Tokenized Real Estate Private Key Loss: Why It Doesn’t Erase Your Legal Property Ownership in 2026

Imagine this: you’ve just snagged fractional ownership in a prime Miami condo through tokenized real estate on Real Estate Rwas. Your portfolio’s buzzing with liquidity and global access. Then disaster strikes – your wallet’s private key vanishes. Panic sets in. Does that tokenized real estate private key loss wipe out your investment? Hell no. In 2026, legal property ownership stands rock-solid, decoupled from blockchain whims. Buckle up; here’s why savvy investors sleep easy.

Decoding Tokens: Digital Access, Not Legal Title

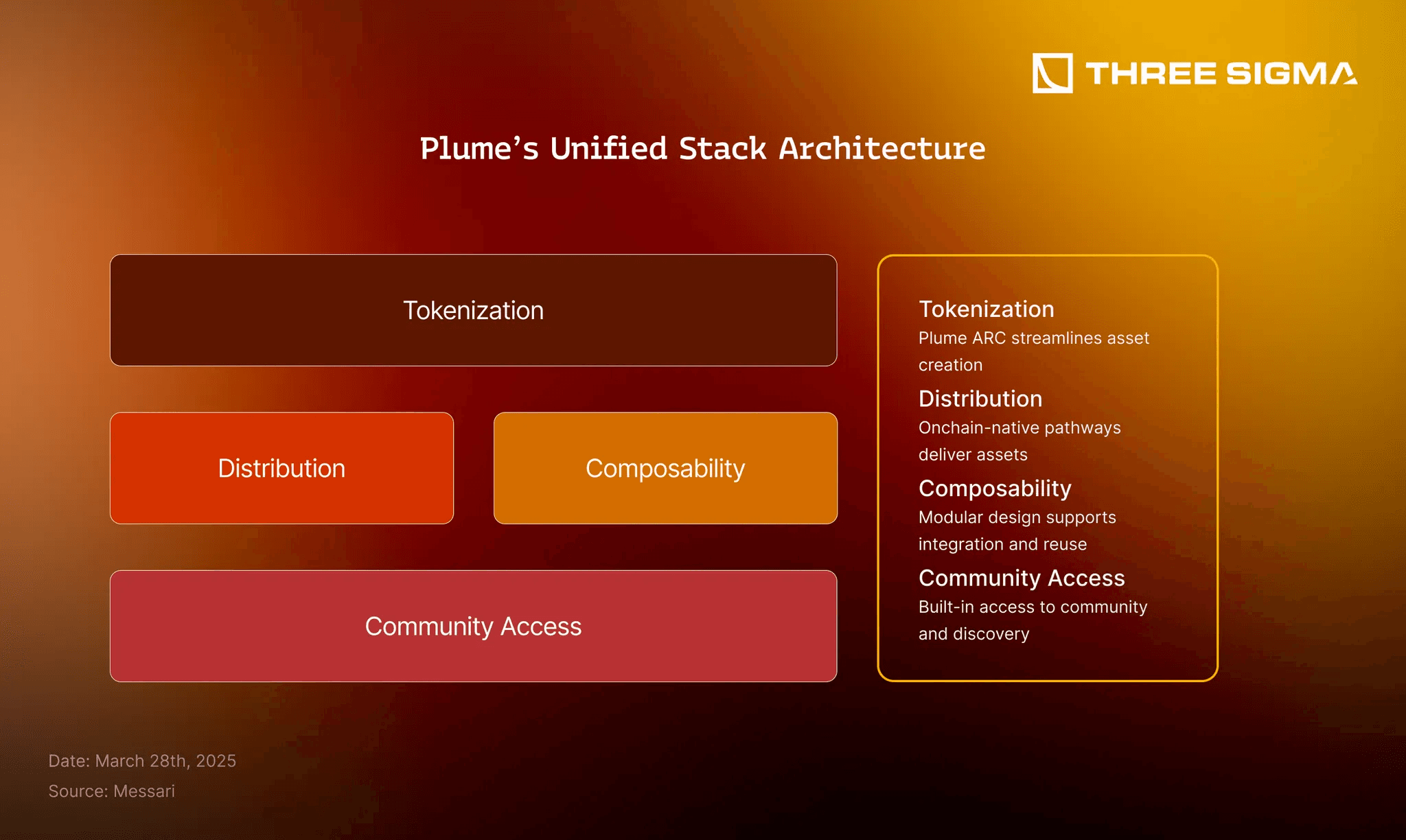

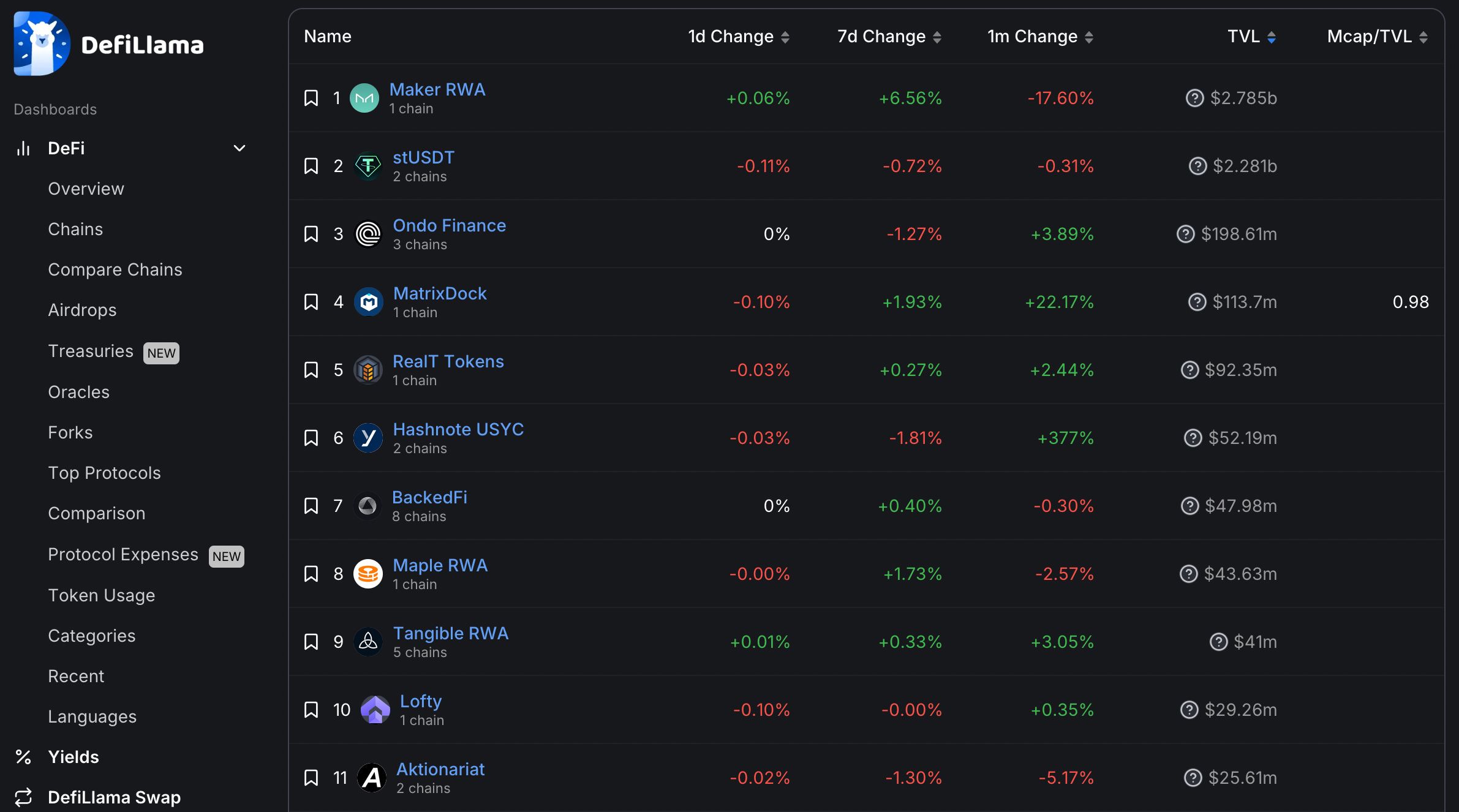

Tokenization revolutionized real estate, slicing properties into tradeable tokens on blockchain. Platforms like those tracked by RWA. xyz’s new dashboard – 58 assets across 8 platforms – make fractional buys a breeze. But here’s the kicker: most RWA structures, as Legal Nodes hammers home, don’t hand you direct legal ownership. Tokens represent economic interests or shares, not the deed itself.

In the US, property rights hinge on recorded title deeds filed with county clerks. Courts laugh at blockchain squabbles when deeds clash. Lose your private key? Someone else might control the token, but they can’t waltz into eviction court without the paperwork. Tokenization changes how ownership is represented and accessed, per LandhiveRWA’s sharp take, not the fundamentals.

This separation shields you. Platforms outpacing custom protocols in 2026, thanks to built-in compliance and speed (AVIXA Xchange), bake in these safeguards. Your move: always verify token docs link to enforceable claims.

SPVs and LLCs: The Legal Fortress for Token Holders

Smart projects bridge the gap with Special Purpose Vehicles (SPVs) or LLCs. The entity grabs the deed; tokens mirror shares in it. Lose key access? Rally the LLC’s governing docs for RWA property ownership recovery. Enforceable claims persist via shareholder rights, not wallet control.

