Fractional Ownership Dubai Real Estate Tokens: Compliant Blockchain Guide for Crypto Investors

Dubai’s real estate market has long captivated global investors with its skyline of luxury towers and promise of high returns, but dubai real estate tokenization is rewriting the rules. Now, crypto enthusiasts and traditional investors alike can secure fractional ownership dubai property tokens starting at just AED 2,000, roughly $545. This blockchain innovation slices high-value assets into tradable shares, blending the stability of property with crypto’s speed and liquidity. Platforms compliant with UAE regulations are leading the charge, offering a strategic entry into one of the world’s hottest markets without needing seven-figure capital.

As a portfolio manager who’s woven real estate into crypto-heavy strategies for high-net-worth clients, I see this as a resilient diversification play. Tokenization doesn’t just lower barriers; it enforces transparency through immutable ledgers, reassuring even the most cautious investors. Yet success hinges on navigating Dubai’s strict compliance framework, which separates viable opportunities from speculative traps.

Dubai’s Robust Regulatory Backbone for Tokenized Assets

The UAE’s Virtual Assets Regulatory Authority (VARA) solidified its stance on June 19,2025, classifying property-backed tokens as Asset-Referenced Virtual Assets (ARVAs). Issuers must secure a Category 1 Virtual Asset Issuance license, submit detailed whitepapers, meet capital thresholds, and enforce rigorous KYC and AML protocols. This isn’t red tape; it’s investor armor in a market projected to tokenize billions in assets by 2026.

Complementing VARA, the Dubai Land Department (DLD) has championed tokenization to enable fractional ownership. Their collaboration with Prypco launched the ‘Prypco Mint’ platform in May 2025, built on the XRP Ledger for seamless, secure trades. Currently limited to UAE ID holders, it democratizes access to prime properties, with global expansion on the horizon. These steps reflect Dubai’s strategic pivot toward uae blockchain real estate investment, balancing innovation with oversight.

Why Fractional Tokens Trump Traditional Property Buys

Imagine owning a slice of a Burj Khalifa-view apartment without the full purchase burden. Each token on rwa dubai compliant platforms mirrors a precise property share, backed by legal titles registered with DLD. Liquidity surges as tokens trade 24/7 on blockchain exchanges, far outpacing months-long sales processes. For crypto investors, this means portfolio agility: sell fractions during market dips or hold for rental yields distributed proportionally.

Young investors and first-timers, often sidelined by steep prices, now enter via AED 2,000 stakes. Platforms leverage standards like ERC-3643 for compliance, ensuring tokens are programmable yet regulated. I’ve advised clients to allocate 10-15% here, pairing tokenized dubai luxury apartments crypto with stables and equities for resilience. Risks? Volatility ties to property cycles, but blockchain’s audit trails mitigate fraud better than paper deeds.

Tokenization platforms prioritize scalability and security, with DLD-verified assets reducing counterparty worries. Early adopters on Prypco Mint report frictionless minting and redemptions, proving the model’s maturity. For strategic minds, this convergence of global accessibility and local compliance signals a portfolio cornerstone, not a gamble.

Spotting Compliant Platforms Amid the Hype

Not all shiny tokens deliver. Prioritize VARA-licensed issuers with DLD ties, transparent whitepapers, and proven blockchains like XRP Ledger. Prypco Mint exemplifies this: fractional shares in vetted properties, real-time ownership proofs, and yields from rents or appreciation. Costs? Minimal beyond the entry AED 2,000, with gas fees offset by liquidity gains. My rule: audit the legal wrapper first, tech second.

Look for platforms integrating ERC-3643 standards, which embed compliance rules directly into smart contracts, automating KYC checks and transfer restrictions. This tech-forward approach, highlighted in 2026 development guides, ensures tokens only move to verified wallets, shielding investors from illicit flows. Dubai’s ecosystem now boasts top platforms driving fractional ownership, evaluated on these exact merits.

