A Step-by-Step Guide to Buying Your First Tokenized Property on Real Estate Rwas

Ready to make your first move into the world of tokenized real estate? You’re not alone. As of September 2025, the market value of tokenized real-world assets (RWAs) has soared past $25 billion, with platforms like Real Estate Rwas leading the charge to democratize property investment. If you’ve ever wished you could own a slice of prime real estate without the traditional hurdles, tokenization is your answer. Let’s break down exactly how you can buy your first tokenized property step by step, no jargon, just actionable guidance.

Why Tokenized Real Estate Is Changing the Investment Game

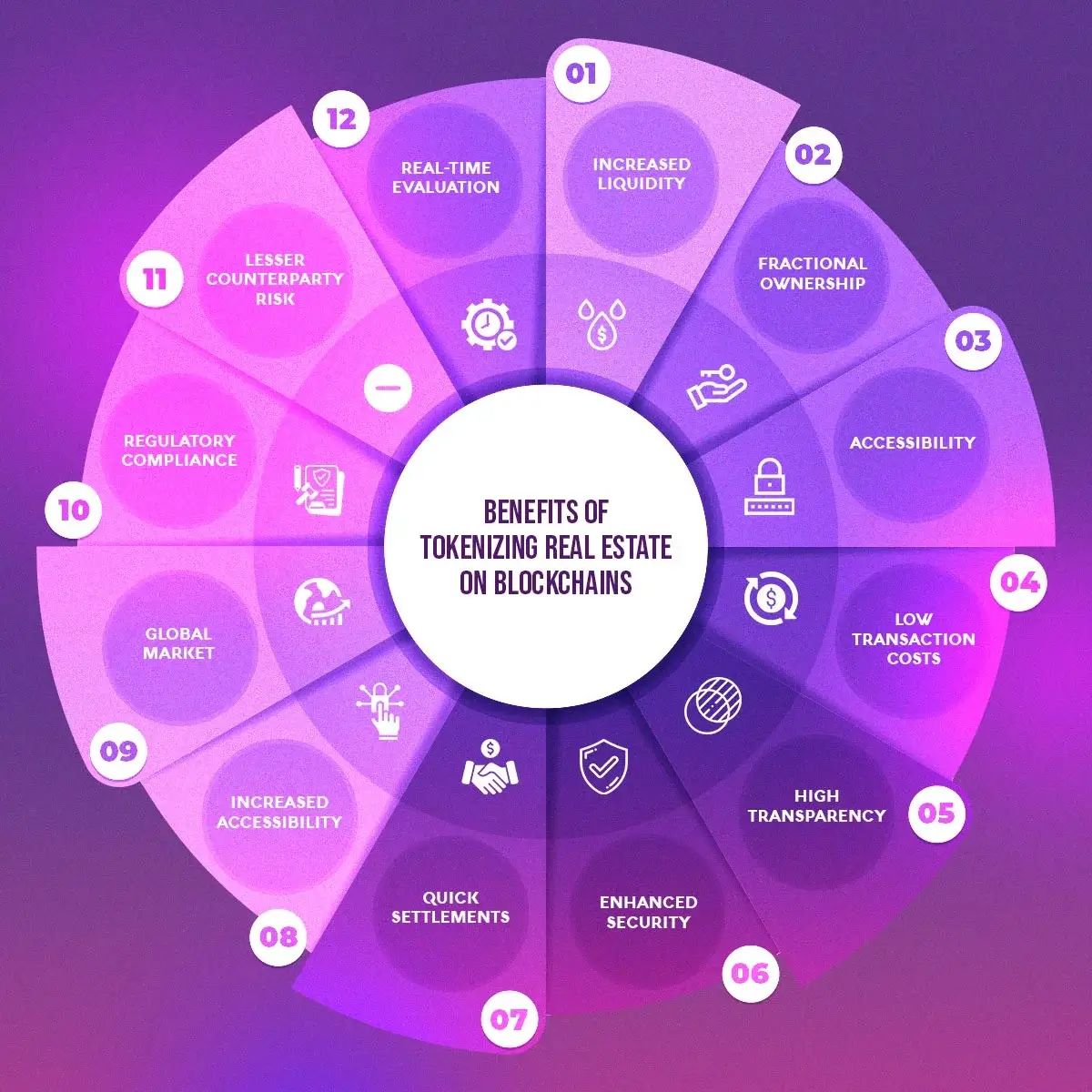

Traditional real estate investing has always had high barriers: large capital requirements, complex paperwork, and long holding periods. With tokenization, these barriers are crumbling. By converting property ownership or economic rights into digital tokens on a blockchain, you can now buy fractions of real estate, sometimes for as little as a few hundred dollars, and trade them with unprecedented speed and ease.

This isn’t just hype. According to Deloitte Insights and Investopedia, platforms like World Property Exchange and Securitize have shown that tokenized real estate can dramatically increase liquidity while reducing transaction friction. And with $25 billion in market value already in play, this trend is no longer just experimental, it’s mainstream.

Getting Started: What You Need Before You Buy

Before you jump in, let’s ensure you have everything set up for a seamless experience on Real Estate Rwas:

