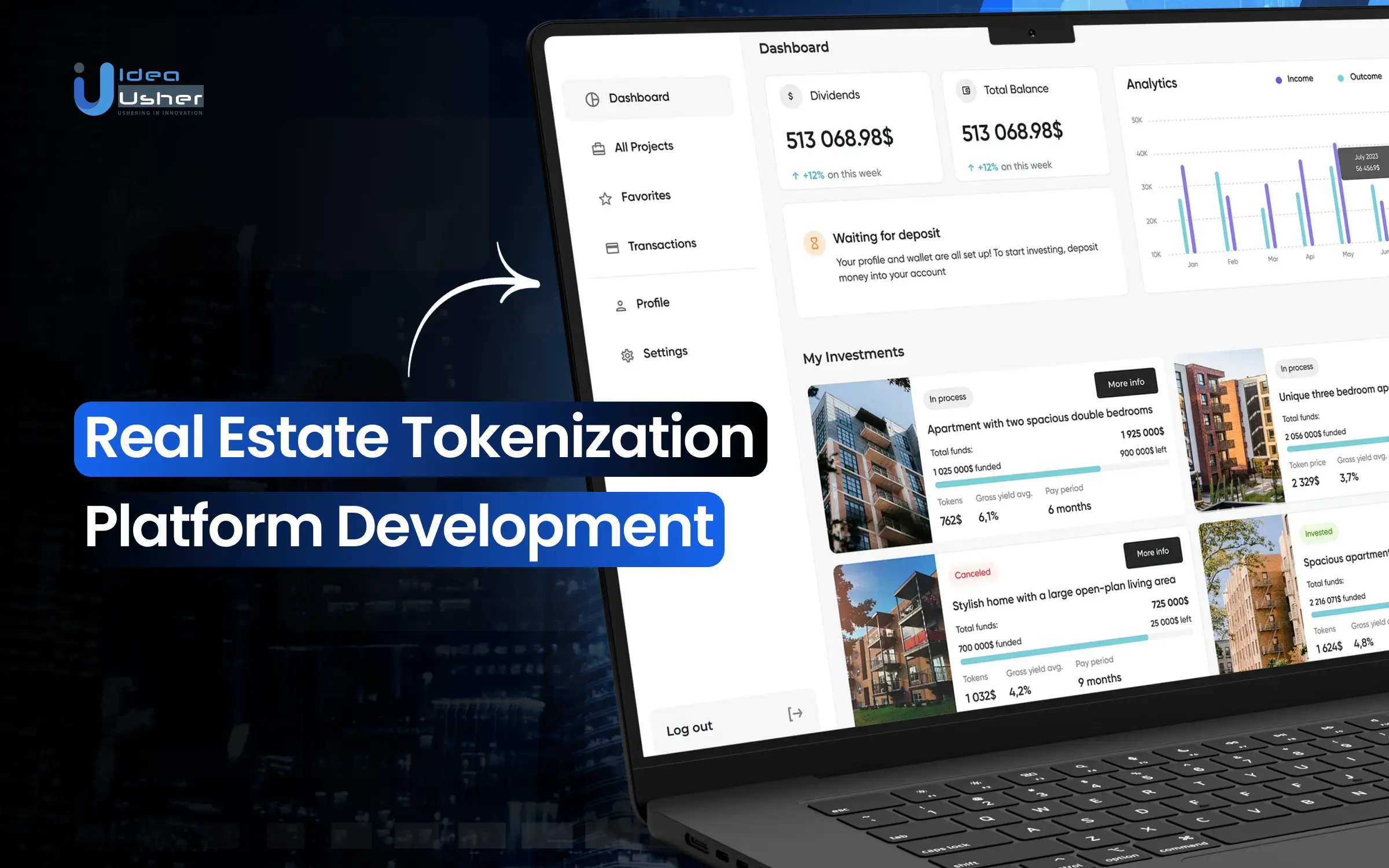

How Tokenized Real Estate Improves Liquidity for Global Investors

Traditional real estate has long been synonymous with illiquidity. Investors faced high capital requirements, lengthy transaction timelines, and significant friction when trying to buy or sell property. In contrast, tokenized real estate liquidity is fundamentally shifting this paradigm by leveraging blockchain technology to bring unprecedented flexibility and speed to property markets worldwide.

Fractional Ownership: Lowering Barriers, Increasing Access

The cornerstone of tokenized real estate’s appeal is fractional ownership. By converting physical assets into digital tokens on a blockchain, investors can purchase small fractions of properties instead of entire buildings or large portfolios. This dramatically lowers the minimum investment threshold and opens up previously exclusive markets to a broader pool of global investors. For example, platforms like RealT have already tokenized over 700 properties, allowing individuals to buy fractions of rental homes and earn daily rental income in cryptocurrency. This model not only democratizes access but also enables investors to diversify across multiple assets and geographies with modest capital outlays.

