How Fractional Real Estate Tokenization Lowers the Entry Barrier for Global Investors

Imagine being able to invest in a luxury apartment in New York, a beachfront villa in Bali, or a commercial property in London – all with as little as $100. Thanks to fractional real estate tokenization, this scenario is no longer just a dream for global investors. By leveraging the power of blockchain technology, real estate assets can now be split into digital tokens, making high-value properties accessible to everyone, not just institutional players or ultra-wealthy individuals.

Breaking Down Barriers: The Power of Fractional Ownership

Historically, investing in real estate has required substantial upfront capital – often hundreds of thousands or even millions of dollars. This high entry threshold has kept many would-be investors on the sidelines. However, with fractional ownership through tokenization, platforms like Arrived and Homebase are changing the game by allowing users to invest in real estate with $100. This seismic shift means that more people across the globe can participate in property markets that were previously out of reach.

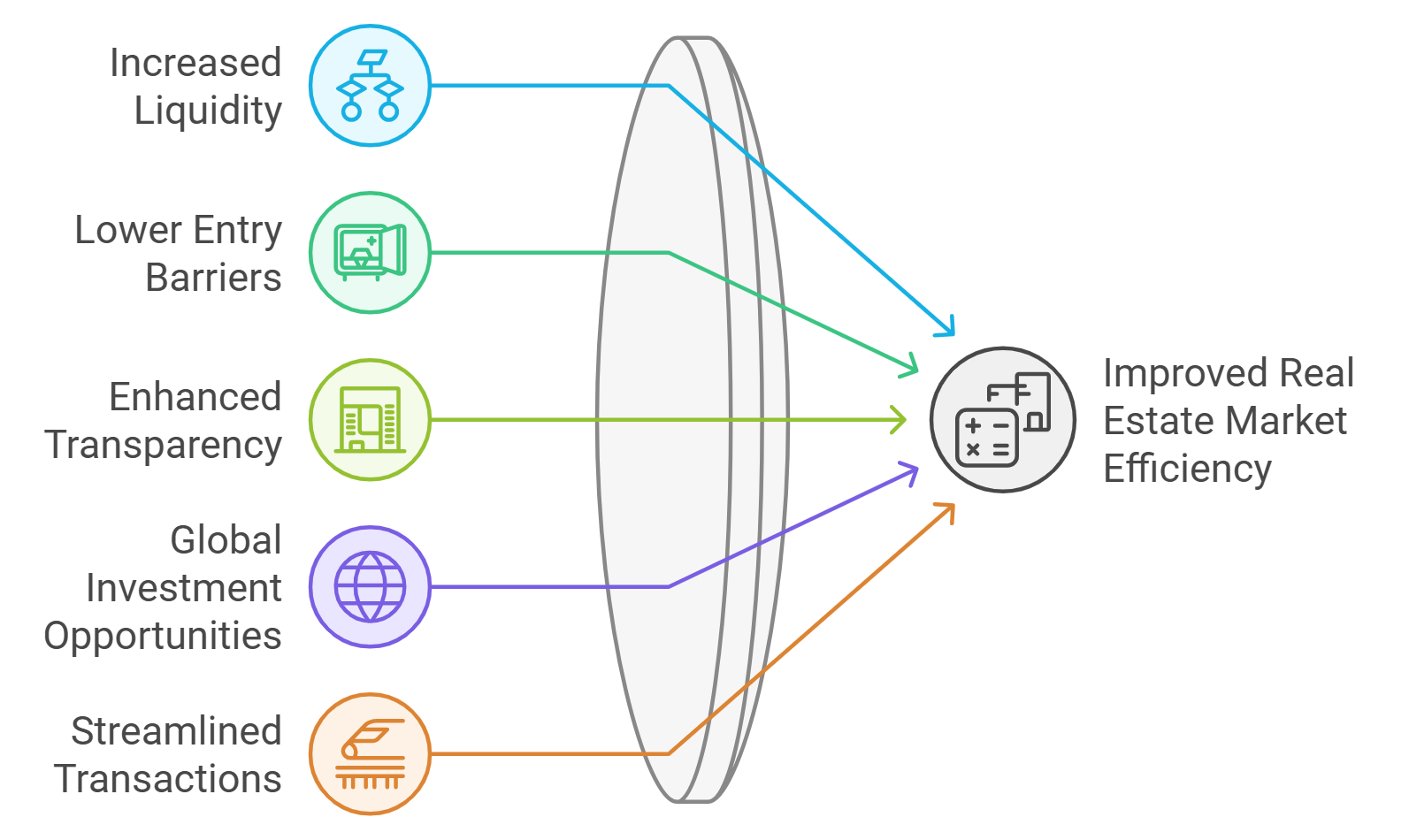

Key Benefits of Fractional Real Estate Tokenization

-

Enhanced Liquidity: Tokenized real estate can be traded on secondary markets, letting investors buy and sell property tokens quickly—unlike traditional real estate, which is often illiquid and slow to transact.

-

Global Accessibility: Blockchain-powered platforms enable cross-border participation, so investors worldwide can access real estate markets without excessive fees or complex regulations.

-

Increased Transparency and Security: Every transaction is recorded on an immutable blockchain ledger, providing verifiable ownership records and reducing fraud risk for all parties involved.

