Tokenized Real Estate vs. Traditional REITs: Key Differences and Investment Benefits

Real estate investing has always been a cornerstone of wealth-building, but the landscape is rapidly evolving. Today, investors are faced with a new decision: tokenized real estate vs REITs. Both offer access to property markets, but they operate in fundamentally different ways and cater to distinct investor needs. Whether you’re a crypto enthusiast looking to diversify or a traditional investor exploring new horizons, understanding these differences can help you make smarter financial decisions.

Ownership: Indirect vs Direct Exposure

Let’s start with the basics. Traditional REITs (Real Estate Investment Trusts) let you buy shares in a company that owns and manages income-producing properties. When you invest in a REIT, you’re not buying the building itself, you’re buying into the company that owns it. This means your stake is indirect; your returns depend on the REIT’s overall performance and management decisions.

Tokenized real estate, on the other hand, leverages blockchain technology to divide individual properties into digital tokens. Each token represents fractional ownership of a specific asset, think of it as owning a slice of an apartment building or office tower. This model gives investors direct exposure to the underlying property, not just shares in a management company.

Liquidity and Trading Hours: 24/7 vs Market Hours

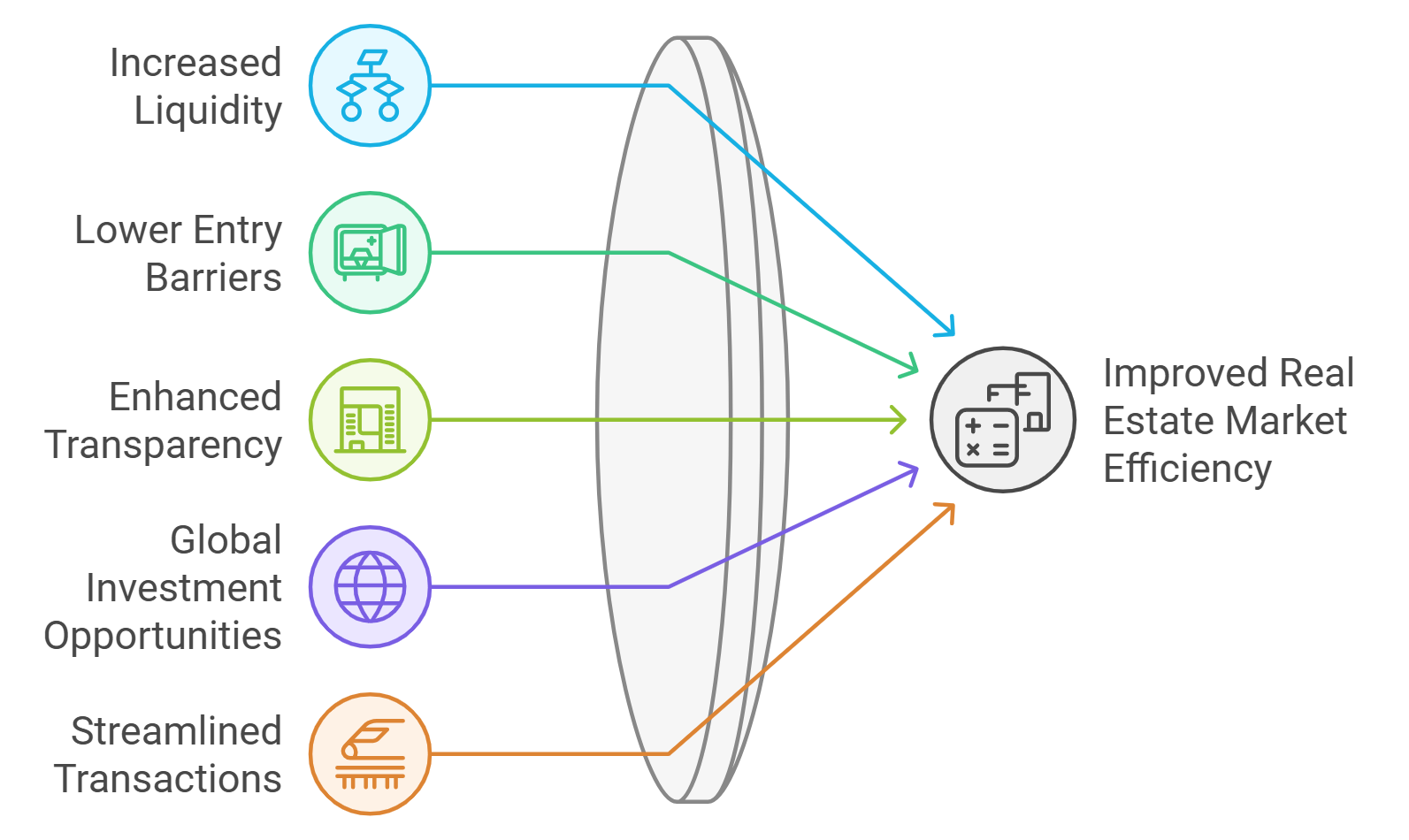

One of the most exciting developments in blockchain REIT comparison is liquidity. Publicly traded REITs offer reasonable liquidity since they’re listed on stock exchanges like NYSE or NASDAQ. You can buy or sell shares during market hours, but only when those markets are open, and often at prices influenced by broader stock market trends.

