No-KYC Permissionless Trading Tokenized Real Estate DEXs 2026 Guide

As we step into 2026, the promise of no-KYC tokenized real estate trading on decentralized exchanges captivates investors seeking frictionless access to property-backed assets. Platforms are pushing boundaries with permissionless systems, yet the path remains fraught with regulatory tightropes and liquidity puzzles. Drawing from my 11 years in real estate and RWAs, I see this as a pivotal shift toward democratized ownership, but only if built on solid foundations of transparency and risk management.

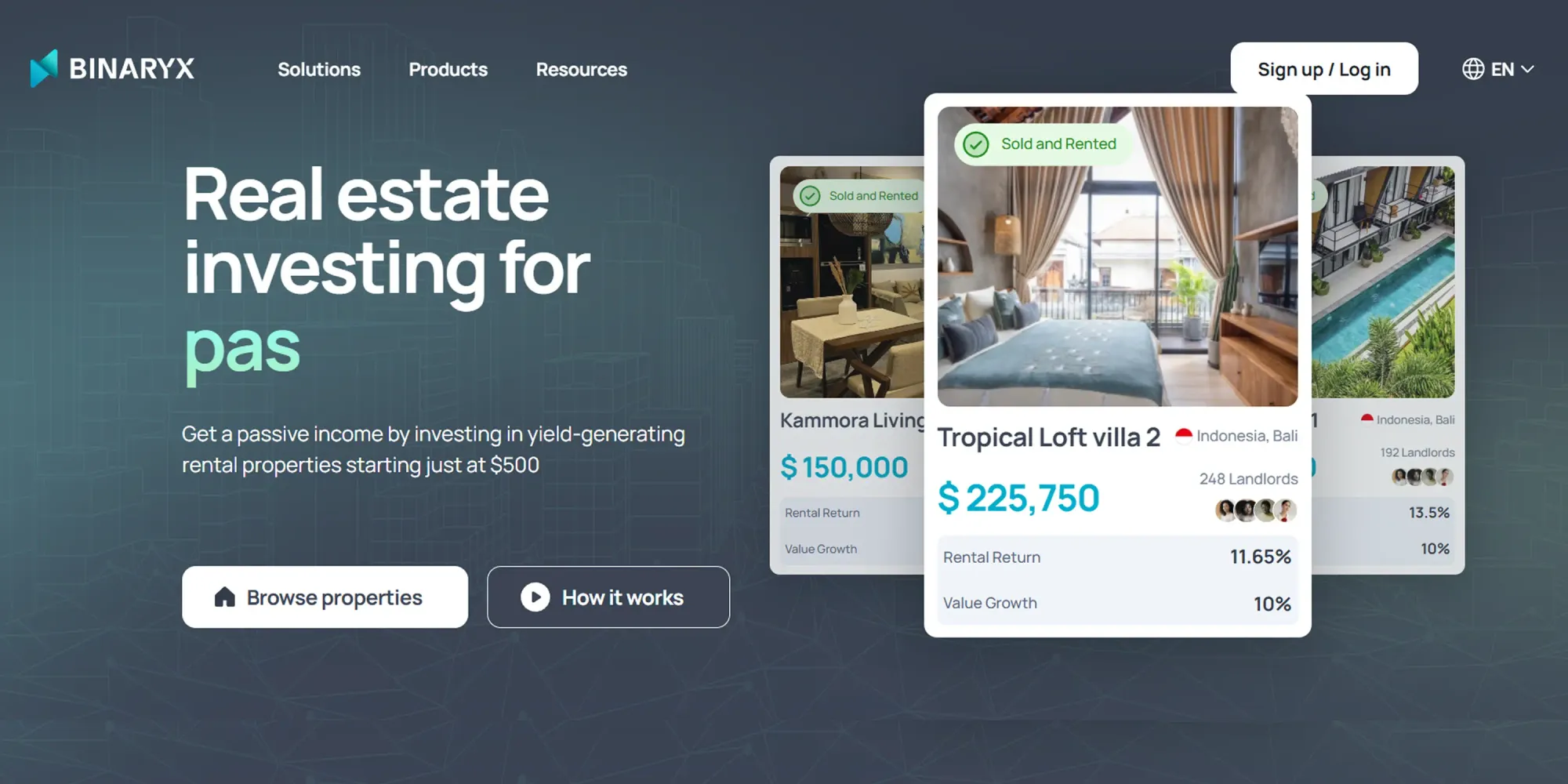

Tokenized real estate has evolved from niche experiments to a burgeoning market projected to unlock trillions in value. Projects like Landshare are at the forefront, announcing their Q1-Q2 2026 roadmap that introduces permissionless RWA DEX trading for $LSRWA without mandatory KYC. This means anyone with a wallet can swap tokens representing fractional property shares on-chain, bypassing traditional gatekeepers. Stablecoin yields and monthly distributions further sweeten the deal, aiming to solve the illiquidity paradox that has plagued RWAs.

