How Real-Time On-Chain Rental Data Is Revolutionizing Tokenized Real Estate (2025 Guide)

Imagine a world where every dollar of rental income from a property is tracked, verified, and distributed instantly, with full transparency. In 2025, this vision is no longer futuristic hype – it’s the new reality for tokenized real estate. Thanks to real-time on-chain rental data, investors can now access live insights into property performance and enjoy seamless income distributions that rival the speed and clarity of DeFi protocols.

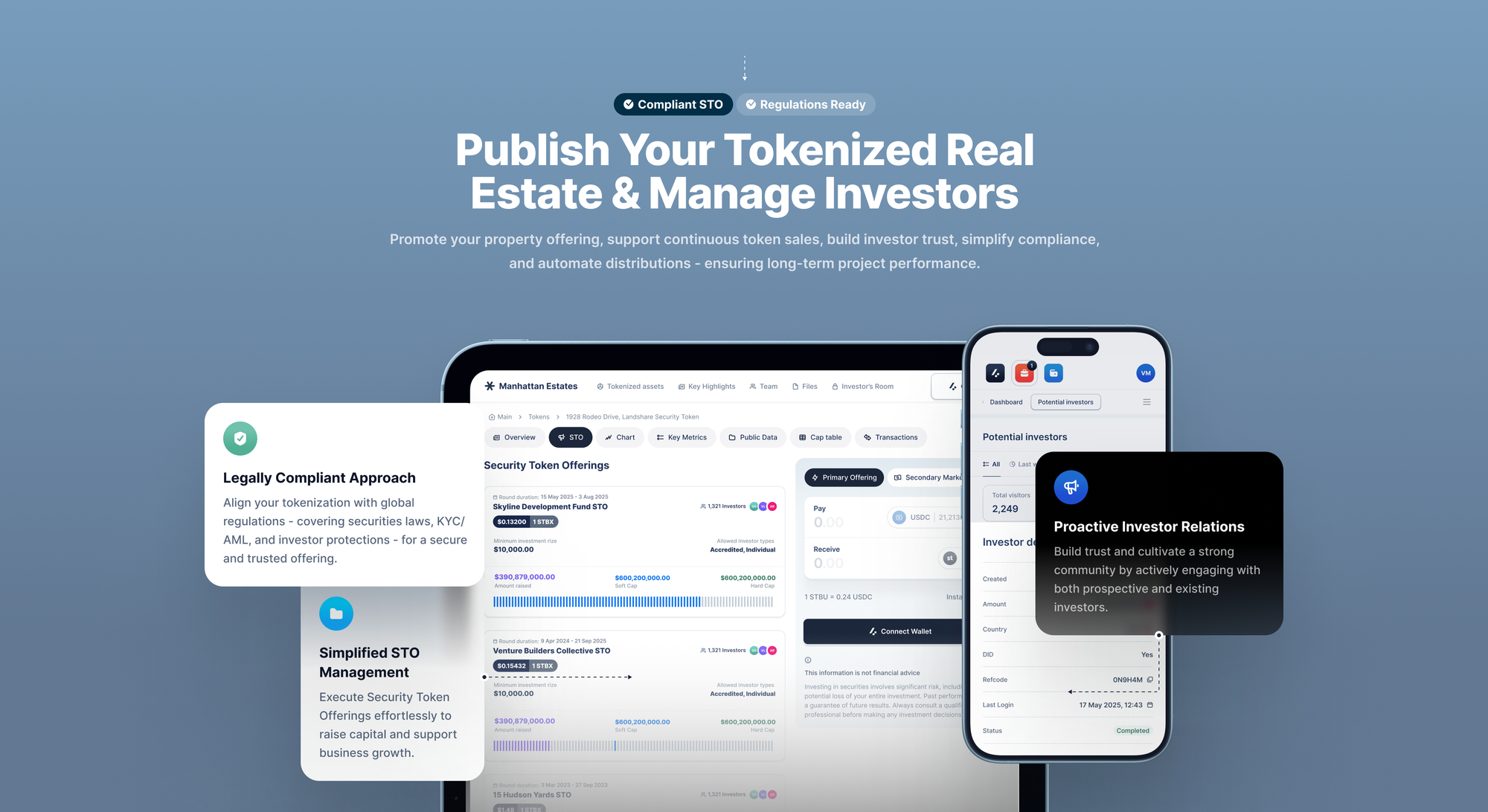

How Real-Time On-Chain Rental Data Works

Traditionally, rental payments are slow to process, opaque to track, and prone to errors or delays. With blockchain-powered platforms like Estate Protocol and RealT, those days are over. Every rent payment is recorded as an on-chain transaction – timestamped, immutable, and publicly verifiable. This means token holders receive their share of rental income directly, often in stablecoins like USDC or DAI, without waiting weeks for wire transfers or paper checks.

