How Fractional Real Estate Ownership via Blockchain is Opening Global Property Investment to Everyone

Imagine owning a slice of a Manhattan skyscraper or a beachfront villa in Bali – not as a billionaire, but as an everyday investor with just $50 or $100 to spare. Thanks to fractional real estate ownership via blockchain, this vision is becoming reality for people around the globe. Tokenization is transforming how we think about property investment, making it more accessible, transparent, and liquid than ever before.

Breaking Down Barriers: How Blockchain Democratizes Property Investment

Traditional real estate has always been an exclusive club. High minimum investments, complex paperwork, and geographic limitations kept most would-be investors on the sidelines. But now, blockchain-powered platforms are shattering those barriers. By converting property ownership into digital tokens recorded on-chain, anyone can buy fractional shares in real estate assets from anywhere in the world.

For example, platforms like RealT and Lofty. ai allow users to buy real estate tokens representing fractional ownership for as little as $50 per token. Homebase lets you start with just $100. This is a seismic shift from the six-figure down payments required for direct property purchases. Suddenly, global property investment isn’t just for institutions or the ultra-wealthy – it’s open to students, freelancers, and anyone seeking passive income or portfolio diversification.

The Power of Liquidity: Trading Property Tokens Like Stocks

One of the most exciting aspects of blockchain real estate investment is liquidity. In the past, selling a piece of property could take months (or longer), locking up your capital and limiting flexibility. With tokenized assets, you can trade your shares on secondary markets in minutes – similar to stocks or crypto coins.

This new liquidity means investors can respond faster to market changes or personal cash needs. It also enables innovative strategies like swing trading property tokens or earning stablecoin yield from rental distributions paid directly through smart contracts.

