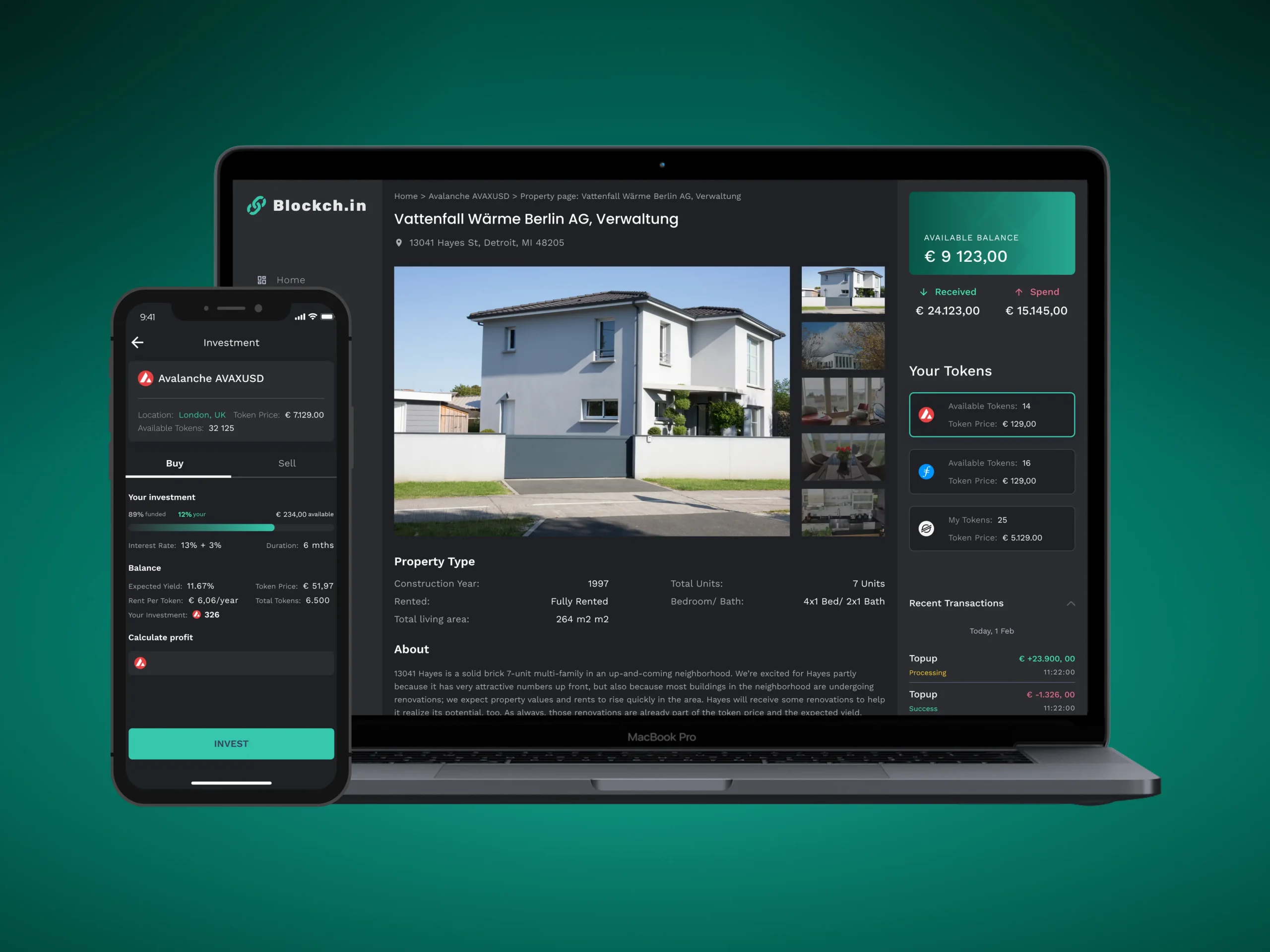

How Tokenized Real Estate is Changing Property Investment for Crypto Enthusiasts

Tokenized real estate investment is rapidly reshaping the landscape for crypto enthusiasts, merging the tangible world of property with the borderless efficiency of blockchain. By converting ownership rights into digital tokens, platforms now allow investors to buy, sell, and trade fractions of properties with unprecedented ease. This innovation is not just a technological leap; it’s a fundamental shift in how individuals access and manage real estate assets.