-

Reduced Transaction Costs: Automated smart contracts eliminate many intermediaries, lowering administrative expenses and making real estate investment more cost-effective for both small and global investors.

The concept is simple: instead of buying an entire property outright, investors purchase digital tokens that represent fractional shares. These tokens are recorded on an immutable blockchain ledger, ensuring secure and transparent ownership records for all parties involved. Not only does this lower the financial barrier to entry, but it also democratizes access to premium properties and diversifies risk across multiple assets.

Enhanced Liquidity and Global Access

Traditional real estate investments have always been notorious for their illiquidity – selling a property can take months and involves layers of paperwork and intermediaries. Tokenization solves this by introducing secondary trading markets where property tokens can be bought or sold almost instantly. Investors now enjoy greater flexibility and faster access to capital without being locked into long-term commitments.

This new model is especially attractive for international participants. Blockchain-based platforms facilitate cross-border transactions seamlessly, eliminating excessive fees and regulatory headaches that often come with foreign investment. Whether you’re based in Singapore or São Paulo, you can now join thriving property markets around the world with just a few clicks.

The Rise of Real Estate Tokenization Platforms

The adoption curve is steepening fast. Deloitte projects that by 2035, approximately $4 trillion worth of real estate assets will be tokenized – up from less than $0.3 trillion in 2024. Leading platforms like Lofty AI and RealT already enable users to buy U. S. -based residential property tokens directly from their phones or desktops. Entry points are low (as little as $10 on some apps), but transparency and compliance remain top priorities thanks to blockchain’s inherent security features.

This rapid growth is creating new opportunities for both novice investors seeking passive income streams and seasoned traders looking for diversified exposure beyond stocks or crypto assets alone.

How Does It Work? An Easy Step-by-Step Overview

If you’re curious about how easy it is to get started with blockchain property investment today:

- Select a trusted platform: Research options like Arrived, HomebaseDAO, Lofty AI or RealT.

- Complete KYC/AML checks: Verify your identity as required by regulations.

- Add funds: Deposit your chosen amount (starting from $100) via fiat or crypto.

- Select your asset: Browse available properties around the world; review details like expected returns and occupancy rates.

- Buy tokens: Purchase fractional shares representing your stake in one or more properties.

- Monitor and trade: Track performance, receive rental income distributions (where applicable), and sell your tokens on secondary markets if desired.

The future is clear: fractional ownership via tokenized platforms is set to redefine what it means to invest in global real estate – making it more inclusive, liquid, transparent and efficient than ever before.

But what about the bigger picture? Real estate tokenization is not just a technical upgrade or a new investment fad. It’s driving a cultural shift in how people think about property ownership and wealth-building. By lowering the minimum investment threshold to $100, platforms are opening the doors for younger investors, digital nomads, and communities previously excluded from high-value markets. This is more than democratization, it’s an invitation to participate in global prosperity.

One of the most exciting aspects is portfolio diversification. Investors can now spread their risk across multiple regions and asset types, residential, commercial, short-term rentals, without being locked into a single location or property type. This flexibility was nearly impossible before blockchain-based fractional ownership arrived on the scene.

Transparency, Security, and Reduced Costs

Another game-changer is the unprecedented transparency and security offered by blockchain. Every transaction, from initial purchase to secondary trading, is recorded on an immutable ledger. This drastically reduces fraud risk and ensures clear ownership records for all parties involved.

Smart contracts further streamline transactions by automating rent distribution, compliance checks, and even governance votes among token holders. Administrative costs drop as middlemen are replaced with code, meaning more of your money goes directly into real estate rather than fees.

A Look at Leading Platforms

Curious where to start? Here’s a quick snapshot of some leading real estate tokenization platforms:

Top Platforms for $100 or Less Real Estate Investing

-

Arrived: Start investing in U.S. rental properties with as little as $100. Arrived handles property management, so investors earn passive income without the hassle. Learn more.

-

Homebase: Buy fractional shares in tokenized real estate for a minimum of $100. Homebase leverages blockchain to provide transparent ownership and regular rental income. Learn more.

-

Realbricks: Accessible to everyone with a low $100 minimum, Realbricks offers fractional ownership in vetted properties, plus up to 9.8% ownership per investor. Learn more.

-

Lofty AI: Invest in tokenized U.S. properties with entry points as low as $50. Lofty provides instant liquidity, allowing users to buy and sell property tokens 24/7. Learn more.

-

RealT: Own fractions of U.S. rental properties starting at $50. RealT pays rental income daily in cryptocurrency, with a seamless blockchain-powered experience. Learn more.

Each platform has its own focus, some specialize in U. S. residential properties while others offer access to international assets or commercial buildings. What unites them is their commitment to lowering barriers and enhancing liquidity for all investors.

What’s Next for Fractional Real Estate Investment?

The momentum behind fractional ownership real estate isn’t slowing down anytime soon. As regulatory clarity improves and user interfaces become even more intuitive, expect adoption rates to accelerate worldwide. With predictions pointing toward $4 trillion in tokenized assets by 2035, early adopters have a chance to shape this new frontier, and potentially reap significant rewards along the way.

If you’re ready to explore this bold new world of global real estate access, or want to learn more about how fractional tokenization is making global real estate accessible: there’s never been a better time to start researching your options.

The future of property investment isn’t reserved for the few, it’s open to anyone with vision and $100 in their pocket.