How to Invest in Fractional Real Estate Tokens: A Step-by-Step Guide for 2024

Fractional real estate tokens are fundamentally changing how investors access global property markets. By leveraging blockchain technology, these digital assets allow individuals to buy, sell, and trade fractional shares of high-value properties with unprecedented liquidity and transparency. In 2024, platforms like PropShare, ProperFi, OwnProp, Proptee, and Real Estate Rwas have brought minimum investment thresholds down to as little as $50, making real estate accessible to a broader demographic than ever before. Regulatory clarity in leading jurisdictions such as Dubai and the US has further legitimized this asset class, ensuring compliance and investor protection.

Step 1: Understand Real Estate Tokenization and Market Dynamics

Before making any investment, it’s crucial to grasp the fundamentals of real estate tokenization. This process involves converting ownership of physical properties into digital tokens on a blockchain, each representing a fractional share of the underlying asset. Tokens can be traded on secondary marketplaces, giving investors the ability to exit positions or rebalance portfolios far more easily than with traditional real estate. Market data from 2024 shows continued growth in tokenized property volumes, with increased participation from both retail and institutional investors. For a deeper dive into the mechanics, see this step-by-step guide.

Step 2: Choose a Reputable Tokenization Platform

Your choice of platform is a strategic decision that directly impacts asset security, liquidity, and user experience. Look for platforms with robust compliance protocols, transparent property listings, and a proven track record. Real Estate Rwas stands out by offering institutional-grade security, seamless user interfaces, and access to a diverse portfolio of global properties. Compare features such as transaction fees, supported payment methods (crypto and fiat), and the depth of secondary market liquidity before committing capital.

Step 3: Complete KYC/AML Verification and Set Up a Digital Wallet

Regulatory compliance is non-negotiable in today’s tokenized real estate landscape. After registering on your chosen platform, you’ll need to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) verification. This typically involves uploading government-issued identification and proof of address. Once verified, set up a digital wallet compatible with the platform, most support both custodial and non-custodial options for storing your property tokens securely. Wallet integration is critical for participating in primary sales and accessing secondary markets.

6 Essential Steps to Invest in Fractional Real Estate Tokens

-

Understand Real Estate Tokenization and Market Dynamics: Learn how blockchain technology enables fractional ownership by converting real estate assets into digital tokens. Stay updated on market trends, regulatory developments (such as those in Dubai and the United States), and the benefits of transparency, liquidity, and accessibility.

-

Choose a Reputable Tokenization Platform (e.g., Real Estate RWAs): Select a trusted platform like PropShare, ProperFi, OwnProp, or Proptee that offers secure, compliant, and transparent access to tokenized properties. Evaluate platform reputation, user experience, and regulatory adherence.

-

Complete KYC/AML Verification and Set Up a Digital Wallet: Register on your chosen platform and complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Set up a secure digital wallet (e.g., MetaMask or platform-integrated wallets) to safely store and manage your real estate tokens.

-

Research and Select Tokenized Properties Based on Due Diligence: Analyze available properties, reviewing details such as location, yield, legal documentation, and historical performance. Conduct thorough due diligence using platform-provided data and independent research to make informed investment choices.

-

Purchase Fractional Real Estate Tokens Using Supported Payment Methods: Invest in selected properties by purchasing tokens, often starting at minimums as low as $50. Use supported payment methods such as bank transfer, stablecoins, or credit card to complete your transaction securely.

-

Monitor, Trade, or Hold Tokens via the Platform’s Marketplace: Track your investments in real-time, receive rental income or dividends, and use the platform’s marketplace to trade or liquidate tokens as needed. Leverage analytics tools to optimize your real estate portfolio.

Step 4: Research and Select Tokenized Properties Based on Due Diligence

Not all tokenized properties are created equal. Conduct thorough due diligence on each asset, evaluate location, occupancy rates, yield history, sponsor reputation, and legal structure of the tokenization wrapper. Leading platforms provide detailed prospectuses, third-party valuations, and transparent documentation. Analytical tools and market data can help you compare expected returns across multiple properties, aligning your investment with your macroeconomic outlook and risk profile.

Stay tuned for the next steps, purchasing tokens and managing your digital portfolio, where we’ll walk through transaction mechanics, payment methods, and strategies for maximizing returns in this rapidly evolving sector.

Step 5: Purchase Fractional Real Estate Tokens Using Supported Payment Methods

Once you have identified a property that aligns with your investment strategy, the next step is to execute your purchase. Platforms like Real Estate Rwas and others enable you to buy fractional real estate tokens with a range of payment options, including major cryptocurrencies and fiat currencies. The minimum investment amount can be as low as $50, significantly lowering the barrier to entry compared to traditional real estate deals. Ensure that your digital wallet is funded and ready to transact. Review transaction fees, which can vary depending on blockchain network congestion and platform-specific policies. After confirming your purchase, tokens representing your fractional ownership will be deposited directly into your wallet, and you’ll gain access to associated income streams, such as rental yields or profit shares, depending on the property structure.

It’s important to note that token purchases are typically processed through smart contracts, ensuring transparency and reducing counterparty risk. Always double-check the property’s legal documentation and the smart contract address before finalizing your transaction. For a comprehensive walk-through of this process, you can reference this detailed guide.

