Borrowing Against Tokenized Real Estate Tokens: Permissionless Liquidity Up to 70% TVL in 2026

In the evolving landscape of real estate investment, tokenized assets are reshaping how investors access capital. Imagine holding fractional ownership in a prime property, represented as blockchain tokens, and borrowing against it without banks, paperwork, or credit scores dictating terms. This is permissionless real estate liquidity, a DeFi innovation projected to unlock up to 70% of total value locked (TVL) in tokenized real estate by 2026. Platforms like Reental and EstateX are leading this charge, blending real-world assets (RWAs) with decentralized lending protocols for efficient capital deployment.

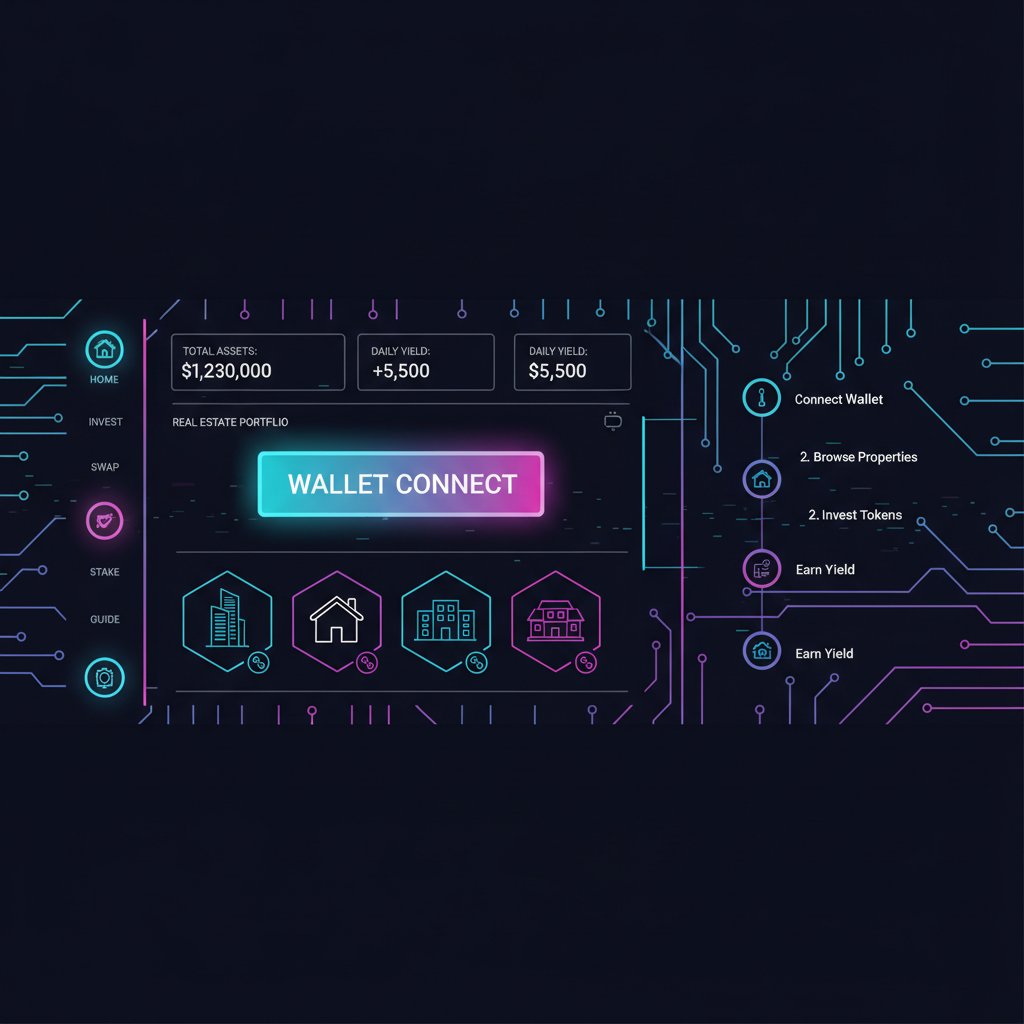

How Tokenized Real Estate Tokens Enable Instant Borrowing

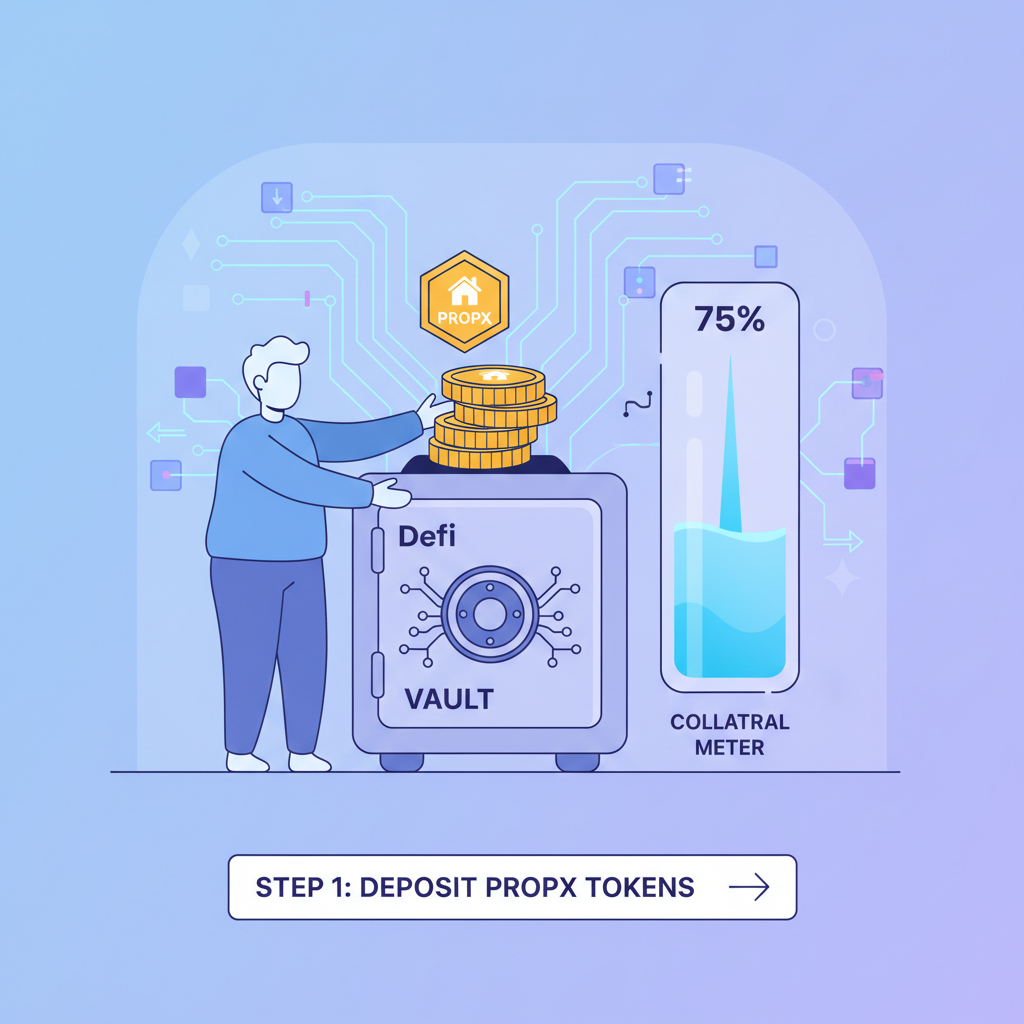