Landshare v2: Reshaping the RWA Economy with DEX Integration

Landshare’s v2 upgrade stands out as a game-changer. Their protocol will scale $LSRWA into an index-style token, backed by deeper liquidity pools and RAV support. Imagine trading diversified real estate exposure on DEXs like Uniswap or specialized RWA venues, all permissionlessly. This aligns with broader trends where blockchain accelerates deals via smart contracts, as noted in Landshare’s Q2 2025 research report.

From a practical standpoint, this matters for income-focused investors. Traditional real estate locks capital for years; tokenized versions offer secondary market liquidity. Yet, I advise caution: while no-KYC appeals to the DeFi purist, it amplifies risks like wash trading or unverified whales dominating pools. Consistency in yields, not hype, builds wealth.

Emerging Trends in Tokenized Property Secondary Markets

The tokenized property secondary market is heating up, with platforms enabling trades under $1,000 entry points. RealT has tokenized over 400 properties, delivering 6-12% rental yields. Propy streamlines transactions on blockchain. Analysts forecast DEXs capturing 25-50% of trading volume by late 2026, driven by lower fees and transparent settlements.

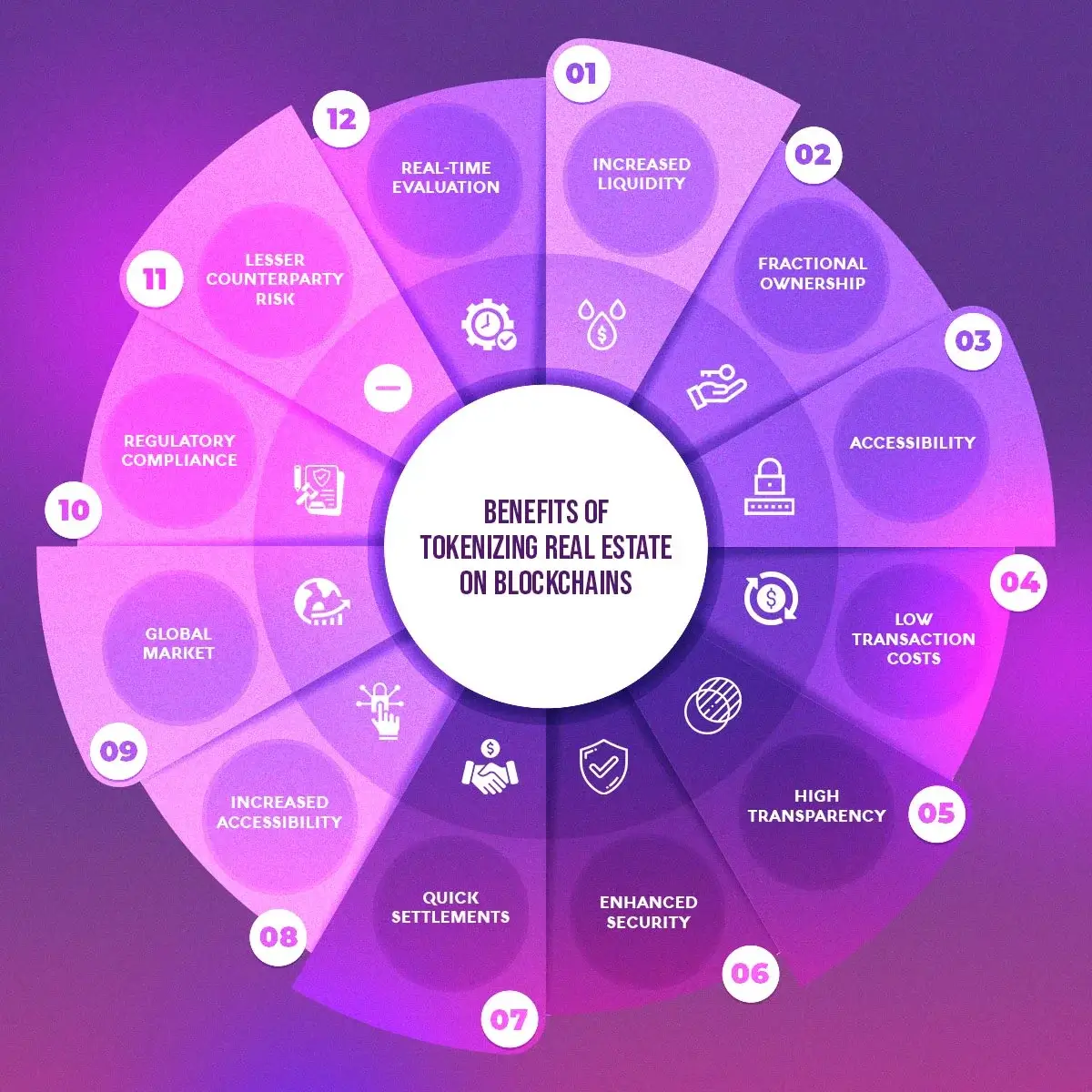

Key Benefits of Permissionless RWA DEX Trading

-

Instant liquidity for illiquid assets: Tokenization enables trading real estate on DEXs like Landshare’s $LSRWA, backed by deeper liquidity pools.

