Pooled vs Single-Asset Tokenized Real Estate: Boosting Liquidity and Diversification for RWA Investors

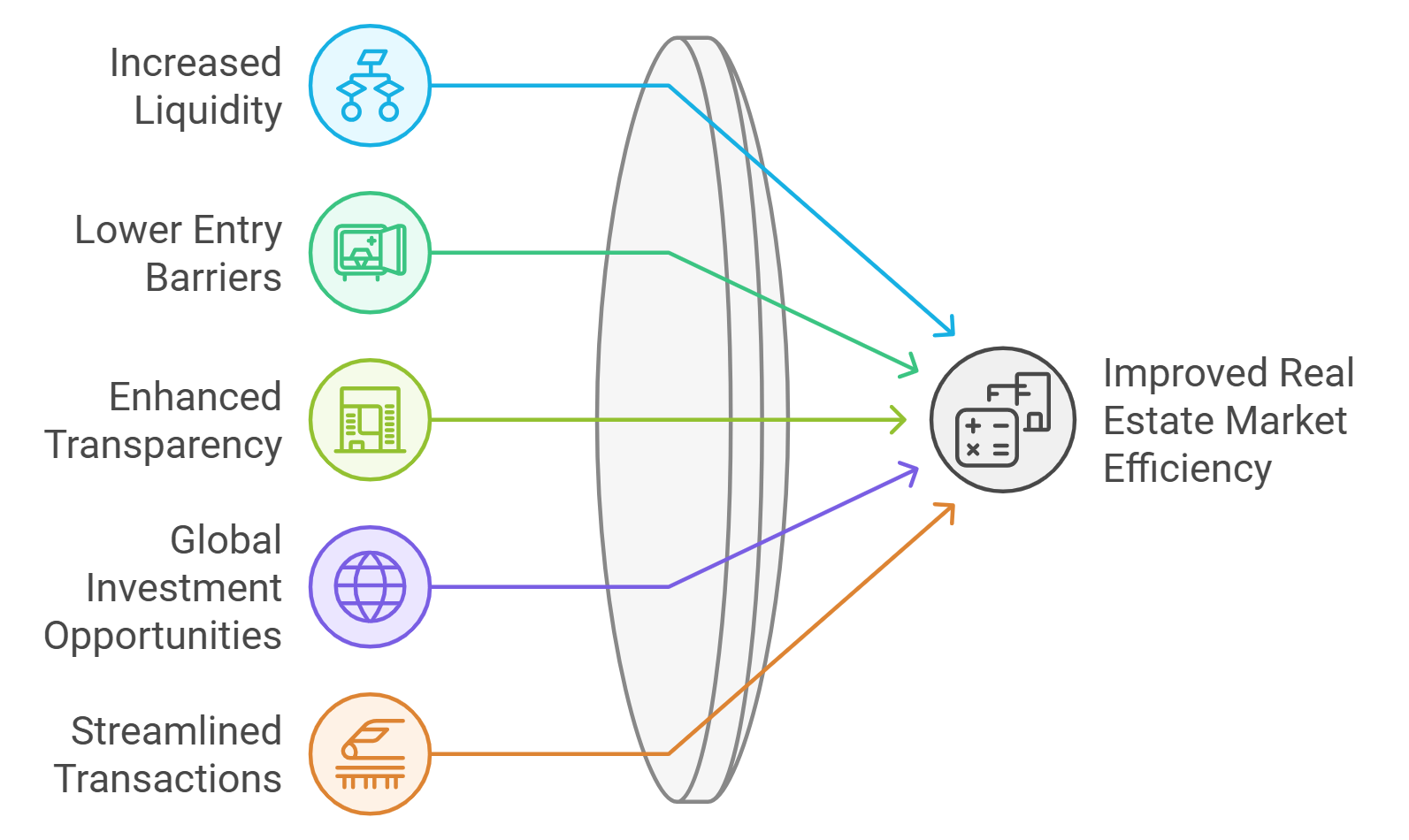

In the rapidly evolving world of real-world assets (RWAs), tokenized real estate stands out as a transformative force, bridging traditional property investment with blockchain efficiency. Investors now face a pivotal choice: pooled RWAs real estate, which aggregates multiple properties into a diversified fund, or single-asset tokenization, tying ownership to one specific building. Both models supercharge tokenized real estate liquidity and open doors to sophisticated RWA diversification strategies, but they cater to different appetites for risk and control. As a portfolio manager who’s navigated these waters for over a decade, I see pooled options building resilience through scale, while single-asset plays reward those with a keen eye for standout properties.

![]()

Pooled tokenized real estate has gained traction because it mirrors the securitization strategies that stabilized markets for generations. By bundling diverse assets – think urban apartments alongside suburban offices – into on-chain property pools, these funds spread exposure across geographies and property types. This isn’t just theoretical; platforms like Centrifuge’s Tinlake demonstrate how such aggregation draws deeper liquidity pools, making trades faster and cheaper than ever. Investors benefit from economies of scale in management, where shared overheads boost net returns without the headache of solo property oversight.

Why Pooled Structures Excel in Risk Management

Diversification remains the cornerstone here. A single tenant default or local market dip barely ripples through a well-constructed pool, safeguarding capital in ways single holdings can’t match. Recent data underscores this: pooled assets often see secondary markets hum with activity, as broader appeal pulls in institutional players alongside retail enthusiasts. For those building resilient portfolios, these pools align perfectly with strategic allocation, much like the multi-asset funds I’ve managed for high-net-worth families.