For example, Estate Protocol has tokenized over $7 million in real estate assets on Arbitrum. They’ve distributed rent in USDC for 13 straight months without missing a single payment – all tracked transparently on-chain. RealT has gone even bigger: over 700 U. S. properties worth more than $130 million are now fractionalized into digital tokens. Investors worldwide can buy in for as little as $50 and receive daily payouts based on their share of the property’s actual rental cash flow.

The Power of Instant Transparency

This leap forward isn’t just about speed or convenience – it’s about trust. On-chain rental data offers irrefutable proof that rent was paid (or not), when it was paid, and exactly how much each investor received. This level of transparency is impossible to achieve with legacy real estate systems where payments are buried in spreadsheets or siloed databases.

Platforms automatically record every transaction related to property management: rent collection, expense payments (think repairs or taxes), profit distributions – all visible to anyone with a blockchain explorer. This empowers investors to audit their returns in real time and holds property managers accountable like never before.

If you want a deeper dive into how this transparency makes tokenized real estate truly liquid, check out our detailed guide at How Real-Time On-Chain Rental Data Makes Tokenized Real Estate Truly Liquid in 2025.

Fractional Ownership Meets Automated Income

The combination of fractional ownership via tokenization and automated rent distribution is unlocking new opportunities for both retail and institutional investors:

- Low Minimums: Platforms like RealT let users start with just $50 per property token.

- Diversification: Investors can spread funds across dozens or hundreds of properties globally – something previously reserved for large funds.

- No Middlemen: Smart contracts handle the math and the money flow automatically; there’s no need for slow manual reconciliations.

- Global Access: Anyone with an internet connection can participate – opening up U. S. , European, or Middle Eastern markets to international buyers for the first time at scale.

This shift isn’t just theoretical; Dubai’s DAMAC Group recently partnered with MANTRA to tokenize at least $1 billion in assets across the Middle East. Deloitte forecasts that by 2035 the global market could reach $4 trillion as more institutions embrace these efficiencies.

What’s especially exciting is how real-time on-chain rental verification is eliminating the trust gap that has long plagued traditional real estate investing. With every rent payment and expense logged on an immutable ledger, investors no longer have to rely on quarterly reports or opaque management updates. Instead, they get a live, unfiltered window into their property’s performance, down to the last cent.

This radical transparency is driving new levels of confidence for both seasoned pros and first-time buyers. For many, tokenized real estate yields are no longer just theoretical projections, they’re verifiable, auditable streams of income that arrive automatically. And because everything is handled by smart contracts, there’s less room for human error or bad actors to interfere.

Automated Compliance and ESG Data: The Next Frontier

The benefits go beyond just rental payments. Modern tokenization platforms are now integrating automated compliance checks and even on-chain ESG (Environmental, Social, Governance) metrics. This means investors can monitor not just financial performance but also sustainability and ethical standards in real time, a growing priority for institutional capital.

For example, when a property upgrades its energy systems or completes a major renovation, these events can be recorded as blockchain transactions. Investors see instantly how such changes impact both rental income and the property’s ESG profile. This level of granularity was simply unattainable in legacy systems.

What Does This Mean for Investors?

The upshot? Tokenized real estate in 2025 isn’t just more accessible, it’s fundamentally more reliable and data-driven. Whether you’re diversifying with a handful of propertyNFTs or building a global portfolio across continents, you benefit from:

- Live income tracking: Know exactly when your next payment lands, and why.

- Instant liquidity: Trade your tokens on secondary markets with confidence that all historical data is accurate and up-to-date.

- Automated reporting: Download tax forms, yield statements, and compliance docs at the click of a button, no more chasing down paperwork.

- Global diversification: Access properties in multiple countries without worrying about local red tape or currency conversion headaches.

If you want to learn more about earning passive income from tokenized properties using these new tools, check out our practical guide: How to Earn Passive Rental Income from Tokenized Real Estate in 2025.

The bottom line: As we move toward $4 trillion in global market potential by 2035, platforms that harness real-time blockchain rental data will lead the way, delivering speed, trust, and opportunity at unprecedented scale. For forward-thinking investors ready to embrace this revolution, the future is already here, and it’s running on-chain.