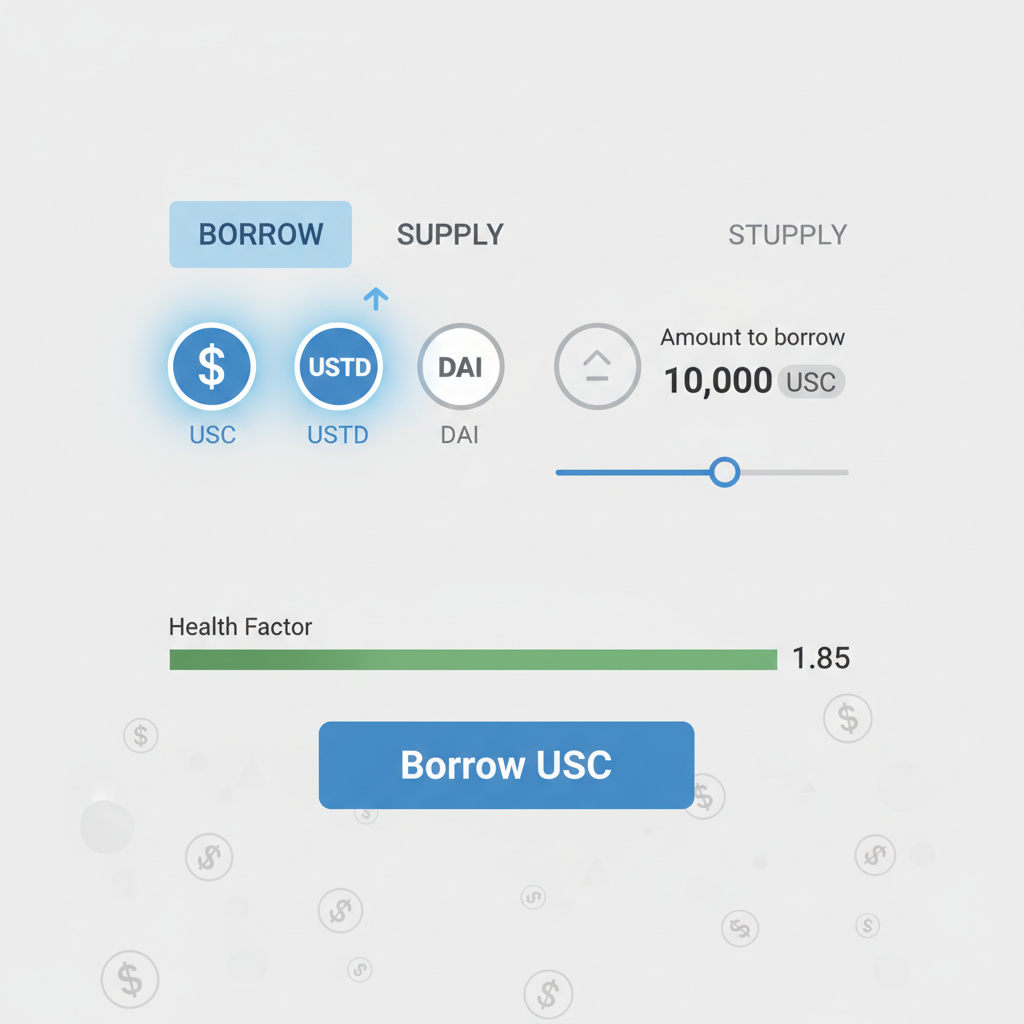

Tokenized real estate works by converting property ownership into digital tokens on a blockchain, each representing a share of the asset. These tokens, often backed by legal structures like special purpose vehicles, can then serve as collateral in DeFi lending markets. Borrowers deposit their property tokens into smart contracts, which issue stablecoin loans based on the collateral’s value. Loan-to-value (LTV) ratios typically cap at 50-70%, safeguarding lenders against volatility.

EstateX exemplifies this with its PROPX tokens. Holders can borrow against property tokens up to 70% of asset value through integrated DeFi protocols. No intermediaries mean settlement in minutes, not months. During Reental’s pilot, this model facilitated over €1 million in loans, proving scalability without traditional friction.

Permissionless Access: No Credit Checks, Pure Efficiency

Traditional mortgages demand extensive documentation, credit history, and approval timelines that stifle opportunity. In contrast, RWA DeFi lending 2026 operates on-chain, where smart contracts enforce rules transparently. Anyone with qualifying tokens can borrow stablecoins like USDC or USDT, using the collateral to fund ventures, diversify portfolios, or cover expenses while retaining property upside.

This permissionless model democratizes liquidity. A small investor in a tokenized Lagos apartment, for instance, accesses global capital pools without jurisdictional barriers. EstateX’s CapitalX feature highlights this: zero paperwork, fully on-chain, targeting high-yield real estate yields paired with leverage.

Pure DeFi efficiency turns illiquid real estate into a dynamic asset class.

