BlackRock Tokenized Real Estate: Buying $50 Fractional Shares on Blockchain in 2025

Imagine owning a slice of prime real estate for just $50, traded seamlessly on the blockchain. In 2025, BlackRock tokenized real estate is no longer a distant dream but a tangible evolution, fueled by the explosive growth of real-world assets (RWAs). With the RWA market surging toward a $50 billion valuation, platforms are enabling fractional real estate shares $50 investments, and BlackRock’s moves signal they’re poised to lead this charge.

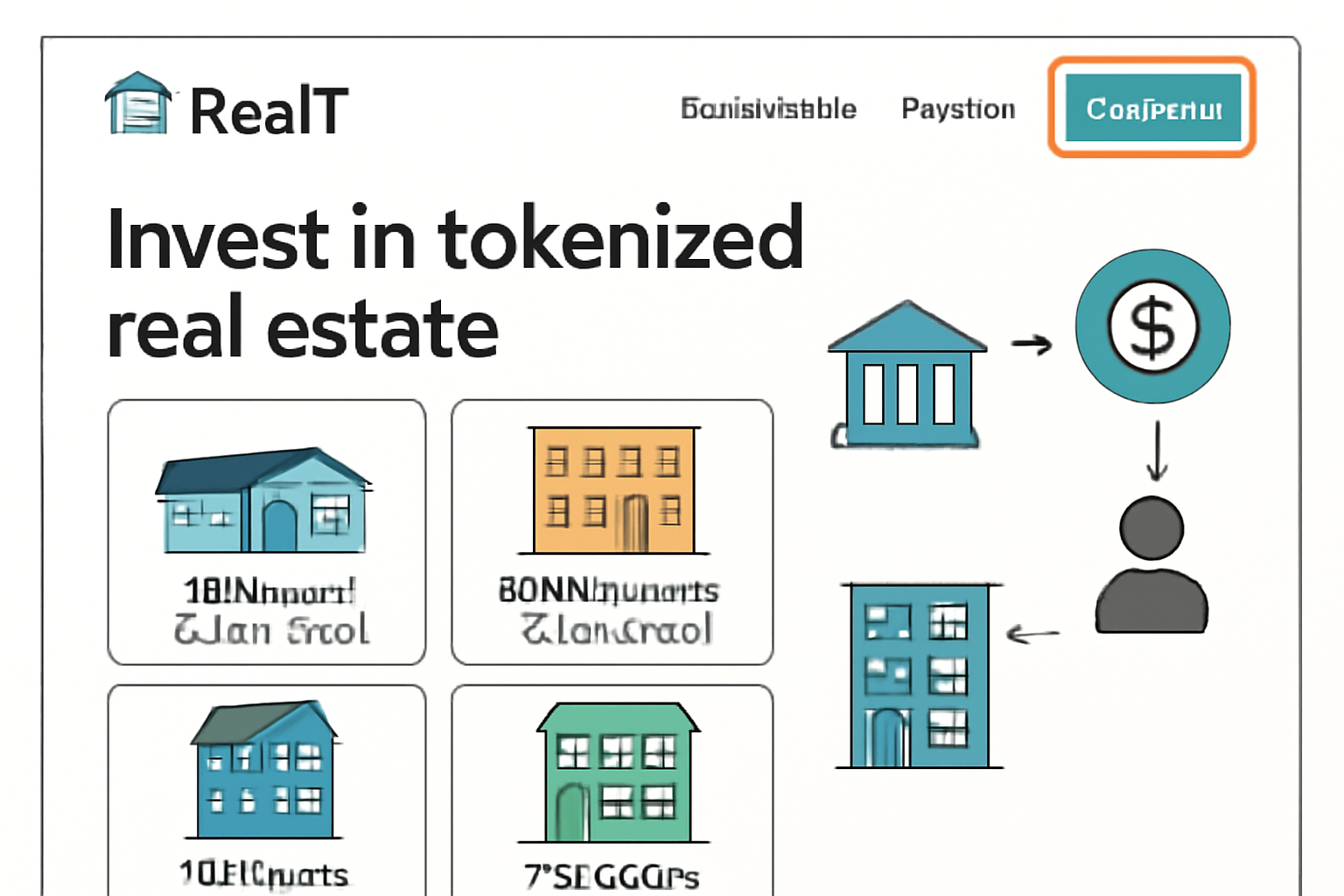

