Tokenized Real Estate NFTs Starting at $50: Fractional Land Ownership on Blockchain Explained

Imagine snapping up a slice of prime land for just $50. No bank loans, no realtor fees, just your wallet and the blockchain. Tokenized real estate NFTs are flipping the script on property investment, letting everyday traders like you dive into fractional land ownership blockchain style. With platforms tokenizing everything from U. S. rentals to Bali villas, you’re in on rental yields without the hassle. Ethereum’s humming at $2,077.75 today, fueling this RWA boom with smart contracts that lock in your share.

Unlocking Property Tokens: From Whole Deeds to $50 NFTs

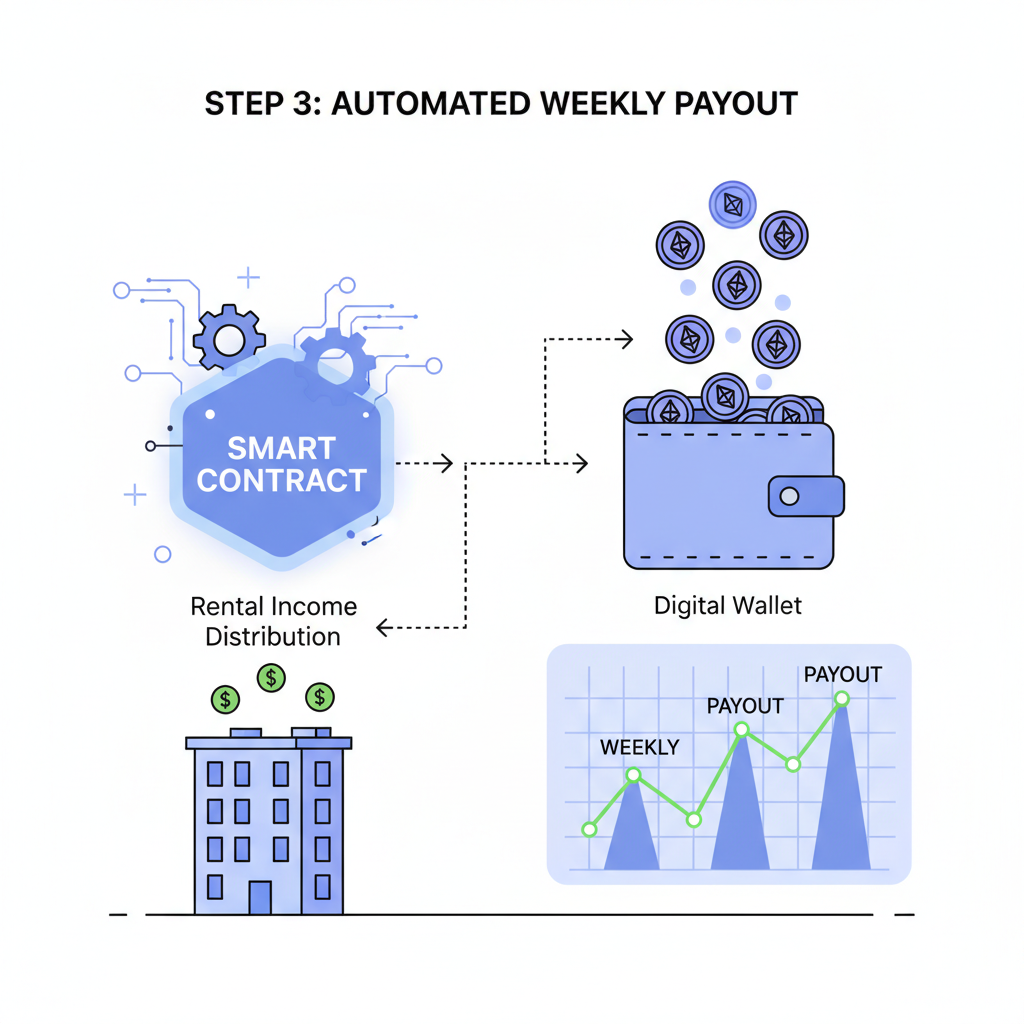

Tokenized real estate NFTs turn massive assets into bite-sized digital deeds. A single property gets sliced into hundreds or thousands of tokens, each an NFT representing your cut. Buy one for $50, and boom: you’re earning pro-rata rent paid out in stablecoins weekly. RealT’s tokenized over 200 U. S. spots, delivering blockchain-secured passive income to global holders. This isn’t hype; it’s markets exploding as fractional ownership surges per Antier Solutions’ 2026 trends.