Tokenized real estate breaks down these barriers. Tokens trade on digital platforms around the clock, 24/7, enabling faster entry and exit for investors worldwide. Want out at midnight? No problem. Plus, since these tokens are fractionalized, you don’t need deep pockets to get started; even small amounts can buy you exposure to premium assets.

Top Benefits of Property Tokens Over Traditional REITs

-

Fractional Ownership & Lower Entry Barriers: Tokenized real estate allows investors to buy small fractions of individual properties, making real estate accessible to a broader audience. Unlike traditional REITs, which often require higher minimum investments, property tokens let you start with much less.

-

Direct Ownership of Real Assets: With property tokens, investors hold a direct stake in specific properties, not just shares in a company that owns real estate. This gives greater transparency and a closer connection to the underlying asset compared to the indirect ownership structure of REITs.

-

Enhanced Liquidity & 24/7 Trading: Tokenized real estate platforms enable trading of property tokens around the clock, unlike REITs which are limited to stock market hours. This means you can buy or sell your stake whenever you want, improving flexibility and access.

-

Greater Transparency & Security: Blockchain technology ensures all transactions and ownership records are transparent and immutable. This reduces the risk of fraud and gives investors real-time insight into their holdings, far beyond what most REITs offer.

-

Lower Fees Through Automation: Smart contracts automate many processes in tokenized real estate, reducing the need for intermediaries and cutting down on management and transaction fees. This can lead to more cost-effective investments compared to the often higher fees charged by traditional REITs.

-

Portfolio Customization & Control: Investors can choose exactly which properties to invest in and tailor their portfolios to match their risk and return preferences. In contrast, REIT investors are limited to the properties selected by the fund managers.

Accessibility: Lower Barriers for All Investors

If you’ve ever felt priced out of prime real estate markets, you’re not alone. Traditional REITs typically set higher minimum investments, making them less accessible for everyday investors hoping to diversify their portfolios.

Property tokens revolutionize accessibility. By enabling fractional ownership through tokenization, these platforms let users purchase small portions of high-value assets, sometimes for as little as the price of dinner out. This democratizes real estate investment and brings opportunities once reserved for institutional players into reach for everyone.

Current Market Data: How Are Traditional REITs Performing?

If you’re tracking performance closely, here are the latest prices for some major US-listed REIT ETFs as of September 19,2025:

- Vanguard Real Estate Index Fund ETF (VNQ): $92.19, down $0.06 (-0.07%)

- Schwab U. S. REIT ETF (SCHH): $21.505, down $0.015 (-0.07%)

- iShares U. S. Real Estate ETF (IYR): $96.61, down $0.07 (-0.07%)

- Real Estate Select Sector SPDR Fund (XLRE): $42.05, down $0.01 (-0.02%)

- SPDR DJ Wilshire REIT ETF (RWR): $100.37, down $0.04 (-0.04%)

This snapshot highlights how traditional vehicles remain stable but may miss out on some advantages that blockchain-based models now offer.

