Tokenized Real Estate Resilience in Crypto Bear Markets: Fractional Ownership Backed by Physical Properties

In the throes of a crypto bear market, where volatility reigns and speculative tokens plummet, tokenized real estate stands as a beacon of stability. Backed by physical properties, these digital tokens offer real estate tokenization resilience that pure cryptocurrencies often lack. As a portfolio manager who’s navigated multiple downturns, I’ve seen how RWA fractional ownership provides a tangible anchor, turning market fear into opportunity for strategic investors.

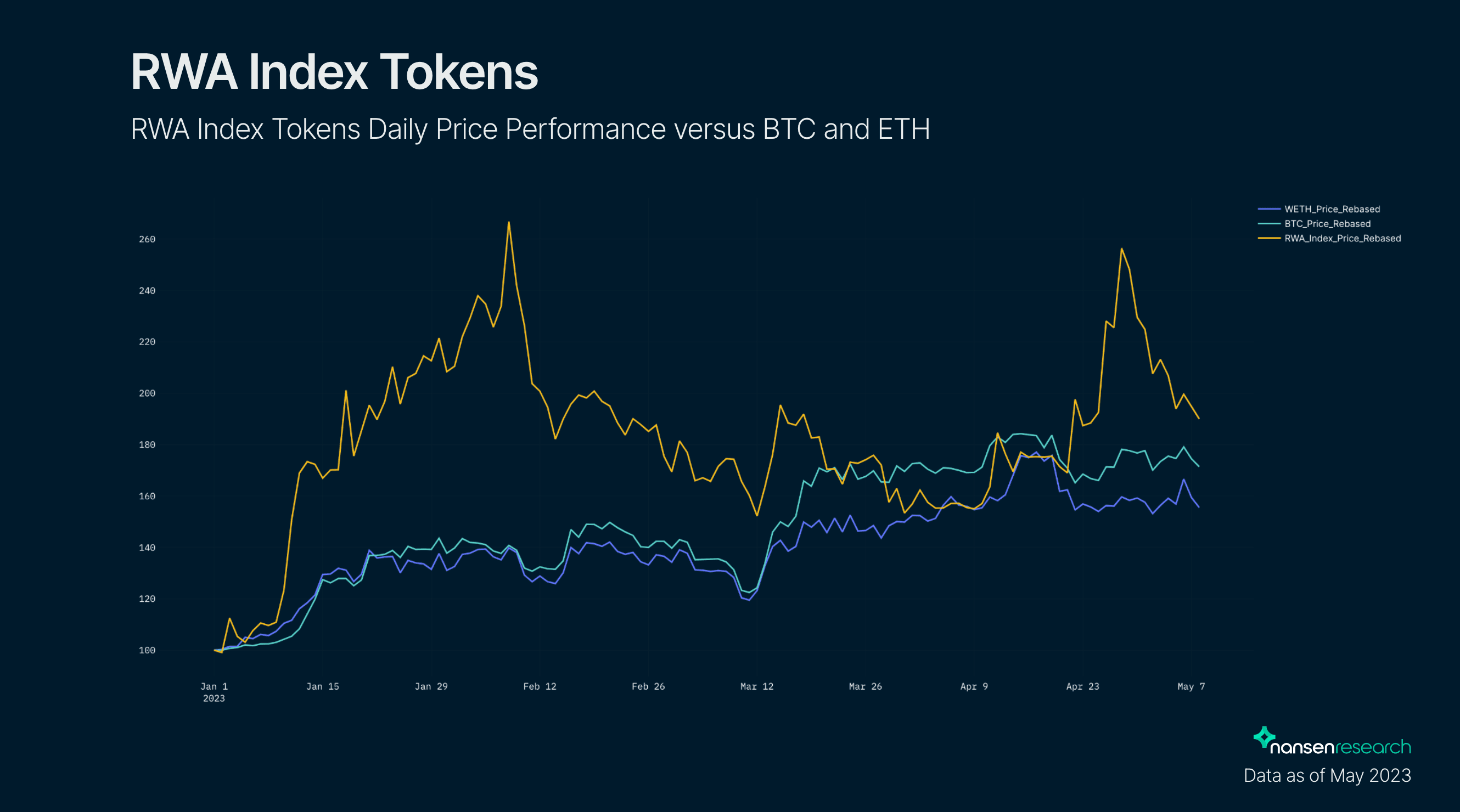

The appeal intensifies when you consider recent trajectories. Real-world assets (RWAs) nearly faded into obscurity post-2022 crashes, yet they’ve roared back. Tokenization market cap ballooned from $5 billion in 2022 to approximately $24 billion by June 2025, a staggering 380% surge, second only to stablecoins in growth momentum, according to Forbes. This isn’t fleeting hype; it’s a structural shift driven by blockchain property investment stability.

