How Tokenized Real Estate Enables Fractional Home Ownership for Small Investors

For decades, real estate has stood as one of the most coveted yet inaccessible asset classes for small investors. High minimum investment thresholds, illiquidity, and complex legal processes have made direct property ownership a privilege reserved for institutional players and high-net-worth individuals. Today, real estate tokenization is reshaping this paradigm, unlocking fractional home ownership opportunities for a new generation of investors.

How Real Estate Tokenization Works in 2025

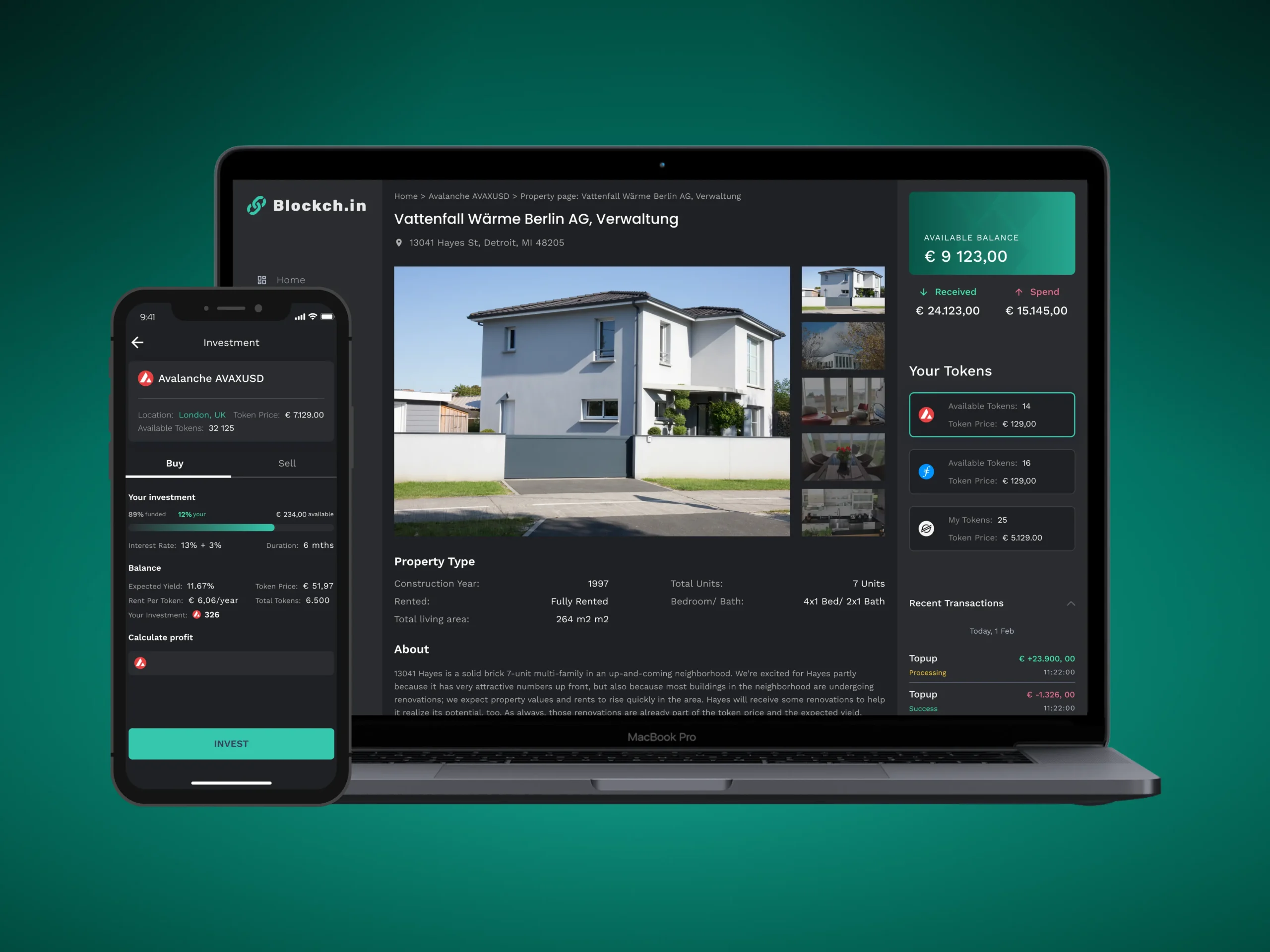

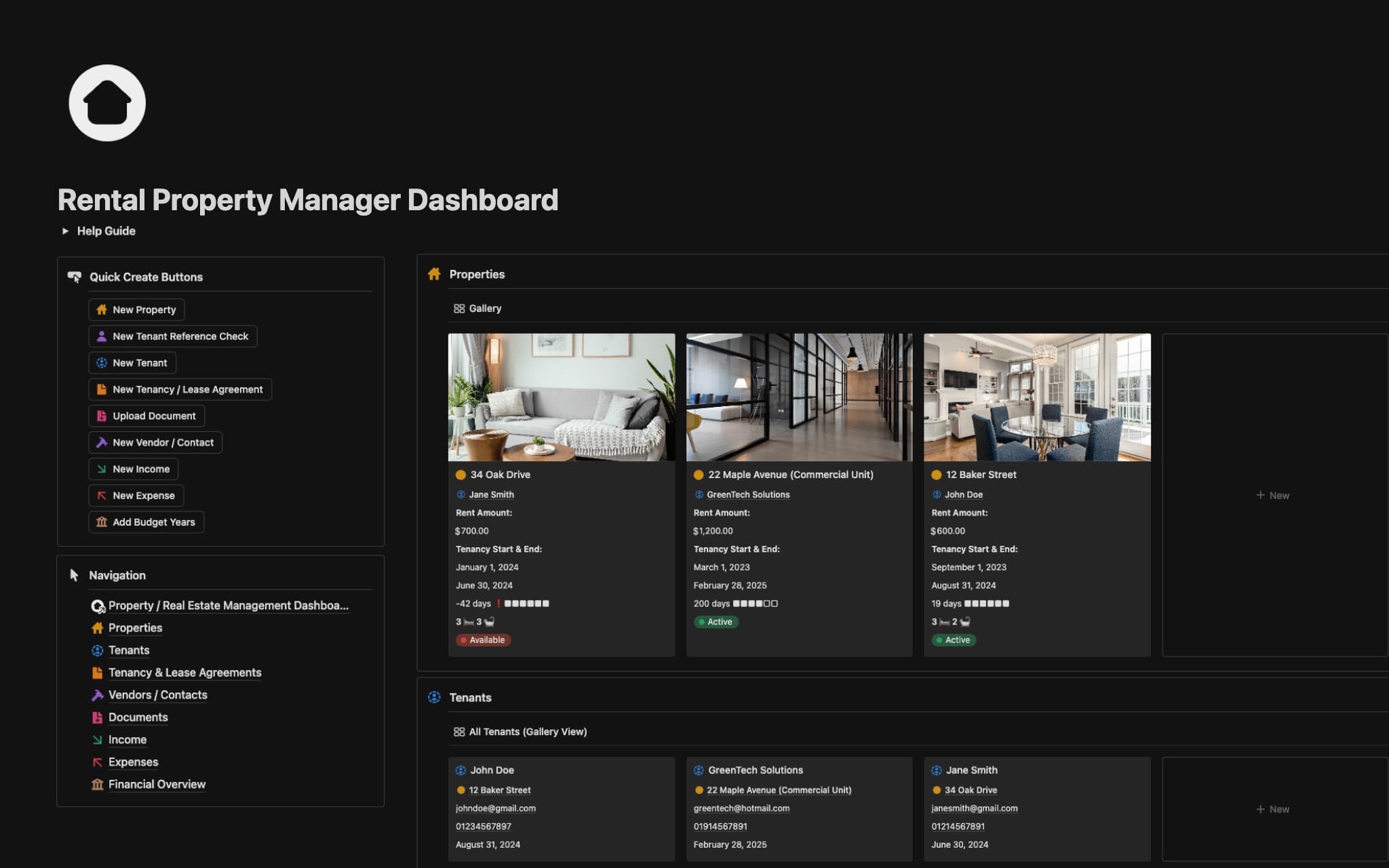

Tokenization leverages blockchain technology to divide property ownership into digital tokens, each representing a fractional share of the underlying asset. These tokens are securely recorded on-chain, allowing multiple investors to collectively own portions of a single property or portfolio. The process is straightforward: a property is valued and legally structured (often via an SPV or trust), then split into thousands of tokens that can be purchased by individual investors worldwide.

This innovation dramatically lowers the capital required to participate in real estate markets. For example, platforms like Lofty have democratized access by offering investment options starting at just $50, enabling virtually anyone with an internet connection to buy into high-value assets once out of reach. As of 2025, Lofty has tokenized 148 properties across 11 states and serves approximately 7,000 monthly users, illustrating both the scale and momentum behind this trend.

