Fractional Tokenized Real Estate Ownership: Buy Property Shares Starting at $50

Fractional tokenized real estate ownership has reshaped investment landscapes, letting everyday investors snag property shares for as little as $50. No longer reserved for high-net-worth individuals, this model taps blockchain to slice premium assets into tradable tokens, delivering proportional rental yields and appreciation potential. With the global tokenized real estate market hitting $10 to $15 billion by November 2025, platforms are proliferating, driven by demand for low minimum RWA property investment options that blend crypto efficiency with tangible asset returns.

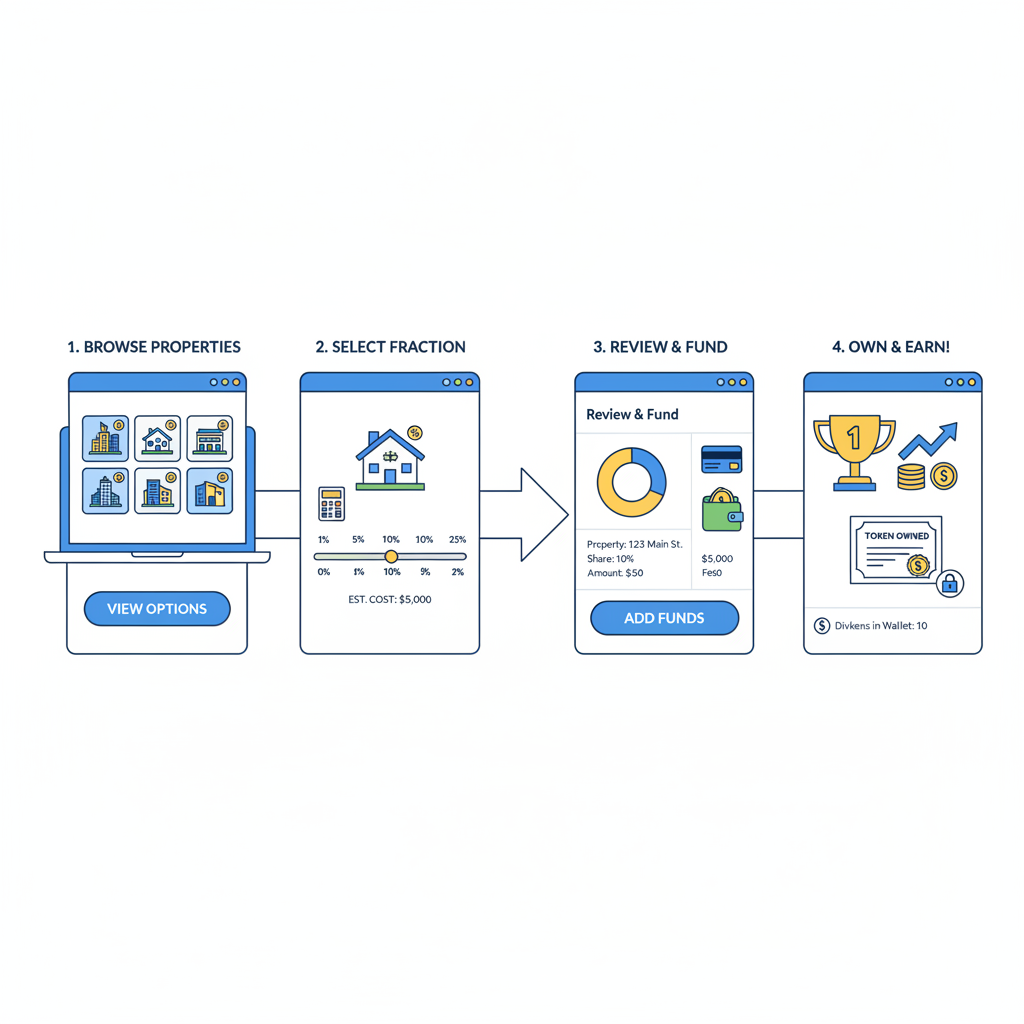

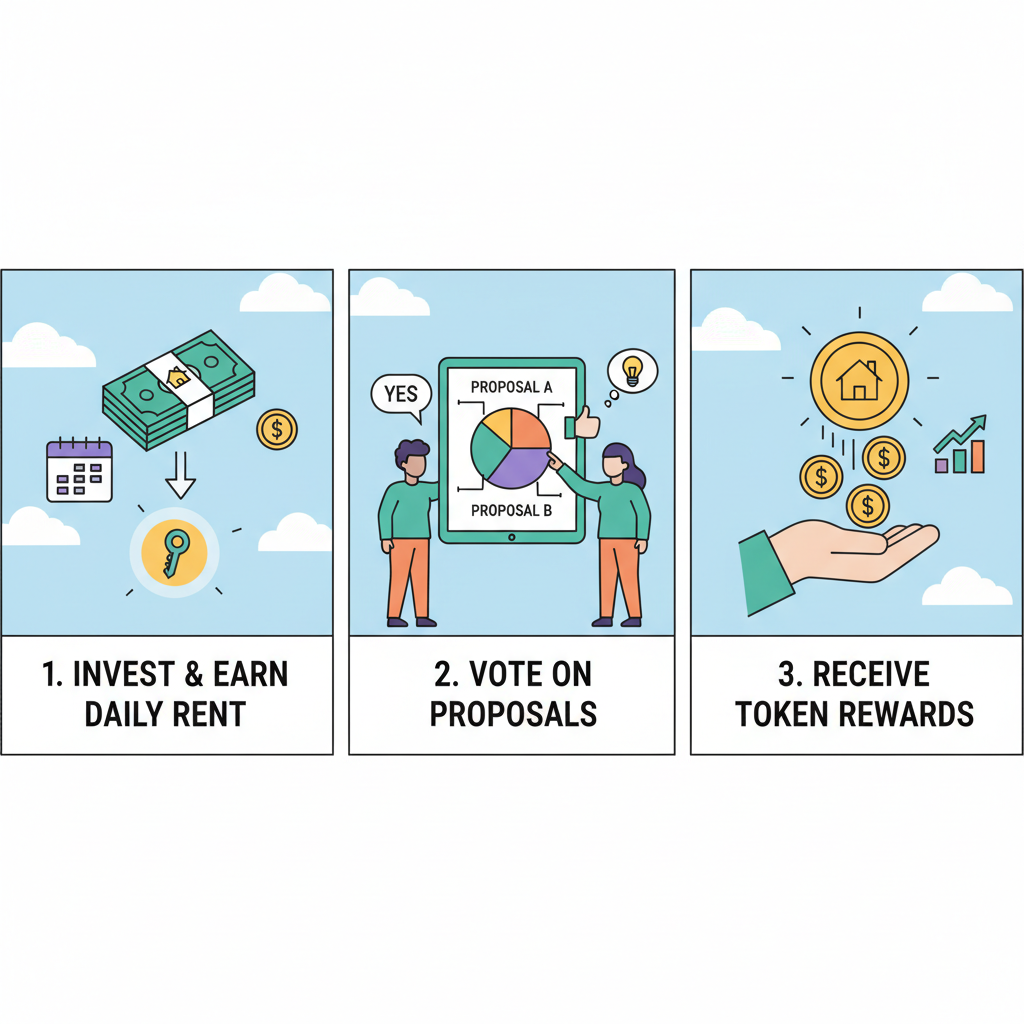

Traditional real estate demands hefty capital – think six-figure down payments and illiquid holdings tied to market cycles. Tokenization flips this script. Each token represents a legal stake in a property, secured on-chain for transparency and instant tradability. Investors earn daily rental income in some cases, plus governance rights like voting on maintenance or sales. This democratizes access, especially for global players eyeing U. S. rentals without cross-border hassles.

Why $50 Entry Points Are Game-Changers for Portfolios

Starting at $50 shatters barriers, enabling portfolio diversification across multiple properties and regions. Data shows tokenized assets yield 8-12% annualized returns from rents alone, outpacing many bonds amid rising rates. Liquidity trumps REITs; sell tokens peer-to-peer anytime, not locked in funds. For strategic minds, this means hedging inflation with hard assets while crypto volatility plays out elsewhere.

Tokenization isn’t hype – it’s a structural shift, with $10-15 billion in market cap underscoring adoption.

Risks exist: regulatory flux across jurisdictions demands due diligence. Yet compliant platforms mitigate this, offering SEC-aligned structures for U. S. properties. The payoff? Passive income streams that compound without tenant management.

