Fractional Ownership of Tokenized Airbnb Properties: Earn Rental Yields on Blockchain Starting at $100 in 2025

Imagine owning a slice of a sun-soaked beach villa in Bali or a cozy urban loft raking in nightly bookings on Airbnb, all without dropping six figures or dealing with property management headaches. In 2025, fractional ownership of tokenized Airbnb properties makes this reality possible, letting you dive into tokenized real estate rentals 2025 with as little as $50 to $100. Blockchain turns high-demand short-term rentals into tradable digital tokens, delivering RWA Airbnb investment yields straight to your wallet. As a crypto analyst who’s tracked this space for years, I’m buzzing about how platforms are blending DeFi perks with real-world passive income from property tokens.

This isn’t hype; it’s a seismic shift. Real estate tokenization hit over $18 billion in project value this year, per Fire Bee Techno Services, with forecasts eyeing a $4 trillion market by blending TradFi liquidity and DeFi yields up to 15%, according to 4IRE. Fractional models from Lofty. ai highlight sustainability trends, while Landshare’s Q2 report spotlights how tokenization slices properties into bite-sized, affordable units. Suddenly, blockchain fractional real estate ownership opens doors for everyday investors chasing passive income property tokens.

How Tokenization Transforms Airbnb Rentals into Everyday Investments

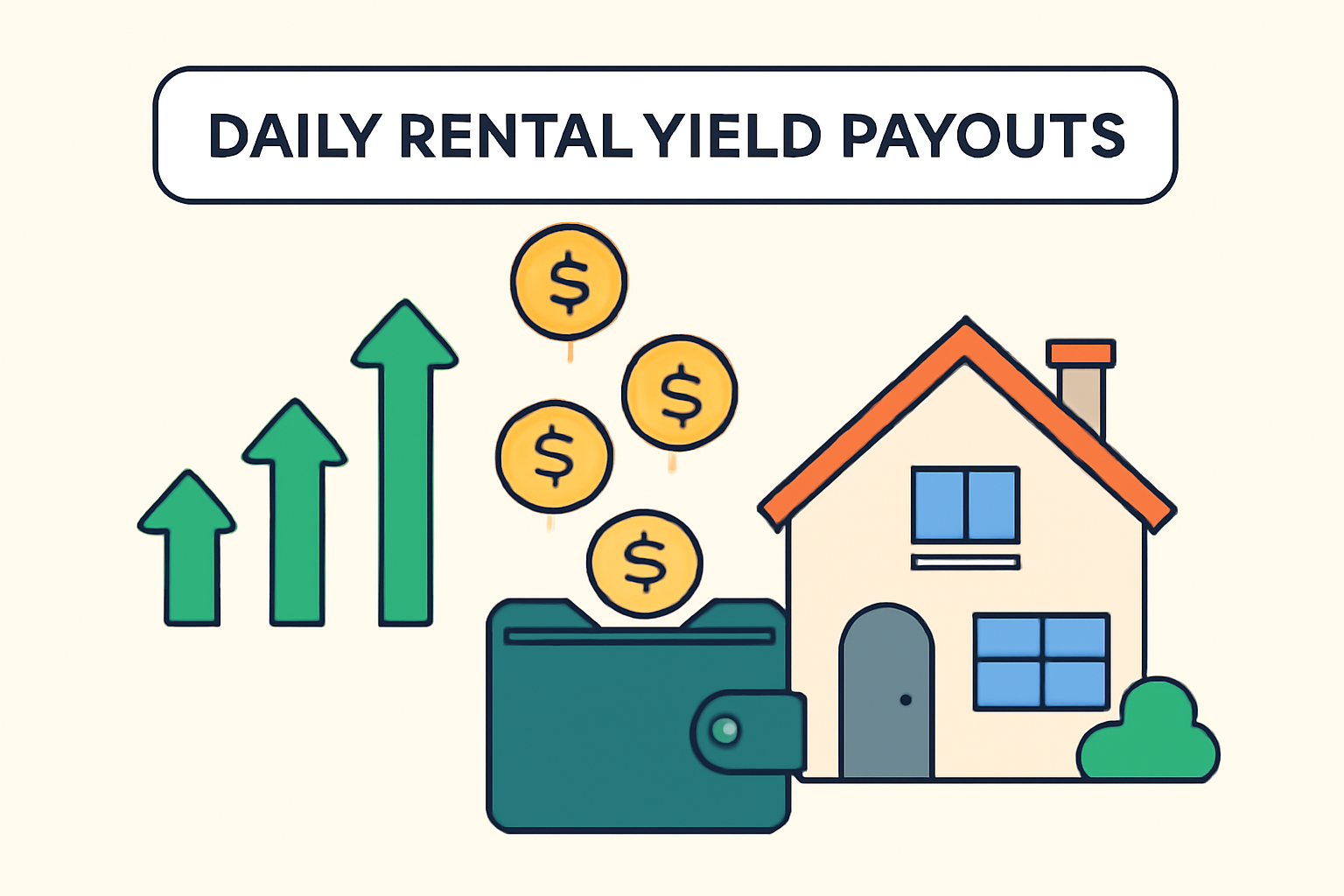

At its core, fractional ownership splits a property into shares, but tokenization supercharges it. Each token on the blockchain represents a real deed-backed fraction of an Airbnb-listed gem, ensuring transparency via immutable ledgers. You buy tokens for, say, a U. S. rental on Lofty AI starting at $50, and boom: proportional rental yields hit your account daily, often in stablecoins. No more waiting 30 days for checks or navigating LLC paperwork.

