Pooled vs Single-Asset Real Estate Tokenization: Fixing Liquidity and Risk in RWAs 2026

Imagine unlocking the doors to prime real estate without needing a massive down payment or dealing with lengthy closings. In 2026, real estate tokenization has exploded, thanks to blockchain magic that’s turning bricks and mortar into tradeable digital tokens. But here’s the game-changer: investors now face a big choice between pooled RWAs real estate and single-asset tokenization. Each model tackles real estate RWA liquidity and risk in wildly different ways, and picking the right one could supercharge your portfolio.

We’ve seen tokenized assets skyrocket, with dashboards like RWA. xyz tracking 58 properties across platforms. Experts at Centrifuge call 2026 the inflection point, where liquidity venues mature and compliance goes programmable. Yet, liquidity remains the holy grail, especially as tokenized property pools 2026 promise 24/7 trading. Let’s break it down, starting with why these models matter for slashing risks and boosting flow.

Pooled Asset Tokenization: Your Diversification Powerhouse

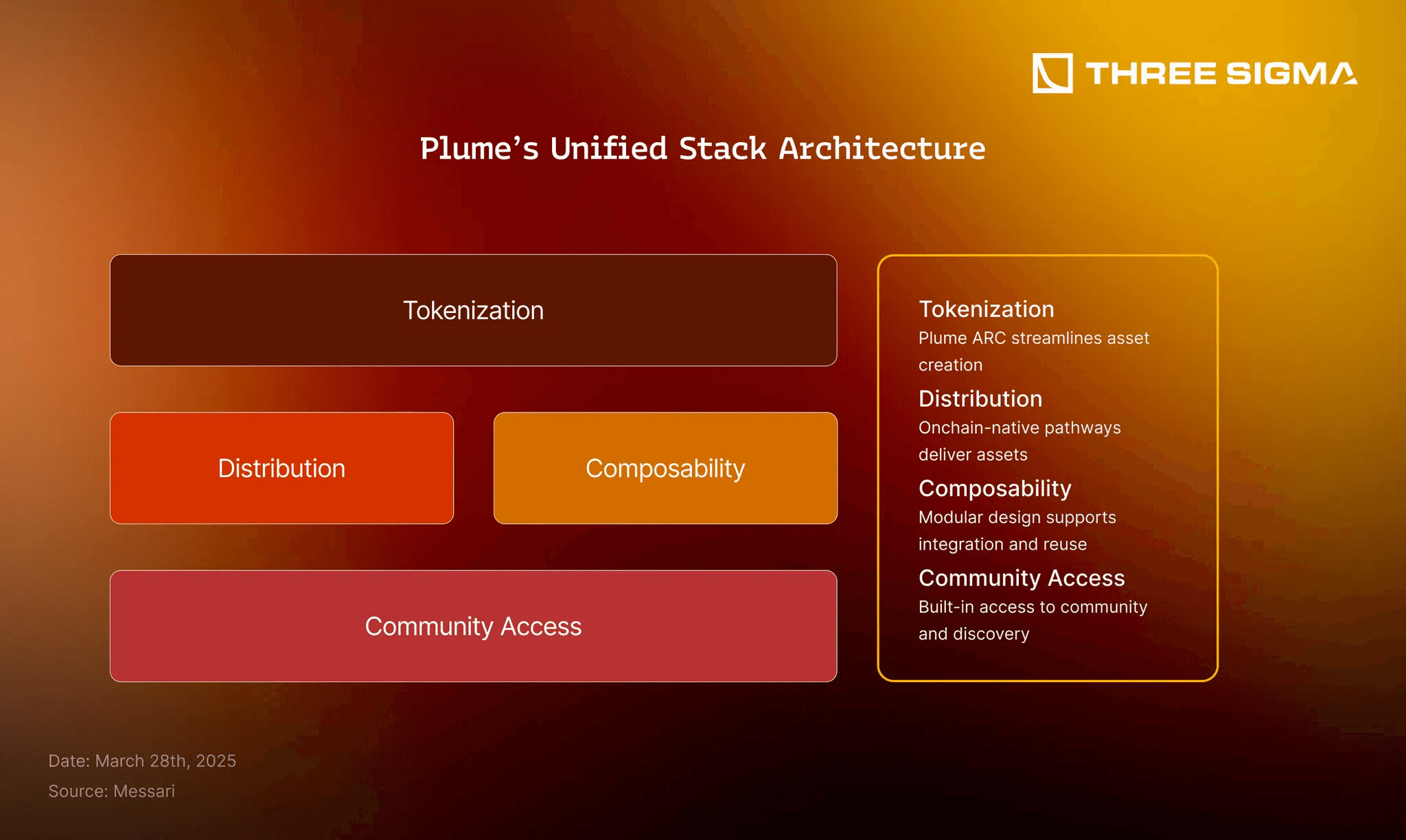

Pooled asset tokenization bundles multiple properties into one tokenized fund, letting you own fractions across a portfolio of apartments, offices, and retail spaces. Think of it as an on-chain REIT, but with blockchain’s transparency and speed. This approach shines for RWA risk diversification, spreading exposure so one bad tenant or market dip doesn’t tank your returns.

Advantages jump out immediately. Diversification cuts individual property risks, while larger pools draw institutional whales, pumping up trading volumes for better real estate RWA liquidity. Sources like Blockchain App Factory highlight how tokenization speeds capital formation and fractional ownership, making high-end assets accessible to everyday investors. New tech, per RWA. io, adds AI valuations and private transactions, smoothing operations.