Why now? Blockchain slashes barriers. Traditional real estate demands six figures and endless paperwork. Here, smart contracts handle dividends, sales, even votes on upgrades. Chainlink nails it: RWAs divided transparently, no middlemen skimming yields. Ethereum’s 24-hour high hit $2,100.47, underscoring the chain’s strength for these property token offerings (PTOs).

Fractional Ownership Mechanics: Smart Contracts Meet Land Deeds

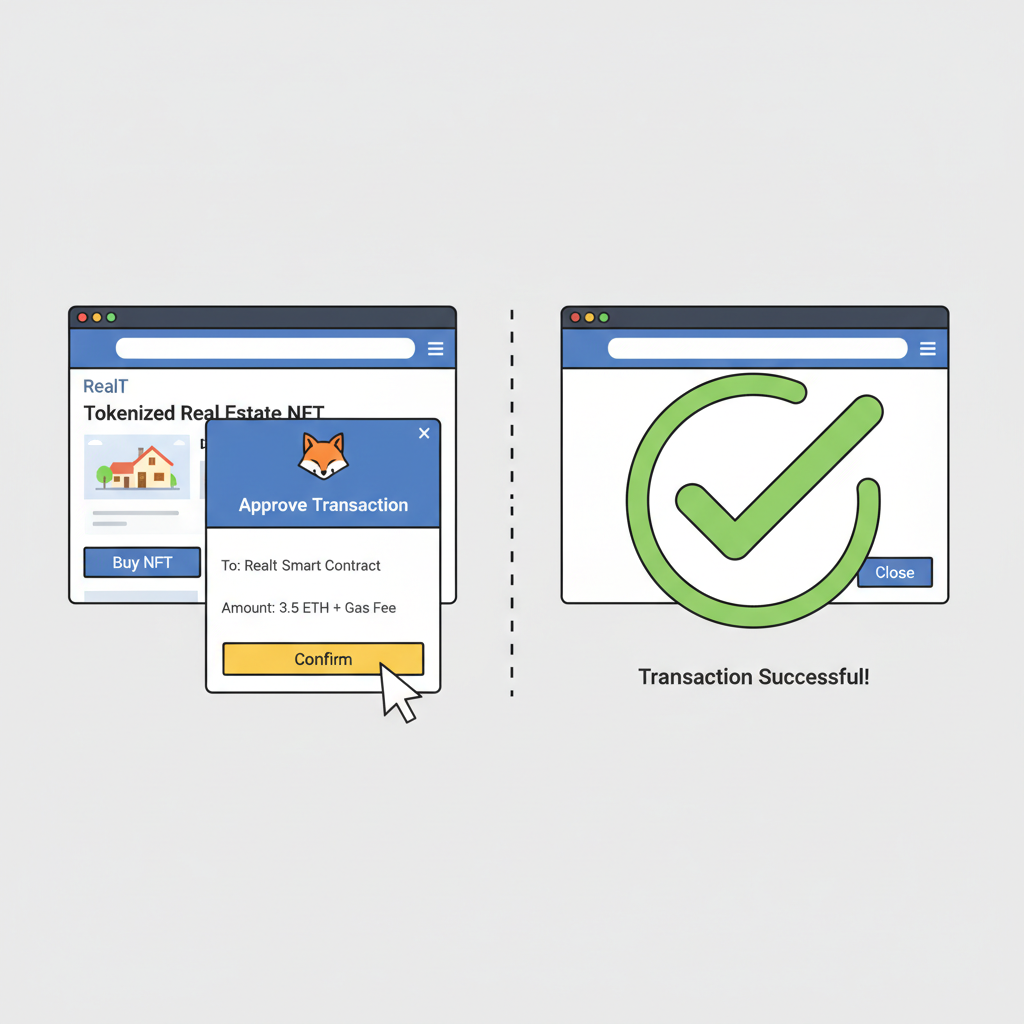

Dive in: A developer offloads a rental via a property token offering PTO. Legal wrappers like LLCs back the tokens, with oracles feeding rent data on-chain. Your NFT? It’s ERC-721 or ERC-1155 standard, tradable 24/7 on DEXes or NFT markets. Sell half your stake mid-month if yields spike. Binaryx tokenizes cash flows from villas, separating ownership from ops for pure income plays.

Tokenization reimagines RWAs via blockchain, with 2026 policies accelerating adoption – BDO USA.

