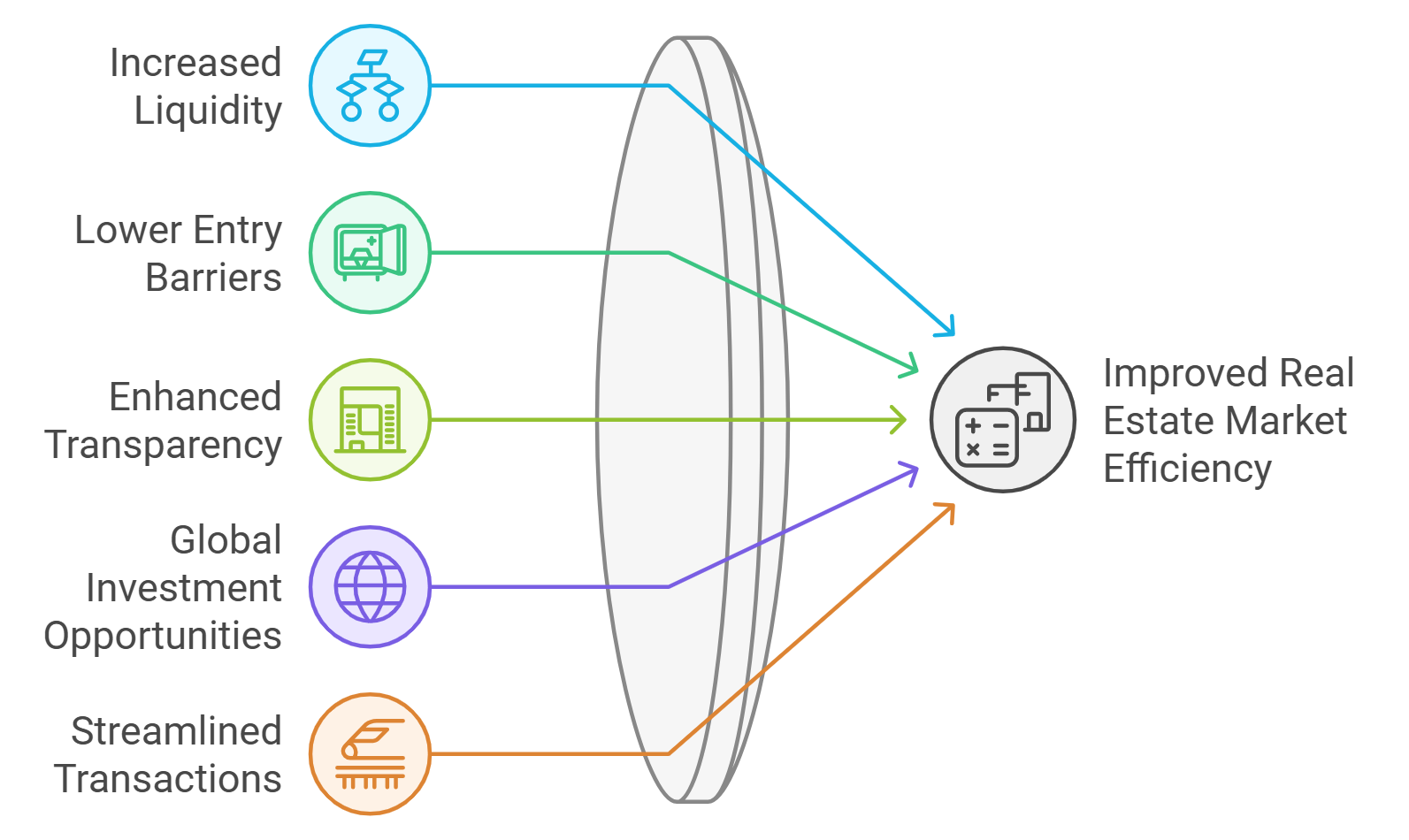

Enhanced Liquidity: Unlike traditional real estate, which is notoriously illiquid, tokenized assets can be traded on blockchain-based platforms. This flexibility allows investors to buy or sell their property shares quickly, unlocking liquidity previously unavailable in the real estate market.

-

Global Access and Diversification: Blockchain technology enables investors from around the world to buy into properties across different countries and regions. This global reach helps small investors diversify their portfolios and reduce risk associated with local market fluctuations.

