How to Trade Property Tokens on Real Estate Rwas: Tips for Maximizing Returns

Trading property tokens on Real Estate Rwas has emerged as a dynamic way for investors to access real estate markets with greater liquidity, transparency, and flexibility. As tokenization reshapes the landscape, understanding how to efficiently trade property tokens is crucial for maximizing returns while managing risk. In today’s market, where secondary marketplaces and blockchain-based compliance are rapidly evolving, a strategic approach can make all the difference.

Analyze Token Liquidity and Trading Volume Before Entering Positions

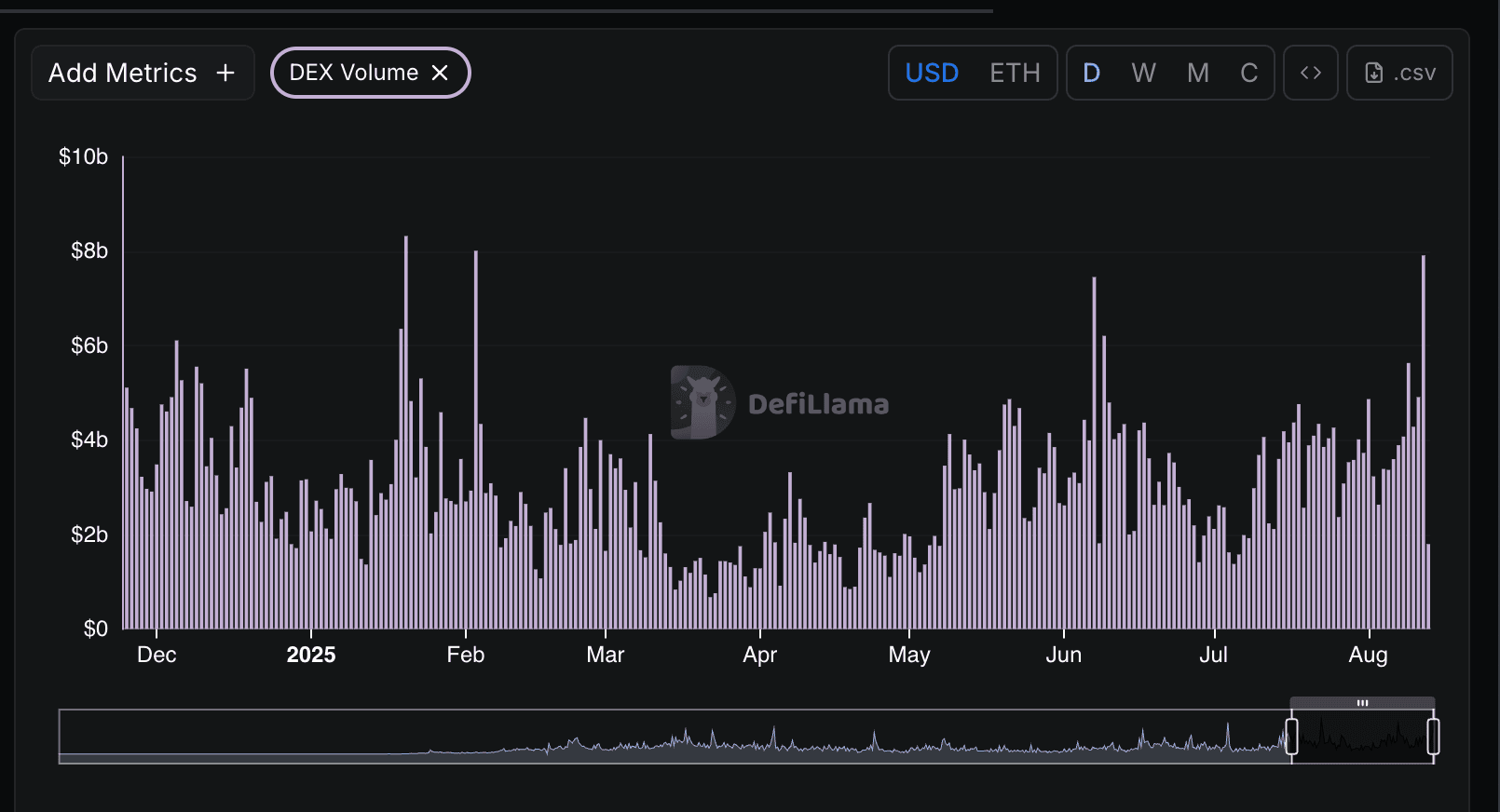

One of the most overlooked aspects of trading property tokens is liquidity. Unlike traditional real estate transactions that can take weeks or months, tokenized assets on Real Estate Rwas can be traded in minutes – but only if there’s sufficient market activity. Before entering any position, carefully review the trading volume and order book depth for each property token. High liquidity not only ensures you can enter and exit positions efficiently but also helps minimize slippage and unexpected price fluctuations.