But it’s not all smooth sailing. Valuing a mix of properties across locations demands sophisticated oracles and AI, and regulatory hurdles multiply with cross-jurisdiction assets. Still, as AdamSmith’s 2026 legal guide notes, converting ownership to tokens unlocks massive on-chain markets. I love how pools democratize elite real estate; they’re perfect for swing traders eyeing steady yields.

Single-Asset Tokenization: Precision Picks for Bold Investors

Flip the script to single-asset tokenization, where tokens tie directly to one property, say a luxury Miami condo or a Chicago warehouse. You pick your prize based on location, yield potential, or growth story. Transparency rules here; every detail from cap rates to tenant leases lives on-chain, empowering data-driven decisions.

The appeal? Tailored exposure lets you bet big on winners matching your risk appetite. No dilution from underperformers. Katten Muchin Rosenman LLP points to enhanced liquidity as a core win, freeing assets once locked for deep-pocketed buyers only. For crypto enthusiasts, it’s like cherry-picking NFTs, but backed by hard assets.

Challenges loom large, though. Lower trading volumes mean single asset vs pooled tokenization often favors the latter for quick exits. Concentration risk bites if that one property floods or vacancies spike. Elliptic’s analysis warns of regulatory complexities and hype versus reality in RWAs. Yet, for those with conviction, single assets deliver outsized upsides, especially with maturing platforms.

Pooled vs Single-Asset Real Estate Tokenization: Liquidity and Risk Comparison

| Aspect | Pooled Tokenization | Single-Asset Tokenization |

|---|---|---|

| Liquidity | ✅ Enhanced: Broader investor base increases trading activity and market depth | ❌ Limited: Lower trading volumes due to asset specificity |

| Risk Diversification | ✅ Strong: Spread across multiple properties mitigates individual asset risks | ❌ High Concentration: Exposed to performance of single property |

| Transparency | Moderate: Harder to assess individual holdings in pool | ✅ High: Clear insight into specific asset details |

| Valuation | ❌ Complex: Varies by property types and locations | ✅ Straightforward: Focused on one asset |

| Regulatory Compliance | ❌ Challenging: Multi-jurisdictional issues for pooled assets | Simpler: Tied to single asset jurisdiction |

Why Liquidity Still Stumps Tokenized Real Estate

Tokenization promised endless liquidity, but secondary markets lag. Primior. com compares it to traditional investments, noting regulatory fog, tech gaps, and adoption hurdles throttle trades. Single-asset tokens suffer most, with thin order books, while pools fare better but still need volume to thrive.

Strategies are emerging fast. Programmable compliance, per Centrifuge, automates KYC and trades. Robust DEXs and AMMs tailored for RWAs boost depth. Investor education, as in 4IRE’s guide, builds trust. I’ve traded both models, and pools edge out for liquidity, but hybrids might rule 2026. Check this deep dive on secondary markets for tactics closing the gap. The future? Fluid, fractional ownership revolutionizing how we invest.

Picture this: you’re swing trading tokenized property pools 2026 style, flipping fractions of diversified assets faster than a traditional flipper could close escrow. Platforms are rolling out AI-driven oracles for real-time valuations, pulling from RWA. xyz’s dashboard tracking those 58 assets. Privacy tech keeps deals discreet, while programmable compliance zips through regs like a hot knife through butter.

Hybrid Models: The Smart Fusion Winning in 2026

Why settle for single asset vs pooled tokenization when hybrids blend the best? These bad boys layer single-property precision inside broader pools, letting you dial in diversification levels. Early adopters on Centrifuge see liquidity pop as investors mix targeted bets with safety nets. It’s my favorite play for RWA risk diversification – think a core pool of stable multifamily units spiced with high-upside single flips.

Take tokenized mortgages, delivering stable yields for crypto holders. Or BlackRock’s push into fractional shares on blockchain, eyeing 50% ownership slices. These hybrids crush pure models by balancing transparency with volume. Ideasof. io’s guide nails asset selection: prioritize liquidity potential and risk profiles upfront.

Regulatory tailwinds accelerate everything. AdamSmith’s legal blueprint shows on-chain RWAs exploding as jurisdictions standardize token rules. Elliptic cuts through hype, stressing audits and oracles to tame risks. For traders like me, this means charting tokenized yields with TradingView overlays, spotting swings in pool NAVs versus single-asset pops.

Risk Management Tactics That Actually Work

Diving deeper into risks, pooled RWAs real estate sidesteps single-point failures but invites correlation traps – like regional downturns hitting all assets. Counter with geo-diverse pools and dynamic rebalancing via smart contracts. Single assets? Hedge with derivatives or pair with stablecoin yields from tokenized debt.

| Strategy | Pooled Impact | Single-Asset Impact |

|---|---|---|

| AMM Integration | High volume depth | Boosts thin books |

| Streamlined NAV | Precise pricing | |

| Broader liquidity | Network hopping | |

| Mass adoption | Niche targeting |

4IRE’s tokenization walkthrough reveals business perks: faster capital, global reach. Wiseway Tec envisions 24/7 markets by 2026, freeing investors from gatekeepers. I’ve seen pools yield 8-12% annualized with half the volatility of singles – data from my charts doesn’t lie.

Choosing your path boils down to style. Swing traders? Pools for liquidity flow. Conviction players? Singles for alpha hunts. Platforms like Real Estate RWAs make switching seamless, with dashboards fusing both worlds. As liquidity venues mature, expect tokenized real estate to outpace stocks in accessibility.

2026 isn’t hype; it’s handover. Blockchain App Factory flags fractional ownership as the liquidity kingmaker. Dive in armed with knowledge – diversify smart, trade liquid, and watch your portfolio brick up real gains. The chain is calling; answer with tokens, not title deeds.