Advantages of Pooled Tokenized Real Estate

-

Diversification Across Assets: Spread risk across multiple properties in a single pool, reducing the impact of any one underperforming asset.

-

Enhanced Liquidity: Attracts broader investors to active secondary markets, as seen with Centrifuge’s Tinlake protocol for easier trading.

-

Operational Efficiencies: Economies of scale from pooled management lower administrative costs and boost net returns.

-

Fractional Ownership: Low entry points from $50 enable accessible investing, similar to platforms offering pooled real estate tokens.

Single-Asset Tokenization: Power and Perils

Contrast that with single-asset tokenization, where precision meets potential pitfalls. Here, you buy into a specific property – say, a high-rise in Miami or a warehouse in Texas – gaining direct exposure to its performance. This appeals to investors chasing outsized gains from booming locales, with crystal-clear transparency on rental yields and valuations tied to one asset. Platforms like RealT exemplify this, tokenizing hundreds of properties with automated daily rent payouts starting at minimal stakes.

Yet, single-asset tokenization risks loom larger. Without diversification, a vacancy surge or zoning change can hit hard, amplifying volatility. Liquidity, while improved over traditional sales that drag on for months, may lag behind pools due to narrower buyer interest. In my experience, this model suits satellite positions in a broader portfolio, not core holdings, demanding rigorous due diligence on location and management quality.

Navigating Liquidity in Tokenized Real Estate

Liquidity defines the edge of both approaches, turning illiquid bricks into tradable tokens. Pooled RWAs real estate shines here, fostering vibrant secondary markets akin to stock exchanges, where fractional shares trade seamlessly 24/7. Single-asset tokens, though liquid compared to deeds and closings, depend on property allure; niche assets might trade slower, echoing traditional hurdles in thinner markets.

Regulatory nuances add layers. U. S. and EU frameworks demand compliance, favoring onshore pools for institutional trust, while offshore structures offer flexibility. Technological safeguards, from audited smart contracts to platform security, mitigate risks across the board. For strategic investors, blending both – pools for stability, singles for alpha – crafts RWA diversification strategies that weather cycles effectively.

Recent institutional moves, like BlackRock’s forays into tokenization, signal maturing infrastructure. Their BUIDL fund, managing $2.9 billion, hints at the scale possible, though focused on treasuries, it paves the way for real estate parallels. As secondary markets deepen, expect tokenized real estate’s portfolio impact to rival equities in accessibility and flow.

Blending these models into a cohesive strategy unlocks the full potential of tokenized real estate liquidity. For conservative allocators, dedicate 60-70% to pooled RWAs real estate, leveraging their stability as an anchor. Use single-asset tokens for the remaining 30-40%, targeting high-conviction picks in growth corridors like Sun Belt logistics hubs. This hybrid approach mirrors the multi-asset mandates I’ve steered, balancing yield with upside while curtailing drawdowns.

Real-World Performance Insights

Examine platforms in action: RealT’s single-asset model delivers average yields of 8-12% through daily rent distributions, but variance ties to individual property health. Pooled offerings, such as those on Centrifuge, average steadier 6-10% returns with lower volatility, thanks to asset mixing. Secondary trading volumes for pools often exceed singles by 3-5x, per emerging market scans, underscoring why on-chain property pools draw institutional flows. Investors eyeing resilience prioritize these dynamics, especially amid economic shifts.

Liquidity Comparison: Pooled vs. Single-Asset Tokenized Real Estate

| Model | Avg Secondary Volume | Trade Speed | Risk of Illiquidity |

|---|---|---|---|

| Pooled | High 🚀 | Instant ⚡ | Low ✅ |

| Single-Asset | Medium 📊 | Days ⏳ | High ⚠️ |

Regulatory evolution bolsters confidence. U. S. frameworks under SEC scrutiny favor compliant pools, while EU’s MiCA paves clearer paths for tokenized funds. Offshore options, though nimble, carry jurisdictional premiums best weighed against onshore predictability. Technological maturity addresses early bugs; audited protocols now underpin billions in RWAs, minimizing smart contract fears.

For hands-on traders, secondary markets on platforms like Real Estate Rwas simplify execution. Focus on depth metrics – bid-ask spreads under 1% signal robust liquidity. As adoption swells, expect on-chain utilities like lending against tokens to amplify returns, turning static holdings into yield engines.

Looking ahead, 2025 forecasts point to explosive growth: tokenized real estate AUM could hit $16 billion, per analyst consensus, driven by yield-hungry institutions. Innovations like AI-driven property selection and cross-chain interoperability will erode remaining frictions. For forward-thinkers, this isn’t hype – it’s the next diversification frontier, where blockchain unlocks property’s latent power. Anchor your portfolio here, and resilience follows, much as diversified strategies have for my clients through thick and thin. Platforms like Real Estate Rwas stand ready, with intuitive tools for seamless entry into this liquidity-rich ecosystem.

Whether scaling via pooled RWAs real estate or pinpointing gems through singles, the choice hinges on your horizon. I’ve seen both thrive in tandem, fortifying portfolios against uncertainty. Step in strategically, and tokenized real estate becomes your edge in an on-chain world.