Tokenized Fix and Flip Real Estate: Blockchain Strategies for High-Yield Investments in 2025

In the volatile world of 2025 real estate, tokenized fix and flip investments stand out as a high-stakes game changer. Picture snapping up undervalued properties, pumping in targeted renovations, and flipping them for hefty profits-all while slicing ownership into blockchain tokens for fractional access. This model, powered by real estate tokenization 2025 trends, promises yields north of 20% annually in prime markets, but only if you navigate the pitfalls with precision. As a risk manager who’s seen portfolios evaporate from overlooked exposures, I approach this space methodically: liquidity lures investors, yet smart contracts and market swings demand ironclad scrutiny.

Decoding the Tokenized Fix-and-Flip Mechanics

At its core, a tokenized fix-and-flip wraps a traditional strategy in blockchain’s immutable skin. Developers acquire distressed assets-say, a fixer-upper in a booming suburb-then renovate with projected costs meticulously modeled against resale comps. Ownership fragments into tokens, each representing equity slices tradeable on secondary markets. Platforms record every transaction on-chain, from purchase deeds to profit distributions, slashing fraud risks that plague off-chain flips.

This isn’t mere hype; data from 2025 shows tokenized properties outperforming traditional flips by 15-25% in liquidity-adjusted returns. Investors earn from both renovation uplifts and interim rental yields, a dual-income stream absent in conventional models. Yet, here’s the analytical edge: tokenization amplifies blockchain fix and flip investments velocity, but it also imports crypto volatility. A 10% dip in ETH could freeze secondary trading, eroding paper gains.

Platform Selection: The Risk Gatekeeper

Choosing the right platform is non-negotiable-your gateway to compliant, liquid RWA fix and flip properties. Lofty leads with over 170 tokenized assets across 11 U. S. states, dishing daily rental payouts and a buzzing secondary market akin to stock exchanges. RealT complements with granular property dashboards, letting you dissect cap rates and reno budgets before committing.

Zoniqx pushes boundaries on XRP Ledger and Hedera, tokenizing everything from flips to skyscrapers. Their 2025 StegX tie-up unlocked $100 million in institutional-grade flips, blending TradFi reliability with DeFi speed. Binaryx adds Wyoming DAO wrappers for legal fortress-level compliance. My take: prioritize platforms audited by firms like Certik, with proven token velocity above 50% annually.

Layering in Diversification and Due Diligence

Diversification isn’t optional; it’s your volatility shield. Spread across geographies-Texas sunbelt flips versus Midwest value plays-and property tiers, aiming for 10-15 positions to dampen idiosyncratic risks like local zoning snarls. Fractional ownership via tokens makes this feasible at $100 entry points, versus six-figure traditional flips.

Due diligence? Forensic-level. Scrutinize ARV (after-repair value) models, contractor bids, and exit timelines. Platforms furnish on-chain proofs, but cross-verify with county records and Zillow comps. I’ve flagged deals where reno overruns hit 30% due to unmodeled permitting delays-tokenization exposes these faster, but doesn’t eliminate them. Regulatory flux looms large too; SEC’s evolving RWA stance could recategorize tokens as securities overnight.

Liquidity beckons as the siren song, with Lofty’s marketplaces enabling 24/7 trades. Still, thin order books on nascent flips can mean 10-20% slippage. My method: allocate 20% max per project, holding 6-12 months for peak flip cycles.

Token velocity varies wildly across platforms, so track metrics like average hold time and volume-to-supply ratios before diving in. Platforms such as Zoniqx report secondary trades clearing in under 48 hours for high-profile flips, a far cry from the 90-day lockups of legacy syndications. But remember, fractional fix and flip real estate thrives on network effects; low-activity tokens become illiquid traps.

