How Fractional Real Estate Tokenization Opens Global Investment for Less Than $150

Imagine owning a piece of a Miami beachfront condo or a share in a bustling Chicago rental property for less than $150. Thanks to fractional real estate tokenization, this is no longer a distant dream but a rapidly growing reality. By leveraging blockchain technology, platforms now allow investors worldwide to buy digital property shares with minimal upfront capital, often starting as low as $50. This seismic shift is democratizing real estate investing, opening doors previously reserved for high-net-worth individuals and institutional players.

How Fractional Tokenization Works: Turning Buildings into Digital Shares

At its core, fractional real estate tokenization involves converting ownership of a physical property into a series of digital tokens on a blockchain. Each token represents a fraction of the underlying asset, granting holders rights to rental income and potential appreciation. Instead of needing $100,000 or more for a down payment, you can now invest in property tokens for as little as $50 to $150, depending on the platform.

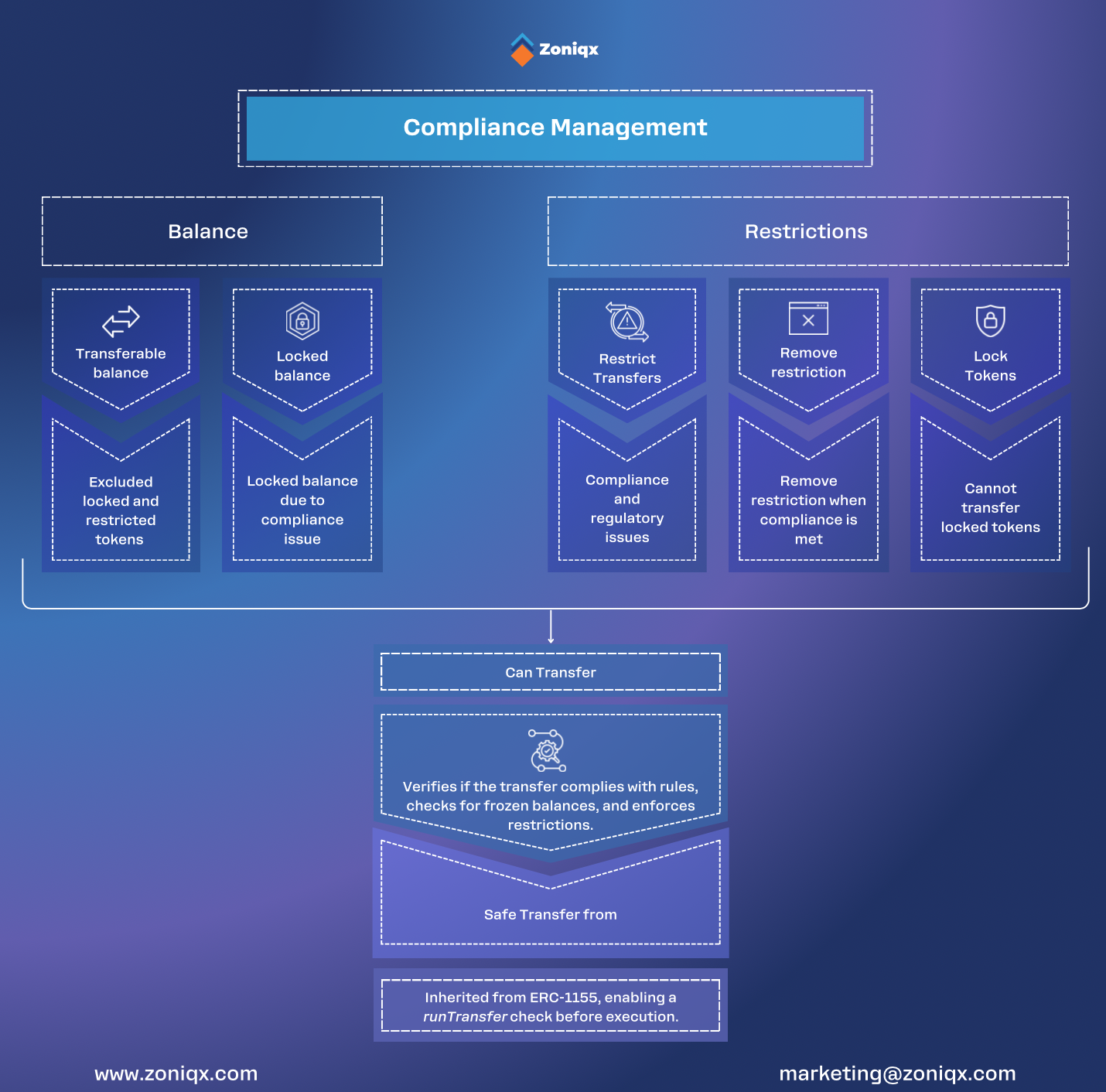

This process is powered by smart contracts that automate dividend payouts and facilitate peer-to-peer trading on secondary markets. The result? Enhanced liquidity and transparency, with every transaction recorded immutably on-chain. Platforms like RealT and Lofty AI have pioneered this model, offering global access to U. S. rental properties with minimum investments starting at $50.

