How Blockchain is Revolutionizing Commercial Real Estate Tokenization in 2025

In 2025, blockchain technology is not just a buzzword in commercial real estate (CRE) circles, it’s the core driver behind a paradigm shift in how assets are owned, traded, and financed. The adoption of tokenization, powered by blockchain, is fundamentally altering market structures by enabling fractional CRE ownership, on-chain property trading, and unprecedented liquidity for investors worldwide. According to Deloitte and Cointelegraph projections, the global value of tokenized real estate is set to rocket from less than $300 billion in 2024 to more than $4 trillion by 2035. This growth trajectory underscores a dramatic transformation: commercial real estate tokenization is no longer experimental, it’s strategic infrastructure for the digital asset era.

Tokenization Use Cases Dominate Real-World Asset Markets

While blockchain tokenization is revolutionizing various sectors, including commodities, carbon credits, and luxury goods, real estate remains the flagship use case in 2025. Tokenized CRE platforms are now facilitating fractional investment in office towers, retail centers, logistics hubs, and even data centers. The Legend Siam project demonstrates that institutional-scale developments can raise capital efficiently via tokenized offerings. Meanwhile, new entrants and established players alike are racing to capture market share in this rapidly evolving space.

Recent initiatives highlight the global scope of this trend:

- United States: Blocksquare and Vera Capital’s $1 billion program allows investors to buy shares in CRE assets across seven states. Their inaugural property, a $5.4 million commercial complex in Florida, offers an expected 5% annual return through fractional tokens.

- Middle East: Dubai’s DAMAC Group inked a $1 billion deal with MANTRA to tokenize properties and data centers as part of Dubai’s push to become a digital asset hub.

- Asia-Pacific: Seazen Group’s Hong Kong institute aims to convert Chinese property assets into tradable digital tokens as a solution for sector-wide liquidity issues.