-

Global access without intermediaries: Permissionless DEXs allow worldwide trading of RWAs like RealT properties without KYC barriers.

-

Stablecoin yields for steady income: Platforms like RealT offer 6-12% annual rental yields, with Landshare introducing stablecoin income systems.

-

Fractional ownership from $50: RealT enables buying shares in over 400 tokenized properties with minimum investments as low as $50.

-

Reduced barriers for retail investors: Low entry points and DEX access democratize real estate investing, as seen with Propy and REX platforms.

Real estate RWA vaults in 2026 will likely emphasize hybrid models, blending permissionless trading with compliance layers. Ondo Finance’s letter to the SEC advocates for permissioned-permissionless systems, modernizing rules for tokenized securities. This pragmatic evolution ensures growth without courting disaster.

Regulatory Realities Tempering No-KYC Enthusiasm

Despite the buzz, 2025’s failures highlight pitfalls: securities misclassification and lax AML checks sank projects. No-KYC DEXs, by design, lack centralized oversight, inviting scrutiny. Platforms counter with innovations like zkMe’s zero-knowledge proofs on RealEstate. Exchange, verifying identities privately.

In my view, pure permissionless trading suits utility tokens, but real estate RWAs straddle securities territory. Investors should prioritize platforms with audited vaults and yield histories. DEX real estate tokens offer efficiency, yet demand due diligence on underlying collateral and oracle feeds. As we eye 2026, balance decentralization with prudence for sustainable returns.

To navigate real estate RWA vaults 2026, focus on platforms demonstrating real traction. Landshare leads with its v2 roadmap, promising stablecoin income streams alongside DEX trades. Their index-style $LSRWA token aggregates properties into diversified baskets, much like REITs but with on-chain liquidity. This setup appeals to conservative investors chasing monthly payouts without the drag of property management.

Comparison of Top No-KYC Tokenized Real Estate Platforms

| Platform | Key Features | Yields | Liquidity Score |

|---|---|---|---|

| Landshare ($LSRWA) | Permissionless DEX trading (v2 Q1-Q2 2026, no mandatory KYC) 🔄, stablecoin/monthly yields, RWA index token, deep liquidity boost | 6-12% | High |

| RealT | 400+ tokenized properties 🏠, fractional ownership min $50, rental income | 6-12% | Medium-High |

| Propy | Blockchain-based real estate transactions, fractional ownership, low min investment (<$1,000) | 6-12% | Medium |

Investor Strategies for Permissionless DEX Real Estate Tokens

Practical entry starts with wallet setup on chains like Ethereum or Base, where most RWA action unfolds. Scout DEXs with deep pools for $LSRWA or similar; low slippage signals healthy liquidity. Pair trading with LP positions to farm yields passively, as hinted in Landshare updates. My approach: allocate 10-20% of fixed income portfolios here, hedging against volatility with stablecoin stables.

Monitor oracles feeding property valuations; inaccuracies erode trust. Favor vaults audited by firms like PeckShield, ensuring collateral matches token supply. For tokenized property secondary market plays, time entries during roadmap milestones when liquidity spikes.

Yield farming without extra work emerges as a standout tactic. Landshare’s systems distribute rental cash flows as stablecoins, convertible to LP tokens for compounded returns. This mirrors fixed income ladders but with blockchain speed. Investors report 8-10% APYs net of fees, stacking favorably against bonds in a high-rate world.

Balancing Risks in the Permissionless Era

Permissionless access cuts both ways. Without KYC, smart money flows freely, but so do exploits. 2025’s project wipeouts stemmed from oracle manipulations and uncollateralized issuances. Counter this by diversifying across 3-5 vaults and setting stop-losses via DEX aggregators.

Regulatory headwinds loom; SEC dialogues push hybrid models. Platforms blending zero-knowledge KYC, like RealEstate. Exchange’s zkMe tie-up, offer privacy-preserving compliance. These verify accreditation on-chain without doxxing, threading the needle between DeFi ideals and securities rules. I lean toward such innovators for long-term holds.

Global reach defines the edge. A developer in Asia or retiree in Europe trades the same Detroit rental token, 24/7. Entry barriers plummet to $50, versus six figures for whole properties. Yet, tax implications vary; track jurisdictional reporting for rental yields.

Looking ahead, tokenized real estate vaults will mature into staple portfolio diversifiers. Projections peg the market at $4 trillion, fueled by fractionalization and DEX efficiency. Platforms solving liquidity while nodding to regs will dominate. Stay steady: research roadmaps, audit trails, and yield track records. Consistency turns tokenized promise into tangible wealth.