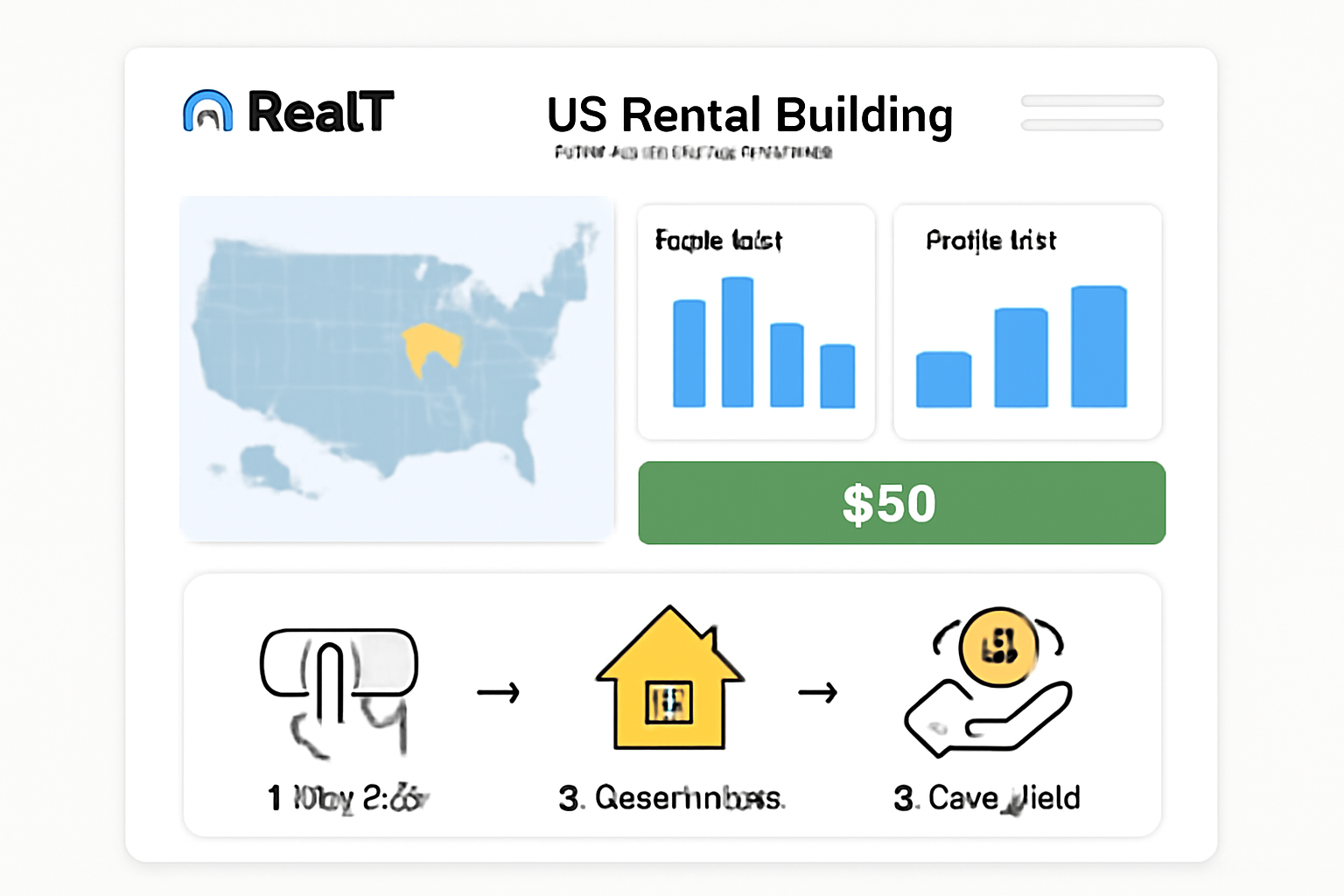

The tokenization wave has transformed real estate from an exclusive club into an accessible market. As of mid-2025, over $7 billion in property sits tokenized, drawing 1.2 million investors worldwide. Pioneers like RealT allow entry at $50 for U. S. rental properties on Ethereum, yielding passive income. BlackRock, while not yet offering specific RWA real estate investment 2025 products at that price point, has laid foundational groundwork through its tokenized treasury fund, hinting at broader ambitions.