Fractional Ownership: Lowering Barriers and Democratizing Access

Traditionally, real estate investing demanded substantial capital outlays, local market expertise, and patience for illiquid assets. Tokenization disrupts this paradigm by enabling fractional ownership. Instead of purchasing an entire building or unit, investors can now acquire digital tokens representing small portions of high-value properties. For example, some blockchain real estate platforms issue tokens priced as low as $50 each, making it possible for a broader spectrum of investors to participate in markets previously reserved for institutions or wealthy individuals.

This democratization is particularly attractive to crypto-savvy users seeking diversification beyond volatile cryptocurrencies. With tokenized property compliance built into smart contracts and KYC procedures streamlined online, onboarding has become as simple as funding a wallet with Bitcoin or fiat and selecting from a curated list of available assets.

Liquidity and Efficiency: Trading Property Like Crypto

The illiquidity of traditional real estate has long been a sticking point for investors. Selling property typically involves months of paperwork, negotiations, and regulatory hurdles. Tokenized assets solve this by introducing secondary markets where property tokens can be traded 24/7, much like cryptocurrencies. This enhanced liquidity provides investors with flexible exit strategies that were previously impossible in brick-and-mortar markets.

Blockchain further streamlines transactions by automating processes such as property transfers and rent distributions via smart contracts. The result is reduced administrative overhead, faster settlements, and lower transaction costs compared to conventional real estate deals. For those looking to understand how blockchain is revolutionizing real estate liquidity, tokenization offers an instructive case study.

Top Benefits of Tokenized Real Estate for Crypto Investors

-

Fractional Ownership Lowers Entry Barriers: Tokenization enables investors to purchase fractions of high-value properties, making real estate investment more accessible and affordable to a global audience.

-

Enhanced Liquidity Through Secondary Markets: Unlike traditional real estate, tokenized assets can be traded on secondary markets, providing investors with easier exit strategies and improved liquidity.

-

Streamlined Transactions and Lower Costs: Blockchain technology automates processes such as property transfers and payments, reducing administrative overhead and eliminating delays.

-

Increased Transparency and Trust: The immutable ledger of blockchain ensures accurate, tamper-proof record-keeping, giving investors full transparency into property ownership and transaction history.

-

Global Access and Diversification: Platforms like RealT and PropertyToken allow investors worldwide to diversify their portfolios by accessing a broad range of real estate assets across different markets.