24/7 Global Trading: Liquidity Without Borders

Unlike traditional real estate transactions that can take weeks or even months to complete, tokenized assets are traded on blockchain-based platforms around the clock. This continuous trading environment means that investors can enter or exit positions at any time, providing a level of liquidity previously unheard of in the property sector. Leading platforms such as RealT and tZERO facilitate this seamless trading experience, further accelerating market efficiency and reducing the infamous “illiquidity discount” that has historically plagued real estate investments.

Disintermediation: Cutting Costs and Complexity

The automation enabled by blockchain does more than just speed up transactions; it also reduces the need for costly intermediaries such as brokers, escrow agents, and notaries. By embedding ownership records directly into smart contracts on-chain, platforms can streamline processes and minimize administrative expenses. This efficiency translates into lower transaction fees for investors and issuers alike, a critical advantage in an industry notorious for its high overheads.

This new era of blockchain real estate investing is not without its challenges. While tokenization offers clear benefits for liquidity and access, current trading volumes remain modest compared to traditional equities or even REITs. Regulatory uncertainty and valuation opacity continue to limit participation from institutional players. However, as regulatory frameworks mature and secondary marketplaces gain traction, these obstacles are likely to diminish over time.

Custom Portfolios and Continuous Markets: The Next Frontier

One often overlooked benefit is the ability for institutional investors to construct highly customized portfolios using real estate tokens that align precisely with their investment theses (as highlighted by Deloitte Insights). Furthermore, tokenization introduces a continuous market for property equity, eliminating many legacy inefficiencies while allowing for dynamic price discovery based on real-time supply and demand.

Tokenized real estate is also driving a fundamental shift in how investors manage risk and deploy capital globally. By lowering both capital requirements and transaction costs, property tokenization enables more frequent portfolio rebalancing and tactical asset allocation. Investors are no longer locked into decade-long holding periods or forced to endure illiquidity discounts. Instead, they can respond to macroeconomic shifts, local market trends, or changing personal circumstances with agility, buying or selling property tokens as easily as trading equities.

Key Benefits of Tokenized Real Estate Liquidity

-

Fractional Ownership Lowers Entry Barriers: Tokenization enables investors to purchase small fractions of properties, making real estate accessible without large capital outlays. Platforms like RealT have tokenized over 700 properties, allowing global investors to diversify with minimal investment.

-

24/7 Global Trading Access: Unlike traditional real estate, tokenized assets can be traded at any time on blockchain-based platforms such as tZERO, providing continuous liquidity and flexibility for investors worldwide.

-

Reduced Transaction Costs and Intermediaries: Blockchain-based trading automates many middleman functions, lowering fees and administrative burdens. Platforms like Brickblock streamline transactions for both issuers and investors.

-

Instant Settlement and Faster Liquidity: Digital tokens enable near-instant settlement of trades, eliminating the lengthy waiting periods typical of traditional property sales.

-

Portfolio Diversification and Customization: Tokenized real estate allows investors to build custom portfolios with tokens from diverse properties, geographies, and asset types, as supported by institutional-grade platforms like Tokeny.

These innovations are particularly relevant in today’s volatile economic environment, where flexibility and diversification are at a premium. Real estate tokens can be integrated into digital wallets alongside other crypto assets, allowing for seamless cross-asset rebalancing. This interoperability further enhances the strategic value of tokenized property within a diversified, multi-asset portfolio.

Challenges and Market Maturity: Navigating the Road Ahead

Despite these advances, some obstacles remain before tokenized real estate achieves mainstream liquidity levels. Current secondary markets for property tokens often suffer from low trading volumes and limited depth. Many platforms operate in regulatory gray zones, which can deter institutional capital and slow adoption. Transparency around pricing mechanisms and valuation models is still evolving, investors may face challenges assessing fair value or benchmarking returns against traditional real estate indices.

However, the trajectory is clear: as regulatory clarity improves and more high-quality assets come on-chain, we can expect deeper liquidity pools and broader investor participation. Initiatives to standardize smart contract protocols and enhance interoperability between platforms will further accelerate this trend. The emergence of decentralized exchanges (DEXs) specifically designed for real-world assets could be a game changer for market depth and price discovery.

Strategic Implications: Why Liquidity Matters Now

For forward-thinking investors, the rise of tokenized real estate liquidity isn’t just about convenience, it’s about unlocking new strategic possibilities. Enhanced liquidity means more efficient capital deployment across geographies, faster response times to market signals, and reduced exposure to single-asset risk. It also paves the way for innovative financial products such as collateralized lending against property tokens or automated yield strategies tied to rental income streams.

The bottom line: while challenges persist, the direction of travel is unmistakable. Tokenization is steadily transforming global property markets from static silos into dynamic ecosystems where liquidity is no longer a privilege but an expectation. As blockchain infrastructure matures and regulatory frameworks adapt, tokenized real estate will become an integral pillar of modern investment portfolios, bridging the gap between traditional assets and digital finance.

If you’re interested in exploring this emerging landscape further, our deep dive on how real estate tokenization increases liquidity offers actionable insights for both new entrants and seasoned professionals.