-

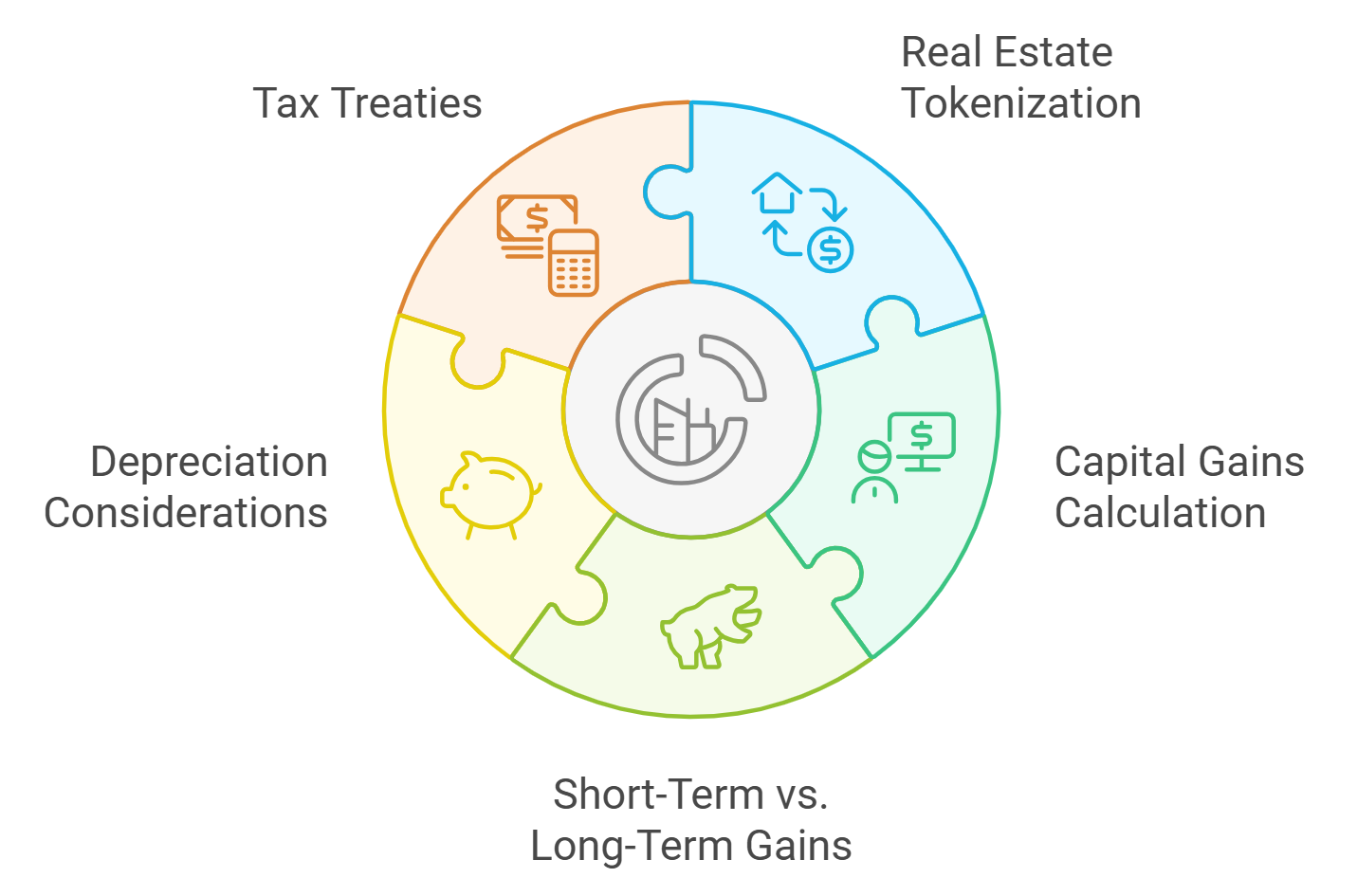

Increased Transparency and Security: All transactions and ownership records are stored on an immutable blockchain ledger. Investors benefit from transparent, traceable, and secure records, reducing risks of fraud or mismanagement.

-

Real-World Use Cases: Platforms like St. Regis Aspen Resort and RealT have successfully implemented tokenized fractional ownership. For instance, St. Regis Aspen Resort issued 18 million digital tokens at $1 each, while RealT has tokenized over 700 U.S. properties, welcoming over 16,000 global investors.

-

Strong Market Growth Potential: According to Deloitte, the tokenized real estate market is projected to grow from less than $0.3 trillion in 2024 to $4 trillion by 2035, with a 27% compound annual growth rate. This trend signals increasing opportunities and mainstream adoption for small investors.

The impact? More people than ever are able to diversify their portfolios with prime commercial buildings, residential rentals, or even hospitality projects across continents.