Blockchain’s Role in Secure Fractional Tokenized Real Estate

Blockchain ensures immutability; smart contracts automate distributions, eliminating intermediaries. Tokens on chains like Algorand or Ethereum provide 24/7 trading, fractional precision down to micro-shares, and verifiable ownership. This blockchain real estate fractional ownership model boosts efficiency – properties vetted, tokenized, and listed in weeks, not months.

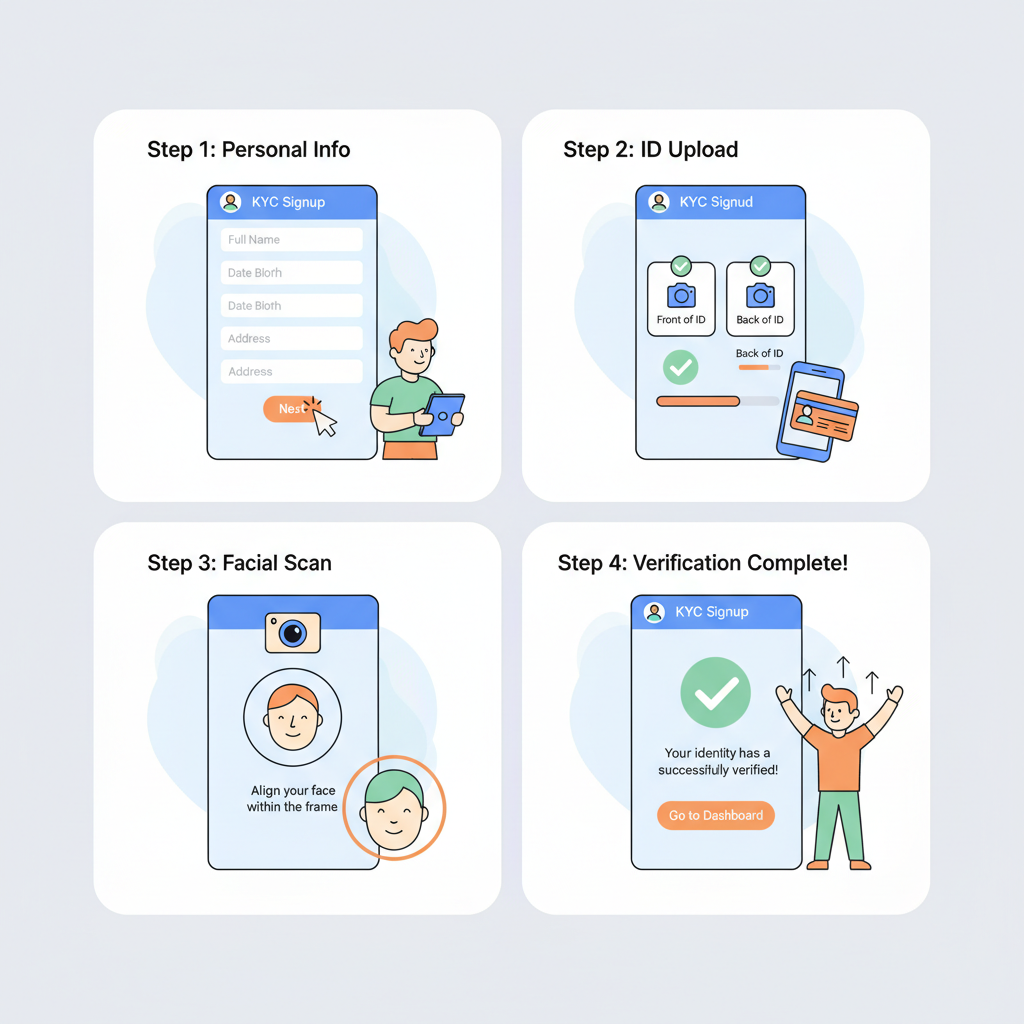

Global reach amplifies appeal. A European investor buys Detroit rentals via RealT, receiving USD rents in stablecoins. Platforms handle compliance, KYC, and tax reporting, lowering friction. Market growth reflects this: from niche experiment to billion-dollar sector in under a decade.