Step-by-Step Path to Your First Tokenized Dubai Property Share

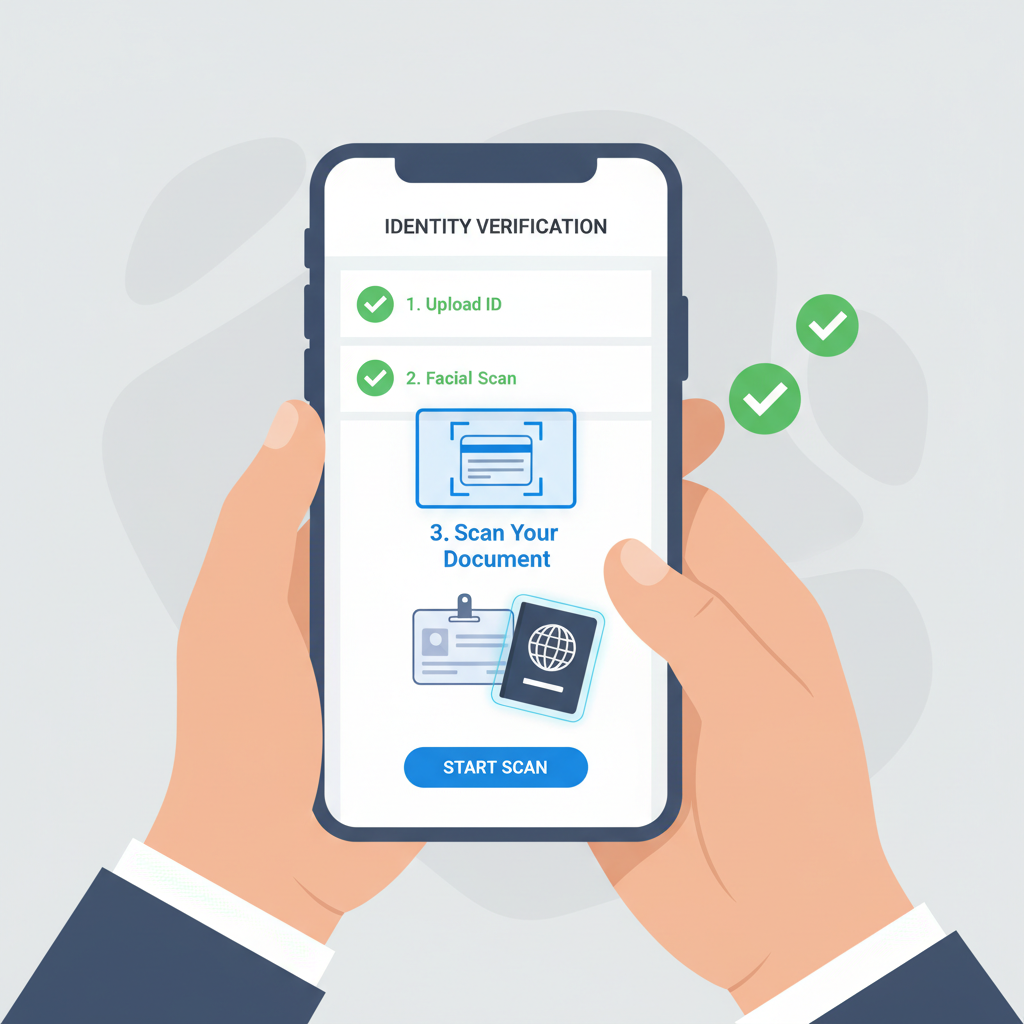

Entering uae blockchain real estate investment demands precision, not impulse. Start by verifying platform credentials: VARA license, DLD asset registry links, and audited reserves matching token supply. Once vetted, funding is straightforward via stables or fiat ramps, with tokens minted against property deeds.

Post-purchase, monitor via dashboards showing occupancy rates, rental distributions, and NAV updates. Redemption options let you cash out shares seamlessly, a far cry from traditional lock-ins. I’ve guided clients through this process, turning AED 2,000 pilots into diversified holdings yielding 8-12% annually, net of fees.

For deeper dives, explore detailed guides on blockchain fractional buys. Pairing these assets with crypto hedges creates the resilience I preach: property’s tangibility tempers volatility.

Strategic Allocation and Risk Calibration

In my multi-asset portfolios, tokenized real estate slots in at 10-20%, counterbalancing crypto’s swings with rental income streams. Dubai’s market, buoyed by Expo legacies and population influx, projects steady appreciation, but temper expectations: correlate with global rates and oil dynamics. Diversify across property types – residential towers, commercial hubs, even tokenized luxury apartments – to smooth cycles.

Risks warrant scrutiny. Property illiquidity persists if secondary markets thin, though blockchain marketplaces are maturing rapidly. Regulatory evolution, like VARA’s ARVA rules, could tighten further, but compliant platforms adapt swiftly. Counter this with thorough due diligence: review whitepapers for off-chain legal structures, ensuring SPVs hold titles cleanly. My clients sleep better knowing tokens grant enforceable claims, not mere promises.

Liquidity edges traditional real estate decisively. Tokens trade instantly, unlocking capital for reallocation – a boon in volatile times. Platforms now forecast a $4 trillion tokenized market by 2026, with Dubai punching above its weight through DLD innovations. Young investors flock here, blending crypto savvy with property upside, as seen in rising adoption stats.

Tokenization’s true edge lies in programmability: automate dividend payouts, enforce governance votes, even collateralize for DeFi yields. Yet stick to rwa dubai compliant platforms; hype chasers crumble under VARA audits. For family offices I’ve managed, this means vetted issuers only, blending tokenized dubai luxury apartments crypto with blue-chip RWAs.

Dubai positions itself as the nexus of real estate and blockchain, drawing global capital with ironclad rules and AED 2,000 entry points. Platforms like Prypco Mint pave a compliant path, turning aspirational assets into accessible stakes. As markets evolve, those allocating strategically will harvest the liquidity and yields this fusion promises, fortifying portfolios against uncertainty.