Transparency, Security, and Fees: Blockchain Advantages in Focus

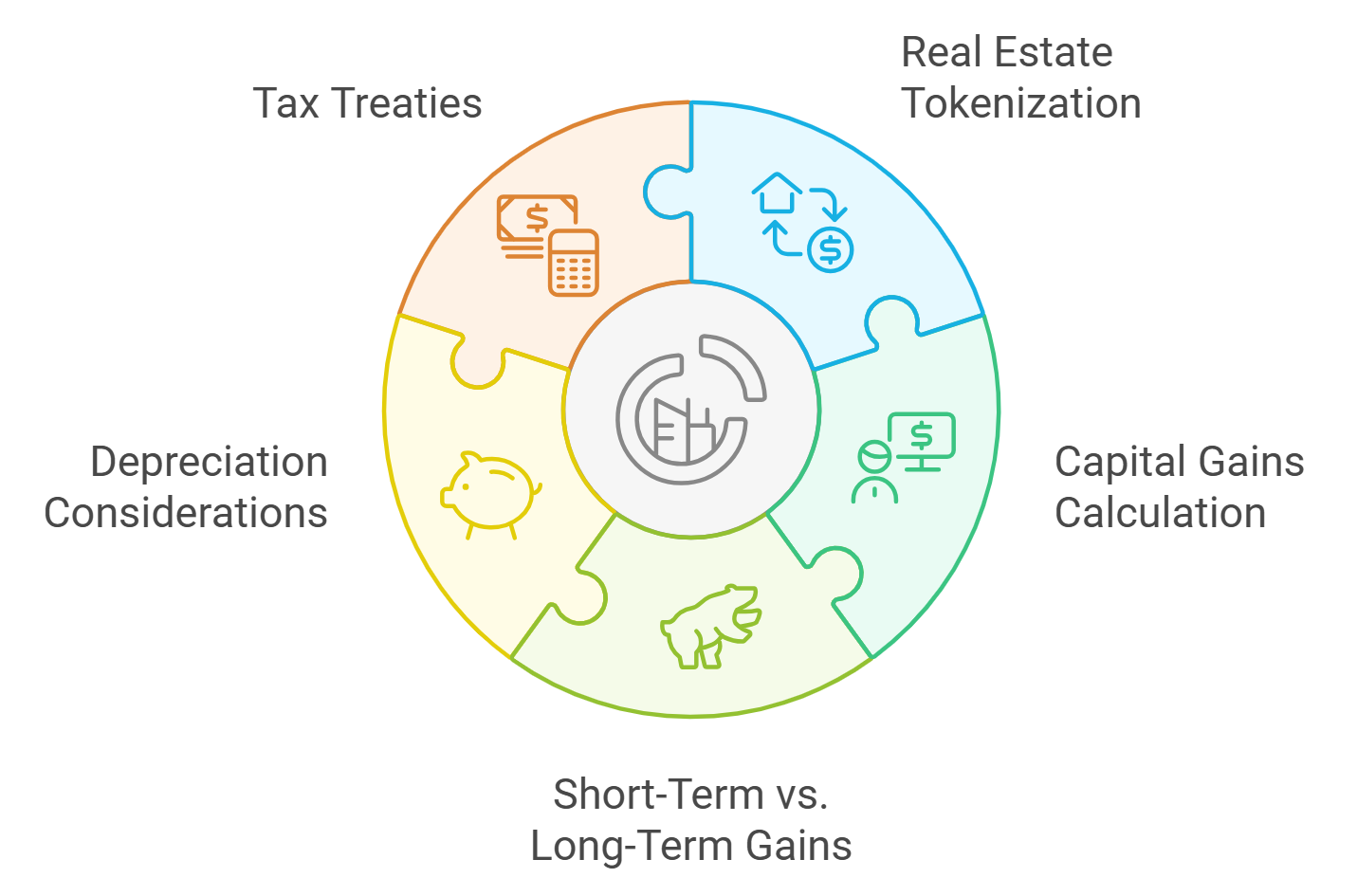

Transparency is a big differentiator in the tokenized real estate vs REITs debate. While REITs are regulated and must meet reporting standards, details about specific property holdings or management decisions can be opaque. Tokenized real estate flips the script: blockchain’s public ledger provides real-time visibility into every transaction and ownership record. This not only builds trust but also helps reduce fraud and error, giving investors a clearer picture of exactly what they own.

Security is another area where tokenization shines. Smart contracts automate processes like rent distribution and asset transfers, minimizing human error and reducing reliance on intermediaries. Plus, because transactions are recorded on an immutable blockchain, there’s an added layer of protection against tampering.

When it comes to fees, traditional REITs often carry layers of costs, management fees, acquisition charges, administrative overhead, that can quietly erode returns over time. Tokenized real estate platforms use smart contracts to automate many functions that would otherwise require costly middlemen. The result? Lower fees for investors and a more streamlined experience overall.

Control and Customization: Building Your Own Portfolio

If you’re someone who likes to call the shots, tokenization offers an appealing level of control. With REITs, you’re buying into a pre-selected bundle of properties managed by someone else, you have little say over what goes in or out of the portfolio. Tokenized platforms let you handpick specific properties or sectors that match your goals or risk appetite. Want exposure to Miami condos but not industrial warehouses? You can tailor your portfolio accordingly.

Regulatory Landscape: Navigating the New Frontier

The regulatory environment is perhaps the biggest wildcard for property tokens. Traditional REITs benefit from decades of legal clarity and investor protections baked into their structure. Tokenized real estate operates in an evolving space where rules can vary by jurisdiction, and sometimes change quickly as governments catch up with technology. Investors should do their due diligence on platform compliance and risk disclosures before diving in.

Which Model Suits You?Making Your Real Estate Investment Choice

Ultimately, your decision comes down to personal priorities, liquidity needs, appetite for direct ownership, desire for transparency or control, and comfort with emerging tech versus established regulation. If you value hands-off management with built-in diversification and regulatory stability, traditional REITs may fit the bill (with VNQ at $92.19, SCHH at $21.505, IYR at $96.61, XLRE at $42.05, and RWR at $100.37). On the other hand, if you want 24/7 trading access, granular customization, lower entry points, and are comfortable with some regulatory uncertainty, property tokens could be your ticket into a new era of global real estate investing.

The landscape will likely continue to evolve as more platforms embrace blockchain technology and regulators offer clearer guidance for digital assets. For now? Both options have merit, just make sure your choice matches your goals.