RWAs Defy Gravity in Prolonged Downturns

During crypto bear markets, sentiment sours fast, but tokenized real estate holds firm. Unlike meme coins or unproven protocols, these assets derive value from underlying properties, hotels, apartments, commercial spaces, that generate rental income and appreciate over time. Take the St. Regis Aspen Resort: its tokenization lets investors claim fractional stakes in a premier luxury hotel, insulating returns from crypto’s wild swings.

Platforms like RealT push this further, enabling entry at just $50 per token share in urban properties. This democratizes access, allowing everyday investors to tap cash flows from major cities without millions upfront. In bear phases, while Bitcoin and altcoins bleed, these tokens maintain floor prices tied to appraisals and leases, offering crypto bear market real estate RWA as a hedge.

Fractional Ownership Unlocks Unprecedented Liquidity

Fractional ownership via tokenization slices high-value assets into tradable digital shares, slashing barriers that once locked out all but the ultra-wealthy. A $10 million skyscraper? Now invest $1,000 and trade 24/7 on blockchain exchanges. Sources like RWA. io highlight how this boosts liquidity, letting holders exit positions swiftly, crucial in bear markets when agility matters.

Regulatory tailwinds bolster this. In the US, SEC compliance treats these as securities, ensuring oversight. Europe’s Luxembourg Blockchain Law IV greenlights ledger-based issuance, smoothing paths for platforms. I’ve advised clients to allocate here for diversification; physical backing plus liquidity creates a resilient layer amid crypto chaos.

Physical Backing Meets Blockchain Efficiency

What truly sets tokenized real estate bear market performers apart is the fusion of bricks-and-mortar security with blockchain’s speed. Tokenized RWAs inject credibility into on-chain ecosystems, as Arkham Exchange notes, bridging traditional finance with DeFi. Investors gain rental yields distributed automatically via smart contracts, plus global reach without intermediaries.

Examples abound: commercial buildings fractionalized for shared ownership, suburbs turned into affordable stakes. Medium analyses from 2025 underscore benefits, unprecedented liquidity, reduced entry barriers. In my experience managing HNW portfolios, this blend yields steadier returns; during downturns, property values hold as crypto doesn’t, proving diversity’s edge in resilience.

Yet strategic entry matters. Focus on vetted platforms with compliance, transparent audits, and diversified property pools. As bear markets test resolve, tokenized real estate isn’t just surviving, it’s positioning savvy investors for the inevitable rebound. For deeper dives into mechanics, explore how fractional real estate ownership works with blockchain tokenization.

While the advantages are compelling, no investment is without hurdles. Tokenized real estate faces regulatory scrutiny and platform risks, yet established players mitigate these through rigorous compliance and audits. In my 14 years steering portfolios, I’ve learned that due diligence on legal wrappers and oracle feeds for property valuations separates winners from pitfalls. Bear markets amplify scrutiny, but they also weed out weak projects, leaving stronger, more resilient options.

Strategic Allocation for Bear Market Strength

Integrating RWA fractional ownership demands a measured approach. Allocate 10-20% of your crypto portfolio to tokenized properties, balancing high-yield urban rentals with stable suburban holdings. Smart contracts automate dividend payouts from leases, providing passive income that cushions against token price dips. Platforms vetted for KYC and escrow services ensure your stake translates to real equity. This isn’t speculation; it’s engineered stability in a sea of volatility.

Resilience Strategies

-

Due Diligence Checklist: Verify physical property backing, SEC compliance (US) or Luxembourg Blockchain Law IV (Europe), platform audits like RealT.