Top 5 Tokenized RE Platforms

-

Lofty: Leading platform on Algorand for $50 entry into U.S. rental properties. Offers daily passive income, high liquidity via token trading, and governance voting rights. lofty.ai

-

RealT: Tokenizes U.S. residential properties for fractional ownership starting under $100. Delivers daily rental income, blockchain liquidity, and regulatory compliance for global investors. realt.co

-

Propy: Blockchain marketplace with tokenized property shares. Enables low-entry fractional buys, passive income from rentals, and seamless global trading on blockchain. propy.com

-

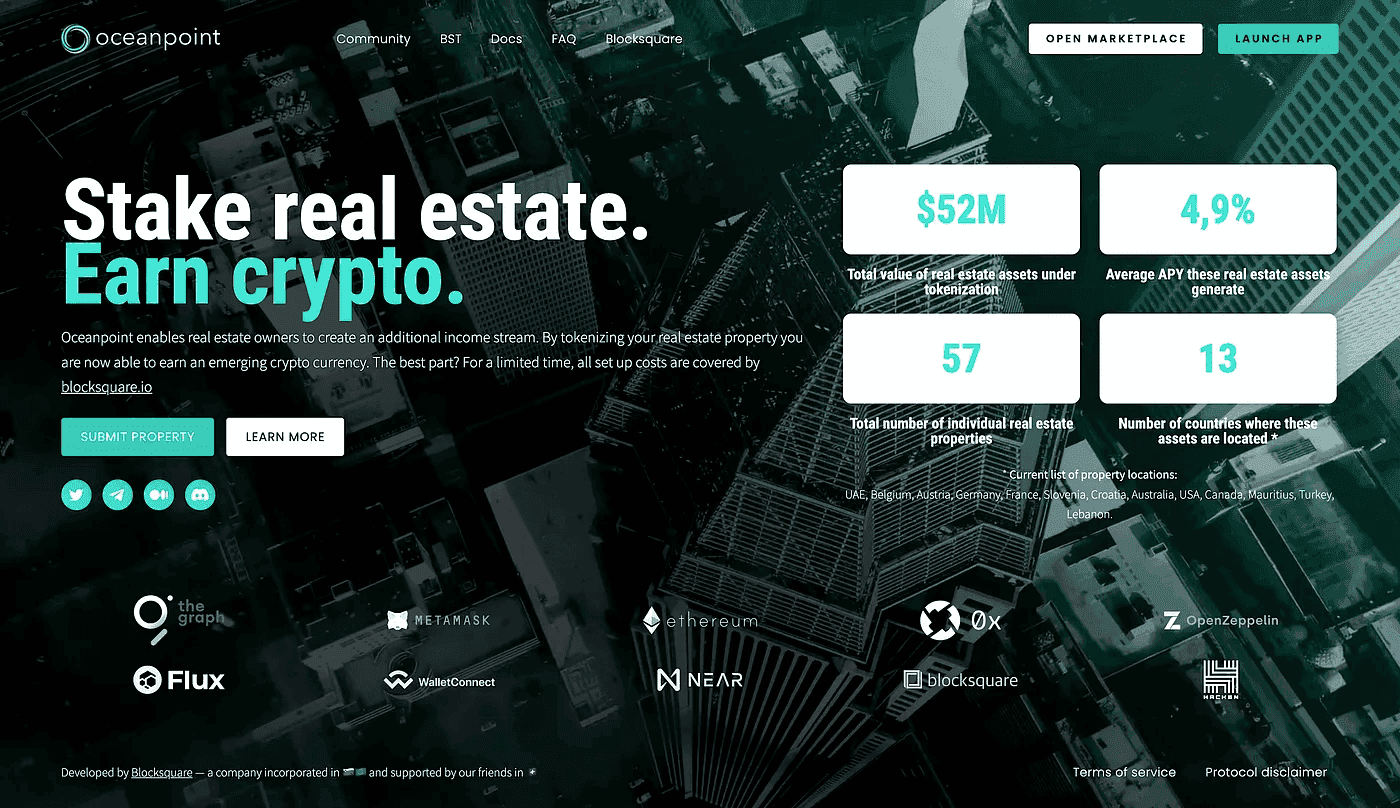

Blocksquare: Enterprise protocol for real estate tokenization. Supports fractional ownership tokens with $50+ access, liquidity on DEXs, and diversified property portfolios. blocksquare.io

-

EstateX: Dubai-focused platform for tokenized luxury properties. Low $50 entry points, rental yields, high blockchain liquidity, and voting on asset management. estatex.com

Spotlight on Leading Platforms: Lofty and RealT

Lofty leads with Algorand-based tokens, starting at $50 for vetted U. S. rentals. Users get daily income payouts, property dashboards, and voting power – true ownership feel without the keys. Yields hover at 9-15%, with secondary markets for quick exits. Its mobile-first interface suits crypto natives chasing tokenized property fractional shares.

