Tokenized Real Estate Platforms 2026: Ctrl Alt RedSwan Groma Reental TVL Breakdown

Imagine owning a slice of prime commercial real estate without dropping millions or dealing with paperwork nightmares. That’s the magic of tokenized real estate in 2026, where blockchain turns bricks and mortar into liquid digital assets. Platforms like Ctrl Alt, RedSwan, Groma, and Reental are leading the charge, locking up billions in Total Value Locked (TVL) and reshaping how we invest in property worldwide. With the RWA sector blasting past $10 billion in TVL as of early 2026, these four stand out for their high TVL dominance across chains like MANTRA Base, Stellar, and Polygon.

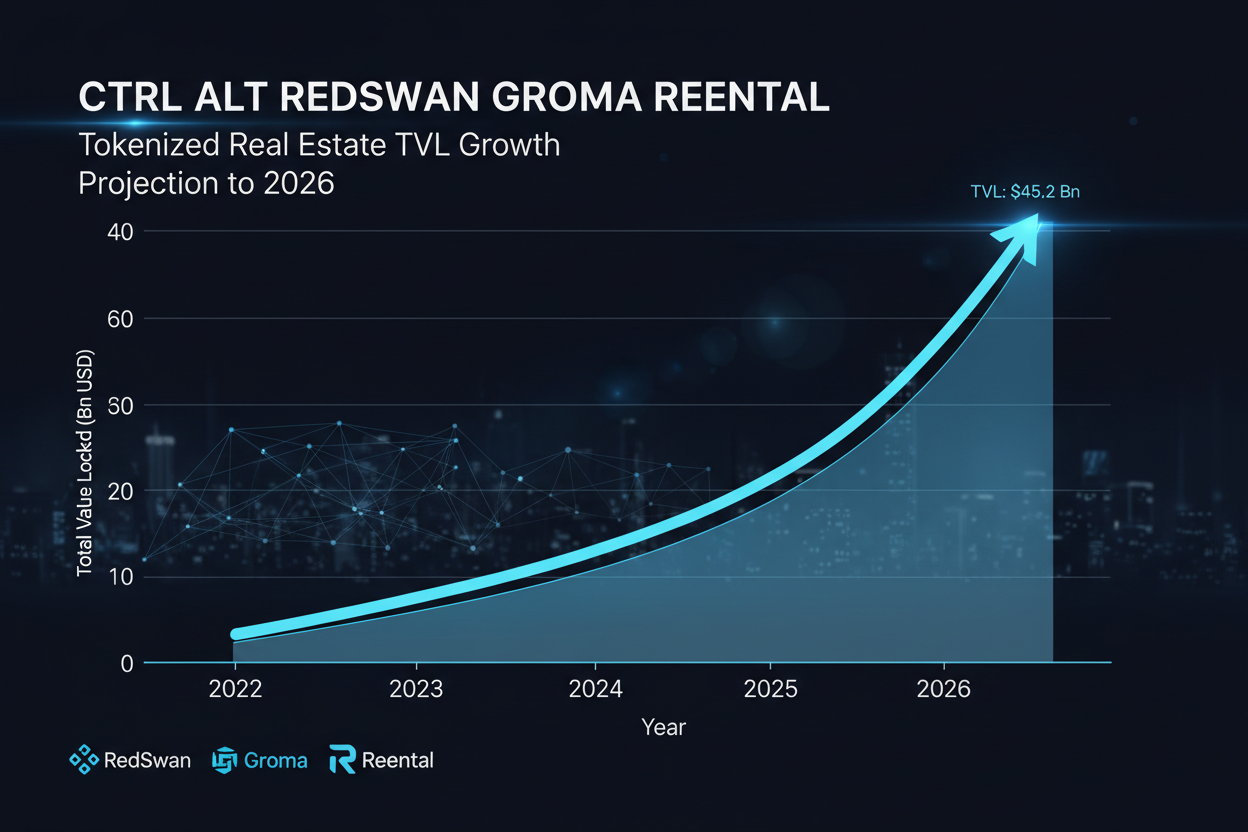

The tokenized real estate market is on fire. Valued at $3.73 billion in 2025, it’s projected to skyrocket to $23.99 billion by 2035 at a 21% CAGR, according to Insightace Analytic. Broader RWA tokenization hits $3.01 trillion in 2026, per Mordor Intelligence, with real estate grabbing a huge chunk. Analysts at ScienceSoft predict $3 trillion by 2030, or 15% of global real estate under management. This 308% growth spurt in three years, as noted by Cotality, stems from fractional ownership making high-end properties accessible from $50 entry points. Check out this deep dive on fractional ownership in luxury properties.