BlackRock’s Bold Entry into Asset Tokenization

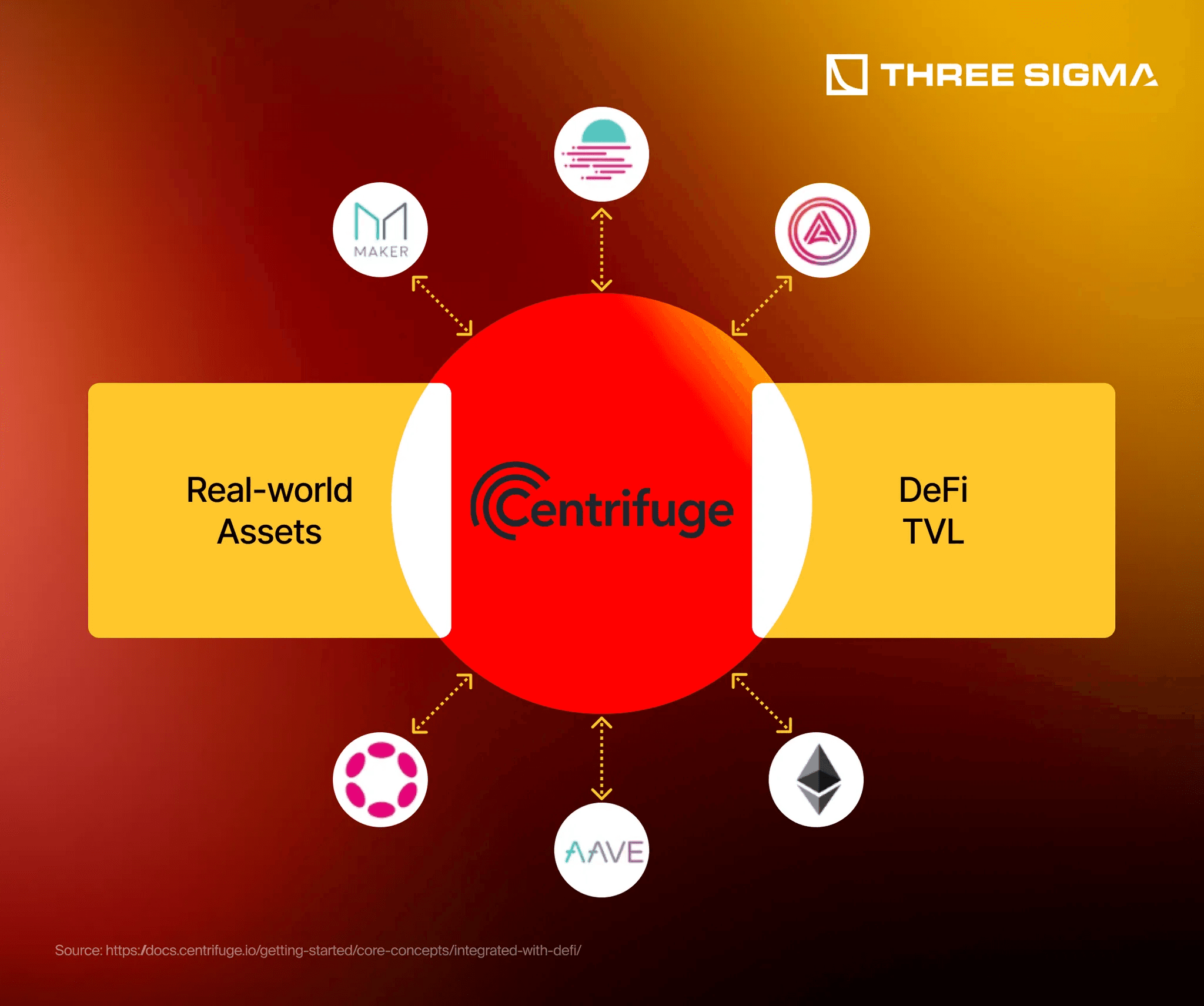

BlackRock’s journey began in March 2024 with the launch of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on Ethereum, a tokenized short-term U. S. Treasury fund. By June 2025, its assets under management reached nearly $2.9 billion, showcasing institutional appetite for on-chain assets. In November 2024, BlackRock expanded BUIDL to Aptos, Arbitrum, Avalanche, Optimism’s OP Mainnet, and Polygon, enhancing liquidity across ecosystems.