The Power of Fractional Ownership for Small Investors

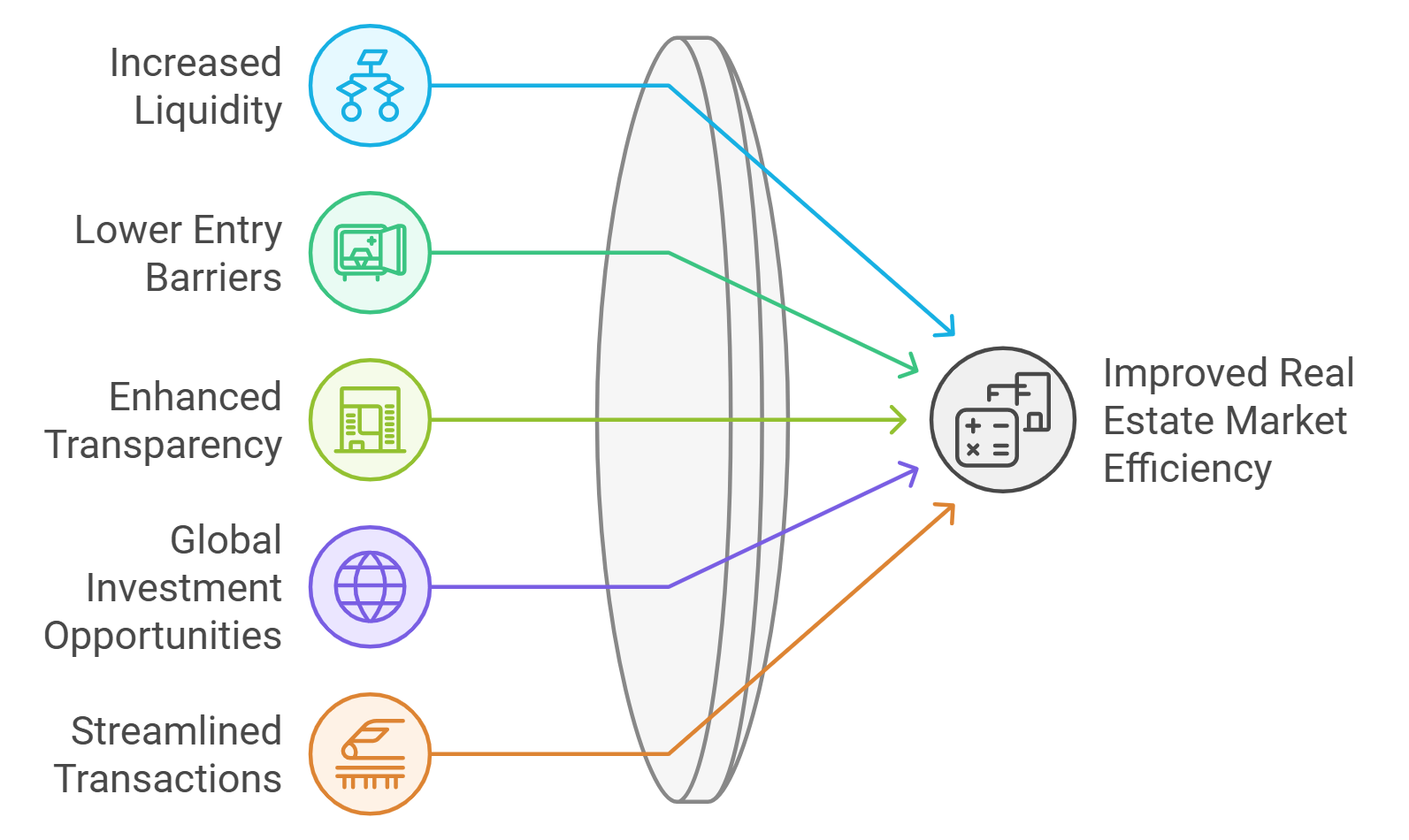

Fractional ownership via blockchain real estate investing offers several strategic advantages:

Key Benefits of Fractional Home Ownership via Property Tokens

-

Lower Barriers to Entry: Tokenized real estate platforms like Lofty allow investments starting as low as $50, enabling small investors to access high-value property markets previously reserved for wealthy individuals.

-

Enhanced Liquidity: By converting property shares into digital tokens, investors can buy, sell, or trade their stakes on blockchain platforms, providing significantly faster and more flexible exit options compared to traditional real estate.