-

Portfolio Allocation Tips: Strategically include RWAs, grown from $5B (2022) to $24B (June 2025), for portfolio stability.

-

Bear Market Entry Points: Accumulate during crypto downturns; tokenized RE holds value via tangible asset backing.

-

Diversify: Residential – Buy fractional rental shares in major cities from $50 via RealT.

-

Diversify: Hospitality – Fractional ownership in luxury assets like St. Regis Aspen Resort.

-

Diversify: Commercial – Tokenized offices/retail for yield diversification and liquidity.

Consider the numbers: RWAs surged 380% to $24 billion by mid-2025, per Forbes, even as broader crypto indices faltered. This trajectory reflects investor flight to assets with intrinsic value. XBTO and Growth Turbine analyses affirm how fractionalization unlocks skyscrapers and single-family homes, turning illiquid bricks into fluid capital.

Case Studies: Proven Resilience

The St. Regis Aspen Resort tokenization exemplifies execution. Fractional shares in this luxury icon delivered yields amid 2025’s downturn, backed by occupancy rates and asset appreciation. RealT’s $50 entry tokens in Detroit and Miami properties generated 8-12% annualized returns, outpacing many alts. These aren’t anomalies; they’re blueprints for real estate tokenization resilience. Adventures in CRE details the full pipeline, from SPVs to secondary trading, underscoring operational maturity.

In the UAE and Europe, frameworks like Cobo’s noted token units and Luxembourg’s laws accelerate adoption. Polytrade Finance highlights DeFi synergies, where collateralized RWAs fuel lending without liquidation spirals common in pure crypto. As bear markets persist, these tokens trade at discounts to net asset value, presenting buy-low opportunities for patient capital.

Bitcoin Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

To annotate this BTCUSDT chart effectively in my balanced technical style, start by drawing a prominent downtrend line connecting the January 2026 peak around 109,500 to the late February 2026 low near 92,500, highlighting the dominant bearish momentum. Add horizontal lines at key support levels (92,500 strong, 95,000 moderate) and resistance (100,000 moderate, 105,000 strong). Use rectangles to mark the recent consolidation zone from mid-February at 92,500-96,000. Place arrow_mark_down at the breakdown point around February 15, 2026, and callouts for volume spike on decline and MACD bearish signal. Include fib_retracement from the January high to February low for potential retracement levels. Finally, mark long_position entry near 95,200 with stop_loss at 92,000 and profit_target at 102,000.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold conditions and RWA growth context suggest reversal potential; medium tolerance warrants confirmation

Market Analyst’s Recommendation: Hold off on aggressive positions; scale in longs on support hold with tight stops

Key Support & Resistance Levels

📈 Support Levels:

-

$92,500 – Recent swing low with volume climax, strong support

strong -

$95,000 – Mid-range support tested multiple times

moderate

📉 Resistance Levels:

-

$100,000 – Immediate resistance from prior consolidation high

moderate -

$105,000 – Major resistance near prior peaks

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$95,200 – Bounce from moderate support with potential reversal signals, aligned to medium risk tolerance

medium risk

🚪 Exit Zones:

-

$102,000 – Initial profit target at resistance confluence with fib 50% retracement

💰 profit target -

$92,000 – Below strong support to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Climax volume on breakdown followed by decreasing volume

High volume confirms selling pressure at lows, potential exhaustion

📈 MACD Analysis:

Signal: Bearish crossover with possible divergence

MACD line below signal, but histogram narrowing suggests weakening momentum

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Gravity Team’s primer nails it: tokenization digitizes ownership rights, blending physical security with blockchain’s transparency. For HNWIs I advise, this means global diversification without geographic hassle. Yields accrue on-chain, tradeable instantly, resilient when sentiment tanks.

Looking ahead, expect institutional inflows to propel volumes. BlackRock and others eye RWAs for trillions in untapped liquidity. In prolonged bears, blockchain property investment stability shines brightest, rewarding those who prioritize substance over hype. Platforms like Real Estate Rwas position you at this nexus, tokenizing premium assets with compliance first. Diversify thoughtfully; resilience follows.

Explore further with this breakdown of a $1 million property example or fractional ownership mechanics. Your portfolio’s anchor awaits in tokenized real estate.