CEO Larry Fink has championed tokenization as the future, predicting it will unlock liquidity in illiquid assets like real estate. This aligns with industry projections: RWAs hit $24 billion earlier this year, with experts eyeing $50 billion by year-end. BlackRock’s actions position them to bridge traditional finance and blockchain property tokens BlackRock, potentially introducing fractional real estate offerings soon.

Fractional Ownership Unlocks Global Real Estate Access

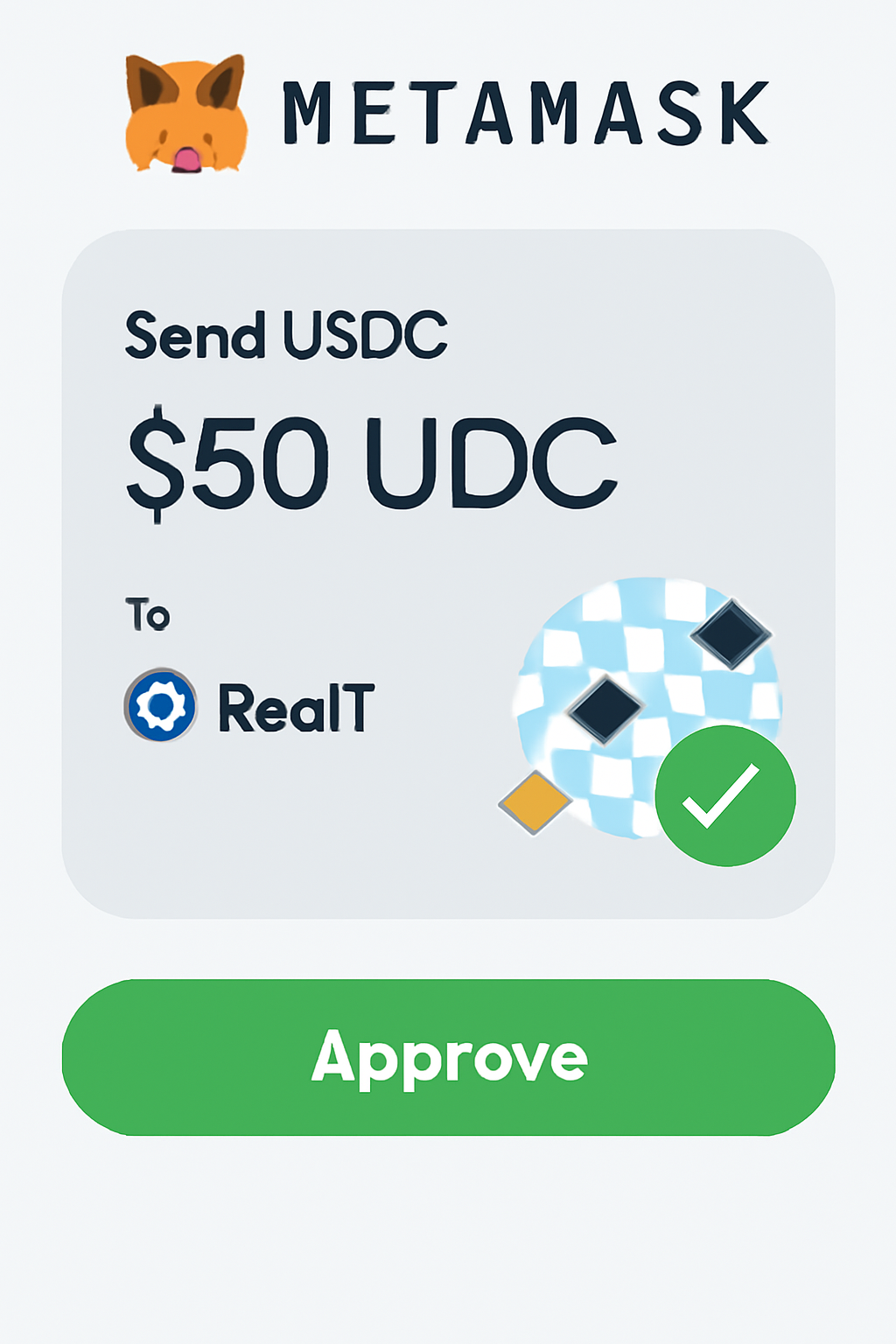

Tokenization slices properties into digital shares, each representing fractional ownership. Investors buy fractional real estate shares $50 with minimal capital, trading 24/7 without intermediaries. Platforms like Swarm Markets offer real estate fractions from $1,000 to $50,000, but the $50 threshold, seen in RealT, democratizes entry further. This model yields rental income via stablecoins, blending real estate stability with crypto efficiency.