Essential Items Before Buying Tokenized Property

-

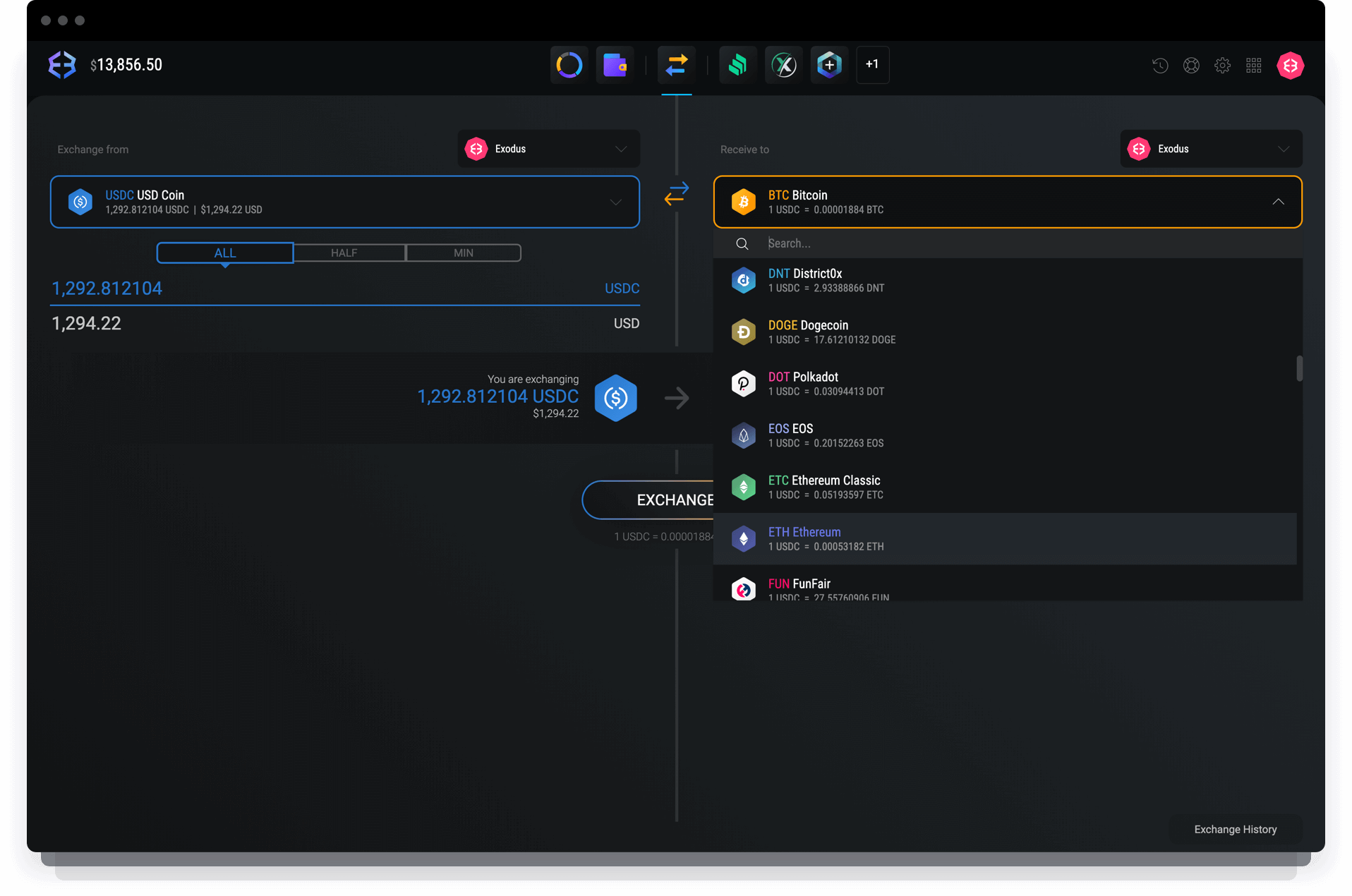

Crypto Wallet Setup: You’ll need a secure digital wallet compatible with real estate tokens. MetaMask and Coinbase Wallet are popular choices that support Ethereum and other major blockchains used by platforms like Estate Protocol and RealT.

-

KYC Verification: Most tokenized real estate platforms require you to complete Know Your Customer (KYC) checks. Be ready to provide a valid government-issued ID and proof of address to platforms such as RealT, Securitize, or Estate Protocol.

-

Funding Options: Ensure you have funds in your wallet. Many platforms accept stablecoins like USDC or USDT, and some accept direct bank transfers. Double-check which currencies are accepted on your chosen platform (e.g., Estate Protocol or Brickblock).

-

Platform Account Registration: Sign up on a reputable tokenized real estate platform such as Estate Protocol, RealT, or Brickblock. Registration typically involves email verification and linking your crypto wallet.

-

Understanding Token Standards: Real estate tokens are often issued as ERC-20 or ERC-1400 tokens on the Ethereum blockchain. Familiarize yourself with how these standards work and how to manage them in your wallet.

Pro tip: Take your time to research each property listing’s details, location, yield projections, holding period requirements, just like you would with any traditional real estate investment.

The Step-by-Step Property Token Purchase Process

Here’s where things get exciting. The process for buying your first tokenized property on Real Estate Rwas is refreshingly straightforward:

Your journey begins by browsing available properties on the platform. Each listing will display clear information about minimum investment amounts (often much lower than traditional deals), projected returns, and legal documentation, all secured transparently via blockchain.

“Tokenization has removed many barriers for investors around the globe, fractional ownership means anyone can now participate in premium markets. ”