Platforms like Real Estate Rwas offer real-time data on trading activity, allowing you to gauge whether a specific token has enough buy and sell interest to support your investment goals. If you’re considering larger allocations or short-term trades, prioritize tokens with consistently high volume. This approach protects your capital from getting trapped in illiquid assets during periods of market stress.

Diversify Across Multiple Property Types and Geographic Locations

Diversification remains a core principle for resilient portfolios – even in the world of blockchain real estate. With Real Estate Rwas, investors have access to a broad spectrum of properties: residential apartments in major cities, commercial office spaces, vacation rentals, and more. Spreading your investments across different property types reduces exposure to sector-specific risks such as regulatory changes or local economic downturns.

Geographic diversification is equally vital. By holding tokens from properties located in various regions or countries (where regulations allow), you buffer your portfolio against localized disruptions like natural disasters or shifts in regional demand. The platform’s intuitive search tools make it easy to filter by asset class and location so you can construct a balanced mix tailored to your risk appetite.

Top Strategies for Diversifying Your Property Token Portfolio

-

Analyze Token Liquidity and Trading Volume Before Entering PositionsBefore investing, assess the liquidity and trading volume of property tokens on established platforms like Lofty AI or RealT. High liquidity and active trading help ensure you can buy or sell tokens efficiently, minimizing slippage and exit delays.

-

Diversify Across Multiple Property Types and Geographic LocationsSpread your investments across different property types (residential, commercial, industrial) and varied locations to reduce risk. Platforms like Lofty AI and RealT offer access to a range of tokenized properties in diverse markets, helping you build a resilient portfolio.

-

Monitor Regulatory Updates and Platform Compliance StandardsStay updated on regulatory changes and ensure your chosen RWA platform maintains compliance with KYC/AML and local laws. Reputable platforms such as Lofty AI and RealT regularly update users about compliance standards, safeguarding your investments.

-

Leverage Secondary Market Timing for Optimal Entry and Exit PointsUse the secondary marketplaces on RWA platforms to strategically time your buys and sells. Monitoring market trends and property token performance can help you capitalize on price movements and maximize returns. Platforms like Lofty AI offer built-in secondary markets for instant liquidity.

-

Utilize Staking and Yield Programs Offered by Real Estate RwasParticipate in staking or yield-generating programs on platforms such as Lofty AI where available. These programs can provide additional returns through rental income distributions or platform incentives, boosting your overall yield.

Monitor Regulatory Updates and Platform Compliance Standards

The regulatory landscape for real estate tokenization is evolving quickly. As governments adapt their frameworks to accommodate digital assets, staying informed about compliance standards is essential for protecting both your capital and peace of mind. Real Estate Rwas places a premium on security and regulatory adherence – including robust KYC/AML checks – but it’s still wise to monitor ongoing legal developments that could affect trading conditions or asset eligibility.

Subscribe to platform updates, set alerts for regulatory news, and regularly review any changes to terms of service or asset documentation. This proactive stance not only helps you avoid unpleasant surprises but also positions you ahead of less-prepared investors when new rules impact market dynamics.

Leverage Secondary Market Timing for Optimal Entry and Exit Points

Timing is everything when trading property tokens on a dynamic platform like Real Estate Rwas. The secondary marketplace offers unique liquidity windows, often influenced by macroeconomic news, platform-specific updates, or seasonal trends in the underlying real estate market. To maximize returns, monitor trading patterns and price movements closely, look for periods of heightened activity or announcements that may drive demand for specific property tokens.

Consider setting price alerts or limit orders to capture favorable entry and exit points rather than executing trades impulsively. This strategy can help you avoid buying into temporary price spikes or selling during low-volume lulls, both of which can erode your returns. Remember, while property tokens are more liquid than traditional assets, their markets can still be sensitive to sudden shifts in sentiment or regulation.

Utilize Staking and Yield Programs Offered by Real Estate Rwas

One of the most innovative features on Real Estate Rwas is the ability to participate in staking and yield-generating programs. By locking up your property tokens for a specified period, you may earn additional rewards, such as a share of rental income or platform-native incentives, that enhance your overall yield. These programs are ideal for investors with a longer-term outlook who want to compound returns beyond simple capital appreciation.

Before committing tokens to staking pools, review each program’s terms carefully: consider lock-up durations, projected yields, risk disclosures, and any associated withdrawal penalties. Evaluate how these rewards compare with direct rental yields from underlying properties or with alternative DeFi opportunities. Used strategically, staking can transform passive holdings into active contributors to your portfolio’s growth.

Strategic Checklist for Trading Property Tokens Efficiently

The evolution of blockchain real estate has made it possible for both seasoned investors and newcomers to access diversified property portfolios with unprecedented ease. By analyzing token liquidity and volume before entering positions, diversifying across asset types and locations, staying vigilant about compliance standards, timing your trades thoughtfully on secondary markets, and leveraging staking programs where appropriate, you position yourself at the forefront of this new investment frontier.

To stay ahead as the landscape evolves into 2025 and beyond, make ongoing education part of your process, whether through platform resources or trusted industry insights like those from Twendee Labs. The future belongs to those who adapt quickly while managing risk with discipline.