-

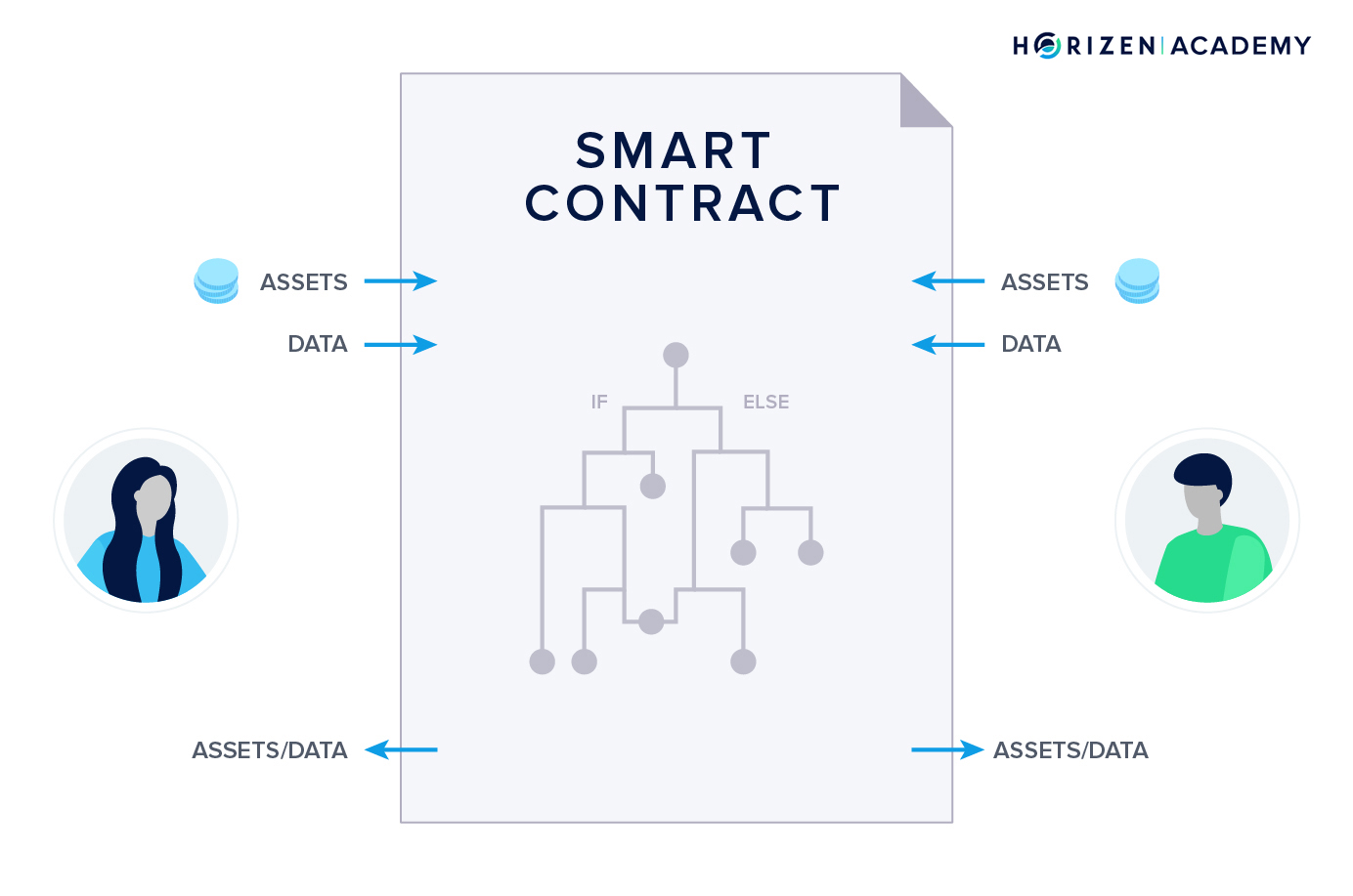

Automated Income Distribution: Platforms such as RealT use smart contracts to automatically distribute rental income to token holders, often on a daily basis and in cryptocurrency.

-

Global Accessibility: Blockchain-based tokenization enables investors worldwide to participate in real estate markets without geographic restrictions, broadening diversification opportunities.

-

Increased Transparency and Efficiency: Smart contracts automate compliance checks and transaction processes, reducing the need for intermediaries and minimizing costs while ensuring transparent property management.

Liquidity: Unlike traditional real estate deals that can take months or years to close, tokenized assets can be bought or sold within minutes on secondary marketplaces. This flexibility empowers investors to rebalance portfolios or exit positions without being locked in for extended periods.