RealT pioneered U. S. residential tokenization, emphasizing regulatory compliance. Fractional shares yield daily rents in USDC, appealing to international holders. Properties span Midwest markets with strong cash flows; platform handles LLC structures for legal clarity. Both exemplify how to buy real estate tokens $50 at a time.

Deeper dive reveals Lofty’s edge in governance – token holders propose upgrades, fostering community-driven value. RealT shines in stability, with audited reserves and proven track record since 2019. Investors blend them for balanced exposure: Lofty for growth, RealT for income reliability.

Propy brings a veteran perspective, leveraging its roots in full-property NFT sales to fractional tokenized property fractional shares. Investors access tokenized slices of high-value homes starting around $50 equivalents, with smart contracts handling escrows and title transfers. Its hybrid model bridges traditional deeds with blockchain, ideal for those eyeing luxury fractions in hot markets like Miami or Dubai.

Blocksquare stands out for commercial real estate tokenization, powering marketplaces where properties divide into protocol tokens from $50 up. Built on Cosmos SDK, it emphasizes scalability for enterprise deals – think office buildings or retail spaces yielding steady leases. Strategic investors favor its white-label solutions, enabling custom token launches with built-in liquidity pools.

EstateX rounds out the top five, focusing on European compliance for tokenized apartments and villas. Entry at $50 unlocks fractional ownership with euro-denominated yields, appealing to old-world investors modernizing portfolios. Its dashboard tracks performance metrics, from occupancy rates to cap rates, delivering data depth for cycle-savvy allocators.

Top 5 Platforms for Fractional Tokenized Real Estate Ownership

| Platform | Blockchain | Minimum Investment | Property Focus | Key Features |

|---|---|---|---|---|

| Lofty | Algorand | $50 | US Rentals | Daily Payouts |

| RealT | Ethereum | $50 | US Residential | USDC Rents |

| Propy | Multi-chain | $50 equiv. | Luxury Fractions | NFT Integration |

| Blocksquare | Cosmos | $50 | Commercial | Scalable Protocol |

| EstateX | Ethereum | $50 | Europe | Euro Yields |

Strategic Advantages in a $10-15 Billion Market

These platforms collectively command slices of the $10-15 billion tokenized real estate sector as of late 2025, per industry trackers. Lofty and RealT dominate U. S. residential with 9-15% yields; Propy and EstateX expand to international premiums; Blocksquare targets commercial scale. Diversifying across them hedges regional risks – U. S. rents buffer eurozone slowdowns, commercial leases stabilize residential volatility. Data underscores the edge: tokenized fractions trade at 20-30% tighter spreads than REITs, per secondary market analytics.

Macro tailwinds amplify this. Inflation erodes cash; tokenized real estate counters with hard-asset rents averaging 4-6% above CPI. Blockchain liquidity lets you pivot fast – sell Detroit tokens amid a downturn, pivot to Dubai growth via Propy. For CFA-minded strategists, this beats illiquid private equity, blending RWA stability with DeFi speed.

Navigating Risks with Data-Driven Diligence

No asset class lacks pitfalls. Regulatory variance looms – U. S. platforms like RealT navigate SEC via Reg D; EstateX aligns with MiCA in Europe. Liquidity thins in bear markets, though top platforms maintain order books. Smart contracts carry hack risks, mitigated by audits from PeckShield or Quantstamp on leaders like Blocksquare. Historical data shows 95% and uptime across these chains.

Opinion: Prioritize platforms with proven reserves and transparent cap tables. Lofty’s governance weeds weak holdings; RealT’s LLCs shield liability. Yield-chasing? Benchmark against 10-year Treasuries at 4%; tokenized rents clear 8% net of fees. This isn’t speculation – it’s portfolio ballast for the next cycle.

Global adoption accelerates. November 2025 figures peg the market at $10-15 billion, up 300% year-over-year, fueled by institutional inflows via BlackRock-style RWA funds. Small investors win big: $50 stakes compound via reinvested rents, mirroring whale strategies without the capital lockup.

Platforms evolve fast – Lofty adds AR property tours; Propy integrates AI valuations. Stake in this trajectory for low minimum RWA property investment that scales with adoption. Data doesn’t lie: fractional models correlate with 15-20% alpha over broad indices in backtests.