Navigating Compliance and Security With Confidence

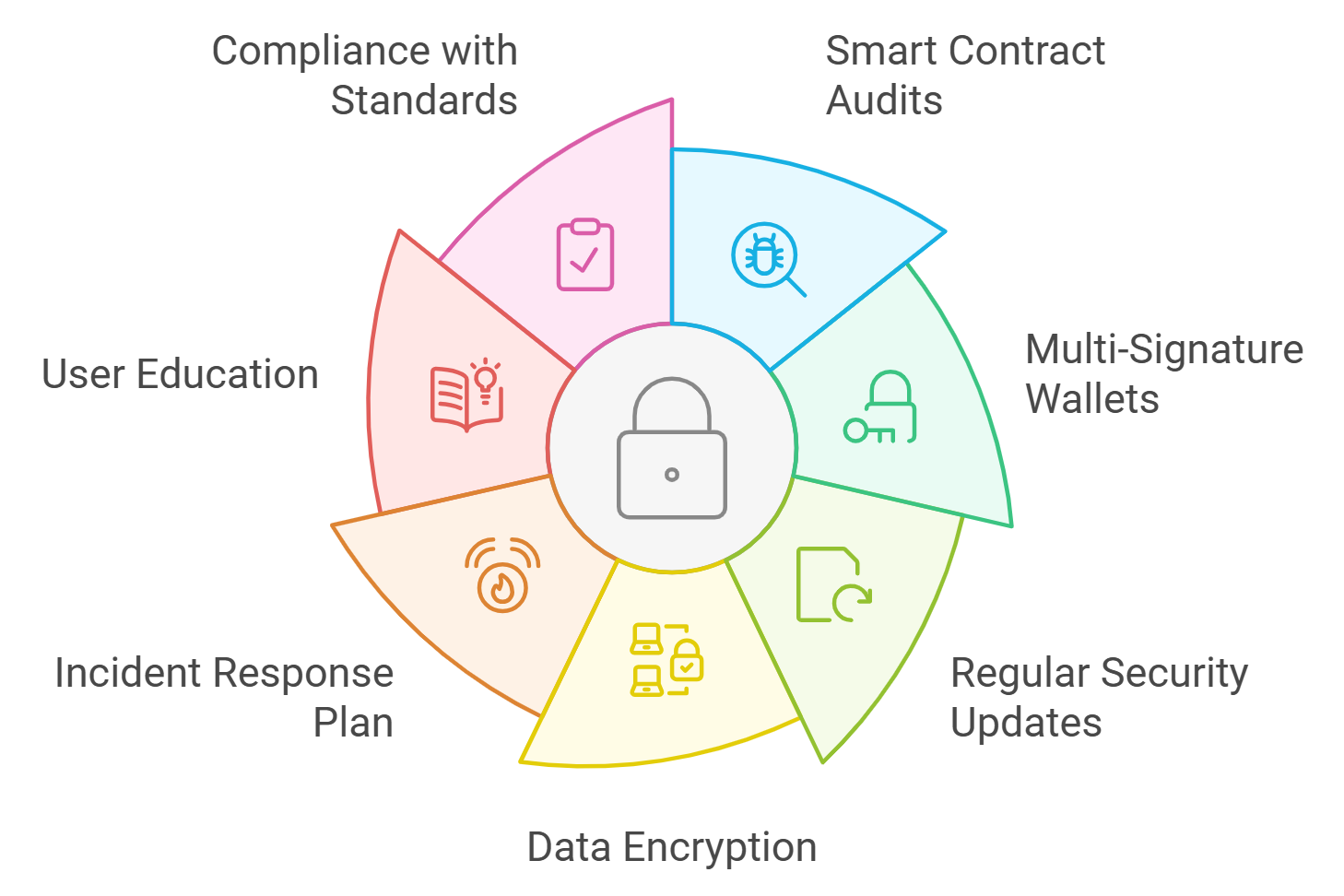

No matter how easy technology makes things, security and compliance are non-negotiable when it comes to real estate investment. The good news? Platforms like Real Estate Rwas integrate robust Know Your Customer (KYC) checks and anti-money laundering (AML) protocols directly into their onboarding process. This ensures all participants are verified and every transaction is traceable on-chain, giving you peace of mind as an investor.

If you’re new to crypto or digital wallets, don’t worry! The platform offers guided support at every stage, from setting up your wallet to safely storing your newly acquired tokens.

Once you’ve completed your KYC and funded your account, you’re ready to pull the trigger on your first property token purchase. The Real Estate Rwas platform will guide you through each step, from selecting the number of tokens (representing fractional shares of the property) to confirming your transaction. You’ll receive instant blockchain confirmation, and your tokens will appear in your secure wallet, no waiting weeks for paperwork to clear.

