How Fractional Ownership is Making Luxury Real Estate Accessible Through Blockchain Tokenization

Luxury real estate has traditionally been reserved for the ultra-wealthy, with high capital requirements and illiquid markets acting as significant barriers to entry. Today, blockchain technology is turning this paradigm on its head. By enabling fractional real estate ownership through tokenization, investors worldwide can now access high-value properties in a way that is both efficient and affordable. This shift is not just a technical upgrade – it’s a fundamental reimagining of how luxury property investment works.

The Mechanics Behind Luxury Real Estate Tokenization

Tokenization involves dividing a physical asset, such as a luxury villa or commercial building, into digital tokens on a blockchain. Each token represents a specific fraction of ownership in the property. For example, imagine a $5 million resort hotel split into 100,000 tokens – each token would be valued at $50. This granular approach allows investors to buy as little or as much exposure as they wish, dramatically lowering the financial threshold for participation.

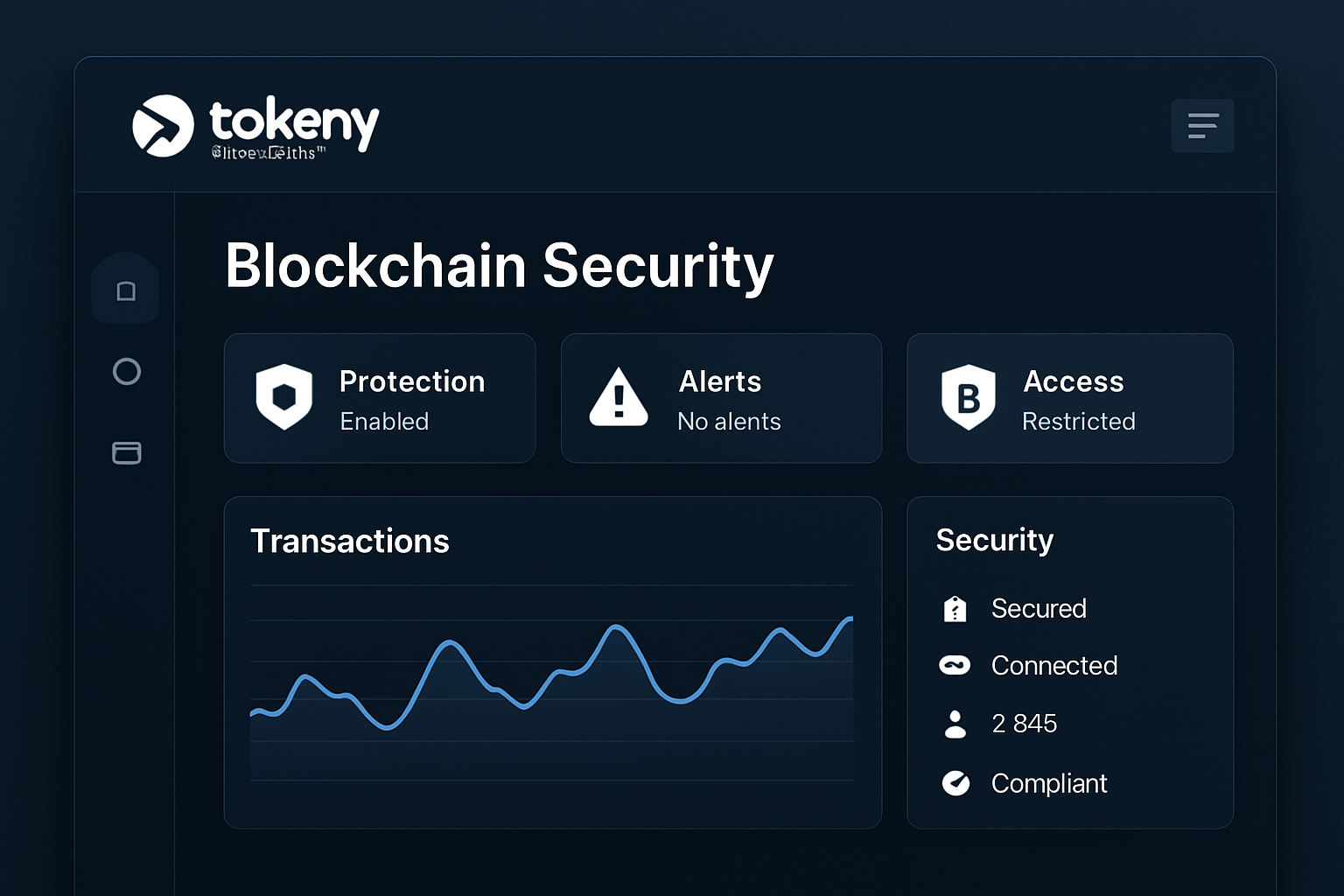

The process leverages secure smart contracts to automate ownership records and transactions. All data is stored on an immutable blockchain ledger, ensuring transparency and reducing the risk of fraud. Leading real estate RWA platforms are building compliant frameworks that enable seamless issuance and trading of these fractional property tokens.