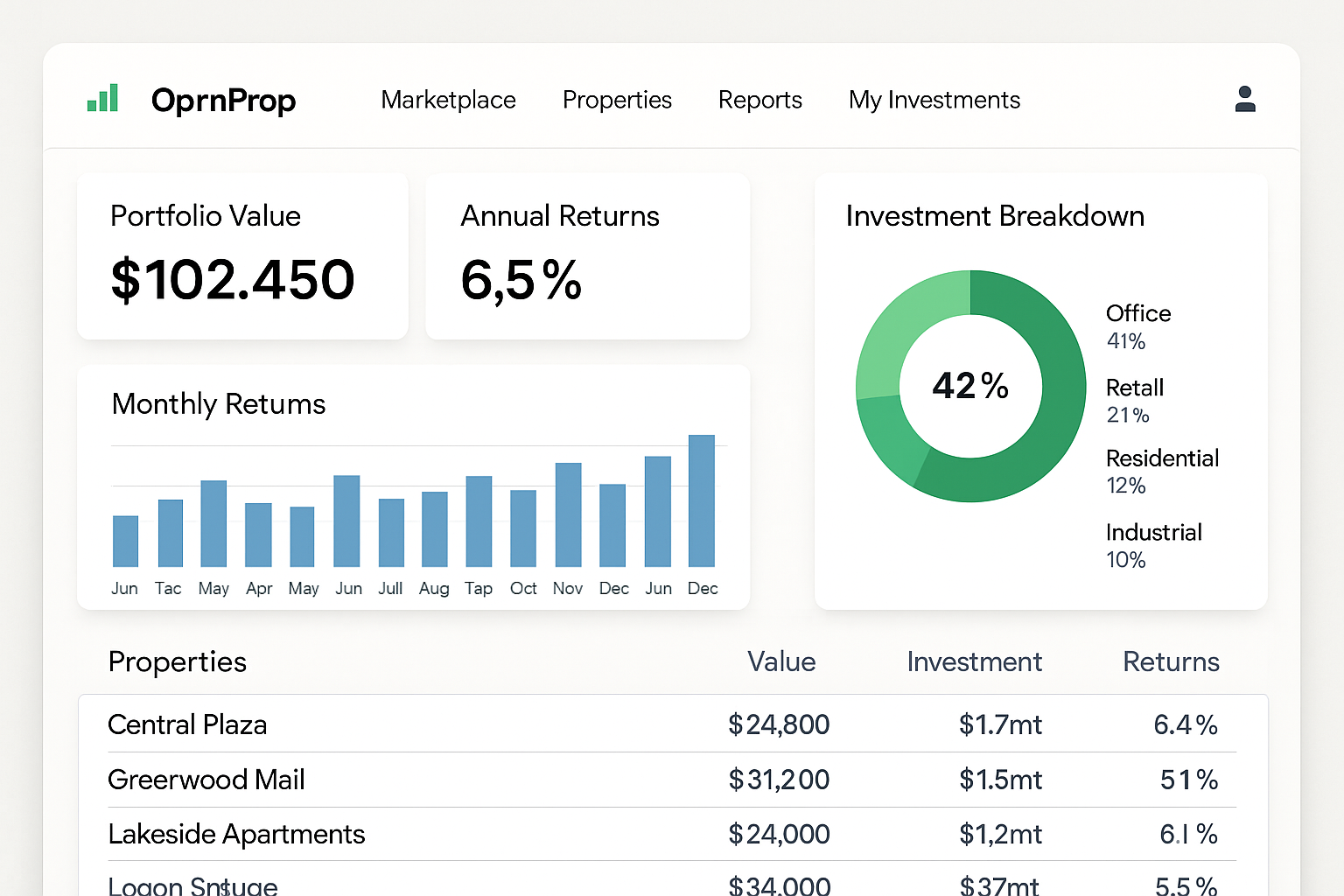

Step 6: Monitor, Trade, or Hold Tokens via the Platform’s Marketplace

After your purchase, active portfolio management becomes key. Real estate tokenization platforms provide dashboards where you can monitor the performance of your holdings, track rental distributions, and review updated asset valuations. If your investment thesis changes, or you wish to rebalance your portfolio, most platforms support secondary marketplaces where you can trade your tokens with other investors, often with much greater liquidity than traditional real estate.

Strategic investors leverage these marketplaces to capture capital gains, diversify across regions or property types, and respond dynamically to macroeconomic shifts. For those with a longer-term outlook, holding tokens can generate passive income and potential appreciation as the underlying property value increases. The transparency of blockchain ensures that all transactions and income distributions are fully auditable, further enhancing investor confidence.

Key Takeaways for 2024 and Beyond

- Accessibility: Enter the real estate market with as little as $50, thanks to fractional tokenization.

- Liquidity: Trade property-backed tokens easily via secondary marketplaces.

- Transparency and Security: Blockchain ensures auditable transactions and robust asset protection.

- Regulatory Clarity: Jurisdictions like Dubai and the US now provide clear legal frameworks for tokenized real estate.

Fractional real estate tokens are not only democratizing access to property investment but also setting new standards for liquidity and transparency. By following this step-by-step approach, from understanding tokenization fundamentals to actively managing your digital portfolio, you position yourself at the forefront of the next generation of real estate investing. For more insights on how tokenization is lowering barriers for global investors, explore this in-depth resource.