Maximizing Your Investment: Trading and Earning Potential

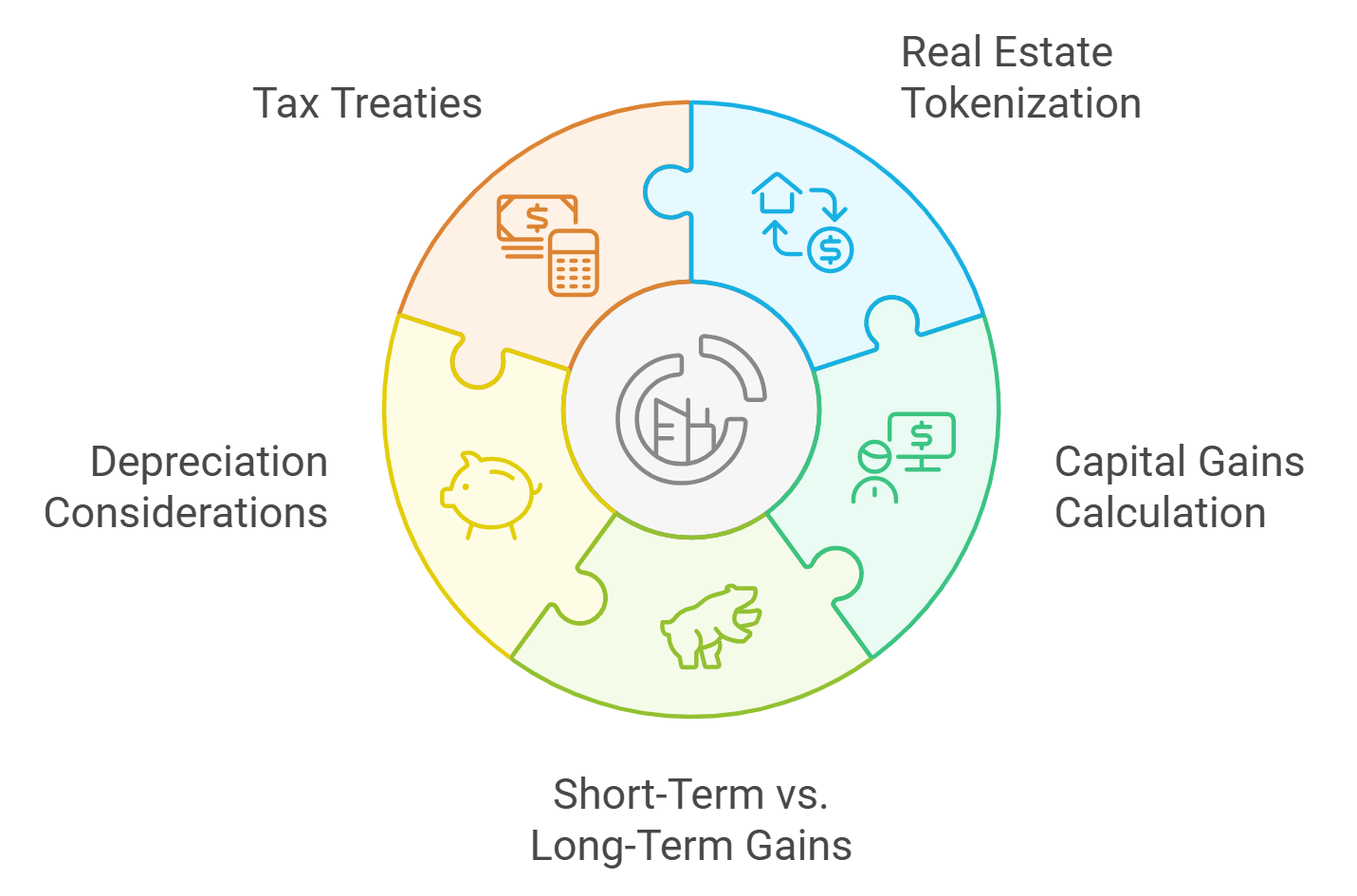

One of the biggest draws of tokenized real estate is liquidity. Unlike traditional real estate, where selling can take months, property tokens can often be traded on secondary markets after an initial holding period. This means if market conditions change or you want to rebalance your portfolio, you have options.