Key Benefits: Accessibility, Liquidity, and Transparency

Top Benefits of Fractional Real Estate Tokenization

-

Increased Accessibility: Tokenization allows investors to own fractions of high-value properties, such as luxury hotels or villas, with minimal capital. For example, a $5 million property can be divided into 100,000 tokens at $50 each, making entry into the luxury real estate market far more attainable.

-

Enhanced Liquidity: Unlike traditional real estate, tokenized shares can be traded on secondary markets. This provides investors with the flexibility to buy or sell their stakes quickly, improving liquidity and reducing the typical long holding periods associated with property investment.

-

Global Participation: Blockchain-based tokenization enables investors worldwide to participate in luxury real estate markets, breaking down geographical barriers and expanding the pool of potential buyers and sellers.

-

Transparency and Security: Transactions are recorded immutably on the blockchain, ensuring a transparent and secure investment process. This reduces the risk of fraud and increases trust among stakeholders.

-

Portfolio Diversification: Fractional ownership lets investors diversify their portfolios by allocating smaller amounts across multiple high-value properties, reducing risk and increasing exposure to premium real estate assets.

Increased Accessibility: Investors no longer need millions to participate in trophy assets – even small amounts can secure exposure to prime properties across global markets.

Enhanced Liquidity: Unlike traditional real estate deals that can take months or years to close, tokenized assets can be traded on secondary marketplaces in minutes. This flexibility empowers investors to rebalance portfolios or exit positions with unprecedented speed.

Transparency and Security: Blockchain’s decentralized ledger ensures every transaction is recorded immutably for all stakeholders to verify. This fosters trust while minimizing disputes over ownership or rights.

Pioneering Examples in Tokenized Luxury Real Estate

The concept isn’t just theoretical – it’s already live in major markets. The St. Regis Aspen Resort was one of the first high-profile cases where fractional tokens allowed accredited investors to gain exposure to luxury hospitality through digital shares. More recently, Seazen Group’s 2025 announcement underscored how even established developers are leveraging tokenization for liquidity and broader investor participation.

This movement is unlocking global access to tokenized luxury villas and commercial spaces, offering opportunities previously limited by geography and wealth status.

Navigating Challenges: Regulation and Market Maturity

Despite its promise, luxury real estate tokenization faces hurdles around regulatory compliance, valuation standards, and market infrastructure for trading these new digital assets. Prospective investors must perform rigorous due diligence regarding legal frameworks and platform credibility before committing capital.

Legal clarity is especially critical, as jurisdictions differ in how they treat blockchain property investment and digital asset securities. Regulatory bodies are working to catch up, but the pace of innovation often outstrips legislation. As a result, investors should look for platforms with established compliance protocols and strong track records in managing tokenized assets. This is particularly vital for cross-border investments, where property rights and enforcement mechanisms can vary widely.

Another challenge is the valuation of fractional property tokens. Unlike traditional real estate, where appraisals are standardized, the price discovery process for tokenized assets is still evolving. Platforms are experimenting with hybrid models that combine third-party valuations, algorithmic pricing, and transparent on-chain data to establish fair market values. The development of robust secondary markets is also essential to ensure liquidity and accurate token pricing.

The Future of Tokenized Luxury Real Estate

The momentum behind fractional real estate ownership is accelerating, driven by both technological progress and shifting investor preferences. As digital natives seek more flexible, diversified portfolios, the appeal of owning a piece of a $5 million luxury hotel for just $50 becomes undeniable. Secondary trading venues are emerging, enabling investors to exit or rebalance positions with a few clicks, rather than navigating the months-long process of traditional property sales.

Tokenization is also democratizing access for global investors, breaking down barriers that once restricted luxury real estate to local elites or institutional buyers. With blockchain-based property tokens, an investor in Singapore can seamlessly acquire exposure to a Parisian penthouse or a Miami beachfront villa, all within a compliant, transparent framework. This global reach is already reshaping how developers approach capital raising and how investors think about diversification.

For those interested in learning more about the mechanics and real-world impact, resources like this guide on how fractional ownership works in tokenized real estate provide deeper technical insights and case studies.