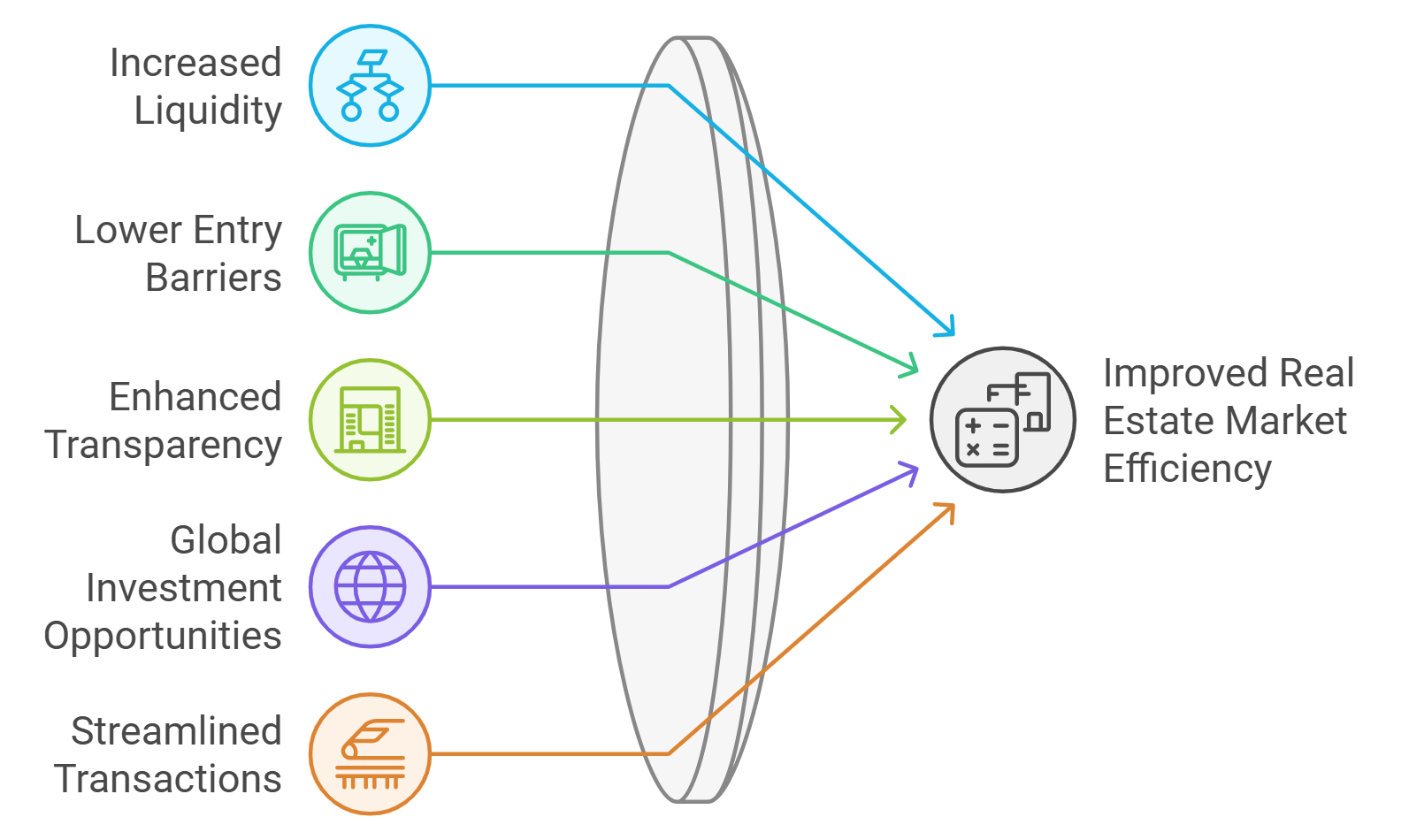

How Blockchain Unlocks Liquidity and Access

The most disruptive advantage of blockchain real estate tokenization lies in its ability to unlock liquidity for traditionally illiquid assets. Tokenization converts legal ownership rights into standardized digital tokens that can be bought or sold on secondary markets within minutes, not months. This enables both institutional funds and retail investors to diversify portfolios with exposure to high-quality CRE without the need for large minimum investments or lengthy holding periods.

Fractional ownership, powered by smart contracts on public blockchains, lowers entry barriers dramatically. Investors can purchase tokens representing small percentages of trophy assets or diversified portfolios, democratizing access once reserved for ultra-high-net-worth individuals or multinational funds. As regulatory frameworks mature and interoperability between platforms improves, cross-border participation is accelerating as well.

The Transparency and Security Revolution in CRE Transactions

The immutable nature of blockchain records brings another crucial benefit: end-to-end transparency. Every transaction, from initial offering through secondary trades, is logged on-chain with full audit trails accessible to all stakeholders. This not only enhances investor trust but also streamlines compliance with global standards such as KYC/AML protocols.

The result? Lower administrative costs (as evidenced by BlocHome’s reported 90% reduction in onboarding time), faster settlements, and reduced risk of fraud or double-spending, a leap forward compared to legacy paper-based processes still prevalent across much of the industry.

To explore further how these innovations are breaking down traditional barriers for small investors, see our guide on democratizing access through tokenized real estate.

Despite these advances, the ecosystem for on-chain commercial real estate is still maturing. Liquidity, while improved, remains a challenge. Many tokenized assets experience low trading volumes and limited secondary market depth, particularly for properties outside major metropolitan centers or marquee developments. This points to an urgent need for robust market infrastructure and active market-makers to ensure that fractional CRE ownership truly delivers on its liquidity promise.

Regulatory clarity is also in flux. Jurisdictions like Dubai and Hong Kong are moving quickly to establish frameworks that foster innovation while protecting investors, but global harmonization is far from complete. As tokenized property trading becomes more mainstream, expect regulators in the United States, EU, and APAC to roll out new guidelines around investor accreditation, tax treatment, and cross-border transactions. The platforms that thrive will be those that invest heavily in compliance automation and transparent governance models.

What’s Next: Interoperability and Institutional Adoption

The next phase of blockchain real estate 2025 will be defined by interoperability between tokenization platforms and deeper institutional participation. Already, we’re seeing integrations with blockchain protocols like Stellar aimed at seamless asset transfers across networks. As these technical rails mature, investors will be able to move capital between different property tokens or even other real-world assets (RWAs) such as commodities or carbon credits with minimal friction.

Institutional capital is increasingly flowing into tokenized CRE deals as large asset managers recognize the efficiency gains of blockchain settlement and automated compliance checks. The $1 billion programs launched by Blocksquare/Vera Capital and DAMAC/MANTRA are just the beginning; expect pension funds, sovereign wealth funds, and global REITs to follow suit as regulatory guardrails solidify.