For portfolio managers like myself, this is resilience in action. Real estate has long anchored diversified strategies, but high barriers excluded many. Now, tokenized skyscrapers crypto and commercial assets become viable for HNWIs and retail alike, reducing concentration risk while tapping global liquidity pools.

Navigating Risks in the RWA Boom

Opportunity abounds, yet strategic caution prevails. Regulatory clarity lags in some jurisdictions, and smart contract vulnerabilities persist. BlackRock’s compliance focus reassures; their BUIDL adheres to institutional standards. Yields vary – from 5-10% on tokenized rentals – but volatility in underlying tokens demands hedging.

Integrating these into multi-asset portfolios requires balance: allocate 5-15% to RWAs for yield and inflation protection, paired with equities and crypto. As 2025 unfolds, watch for BlackRock’s next steps; their scale could standardize $50 entry points, making RWA real estate investment 2025 a cornerstone of modern wealth building.

Diversification isn’t just theory; it’s how I’ve built resilient portfolios through market cycles. Tokenized real estate slots perfectly into this framework, offering steady yields amid crypto volatility. BlackRock’s BUIDL success – now spanning multiple chains with $2.9 billion in AUM – proves institutions are validating the model, paving the way for BlackRock tokenized real estate expansions.

Platforms Powering $50 Entry Points

While BlackRock builds the infrastructure, platforms like RealT lead the charge in fractional ownership. Their Ethereum-based tokens grant access to U. S. rental properties starting at $50, distributing rents in stablecoins weekly. Swarm Markets follows with higher minimums but emphasizes private credit alongside real estate. These aren’t gimmicks; they’re backed by legal structures ensuring token holders’ rights mirror traditional REITs.

Regulatory tailwinds bolster confidence. As jurisdictions clarify rules, tokenized assets gain legitimacy. BlackRock’s compliance rigor in BUIDL sets a benchmark, likely influencing future fractional real estate shares $50 products. For global investors, this means borderless access to prime assets – think tokenized skyscrapers or commercial hubs – without the hassles of cross-border deeds.

Yet, strategy demands scrutiny. I’ve advised clients to stress-test RWA allocations against interest rate shifts and property market cycles. Yields hover at 5-10%, attractive versus bonds, but liquidity premiums apply. Pair with BlackRock’s tokenized treasuries for a low-volatility base, then layer in higher-upside fractions.

Strategic Allocation in Your Portfolio

Picture this: a 10% RWA slice stabilizing your crypto-heavy holdings. In my practice, this blend has weathered downturns better than pure equities. Start small – $50 tokens let you test waters without commitment. Monitor on-chain metrics like token velocity and occupancy rates via platforms’ dashboards. As BlackRock scales, expect seamless integrations with traditional brokerage accounts, blending TradFi and DeFi.

Challenges persist: oracle risks for off-chain data, custody concerns, and nascent secondary markets. Counter with due diligence – favor audited platforms with proven track records. BlackRock’s multi-chain push mitigates some silos, fostering interoperability. By 2026, I foresee $50 fractions as standard, with blockchain property tokens BlackRock at the forefront.

For family offices I’ve managed, RWAs diversify beyond stocks and bonds, hedging inflation via hard assets. Retail investors gain similar edges, previously reserved for the ultra-wealthy. This shift empowers strategic decision-making at any scale.

Embracing RWA real estate investment 2025 requires patience and precision, much like curating fine art. BlackRock’s trajectory suggests they’re engineering the on-ramp. Position yourself early: select vetted tokens, allocate judiciously, and rebalance quarterly. Resilience follows diversity, and tokenized real estate delivers both in spades. As the market matures toward that $50 billion horizon, informed investors will reap the liquidity revolution.