The $50-$150 Revolution: Real Prices, Real Access

The most transformative aspect of this trend is the drastic reduction in entry barriers. In 2025, leading platforms are holding true to their promises:

- RealT: U. S. residential properties with minimums around $50

- Lofty AI: Income-generating property tokens from $50

- Libertum’s B-DEX: Decentralized exchange for real-world assets, minimum investment $100

This means that for the price of a dinner out, nearly anyone can start building a global real estate portfolio. For example, Dubai’s Land Department has enabled fractional purchases of Dubai properties with minimums near $540, but the U. S. market is seeing true micro-investment at the $50-$150 range. This price consistency is critical: these are not promotional rates or temporary discounts but the new standard for blockchain real estate investment entry points.

Top 5 Tokenized Real Estate Platforms Under $150

-

RealT: Specializes in tokenizing U.S. residential properties, allowing global investors to buy fractional shares starting at $50. Investors receive daily rental income directly to their wallets.

-

Lofty AI: Enables fractional ownership of income-generating properties across the U.S. with a minimum investment of $50. Investors benefit from daily rental payouts and a user-friendly marketplace.

-

Arrived: Offers pre-vetted single-family rental and vacation properties for fractional investment. Minimums start at $100, making it accessible for new investors seeking U.S. real estate exposure.

-

Libertum’s B-DEX: A decentralized exchange for real-world assets, including tokenized real estate. Investors can participate with as little as $100 and stake tokens to earn yield from real-world income.