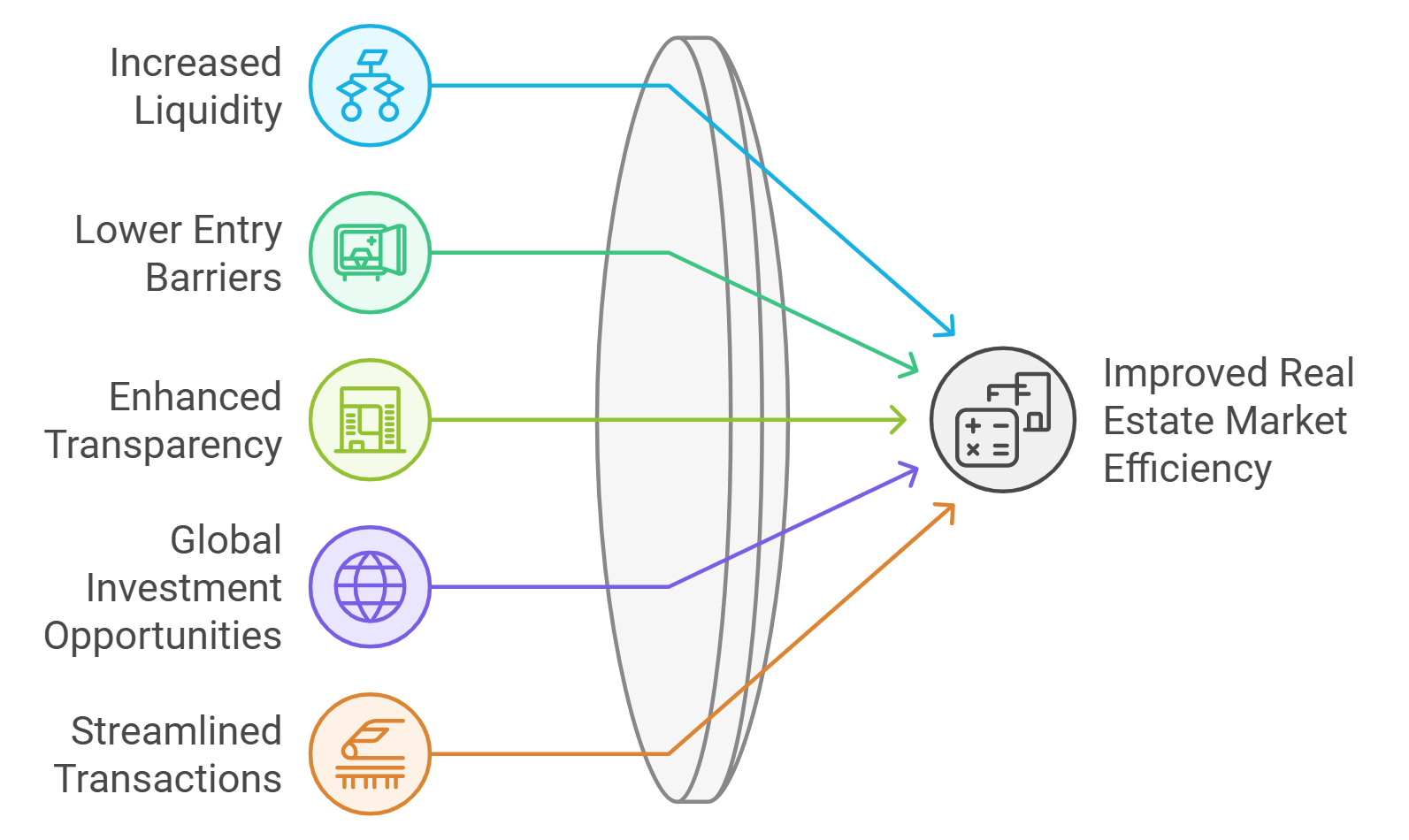

Top 5 Benefits of Tokenized Fractional Real Estate Ownership

-

4. Transparency and Security: Transactions are recorded on decentralized ledgers, and smart contracts automate processes like rental income distribution. This ensures transparent ownership records and reduces fraud risks, as seen on platforms such as GreenArch.

Transparency and Security: Why Blockchain Matters

Tokenized property assets aren’t just easier to buy and sell – they’re also more secure and transparent than legacy systems. Every transaction is recorded on a decentralized ledger that’s tamper-resistant and auditable by anyone. Smart contracts automate processes like rent collection and income distribution, reducing human error and fraud risk.

This transparency builds trust between investors worldwide who may never meet face-to-face but share ownership in the same asset pool. And with regulatory oversight evolving quickly (as seen with initiatives in Hong Kong and Saudi Arabia), compliance frameworks are catching up to support safe participation at scale.

Pioneering Developments Worldwide

The momentum isn’t limited to startups or crypto enthusiasts – major players are entering the space too. In August 2025, China’s Seazen Group announced plans to tokenize its asset income streams in Hong Kong via blockchain technology. Meanwhile, Saudi Arabia’s Rafal Real Estate partnered with droppRWA to enable both retail and institutional investors to acquire fractional stakes in local properties as part of Vision 2030’s economic diversification goals.

If you want a deep dive into how these innovations are transforming global access to real estate investing through blockchain-based fractional ownership, check out this resource: How Fractional Ownership Is Transforming Global Real Estate Investing With Blockchain.

These headline-making moves signal a new era for global property investment. With governments and institutional giants joining the tokenization wave, the legitimacy and scale of blockchain real estate is growing rapidly. As compliance standards evolve, expect even more mainstream adoption and cross-border participation.

Challenges on the Horizon: What Needs to Improve?

Despite all this momentum, fractional real estate ownership via blockchain still faces hurdles. Regulatory clarity varies widely between jurisdictions. While Hong Kong and Saudi Arabia are forging ahead, other regions lag behind or impose cautious restrictions. Security remains a top concern too, smart contracts must be rigorously audited to prevent exploits, and platforms need robust custody solutions to protect user assets.

Liquidity isn’t always guaranteed either. Many tokenized properties see limited trading volume on secondary markets, especially outside of major metropolitan areas. This can make it harder for investors to exit positions quickly or at favorable prices. The industry is actively working on solutions, including improved market structures and integrations with larger exchanges.

Getting Started: How Anyone Can Invest in Real Estate On-Chain

If you’re curious about how to invest $100 in real estate, it’s easier than ever to get started:

You’ll typically need a crypto wallet (like MetaMask), a small amount of stablecoin (such as USDC), and access to a compliant platform that lists tokenized properties. From there, you can browse available assets, review projected yields, and purchase tokens representing fractional ownership, all without leaving your couch.

The Future: Real Estate for Everyone

The pace of change is only accelerating. As more countries embrace real estate on-chain, we’ll see new asset types (hotels, commercial buildings, even farmland) become accessible through fractional ownership models. Rental income paid out as real estate stablecoin yield, instant global transfers of property tokens, and AI-powered analytics for property selection are just around the corner.

This isn’t just a technological upgrade, it’s a fundamental shift in who gets to participate in wealth creation through property. Whether you’re a seasoned investor or just starting with $50 or $100, blockchain-powered platforms are breaking down walls that have stood for centuries.

If you’re ready to explore the possibilities yourself, there’s never been a better time to learn how fractional ownership is transforming global real estate investing with blockchain.