Depending on the property and platform structure, you may also receive rental income or dividends directly to your wallet, automatically and transparently. Returns are typically distributed in stablecoins or fiat equivalents, giving you flexibility in how you manage your earnings.

What Sets Real Estate Rwas Apart?

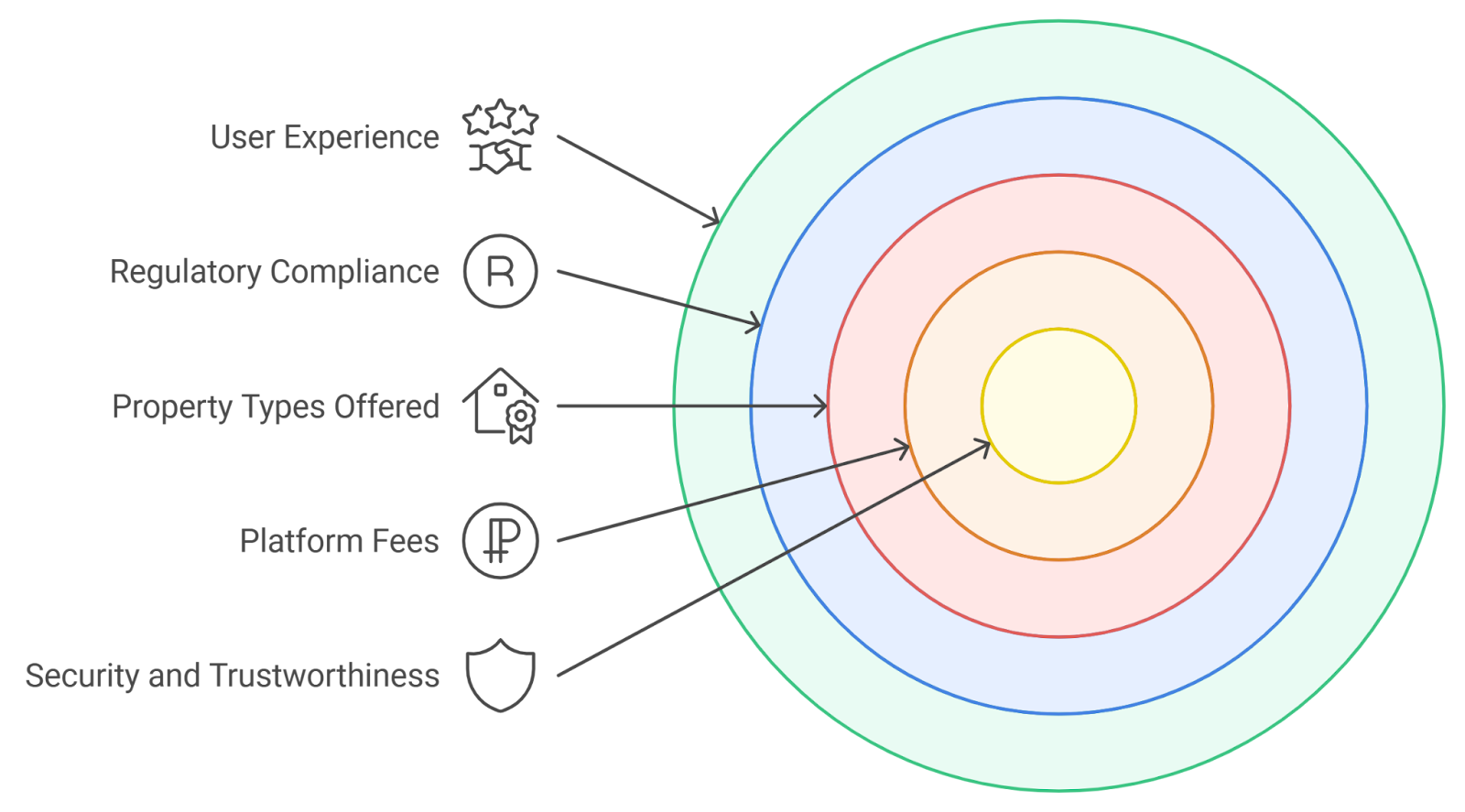

While several platforms have emerged in this space, like Estate Protocol and RealT (see how digital investment is evolving): Real Estate Rwas focuses on user experience, regulatory compliance, and global accessibility. Their intuitive dashboard lets you track performance metrics for each property token in real time. Plus, their marketplace offers a diverse range of assets: residential units in major metros, commercial spaces with strong lease agreements, even niche properties like student housing or logistics centers.

Comparison of Popular Tokenized Real Estate Properties (2025)

| Property Name | Location | Platform | Minimum Investment | Expected Yield (Annual) | Token Price |

|---|---|---|---|---|---|

| Miami Beach Condo | Miami, USA | RealT | $100 | 7.2% | $50 |

| London Office Suite | London, UK | Estate Protocol | $500 | 6.5% | $250 |

| Berlin Residential Block | Berlin, Germany | Brickblock | $200 | 6.8% | $100 |

| Dubai Marina Apartment | Dubai, UAE | Redswan | $300 | 7.0% | $150 |

| Tokyo City Loft | Tokyo, Japan | Tokenise | $250 | 6.1% | $120 |

The platform’s commitment to transparency means every transaction is recorded immutably on-chain. You can audit ownership structures and historical returns at any time, a level of clarity rarely seen in traditional real estate deals.

Tips for First-Time Tokenized Property Buyers

Dipping a toe into blockchain real estate buying doesn’t have to be intimidating. Here are some actionable tips to help smooth your journey:

Top Tips for First-Time Tokenized Property Investors

-

Research reputable tokenization platforms like Estate Protocol, RealT, and RedSwan. These platforms have a proven track record and offer secure, user-friendly experiences for new investors.