-

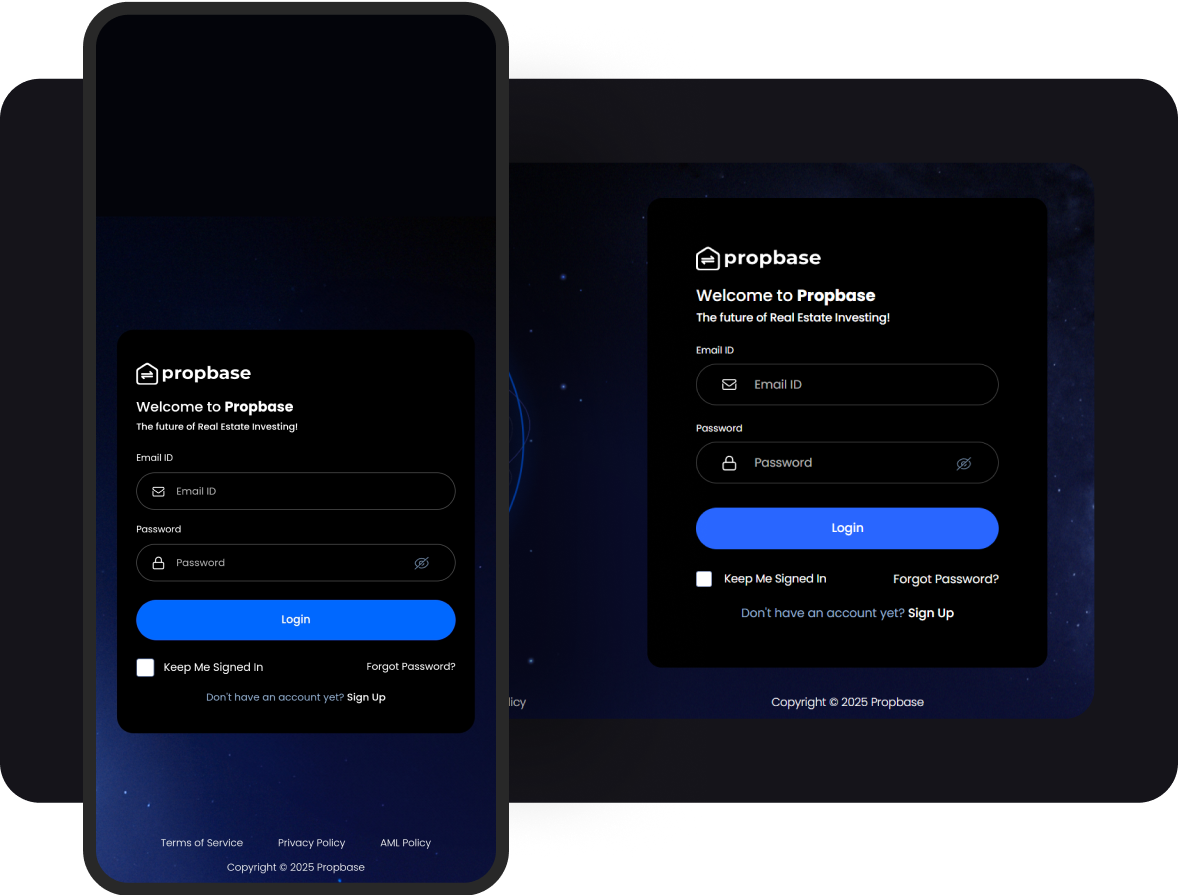

Propbase: Utilizes blockchain to tokenize real estate assets, allowing users to buy shares in high-value properties. Minimum investments typically start around $100, with a global property selection.

The Globalization of Property Investing, No Borders, No Banks

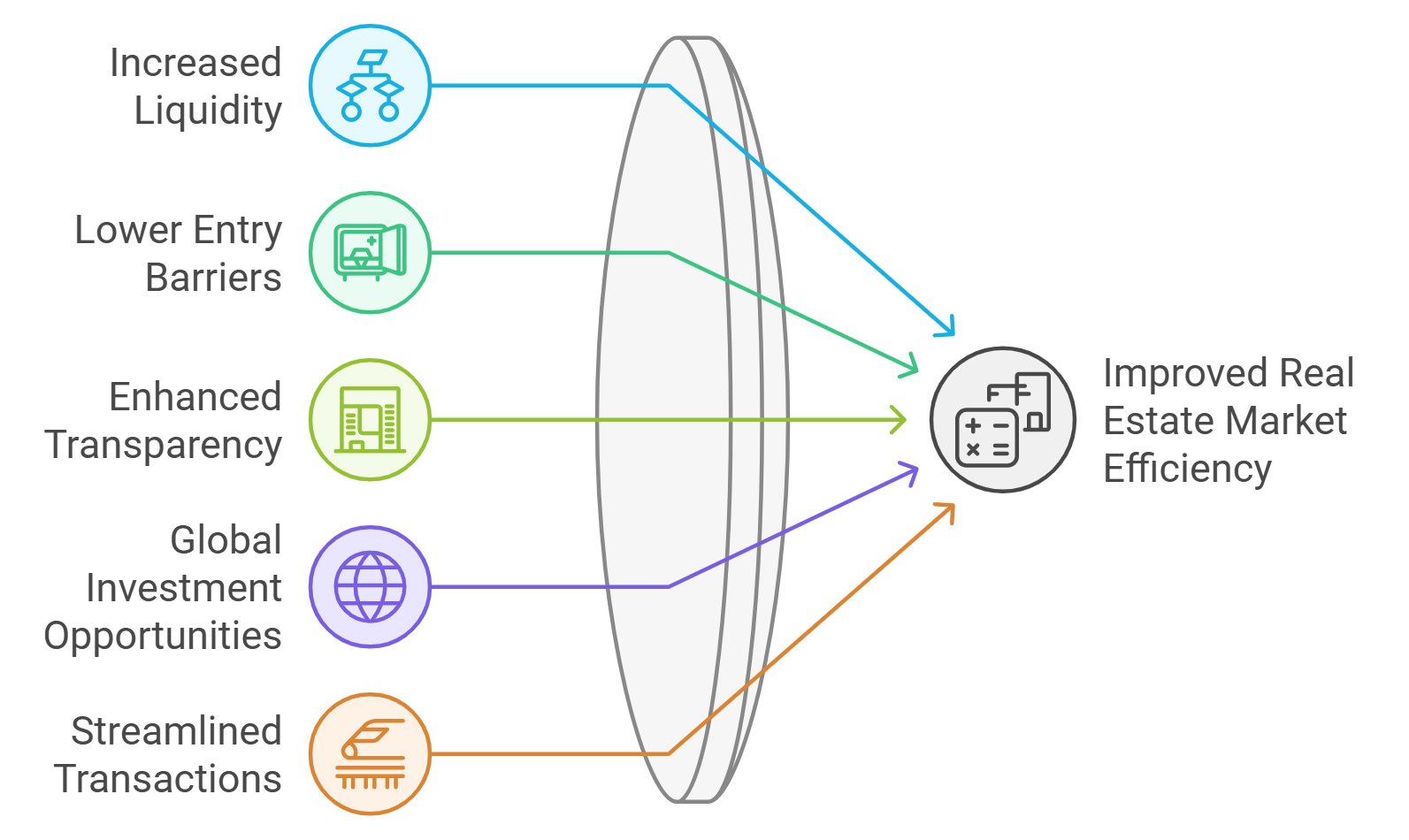

The impact of fractional tokenization goes far beyond affordability. For the first time, investors in Asia, Africa, or South America can own pieces of prime U. S. or European real estate without navigating complex legal and banking hurdles. Blockchain-based platforms handle cross-border compliance and KYC processes digitally, making it possible to buy real estate tokens online from virtually anywhere.