Take RealT’s 700 and properties worth $130 million; investors snag fractions and pocket yields from bustling short-term lets. Or Binaryx’s luxury Bali pads, tokenized for 10-30% APR. It’s liquid too: secondary markets let you trade tokens faster than selling a house, dodging the traditional real estate slog. I’ve swing-traded these myself, and the combo of rental cash flow plus token appreciation is a game-changer for diversified portfolios.

Tokenization doesn’t just digitize deeds; it democratizes wealth-building from vacation hotspots worldwide.

Leading Platforms Powering Fractional Airbnb Token Ownership

2025’s top players make jumping in effortless. Lofty AI on Algorand shines for U. S. rentals at $50 minimums, with daily payouts and a buzzing secondary market. RealT dominates residential with stablecoin distributions, perfect for steady passive income property tokens. Binaryx caters to thrill-seekers with $500 entry into premium international spots like Montenegro villas, boasting eye-popping returns.

HoneyBricks rounds it out for commercial angles, though Airbnb-focused plays lean residential short-term. Each platform vets properties rigorously, from occupancy rates to blockchain compliance, minimizing your homework.

The Edge of Tokenized Yields: Why Airbnb Fractions Beat Traditional Rentals

Why obsess over Airbnb tokens? Accessibility tops the list: $50-$100 barriers crush the old $100K and entry for whole properties. Liquidity trumps all; flip tokens on marketplaces versus months-long sales. Blockchain’s tamper-proof records build trust, while smart contracts automate yield splits, slashing fees.

Picture this: a tokenized loft near Disney pulls 12-15% yields from peak-season bookings, distributed passively. Platforms like those above report consistent RWA Airbnb investment yields, fueled by tourism rebound. Diversification? Mix U. S. stability with exotic locales. I’ve seen portfolios balloon blending these with crypto swings. Yet, it’s not risk-free; regs evolve, markets dip, so DYOR on platforms. Still, for 2025, this is where forward-thinkers park capital for real returns. Check this breakdown on tokenizing a million-dollar property for a deeper dive.

Ready to claim your slice? Getting started feels like onboarding to a DeFi app, but with actual rooftops backing your bag. Pick a platform, connect your wallet, browse vetted Airbnb earners by metrics like occupancy and projected yields, then snap up tokens with USDC or ETH. Smart contracts handle the rest: deeds link to tokens, managers run the show, and yields flow automatically. I’ve guided newcomers through this; within minutes, you’re earning from a tokenized beach house you never visit.

Real-World Yields: What Tokenized Airbnb Looks Like in Action

Let’s crunch numbers from live projects. A Lofty AI urban rental might yield 8-12% annually from steady bookings, paid daily for that sweet compounding effect. RealT’s stablecoin drips from family homes hit similar marks, while Binaryx’s vacation stunners chase 20% plus on peak tourism. Tokenized real estate rentals 2025 shine here, as short-term demand outpaces long-haul leases. Platforms disclose full audits, from cap rates to expense ratios, so you spot gems like a 95% occupied Florida condo token.

Yield Comparison Table for Tokenized Airbnb Properties

| Platform | Avg Annual Yield | Min Investment | Example Property Type | Liquidity Score (1-10) |

|---|---|---|---|---|

| Lofty AI | 10% | $50 | US Short-term Rental | 9 |

| RealT | 9% | $50 | Residential Airbnb | 8 |

| Binaryx | 20% | $500 | Bali Luxury Villa | 7 |

| HoneyBricks | 7% | $1K | Commercial w/Rentals | 6 |

These aren’t pie-in-the-sky; Landshare’s Q2 data backs fractional slices delivering reliable cash flow. Swing traders like me layer in: hold for yields, flip on dips for gains. It’s blockchain fractional real estate ownership at its finest, turning vacation vibes into portfolio anchors.

But here’s my take: chase properties with diversified guest flows, like city centers or tourist hubs, over niche risks. Sustainability angles from Lofty. ai add long-term pop, aligning with green investor vibes.

Navigating the Fine Print: Risks and Smart Strategies

No investment’s a sure thing, and fractional Airbnb property tokens pack familiar real estate quirks plus blockchain twists. Tourism slumps can trim yields; think off-season lulls or economic hiccups. Regs? U. S. SEC eyes tokens as securities, so platforms like RealT prioritize compliance with Reg D or offshore structures. Liquidity’s improved but not crypto-level; secondary markets vary in volume.

Counter it with diversification: spread across 5-10 tokens, mix geographies. Vet managers’ track records, insist on insurance proofs. Platforms’ transparency helps, but cross-check with on-chain data. In volatile times, I’ve stress-tested by holding through dips; resilient bookings rebound fast. For passive income property tokens, set it and forget it, reinvesting yields for turbo growth.

Dive into Airbnb-specific tokenization mechanics here, or explore real rental return case studies.

Zoom out to 2025’s horizon: with $4 trillion projections, tokenized Airbnb will explode as more owners list. DeFi integrations like lending against tokens or yield farms on property RWAs? Game-on. Platforms iterate fast, dropping fees, boosting global access.

Frequently Asked Questions on Fractional Airbnb Tokens

Platforms evolve weekly, but core appeal endures: snag RWA Airbnb investment yields without landlord life. Forward-thinkers grabbing tokens now ride the wave to liquidity and returns traditional real estate can’t touch. Your portfolio’s missing piece? A fractional vacation earner, blockchain-secured and yield-pumping.