Action step: Scan RealT. co for deals under $100. Yields hit 8-12% APY on some, beating bonds while ETH holds $2,077.75 steady. Risks? Regs like SEC custody rules loom, but compliant platforms thrive. Zoniqx lists Binaryx for Bali fractions at $500, but hunt for $50 gems on Base chain for gas savings.

Why $50 Real Estate Investments Crush Traditional Barriers

Entry at $50 means no more watching from sidelines. Landshare and RealT democratize U. S. markets; global players grab international yields sans visas. Liquidity’s king: List your NFT, cash out fast versus years for whole properties. Transparency? Every transaction on-chain, audited yields via oracles.

Per RWA. io’s 2026 platforms, enhanced compliance boosts trust. Costs? Platforms like Blockchain App Factory peg development smart but scaling’s cheap post-launch. US founders, heed Tokenizer. Estate’s checklist: SEC alignment or bust. Yet upsides dominate: Passive income streams, portfolio diversification in RWA real estate Base chain.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts in the context of tokenized real estate NFTs and fractional land ownership growth on Ethereum blockchain

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg) |

|---|---|---|---|---|

| 2027 | $2,500 | $3,500 | $6,000 | +68% |

| 2028 | $3,400 | $4,800 | $8,000 | +37% |

| 2029 | $4,500 | $6,500 | $11,000 | +35% |

| 2030 | $5,800 | $8,500 | $14,000 | +31% |

| 2031 | $7,500 | $11,200 | $18,500 | +32% |

| 2032 | $9,700 | $14,500 | $24,000 | +30% |

Price Prediction Summary

Ethereum prices are expected to experience robust growth from 2027 to 2032, propelled by the booming tokenized real estate sector. Fractional ownership platforms like RealT and Binaryx will drive higher network usage, fees, and burns. Average price projected to surge from $3,500 to $14,500, with bullish maxima up to $24,000 amid RWA adoption and regulatory tailwinds. Bearish minima reflect potential market corrections but remain progressively higher year-over-year.

Key Factors Affecting Ethereum Price

- Explosion in real estate tokenization platforms (e.g., RealT, Zoniqx) increasing ETH transaction volume and utility

- Fractional NFTs enabling $50 entry points for global investors, boosting Ethereum’s DeFi and NFT ecosystem

- 2026-2027 regulatory developments (e.g., SEC compliance for US RWAs) fostering institutional inflows

- Ethereum upgrades (e.g., scaling via L2s) supporting high-volume fractional ownership applications

- Post-2028 BTC halving bull cycle amplifying altcoin gains, including ETH

- Enhanced liquidity and passive income models attracting retail and institutional capital to ETH-based RWAs

- Competition from Solana mitigated by Ethereum’s dominance in smart contracts and security

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Grab a token today; timing’s everything in this volatile gold rush. Platforms evolve fast, yields compound, and your $50 could 10x on resale flips.

