Dubai Tokenized Real Estate on XRP Ledger: Fractional Ownership Opportunities in 2026

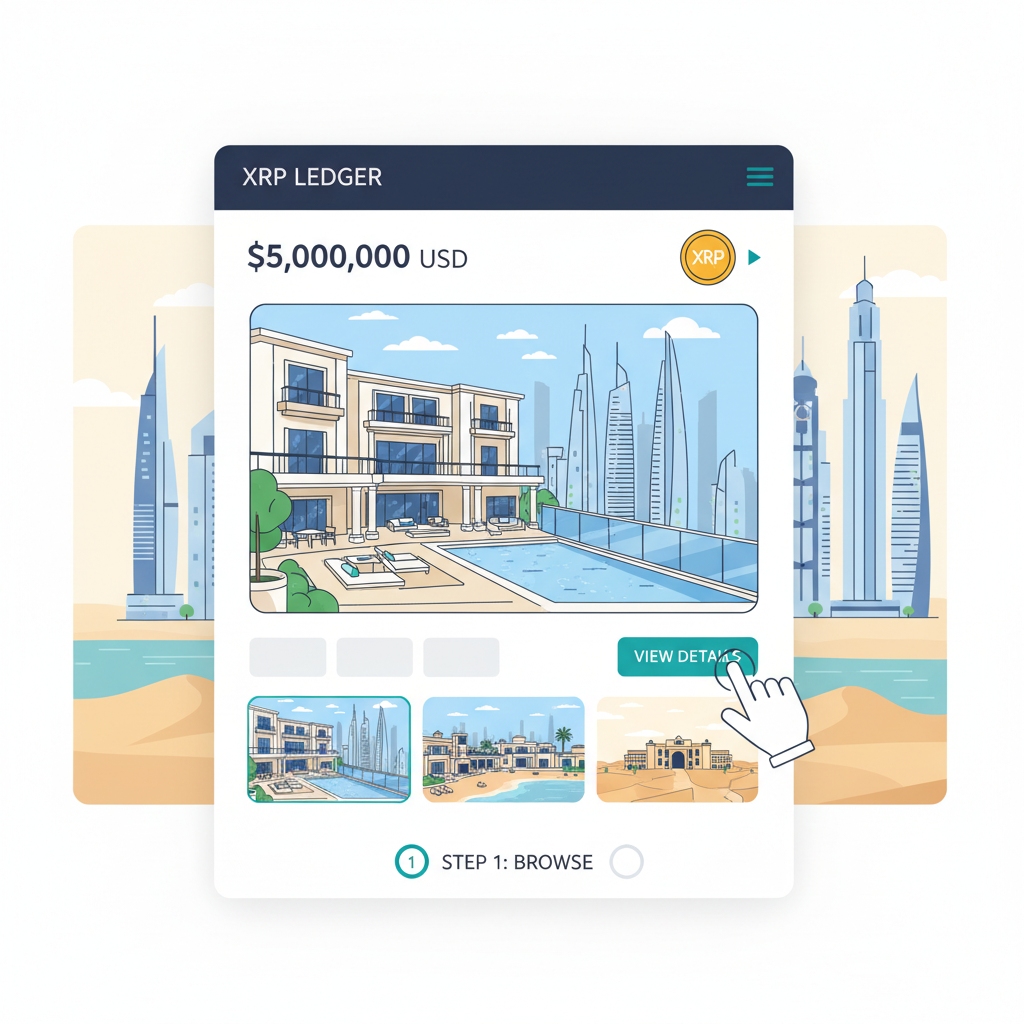

Imagine owning a piece of Dubai’s glittering skyline without needing millions in the bank. As of February 20,2026, the Dubai Land Department has ignited Phase Two of its groundbreaking Real Estate Tokenization Project on the XRP Ledger, turning over $5 million in prime properties into tradable dubai tokenized real estate assets. With Binance-Peg XRP trading at $1.43 after a 24-hour dip of -2.05%, this initiative signals massive potential for fractional ownership in 2026 and beyond. Investors can now dip into a pool of 7.8 million xrp ledger property tokens, representing stakes across ten luxurious properties, all while enjoying enhanced liquidity through a regulated secondary market.

Phase Two Unleashes Secondary Trading Magic

This pivotal upgrade, spearheaded by the Dubai Land Department in partnership with Ctrl Alt and Ripple Custody, opens the gates to controlled resale of tokenized property trading dubai 2026. Previously confined to pilot tokenized ownership documents, the project now empowers holders to trade fractional stakes seamlessly on the XRP Ledger. Limited initially to UAE Emirates ID holders, this step builds a secure foundation, promising broader global access soon. Picture flipping your share of a high-rise condo faster than traditional sales, all backed by blockchain’s unshakeable transparency.

The buzz is real: over $5 million in assets are now live, fueling optimism amid XRP’s steady price at $1.43. This isn’t just tech hype; it’s a liquidity revolution transforming Dubai’s $16 billion tokenized real estate vision into reality. Forward-thinkers, this is your cue to explore how real estate tokenization makes prime Dubai properties globally accessible.

Fractional Ownership Redefines Dubai Investment

Fractional ownership dubai blockchain has never looked so attainable. Those 7.8 million tokens slice up properties into bite-sized investments, letting you own fractions of villas or apartments starting from modest amounts. No more gatekeeping by ultra-wealthy buyers; everyday investors can now tap into Dubai’s booming market, where returns from rentals and appreciation await. With XRP Ledger’s lightning-fast settlements and negligible fees, trading feels effortless compared to sluggish paperwork.