Liquidity and Global Reach: Breaking Down Old Barriers

Traditional real estate has always been notoriously illiquid; buying or selling takes weeks or months and often involves complex paperwork and hefty fees. Enter tokenized assets – now these transactions can happen in seconds on digital marketplaces. Investors gain unprecedented liquidity, with the ability to trade their fractional property tokens 24/7 from anywhere in the world.

The borderless nature of blockchain means you no longer need to live near your investment or even be in the same country. Platforms like RealT have already enabled over 16,000 investors from 154 countries to participate in U. S. rental properties worth more than $130 million – all through simple digital onboarding and transparent smart contracts.

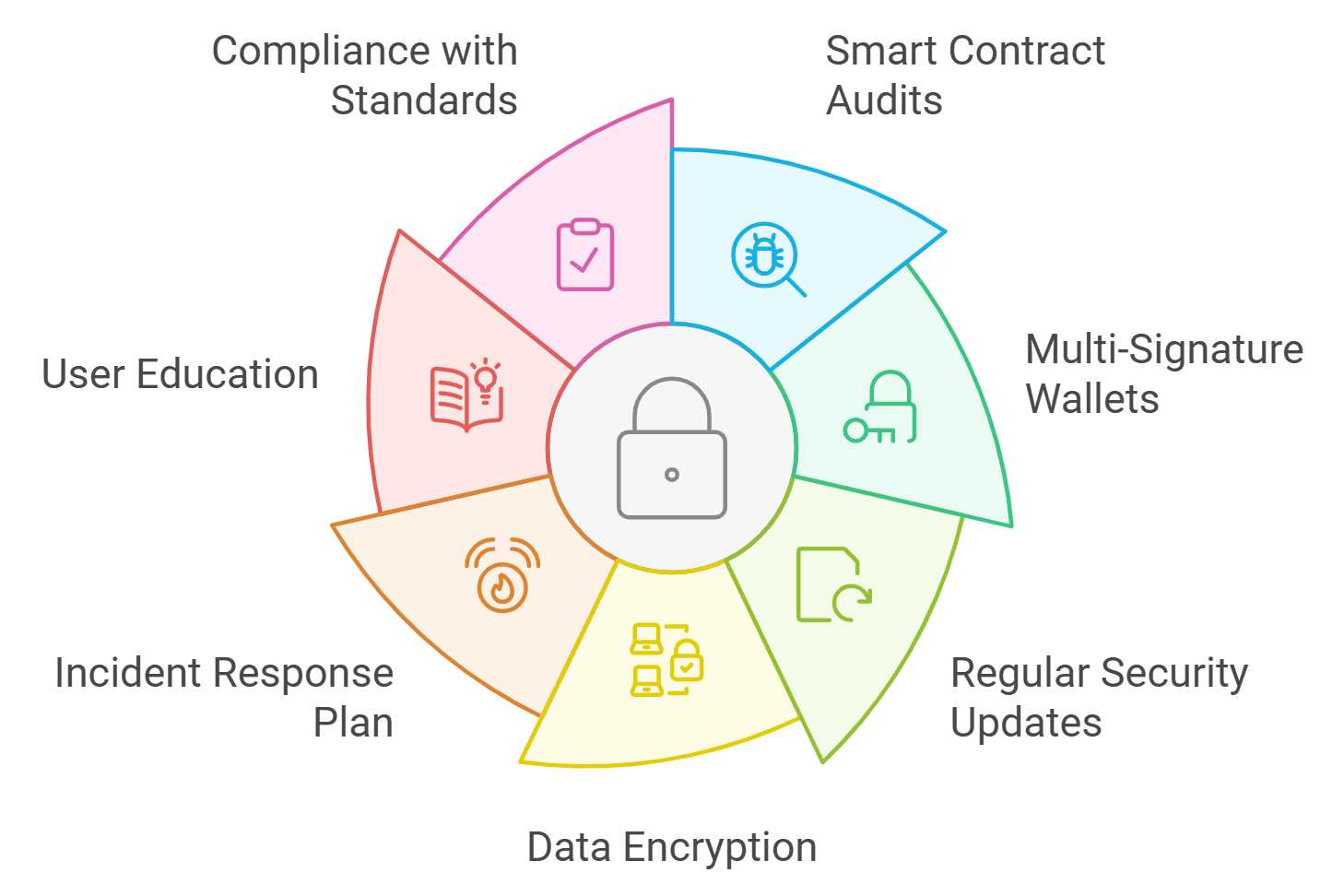

Transparency and Security: Why Blockchain Matters for Small Investors

If you’ve ever worried about shady deals or unclear ownership records in traditional property investing, blockchain brings welcome relief. Every transaction is recorded immutably on-chain; anyone can verify who owns what at any time without relying on third parties. This transparency reduces fraud risk and ensures that your rights as an investor are protected by code rather than bureaucracy.