-

Understand the property’s legal structure before investing. Confirm that the property is legally tokenized and that your rights as a fractional owner are clearly defined in the smart contract and offering documents.

-

Check platform and property due diligence. Platforms like RealT and RedSwan provide detailed property reports, audits, and third-party verifications—always review these before committing funds.

-

Secure your digital wallet for storing tokens. Use trusted wallets compatible with your chosen platform, such as MetaMask or Coinbase Wallet, and enable two-factor authentication for extra security.

-

Review liquidity and trading options. Some platforms, like Estate Protocol, offer secondary marketplaces for token trading after an initial holding period, making it easier to buy or sell your investment.

-

Understand fees and tax implications. Each platform has its own fee structure (transaction, management, withdrawal), and tokenized property income may be subject to local taxes—consult with a financial advisor if needed.

-

Start with a small investment to get comfortable. Most platforms allow you to invest with as little as a few dollars, letting you learn the process with minimal risk.

And remember: diversification is just as important here as with any investment strategy. Consider spreading investments across multiple properties or locations to manage risk while maximizing opportunity.

Ready To Dive In?

The surge past $25 billion in tokenized RWA market value signals that this isn’t just a passing trend, it’s a foundational shift in how we access real estate opportunities globally. Whether you’re looking for yield, diversification, or simply want a taste of tomorrow’s investing landscape today, platforms like Real Estate Rwas make it possible.

As always, do your due diligence, but don’t let old-school barriers hold you back from exploring this dynamic frontier. The future of property investment is unfolding right now, and it’s more accessible than ever before.