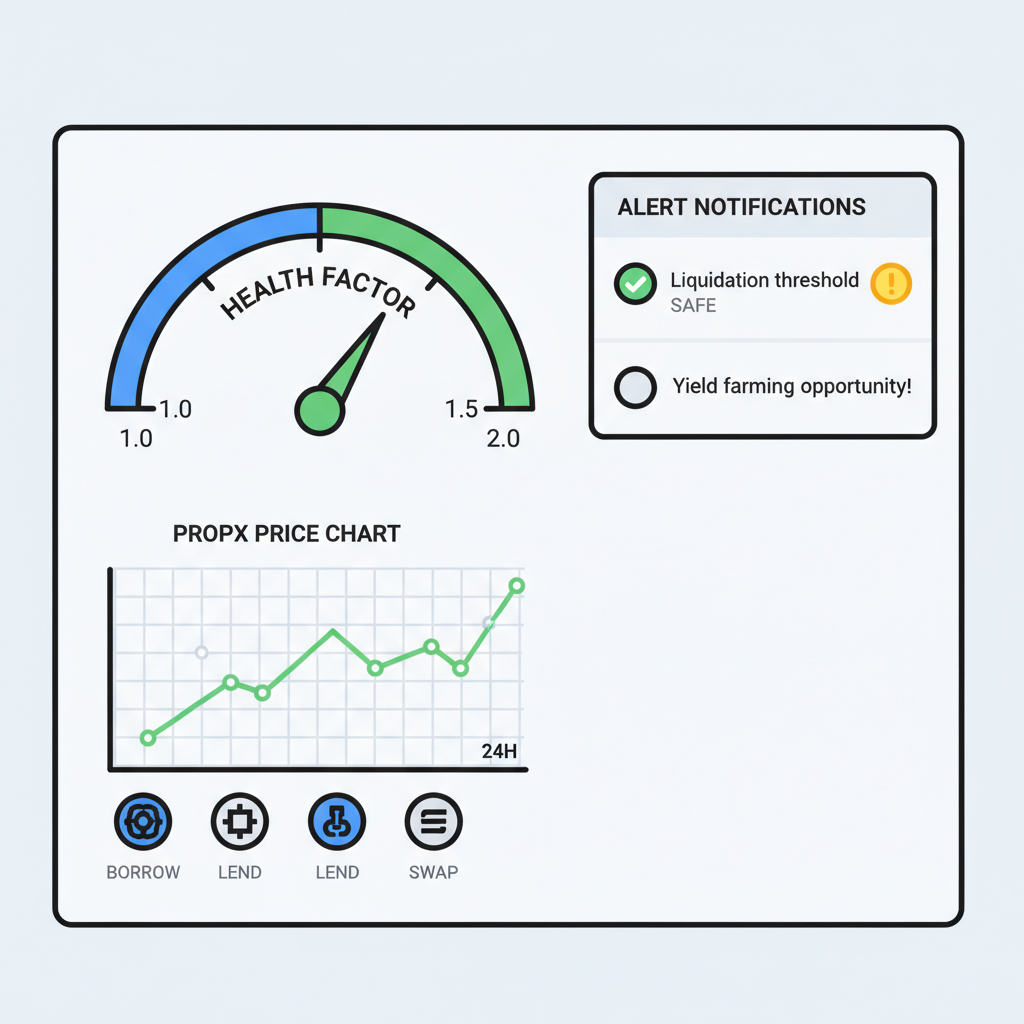

Yet, as a conservative investor, I stress due diligence. Over-collateralization mitigates liquidation risks, but token price fluctuations demand monitoring. Platforms embed oracles for real-time valuations, ensuring stability.

2026 Projections: TVL Growth and Regulatory Realities

By 2026, DeFi TVL is forecasted to surpass $300 billion, with tokenized real estate carving a significant slice. Borrowing up to 70% TVL tokenized assets becomes viable as adoption scales. Reental’s success signals broader integration, from institutional players like World Liberty Financial to emerging markets like Nigeria’s blockchain initiatives.

Regulatory hurdles persist, though. Jurisdictional variances in token classifications could spark compliance issues or disputes. Investors must track updates; for instance, clear legal wrappers enhance token utility in lending pools. This blend of opportunity and caution defines the space.

- Key advantages: Instant access, global reach, retained ownership.

- Risks to watch: Oracle failures, regulatory shifts, market downturns.

- Best practice: Start with conservative LTVs, diversify collateral.

Early adopters gain first-mover advantages, positioning portfolios for steady income amid real estate’s tokenization boom. Platforms prioritizing security and compliance, like those on Real Estate Rwas, pave the way.