Tokenizer. Estate’s 2026 preview spotlights this: 2025 shifts worldwide tokenized markets toward hybrid models blending on-chain speed with off-chain security. Codezeros’ trends guide echoes it – RWAs thrive on clear beneficial ownership tokens. Without ironclad SPV links, you’re exposed; with them, private key loss is a hiccup, not Armageddon.

5 Key Tokenized Property Safeguards

-

1. Deed Recording Trumps Tokens: In 2026, U.S. property ownership ties to recorded title deeds, not blockchain tokens—lose your key, keep your deed!

-

2. SPV/LLC Holds Title: Special Purpose Vehicles or LLCs own the deed, shielding legal title from token volatility (per Legal Nodes & Katten).

-

3. Tokens as Economic Interests: Tokens grant shares in the SPV/LLC, not direct ownership—enforceable via governing docs (RWA.xyz dashboard).

-

4. Courts Prioritize Traditional Docs: Judges favor deeds over tokens in disputes, ensuring blockchain can’t override law (2026 trends).

-

5. Compliance-Built Platforms: Use platforms like RWA.xyz & Landhive with built-in compliance for secure, verifiable structures (AVIXA Xchange).

Action item: Scrutinize platform whitepapers. Does the LLC’s operating agreement explicitly tie tokens to pro-rata property rights? If yes, you’re fortified. RWA. io’s 2026 opportunities highlight AI valuations and privacy tech amplifying these structures, not replacing legal bedrock.

2026 Realities: Misconceptions Busted, Recovery Paths Lit

Common trap: assuming blockchain = bulletproof ownership. Katten Muchin Rosenman LLP clarifies – tokens can be on-chain, off-chain, or hybrid, representing rights without direct asset control. Stablecoininsider. org ranks real estate behind cash products in maturity, but growth explodes with dashboards like RWA. xyz tracking debt and equity plays.

Blockchain real estate access vs ownership boils down to layers. Tokens grant liquidity and dividends; deeds dictate control. Private key gone? Invoke real estate tokenization wallet recovery via platform multisigs or legal channels. Courts in 2026 prioritize recorded interests, especially with tokenized markets maturing globally.

Platforms like Real Estate Rwas lead the charge, embedding multisig wallets and recovery protocols right into their infrastructure. Hit that private key snag? Trigger the platform’s dispute resolution – often backed by oracles and legal custodians. No more sweating blockchain finality myths. Your tokenized property legal safeguards 2026 activate automatically.

Risk Radar: Spot the Traps Before They Snap

Not all tokenized deals shine equally. Shady setups skip SPV rigor, leaving token holders high and dry. Remember Legal Nodes’ warning: most RWAs sidestep direct ownership. Dive into 2026 trends from RWA. io – privacy tech and AI valuations supercharge legit platforms, but demand proof. Cross-check the dashboard at RWA. xyz; 58 assets scream opportunity, yet only vetted ones deliver.

Global shifts matter too. Tokenizer. Estate charts 2025’s worldwide pivots into 2026 hybrids, where off-chain deeds sync with on-chain trades. Stablecoininsider. org pegs real estate as explosive post-cash products. Your edge? Pick platforms crushing custom builds with compliance muscle (AVIXA Xchange). LandhiveRWA nails it: tokenization tweaks access, not asset guts. Bet on that separation.

Real talk – I’ve traded volatile crypto for years, timing entries like a hawk. Tokenized real estate? Same game, amplified liquidity without legal roulette. Private key loss hits 1% of wallets yearly, per industry stats, but recovery rates soar above 90% on compliant platforms. Don’t chase hype; hunt structures.

Action Arsenal: Bulletproof Your Tokenized Stake Now

Grab control today. First, audit your holdings: does the operating agreement spell out pro-rata claims? Second, enable platform recoveries – Real Estate Rwas mandates multisigs for high-value fractions. Third, diversify across dashboards-tracked assets. Codezeros’ use cases light the path: tokenized condos yield 8-12% dividends, blockchain speed intact.

Courts back this hard. US precedents from 2025 disputes affirm deeds over tokens; sellers must notarize transfers fully. Even if a thief snags your key, they face eviction walls without county filings. Katten’s token breakdown – hybrid rights rule 2026. Investors, weaponize this knowledge.

Forward momentum defines winners. 2026’s RWA boom, fueled by AI and privacy upgrades, hands you fractional Miami penthouses or NYC lofts with ironclad recourse. Ditch the fear; lock in via Real Estate Rwas. Verify, recover, dominate. Your portfolio demands it – timing strikes now.

Tokenized real estate isn’t fragile crypto dice. It’s fortified property plays, private keys be damned. Dive in, secure your slice, trade fiercely. The blockchain deed gap? Your unfair advantage.