Transparency and Trust Through Blockchain

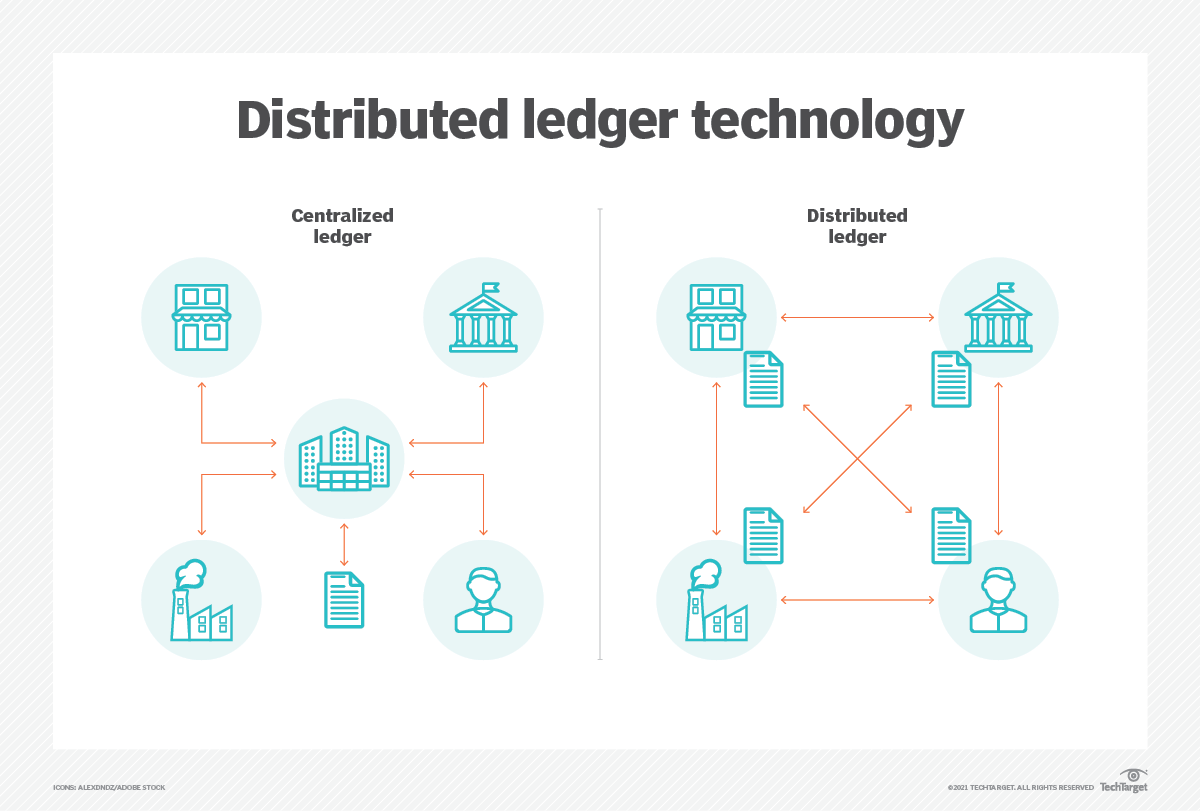

The immutability of blockchain ledgers ensures that every transaction, whether it’s the purchase of a single token or the distribution of rental income, is permanently recorded and publicly verifiable. This transparency builds trust among participants by providing clear proof of ownership history and eliminating the risk of tampering or fraud often associated with opaque traditional systems.

Platforms such as RealT have leveraged these features to offer weekly rent payouts directly to token holders’ wallets while maintaining full auditability on-chain. As more commercial spaces like office buildings are brought on-chain through tokenization initiatives, both institutional and retail investors gain access to lucrative opportunities once limited by geography or exclusivity.

Yet, while the promise of tokenized real estate is compelling, investors should approach this emerging market with a diligent mindset. Regulatory frameworks are still evolving across jurisdictions, and compliance remains a moving target. Platforms must implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to ensure legal integrity and protect investor interests. As with any disruptive technology, early adopters should thoroughly vet platforms for transparency, security standards, and clarity on property rights embedded in each token.

Navigating Risks and Maximizing Opportunities

Tokenized property compliance is not just a technical requirement; it’s foundational for sustainable growth in this sector. Investors should review smart contract audits, platform licenses, and the legal structure underpinning each asset. Additionally, understanding the liquidity profile of specific tokens, such as whether they can be traded instantly on secondary markets or require an initial holding period, is essential for effective portfolio management.

Another consideration is technological risk. While blockchain offers unprecedented efficiency and transparency, it also introduces potential vulnerabilities such as smart contract bugs or platform outages. Diversifying across reputable crypto real estate platforms can help mitigate these risks while capturing upside from different markets and property types.

The Future: Expanding Access to Global Real Estate Markets

As adoption accelerates, tokenized real estate investment platforms are beginning to bridge the gap between traditional finance and decentralized ecosystems. For crypto enthusiasts accustomed to digital-first investing, the ability to buy property tokens in global cities, without geographic restrictions or prohibitive minimums, marks a watershed moment for portfolio diversification.

This transformation is already visible in commercial sectors where institutional players leverage tokenization to tailor custom portfolios that align with their risk-return profiles (see how real estate tokenization increases liquidity for global investors). Meanwhile, retail investors benefit from fractional access to rental income streams or capital appreciation previously out of reach.

The intersection of blockchain real estate innovation and investor demand is creating a new asset class, one that rewards transparency, efficiency, and inclusivity. As regulatory clarity improves and technology matures, tokenized real estate stands poised to become a mainstay in both crypto-native and traditional portfolios alike.