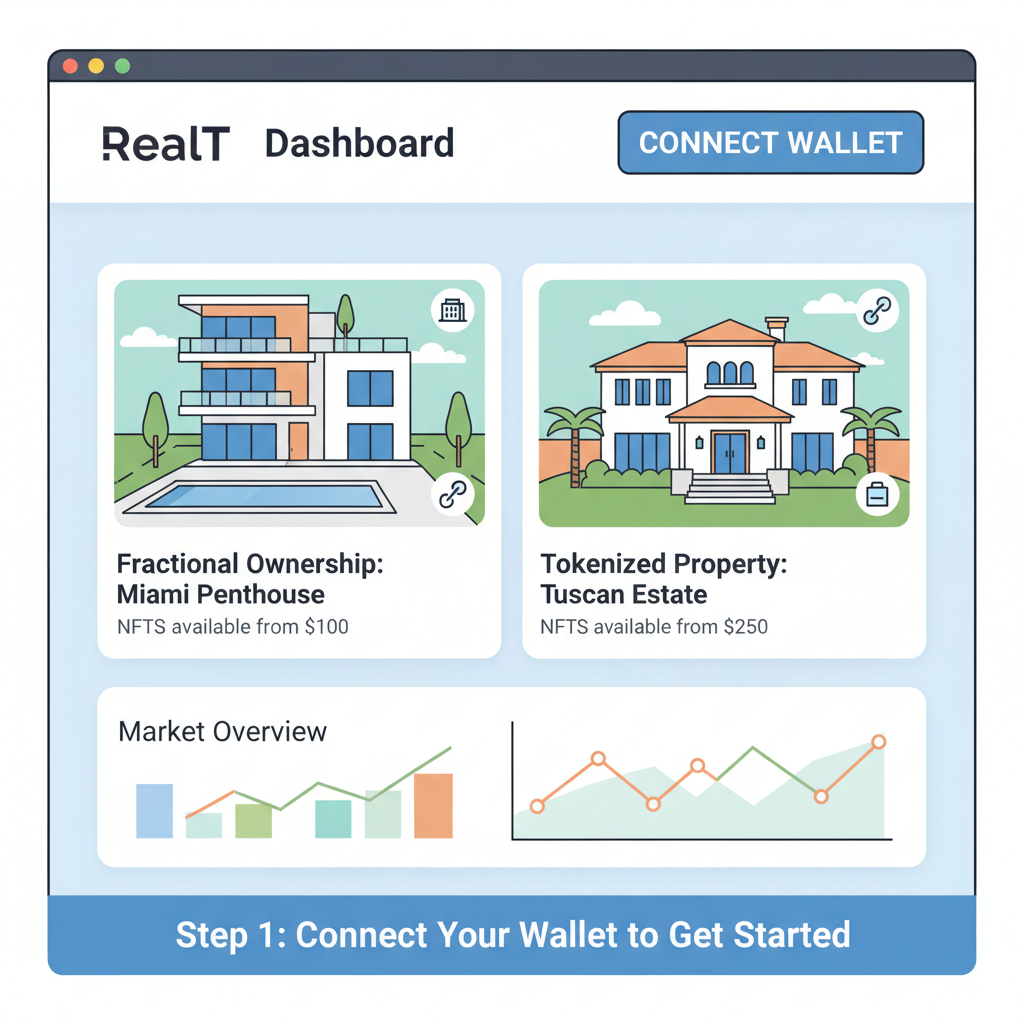

But how do you actually jump in without getting burned? Start by picking compliant platforms laser-focused on tokenized real estate NFTs. RealT leads with U. S. rentals tokenized into NFTs, payouts hitting your wallet weekly. Landshare follows, slicing luxury spots for passive yields. Both crush it on Base chain for dirt-cheap fees, tying into Ethereum’s $2,077.75 stability.

![]()

Top Platforms Crushing It: Your $50 Launchpad

RealT: Over 200 properties, 8-14% yields, global access. Binaryx: Bali villas at $500 entry, but scout sub-$100 deals. Zoniqx spotlights these for international plays. RWA. io ranks them tops for 2026 liquidity. Forget high barriers; these platforms handle compliance, oracles, and trades seamlessly.

Top Fractional RE Platforms

-

RealT: US rentals from $50, weekly payouts, high liquidity via tokenized NFTs. Invest now

-

Landshare: Passive income NFTs for fractional land shares—democratized ownership, easy liquidity.

-

Binaryx: Bali villas from $500, rental yields on blockchain—global access, transparent returns.

Diversify smart: Mix U. S. stability with exotic yields. Ethereum’s 24h change at and $28.76 signals green lights for RWA ramps.

Step-by-Step: Snag Your First Property Token

That’s your playbook. Execute fast; spots vanish as demand spikes per Antier Solutions’ fractional boom forecast.

Real estate tokenization platforms revolutionize investment by converting assets into blockchain tokens – realestatetokenizationplatform. com.

Pro tip: Hunt fractional ownership blockchain deals on Base for sub-$1 gas. Yields compound, liquidity lets you flip on pumps.

Risks? Yeah, But Here’s Your Edge

SEC rules tighten in 2026 per Tokenizer. Estate; custody and costs bite non-compliant ops. Market dips? ETH’s low at $2,041.26 shows volatility, but RWAs hedge crypto swings with real yields. Mitigate: Stick to audited platforms, diversify fractions, DYOR on legal wrappers.

Upshot? Rewards eclipse risks. Passive income beats staking APYs, global reach crushes local limits. BDO USA flags policy tailwinds accelerating this shift.

Scale up: Reinvest rents into more fractions. Watch Ethereum climb from $2,077.75; each tick juices RWA valuations. Platforms like Blockchain App Factory streamline builds, dropping costs for fresh token drops.

Front-run the herd. Tokenized fractions aren’t future tech; they’re your edge now. Load up on RWA real estate Base chain, ride yields, trade liquidity. Your portfolio’s about to level up big time.