Envision parking your capital in a tokenized penthouse overlooking the Burj Khalifa, all verifiable on-chain. This real estate tokenization xrp model slashes entry barriers, aligning perfectly with Dubai’s push for innovation. As XRP holds at $1.43 despite a 24-hour low of $1.42, the ecosystem’s resilience shines, drawing more eyes to these opportunities.

XRP Price Prediction 2027-2032

Bullish trends driven by Dubai real estate tokenization on XRP Ledger and RWA adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 $1.43) |

|---|---|---|---|---|

| 2027 | $1.20 | $2.20 | $3.80 | +53.8% |

| 2028 | $1.80 | $3.20 | $5.50 | +45.5% |

| 2029 | $2.50 | $4.80 | $8.00 | +50.0% |

| 2030 | $3.50 | $6.50 | $11.00 | +35.4% |

| 2031 | $4.50 | $8.50 | $15.00 | +30.8% |

| 2032 | $5.50 | $10.50 | $20.00 | +23.5% |

Price Prediction Summary

XRP is forecasted to experience strong growth from 2027-2032, fueled by Dubai’s Phase Two real estate tokenization enabling secondary trading of $5M+ in assets on XRP Ledger. Average prices could rise from $2.20 in 2027 to $10.50 by 2032, reflecting RWA adoption, regulatory progress, and market cycles, with max potentials up to $20 amid bullish scenarios.

Key Factors Affecting XRP Price

- Dubai Land Department RWA tokenization project with secondary market liquidity

- Ripple Custody and Ctrl Alt infrastructure enabling fractional ownership trading

- Expansion to international investors and $16T real estate market potential

- Favorable regulatory environment in UAE boosting institutional adoption

- XRP Ledger’s scalability advantages over competitors in RWA use cases

- Broader crypto market cycles, Bitcoin halvings, and macroeconomic factors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

XRP Ledger: The Backbone of Dubai’s Token Revolution

Why the XRP Ledger? Its proven scalability handles high-volume trades without congestion, ideal for a secondary market buzzing with activity. Ripple Custody adds institutional-grade security, ensuring your dubai land department rwa tokens stay safe. This trifecta of DLD, Ctrl Alt, and Ripple isn’t experimenting; they’re scaling a model that could tokenize billions in assets.

Market watchers note the $5 million pilot as a mere teaser. With XRP at $1.43 and a 24-hour high of $1.46, momentum builds for expansion. International investors, gear up: future phases promise borderless entry, amplifying fractional ownership opportunities in one of the world’s hottest real estate hubs. Dive deeper into how Dubai’s tokenized real estate sales unlock global property investing.

Staying ahead means acting now. As Dubai pioneers this shift, tokenized properties on XRP Ledger offer not just returns, but a front-row seat to real estate’s blockchain-powered future.

Tokenized assets like these aren’t just investments; they’re your ticket to diversification in a portfolio hungry for real yield. With XRP’s price stabilizing at $1.43 following a 24-hour high of $1.46, the timing feels ripe for bold moves into dubai land department rwa opportunities.

Ready to claim your slice of Dubai’s skyline? The process is streamlined for speed and security, leveraging XRP Ledger’s efficiency. First, verify your UAE Emirates ID eligibility through the platform partnered with Ctrl Alt. Then, fund your wallet with XRP at its current $1.43 value, and browse the ten properties now tokenized across 7.8 million shares. Select your fractional stake, confirm on-chain, and watch ownership transfer in seconds. This tokenized property trading dubai 2026 setup minimizes friction, maximizing your edge in a fast-moving market.

Once in, secondary market trades let you cash out gains swiftly, all under regulated oversight. It’s fractional ownership reimagined, where even small positions in luxury assets deliver outsized potential.

This progression underscores Dubai’s commitment, turning hype into tangible liquidity amid XRP’s resilient $1.43 price point.

Navigating Risks and Rewards in 2026

Every frontier has hurdles, yet Dubai’s model mitigates them smartly. Regulatory controls limit initial access, fostering trust before scaling. Blockchain’s transparency curbs fraud, while Ripple Custody safeguards assets. Rewards? Rental yields from tokenized villas, plus capital gains as Dubai’s market soars. With XRP dipping just -2.05% to $1.43, these xrp ledger property tokens offer stability in volatility.

Opinion: This isn’t a fad; it’s the blueprint for global real estate. Early adopters will recount stories of 2026 entries yielding multi-fold returns by decade’s end. Check out fractional ownership of tokenized Dubai luxury penthouses via blockchain to grasp the luxury angle.

Questions answered, momentum builds. As Phase Two hums with activity, envision your portfolio boosted by Dubai’s glow. XRP at $1.43 today hints at upward trajectories fueled by RWA adoption.

Why 2026 Demands Your Attention Now

Dubai tokenized real estate isn’t waiting; it’s surging ahead on XRP Ledger. Fractional shares democratize wealth creation, blending crypto speed with property solidity. With 24-hour lows at $1.42 underscoring resilience, position yourself for the expansion wave. International borders will blur, liquidity will explode, and returns will compound.

This ecosystem thrives on innovation, much like the visionary investors diving in today. Secure your fractional stake, trade with confidence, and ride the wave shaping real estate’s tomorrow. The future isn’t coming; it’s here, tokenized and tradable.