Tokenized real estate platforms continue to refine these mechanisms, integrating advanced oracles and risk management tools to handle real-world asset volatility. This evolution supports permissionless real estate liquidity, where global investors tap into capital without borders or bureaucracy.

Step-by-Step: Borrowing Against Your Property Tokens

To harness this opportunity, follow a structured process grounded in on-chain security. Platforms like EstateX with its CapitalX feature or Reental streamline the experience, emphasizing conservative leverage to protect principal.

Once collateralized, loans accrue interest rates often below traditional mortgages, thanks to DeFi’s competitive markets. Repayment flexibility allows partial paydowns or swaps, maintaining portfolio balance.

Consider a practical example: An investor holds $100,000 in tokenized Lagos property via PROPX. Borrowing 70% ($70,000 in USDC) funds a new venture while the asset appreciates. If values dip, automated alerts prompt adjustments, avoiding liquidation.

Consistency in monitoring builds wealth; leverage amplifies it when managed steadily.

Risk Management: Navigating Volatility and Regulations

While enticing, tokenized real estate borrowing demands vigilance. Collateral values tie to property markets and token liquidity, exposed to crypto cycles. Maintain LTV below 50% initially for buffer. Oracles from Chainlink or similar ensure accurate pricing, but failures remain a tail risk.

Regulatory landscapes vary: Europe’s MiCA framework bolsters confidence, while emerging markets like Nigeria accelerate adoption amid blockchain pilots. Stay compliant by choosing platforms with KYC-optional pools and legal wrappers. Diversify across assets to spread exposure.

On-chain real estate loans exemplify this balance, unlocking developer capital worldwide without legacy constraints.

Income-focused strategies shine here. Use borrowed funds for yield-generating DeFi positions or REIT complements, targeting 8-12% blended returns with lower drawdowns than pure crypto.

Projections for RWA DeFi Lending in 2026

Analysts project DeFi TVL topping $300 billion by 2026, with RWAs like tokenized real estate claiming 10-15%. Borrowing utilization could hit 70% TVL tokenized assets, driven by institutional inflows and secondary markets. EstateX’s PROPX and peers position early holders for compounded gains.

PROPX Token Price Prediction 2027-2032

Forecast based on 20% CAGR trends, tokenized real estate TVL milestones, and DeFi adoption (2026 baseline: ~$0.20 avg price)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Projected Tokenized RE TVL |

|---|---|---|---|---|

| 2027 | $0.15 | $0.24 | $0.35 | $10B |

| 2028 | $0.18 | $0.29 | $0.50 | $25B |

| 2029 | $0.22 | $0.35 | $0.75 | $50B |

| 2030 | $0.27 | $0.42 | $1.10 | $100B |

| 2031 | $0.33 | $0.50 | $1.65 | $200B |

| 2032 | $0.40 | $0.60 | $2.50 | $400B |

Price Prediction Summary

PROPX token prices are forecasted to grow steadily from 2027-2032 at an average 20% CAGR, fueled by tokenized real estate expansion and permissionless DeFi borrowing up to 70% TVL. Minimum prices reflect bearish regulatory hurdles or market downturns, while maximums capture bullish adoption surges. TVL milestones indicate explosive growth in real-world asset integration, potentially driving token utility and value accrual. Investors should monitor regulatory clarity and competition.

Key Factors Affecting PROPX Token Price

- Rapid DeFi integration with tokenized real estate enabling frictionless liquidity

- 20% CAGR baseline from historical trends and pilot successes like Reental’s €1M loans

- Regulatory developments and jurisdictional compliance for RWA tokenization

- Market cycles favoring utility tokens in bull phases post-2026 DeFi TVL boom ($300B+)

- Technological advancements in platforms like EstateX and competition from WLFI

- Global real estate tokenization initiatives boosting demand for PROPX as collateral

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This trajectory favors patient investors. Pair borrowing with staking rewards on platforms, yielding steady income atop property appreciation. Real Estate Rwas aggregates these opportunities, simplifying discovery.

Adopting these tools methodically transforms real estate from a static holding into a versatile income engine. Platforms evolve daily, but the core principle endures: research deeply, borrow prudently, and let consistency compound your edge in this tokenized frontier.