Ctrl Alt’s $124M TVL Powerhouse on Multi-Chain Rails

Ctrl Alt is the go-to for asset owners serious about tokenization. They’ve already brought over $850 million in real-world assets on-chain, providing legal, financial, and tech stacks that make the process seamless. Their TVL sits at a robust $124 million, dominating tokenized real estate platforms 2026 with deployments on innovative chains like MANTRA Base for speed and Stellar for cross-border efficiency. What sets Ctrl Alt apart? End-to-end solutions that handle compliance headaches, letting investors focus on yields. In a market craving security, their infrastructure shines, drawing institutional money hungry for Polygon-based liquidity too.

RedSwan Builds a $4B and Tokenized CRE Empire

RedSwan isn’t playing small; they’re tokenizing commercial real estate behemoths with over $4 billion in digital assets and a $5.2 billion pipeline. SEC and FINRA approved, they offer global access to premium properties that were once walled off for whales. While exact TVL figures fluctuate, their scale positions them as a RedSwan tokenized properties leader, fueling the sector’s 140% year-on-year surge. Investors love the instant liquidity and transparency, trading tokens like stocks. Picture fractional shares in skyscrapers yielding steady rents, all on blockchain. RedSwan’s marketplace vibe democratizes CRE like never before.

These platforms aren’t isolated; they’re part of a TVL explosion. Solana’s RWA ecosystem alone topped $1 billion by January 2026, signaling massive adoption. For a snapshot:

🏠 2026 Tokenized Real Estate Platforms TVL Breakdown

| Platform | TVL / Assets | Key Chains | Growth Notes |

|---|---|---|---|

| Ctrl Alt 🚀 | $124M TVL / $850M+ tokenized assets | MANTRA Base, Stellar, Polygon | End-to-end RWA tokenization infrastructure; part of $10B+ RWA TVL surge |

| RedSwan 💼 | $4B+ tokenized assets | N/A | Commercial RE leader w/ $5.2B pipeline; SEC/FINRA approved; global access |

| Groma 🌱 | Emerging | N/A | Emerging platform w/ RWA focus amid 140% YoY growth |

| Reental 🏘️ | N/A | N/A | Fractional ownership leader; riding 308% sector growth |

Groma and Reental: Rising Stars in RWA Real Estate

Groma is quietly stacking momentum in the RWA space, specializing in real estate tokenization that bridges traditional finance with DeFi. Though specific TVL data is emerging, their focus on secure, scalable solutions positions them for Groma RWA real estate breakout. Paired with chains like Polygon for low fees, Groma appeals to developers tokenizing mid-tier properties hungry for liquidity.

Reental flips the script on rental income streams, pioneering Reental fractional ownership. By tokenizing residential and commercial rentals, they let users earn passive income from tokenized leases worldwide. Their TVL is climbing amid the broader RWA real estate market share shift, with multi-chain support enhancing accessibility. Together, these platforms highlight why tokenized real estate chains like MANTRA Base are the future.

Let’s break down what makes these platforms tick in terms of TVL and beyond. Ctrl Alt’s $124M TVL isn’t just a number; it’s a testament to their multi-chain mastery, blending MANTRA Base’s DeFi firepower with Stell’s cross-border prowess and Polygon’s cost efficiency. RedSwan, meanwhile, leverages its $4B asset base to command premium CRE yields, while Groma and Reental fill crucial niches in emerging and rental-focused tokenization.