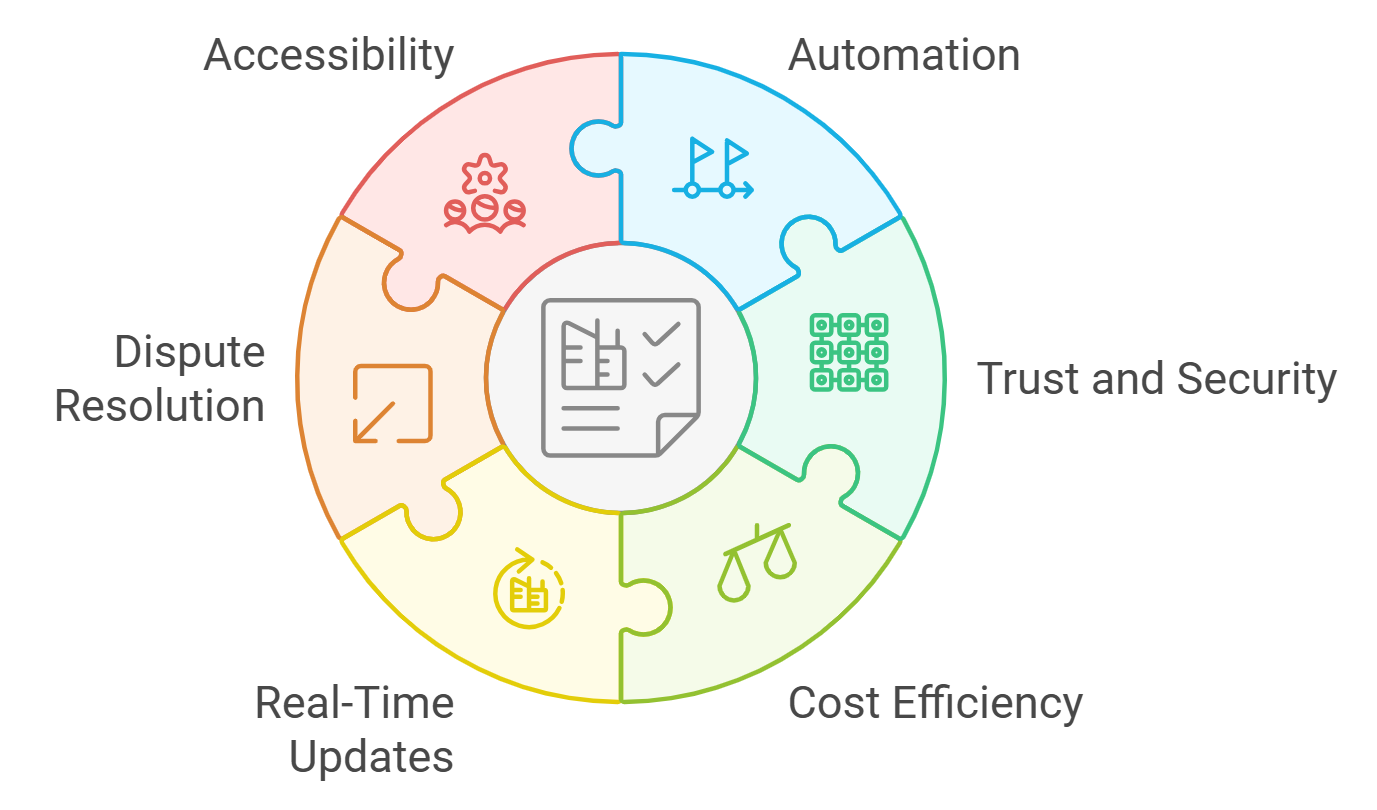

Key Benefits of CRE Tokenization in 2025

-

Enhanced Liquidity: Tokenization enables commercial real estate shares to be traded on secondary markets, providing investors with liquidity that traditional property investments often lack. This advancement is exemplified by platforms like Blocksquare and Tokeny, which facilitate faster and more flexible transactions.

-

Fractional Ownership & Lower Barriers: Investors can purchase fractionalized shares in high-value properties, democratizing access to commercial real estate and lowering minimum investment requirements. Notable 2025 initiatives include Blocksquare & Vera Capital‘s $1 billion U.S. CRE tokenization project and DAMAC Group’s partnership with MANTRA in Dubai.

-

Increased Transparency & Security: Blockchain’s immutable records create full audit trails for transactions, enhancing trust, regulatory compliance, and reducing fraud. Platforms such as Tokeny and Stobox are leading in providing transparent tokenized real estate solutions.

-

Global Market Access: Tokenization allows investors worldwide to participate in commercial real estate markets, overcoming traditional geographic and regulatory barriers. The Seazen Group in Hong Kong and DAMAC Group in Dubai exemplify this global reach in 2025.

-

Operational Efficiency & Cost Reduction: Smart contracts and blockchain automation streamline processes such as onboarding, compliance, and settlement. Case studies like BlocHome demonstrate up to 90% savings in onboarding time and costs through tokenization.

The broader impact is a more dynamic, transparent, and accessible global property market, one where investors from any geography can instantly allocate capital to diversified portfolios of income-generating assets. This shift is not only transforming investment strategy but also how developers approach project financing and lifecycle management.

How Investors Can Participate Today

For forward-thinking investors eager to participate in this revolution, due diligence remains paramount. Evaluate platform security protocols, smart contract audit histories, asset provenance procedures, and secondary market liquidity before committing capital. Platforms like Real Estate Rwas are at the forefront of making these metrics transparent for both retail and institutional participants.

If you’re interested in step-by-step guidance on entering this space, including wallet setup, KYC onboarding, and navigating your first token purchase, see this detailed walkthrough from TokenREITs: Step-by-Step Guide to Tokenizing Commercial Real Estate Assets.

The future of commercial real estate investment is unequivocally on-chain. As technical standards coalesce around interoperability and regulatory certainty increases across key jurisdictions, expect tokenized property trading to become a core allocation within diversified portfolios worldwide.