This global reach is supported by a rapidly expanding market. As of 2025, the total value of tokenized real estate assets sits between $10 billion and $15 billion, with projections pointing to exponential growth in the next few years. The ability to diversify across continents and asset classes, residential, commercial, hospitality, was once the domain of institutional funds. Now, the average investor can achieve this with a few clicks and less than $150.

While the headlines highlight accessibility, it’s the liquidity and transparency that truly differentiate blockchain real estate investment from legacy models. Traditional property stakes are notoriously illiquid, often locking up capital for years. By contrast, tokenized shares can be traded on secondary markets, sometimes instantly, allowing investors to adjust their portfolio or exit positions with unprecedented speed. This flexibility is especially valuable during market volatility or when personal circumstances change.

Transparency is another cornerstone. Every transaction, from initial purchase to rental income distribution, is recorded on-chain. Investors can independently verify property performance and ownership records without relying solely on platform operators or opaque fund managers. This level of openness fosters trust and aligns incentives between asset managers and token holders.

Navigating Risks and Regulatory Realities

No investment innovation comes without challenges. Regulatory frameworks for fractional real estate tokenization remain a work in progress across jurisdictions. While platforms like RealT and Lofty AI have implemented robust KYC/AML protocols and comply with U. S. securities regulations, international investors must still consider local laws and potential restrictions on cross-border ownership.

There’s also the question of platform risk: choosing a reputable provider with a track record of secure asset custody and transparent governance is essential. As with any emerging sector, due diligence remains paramount. Prospective investors should carefully review whitepapers, legal documentation, and the underlying property assets before committing capital.

Essential Due Diligence Steps Before Investing in Tokenized Real Estate

-

Verify Platform Legitimacy and Regulation: Ensure the fractional real estate platform—such as RealT, Lofty AI, or Libertum’s B-DEX—is reputable, operates transparently, and complies with relevant local and international regulations. Look for licensing, audits, and clear legal frameworks.

-

Assess Underlying Property Details: Review the specific property’s location, type, valuation, and income history. Platforms like Lofty AI and RealT provide detailed documentation, including property appraisals, rental agreements, and historical returns.

-

Understand Token Structure and Rights: Examine what rights each token confers—such as ownership, profit-sharing, or governance. Check if tokens grant access to rental income, voting on property management, or only represent economic interest.

-

Evaluate Liquidity and Exit Options: Investigate whether tokens can be traded on secondary markets or decentralized exchanges like Libertum’s B-DEX. Confirm any lock-up periods, withdrawal fees, and the platform’s track record for facilitating timely exits.

-

Review Fees and Cost Structure: Analyze all associated fees, including platform charges, transaction fees, management costs, and any blockchain-related expenses. Platforms such as Arrived and RealT disclose their fee structures transparently.

-

Check Rental Income Distribution and Reporting: Ensure the platform provides regular, transparent reporting on rental income and distributions. For example, Lofty AI and RealT offer daily or periodic payouts and detailed dashboards for investors.

-

Investigate Security and Asset Custody: Confirm how digital tokens and underlying assets are secured. Look for platforms employing robust smart contract audits, secure wallet integrations, and clear custody solutions for both digital and physical assets.

-

Research Secondary Market and Platform Reputation: Seek out independent reviews, user testimonials, and third-party audits. Platforms like RealT and Lofty AI are frequently covered in industry reports and media, which can provide additional assurance.

Despite these considerations, the trend is unmistakable: fractional tokenization is lowering the entry barrier for global real estate investing. The ability to start with as little as $50 to $150 is not a passing fad but a structural shift that is likely to persist as technology and regulation mature in tandem.

What’s Next: The Road Ahead for Global Investors

Looking forward, expect to see more asset classes and geographies join the tokenized ecosystem. Commercial properties, hotels, and even infrastructure projects are being explored as candidates for fractional ownership via blockchain. As liquidity pools deepen and regulatory clarity improves, tokenized real estate could rival traditional REITs in both accessibility and performance.

For those considering entry into this market, now is an opportune moment to learn the mechanics and evaluate platforms that align with your risk appetite and investment goals. The fusion of blockchain technology with tangible assets like real estate creates a compelling proposition for diversification and passive income generation on a global scale.

Transparency and diligence drive sound investments. As always, understanding the mechanics behind tokenized ownership and the platforms you engage with will set you apart in this rapidly evolving landscape.

To explore further how fractional tokenization is reshaping access to global property markets for small investors, see this in-depth guide.