Decoding TVL Drivers: Why These Four Dominate Tokenized Real Estate Platforms 2026

TVL tells the story of trust and utility. For Ctrl Alt real estate TVL, that $124M reflects institutional inflows chasing compliant, scalable tokenization. Asset owners flock here because Ctrl Alt handles the heavy lifting: KYC, smart contracts, and secondary markets all baked in. RedSwan’s edge? Regulatory green lights from SEC and FINRA, unlocking U. S. investors to global CRE. Their pipeline screams expansion, potentially pushing TVL equivalents past $6B soon. Groma’s stealth rise taps into developer tools for quick token launches, ideal for Polygon’s ecosystem where fees stay under a penny. Reental, on the other hand, tokenizes cash-flow machines like apartment leases, turning renters into token holders with daily payouts.

This synergy across chains fuels the boom. MANTRA Base powers high-yield vaults, Stellar enables instant settlements, and Polygon ensures everyday traders can participate without gas wars. The result? A sector up 140% year-over-year, with Solana’s $1B RWA TVL milestone paving the way. Dive into this analysis on tokenized real estate TVL growth for the full trajectory.

2026 TVL Predictions: Bold Bets on Explosive Growth

Looking ahead, expect fireworks. Zoniqx eyes 10% of a $500B tokenized CRE slice, but our quartet could claim outsized shares. Ctrl Alt might double to $250M TVL by year-end, riding MANTRA Base’s momentum. RedSwan’s $5.2B pipeline hints at $10B and assets, translating to dominant TVL flows. Groma and Reental, as rising stars, could hit $50M-$100M each, per sector parallels like Solana’s leap.

Ctrl Alt (CTRL) Price Prediction 2027-2032

Bear, Base, and Bull Scenarios Driven by Tokenized Real Estate TVL Growth and RWA Adoption

| Year | Minimum Price (Bear) | Average Price (Base) | Maximum Price (Bull) |

|---|---|---|---|

| 2027 | $0.95 | $1.75 | $3.85 |

| 2028 | $1.15 | $2.80 | $7.40 |

| 2029 | $1.40 | $4.50 | $14.00 |

| 2030 | $1.70 | $7.20 | $26.50 |

| 2031 | $2.10 | $11.50 | $50.00 |

| 2032 | $2.60 | $18.50 | $95.00 |

Price Prediction Summary

CTRL token forecasts reflect the booming tokenized real estate market, with TVL in RWAs exceeding $10B in 2025 and projections to $3T by 2030. Base scenario anticipates ~60% CAGR, reaching $18.50 by 2032 (12x from 2026 levels), bear case conservative growth amid regulatory hurdles, bull case explosive upside with institutional inflows and market leadership vs. competitors like RedSwan.

Key Factors Affecting Ctrl Alt Price

- Rapid RWA TVL expansion (44%+ CAGR for asset tokenization to $18T+ by 2031)

- Ctrl Alt’s strong positioning with $850M+ tokenized assets and end-to-end infrastructure

- Regulatory advancements (SEC/FINRA approvals) enabling global adoption

- Institutional interest and multi-chain growth (e.g., Solana RWA TVL >$1B)

- Competition dynamics with RedSwan ($4B+ assets), Groma, Reental

- Crypto market cycles, macroeconomic trends, and technological enhancements in blockchain tokenization

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These forecasts align with macro tailwinds: policy shifts in 2025-2026 easing tokenized asset regs, per BDO USA, plus blockchain’s maturity slashing settlement times from weeks to seconds. Real estate’s illiquidity premium vanishes, replaced by 24/7 trading. But it’s not all smooth; volatility hits if crypto winters return, or if off-chain legal snags arise. Still, fractional ownership from $50 democratizes access, as Cotality’s 308% growth underscores.

Smart investors mix these platforms for diversification. Start with Ctrl Alt for blue-chip stability, add RedSwan for CRE yields, sprinkle Groma for growth bets, and Reental for steady rentals. Monitor tokenized real estate chains MANTRA Base for unlocks; its DeFi integrations supercharge returns. Platforms like these aren’t just holding value; they’re programming the programmable square foot, as one LinkedIn visionary put it.

The edge goes to those acting now. With RWAs at $2T and valuation and real estate tokenization racing to $3T by 2030, Ctrl Alt, RedSwan, Groma, and Reental offer front-row seats. Grab your wallet, scout a token, and own the future of property; it’s more accessible than ever in 2026.