Security is further enhanced by compliance measures built into leading platforms – from KYC checks to regulatory frameworks designed for digital securities. The result? A safer environment where small investors can confidently participate alongside institutions.

Real-World Examples: From Luxury Resorts to Rental Homes

The theory is exciting, but let’s get practical. In the U. S. , the St. Regis Aspen Resort was among the first luxury properties to tokenize nearly 19% ownership into 18 million digital tokens at $1 each – inviting accredited investors to become partial owners of an iconic hotel (source: ideausher. com). Meanwhile, platforms like RealT offer fractional shares in residential rentals with transparent income distribution via blockchain-based tokens.

This democratization isn’t limited to America; similar models are emerging across Europe and Asia-Pacific as regulatory clarity improves and investor demand grows.

The Market Is Booming: Where Are We Headed?

The numbers speak volumes: Deloitte predicts that by 2035 nearly $4 trillion worth of real estate will be tokenized, up from less than $0.3 trillion today – an astonishing CAGR of 27%. As adoption accelerates, expect more diverse offerings (from student housing to logistics centers), better platform interfaces for retail users, and increased liquidity across global markets.

For small investors, this means unprecedented access to a broader range of real estate opportunities. Whether you’re looking to hedge against inflation, earn passive rental income, or simply diversify outside of traditional equities and bonds, fractional property tokens make it possible to tailor your portfolio to your goals and risk appetite. The days when prime real estate was the exclusive playground of institutions and ultra-wealthy individuals are fading fast.

Of course, as with any innovation, there are practical considerations. Regulatory frameworks are evolving rapidly to keep pace with digital securities. Most reputable tokenized real estate platforms now integrate KYC/AML checks and operate under strict compliance standards. This not only protects investors but also paves the way for institutional capital to flow into the space – further boosting liquidity and market depth.

The ease of entry is matched by the ease of exit: want to cash out your stake in a commercial building? Simply list your tokens on a compliant marketplace and connect with global buyers in minutes. This agility is transforming how people think about accessible real estate investing, making it as dynamic as trading stocks or crypto.

Key Steps to Start Investing in Tokenized Global Real Estate

-

1. Research Reputable Tokenized Real Estate PlatformsBegin by exploring established platforms like RealT, Elevated Returns, and RedSwan CRE. These platforms offer access to fractional ownership of vetted properties and have a proven track record in the industry.

-

2. Complete Identity Verification (KYC)All legitimate platforms require you to undergo Know Your Customer (KYC) procedures. Prepare to submit identification documents and proof of address to comply with global anti-money laundering regulations.

-

3. Fund Your Digital WalletSet up a compatible digital wallet (such as MetaMask or Coinbase Wallet) and fund it with supported currencies—typically stablecoins like USDC or ETH. This wallet will hold your property tokens and facilitate transactions.

-

4. Select Properties and Purchase TokensBrowse available properties on your chosen platform. Review details such as location, rental yield, and token price. Purchase fractional ownership by buying property tokens, often starting from as little as $50 per token.

-

5. Monitor Investments and Manage PortfolioTrack your holdings and returns through the platform dashboard. Many platforms distribute rental income directly to your wallet and allow you to buy or sell tokens to adjust your portfolio as needed.

The technology behind fractional ownership is also fostering communities of like-minded investors who can collaborate, share insights, and even co-govern properties through decentralized voting mechanisms. Imagine voting on renovations or rental strategies for a property you partially own – all from your phone.

What’s Next? The Future of Tokenized Real Estate

The rapid pace of adoption signals that fractional ownership via tokenization isn’t just a passing trend – it’s a new paradigm for global property investment. As more platforms launch, legal clarity increases, and user experience improves, expect even lower minimum investments (some platforms already start at $50), wider asset selection, and more seamless integration with DeFi protocols.

If you’re curious about how this works in practice or want a deep dive into the mechanics behind these platforms (including step-by-step breakdowns), check out this detailed guide: How Fractional Real Estate Tokenization Works: A $1 Million Property Example.

The bottom line? Tokenization is leveling the playing field for millions worldwide. With transparent records, instant liquidity, low entry points, and access to properties across continents, small investors finally have a seat at the table in one of history’s most enduring wealth-building sectors.