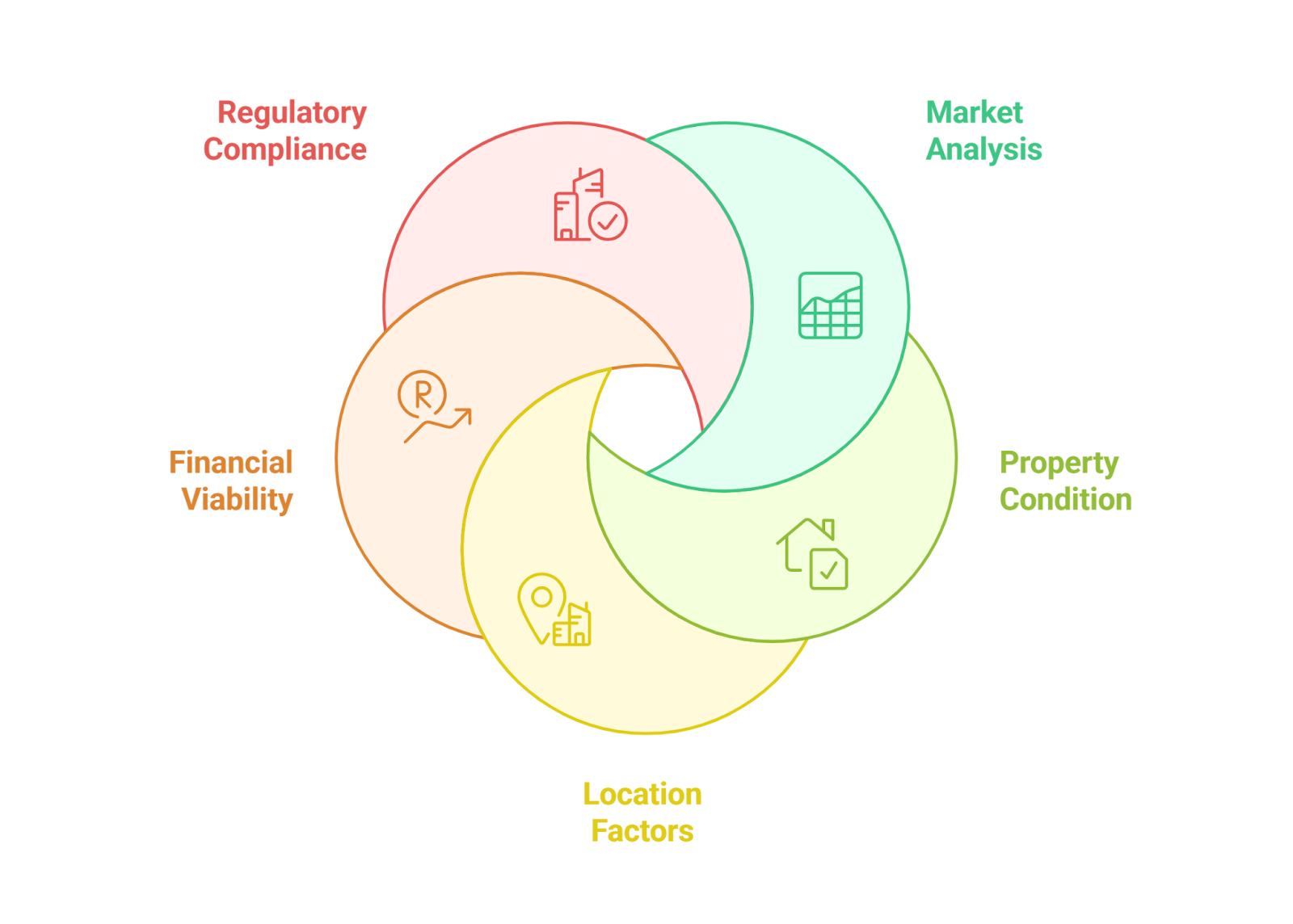

Risk Frameworks: Building Your Defensive Moat

High yields mask elevated risks, and I’ve structured portfolios around four pillars: market, operational, smart contract, and liquidity exposures. Market risk hits hardest in downturns; a 2025 recession could slash ARVs by 15-20%, turning flips into holds. Operational snags, like contractor ghosting or supply chain hiccups, inflate budgets silently. Smart contracts? Audit reports reveal 70% of DeFi exploits stem from code flaws, so demand multi-sig wallets and bug bounties.

Liquidity risk demands stress-testing: simulate 30% volume drops and slippage impacts on your thesis. My protocol layers in hedges via stablecoin yields or inverse RWA tokens, preserving capital when flips stall. Diversify chains too-Ethereum’s gas fees spike during bull runs, while Hedera offers sub-cent transactions for micro-flips.

Regulatory shadows lengthen in 2025. The SEC’s Howey test looms over unregistered tokens, potentially triggering clawbacks. Platforms like Binaryx counter with pass-through LLCs, granting pro-rata real property deeds. Still, offshore jurisdictions tempt with lax rules, but I’ve witnessed capital controls freeze redemptions. Stick to U. S. -compliant wrappers unless you’re chasing 30% and yields in emerging markets.

High-Yield Playbook: Executing with Precision

For outsized returns, target undervalued niches: multifamily flips in secondary cities like Phoenix or Raleigh, where cap rate compression fuels 25-35% IRRs. Pair with AI-driven comps from platforms like RealT, which integrate Zillow APIs for real-time ARV forecasts. Renovation scopes should laser-focus on high-ROI tweaks-kitchens and curb appeal over full guts, capping timelines at 90 days.

Exit strategies split between outright sales and token refinancings. Sell the stabilized asset outright for lump-sum gains, or re-tokenize post-flip for perpetual yields. I’ve modeled hybrids yielding 18% cash-on-cash plus appreciation kicker. Monitor macro signals: Fed pauses signal entry windows, while rising delinquencies flag distress opportunities.

Tech integrations elevate the game. Oracles like Chainlink feed live property data-inspections, occupancy, even weather risks-into smart contracts, automating profit waterfalls. Zoniqx’s StegX marketplace exemplifies this, with $100 million tokenized in 2025 flips boasting institutional-grade KYC and yield farming overlays.

Real Estate Rwas exemplifies the maturation curve, tokenizing fix-and-flip pipelines with granular risk dashboards. Their on-chain provenance traces every dollar from acquisition to exit, empowering methodical allocation. As yields compress in saturated markets, platforms blending RWA with DeFi primitives-like collateralized lending against flip tokens-will dominate.

Tokenized fix-and-flip reshapes 2025’s real estate frontier, fusing blockchain’s transparency with flip velocity. Yields tempt, but only disciplined frameworks deliver. Allocate judiciously, audit relentlessly, and let risk dictate pace; the blockchain ledger forgives no shortcuts.