Diversification: With lower entry costs, small investors can spread capital across multiple properties in different geographies and sectors, residential, commercial, industrial, reducing concentration risk.

Transparency and Security: Blockchain’s immutable ledger provides an auditable record of all transactions and ownership stakes. Smart contracts automate processes like rental income distribution and compliance checks, minimizing human error and reducing reliance on intermediaries.

Real-World Examples: Platforms Leading the Charge

The adoption curve for tokenized real estate is steepening rapidly as platforms prove out the model at scale. RealT stands out with over 700 properties tokenized across the U. S. , representing more than $130 million in total asset value as of October 2025. Investors receive daily rental income paid directly in cryptocurrency, an unprecedented level of efficiency compared to legacy systems.

This shift isn’t limited to niche players; institutional interest is growing as well. According to Deloitte Insights, asset tokenization allows large funds to construct custom portfolios aligned with their investment thesis while maintaining liquidity, a previously unattainable combination in private markets.

The impact? Tokenization is turning one of the world’s most exclusive asset classes into an accessible market for all investor profiles, without sacrificing security or regulatory compliance.

If you want a detailed look at how fractional ownership works within these models, including legal structures and investor protections, visit our comprehensive guide here.

While the benefits of fractional home ownership through real estate tokenization are clear, investors must also weigh the evolving risks and operational realities. Regulatory frameworks are still catching up to this technological leap, with compliance requirements varying by jurisdiction. Market volatility is another consideration; token prices may fluctuate based on both property performance and broader crypto market dynamics. As with any emerging asset class, prudent due diligence remains essential.

Navigating Risks in Tokenized Real Estate

Investors should be aware that the nascent nature of blockchain real estate investing introduces unique challenges. Legal clarity around tokenized property rights is improving but not yet uniform globally. Additionally, secondary market liquidity, while vastly improved over traditional real estate, can be inconsistent depending on platform adoption and regulatory acceptance in different regions.

Key Risks in Tokenized Real Estate for Small Investors

-

Regulatory Uncertainty: The legal framework for tokenized real estate varies by jurisdiction and remains in flux. Changes in regulations could affect the legality, taxation, or transferability of tokens, posing risks for investors.

-

Market Liquidity Risks: While tokenization increases liquidity compared to traditional real estate, secondary markets for tokens are still developing. Investors may face challenges selling tokens quickly or at desired prices during periods of low demand.

-

Smart Contract Vulnerabilities: Tokenized real estate relies on smart contracts to automate transactions and income distribution. Bugs or exploits in these contracts can lead to financial losses or manipulation of ownership records.

-

Asset Valuation and Transparency: Determining the fair value of tokenized property shares can be complex, especially with limited historical data. Inaccurate or opaque property valuations may expose investors to overpaying or unexpected losses.

-

Counterparty and Custodial Risks: Investors often rely on third-party custodians or platform operators for token management. Insolvency or mismanagement by these entities could jeopardize investor holdings.

-

Taxation and Reporting Complexity: Tax treatment of tokenized real estate varies and may require specialized reporting. Investors should be prepared for potential complications in calculating gains, losses, and income across jurisdictions.

Smart contracts, the backbone of these platforms, offer significant efficiencies but are only as secure as their codebase and audit process. Investors should seek platforms with transparent governance, regular code audits, and robust investor protections built into their smart contracts.

The Road Ahead: Expanding Access and Market Maturity

The momentum behind fractional home ownership is undeniable. As more properties are brought on-chain and regulatory standards mature, expect further reduction in entry barriers for small investors worldwide. The ability to invest as little as $50 in a curated portfolio of global properties was unthinkable just five years ago; today it is a reality shaping capital flows across continents.

This democratization is not just about access, it’s about flexibility and control. Small investors can now rebalance allocations or capture rental yields without waiting months for a sale to close or navigating opaque legal processes. Platforms like RealT (with $130 million in tokenized assets) exemplify how technology can unlock value at every level of the market.

If you want to explore how fractionalization is opening global markets to retail investors, and what this means for your portfolio, see our deep dive at this resource.

Frequently Asked Questions: Fractional Home Ownership via Tokenization

The convergence of blockchain technology, smart contracts, and global investor demand is catalyzing a new era for property investment. For data-driven investors seeking diversification beyond stocks and bonds, and willing to embrace innovation, fractional home ownership through property tokens offers strategic upside that simply didn’t exist before.