Getting Started: Best Practices for New Investors

Checklist for Evaluating Tokenized Real Estate Platforms

-

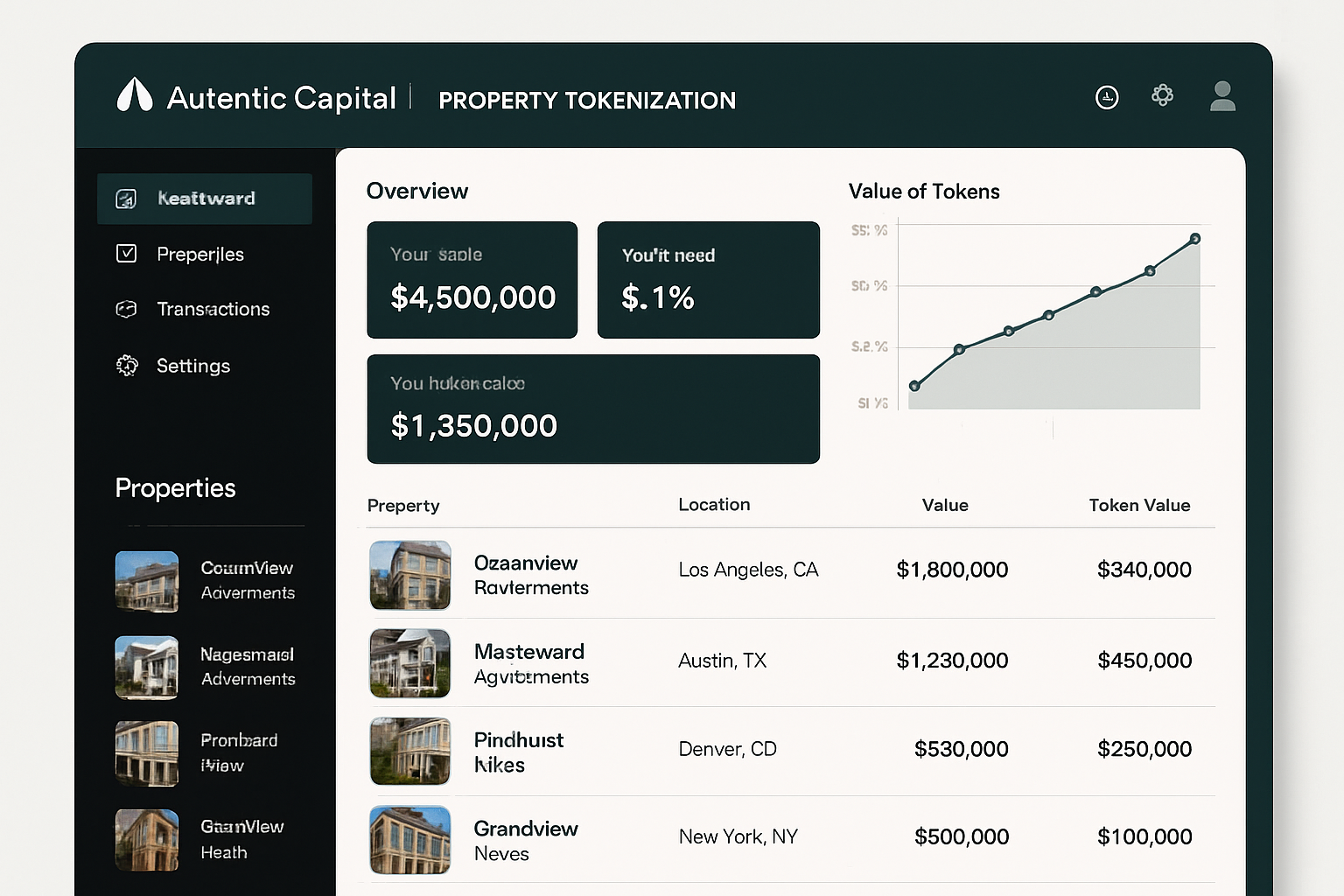

Asset Transparency: Verify that the platform offers detailed property information, including legal documentation, valuation reports, and ownership structure. Platforms like Autentic.Capital and Brickken provide transparent access to asset data.

-

Token Liquidity and Secondary Markets: Assess whether tokens can be traded on reputable secondary markets, enhancing liquidity. Platforms such as tZERO and OpenFinance Network support secondary trading of real estate tokens.

-

Security and Custody: Confirm the use of secure blockchain protocols and robust custody solutions to protect investor assets. Look for platforms that partner with established custodians or utilize audited smart contracts, such as Tokeny Solutions.

-

Track Record and Real-World Examples: Investigate the platform’s history and successful tokenizations, like the St. Regis Aspen Resort project, which set a precedent for luxury real estate tokenization.

Before diving in, prospective buyers should evaluate platform security, regulatory standing, asset transparency, and secondary market functionality. It’s also wise to review historical performance and user feedback, as well as to understand the specific legal structure backing each token. Many leading real estate RWA platforms offer educational content and demo accounts to help new users get comfortable with the process.

As the ecosystem matures, expect to see more innovation in smart contract governance, automated dividend payouts, and integration with DeFi protocols. These advancements will further enhance liquidity, efficiency, and investor protection – making tokenized luxury villas and commercial assets even more attractive for a broader audience.

The convergence of blockchain technology and real estate is not just a trend – it’s a structural transformation that will define the next era of property investment. With careful due diligence and a clear understanding of the risks and rewards, investors now have unprecedented tools to access, diversify, and profit from the world’s most exclusive properties.