Tokenized Commercial Real Estate Loans: Generating Stable Yields with Wiener Privatbank on Real Finance 2025

Picture this: a world where commercial real estate loans, those bulky assets traditionally locked in bank vaults, flow freely like digital cash on a blockchain. In 2025, Wiener Privatbank is making it real by tokenizing $500 million in these loans alongside Real Finance. This isn’t just another crypto hype cycle; it’s a smart pivot toward stable yield real estate tokenization 2025 that everyday investors can actually grasp and profit from. As someone who’s charted DeFi wild rides for years, I see this as the bridge we’ve needed between stodgy TradFi and vibrant Web3.

![]()

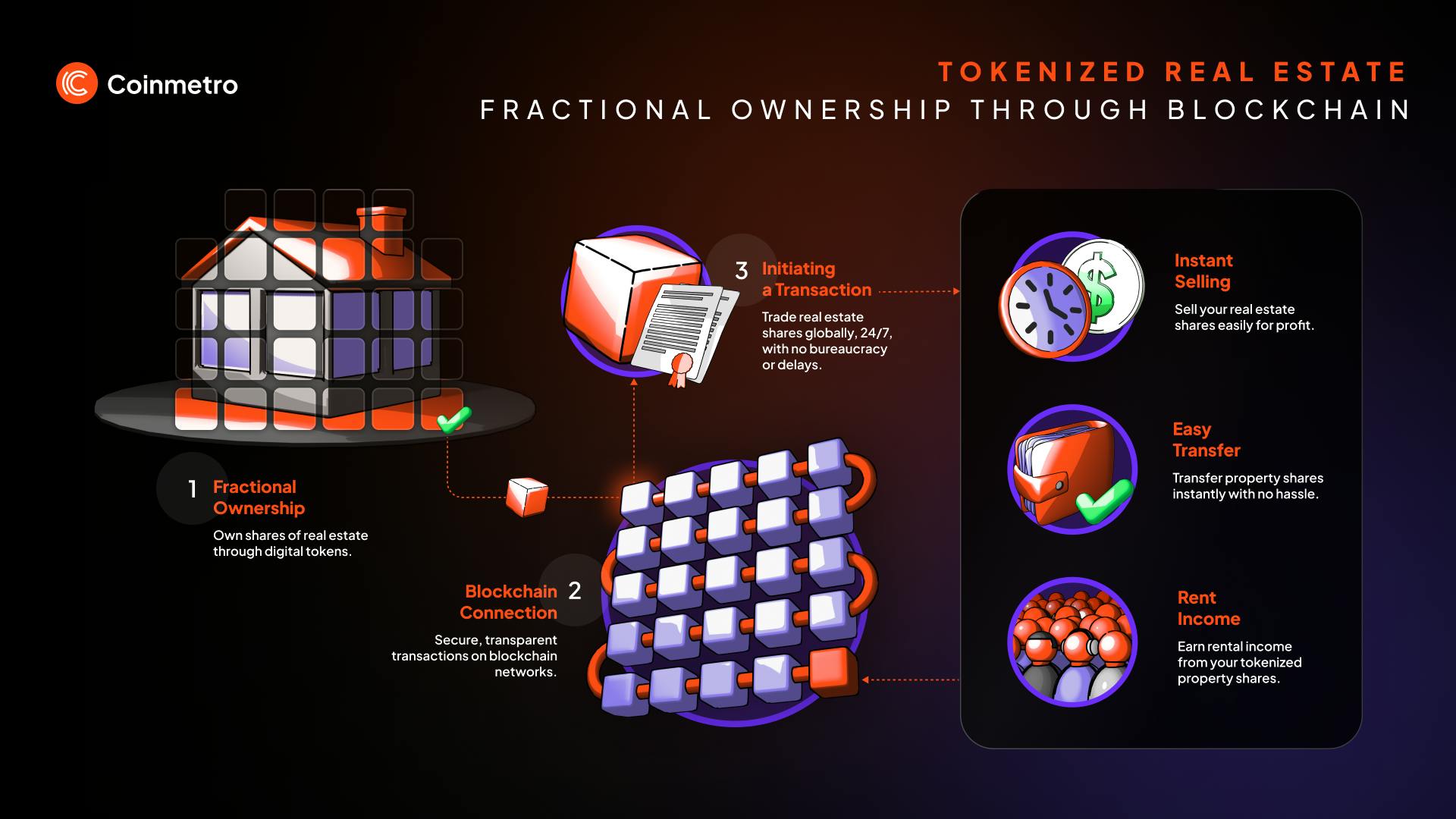

Tokenized commercial real estate loans break down massive loan portfolios into bite-sized tokens. Investors buy fractions, earn yields from rental income or interest payments, and trade them 24/7. No more waiting months for paperwork or dealing with high entry barriers. Wiener Privatbank, a mid-sized powerhouse in private banking, picked Real Finance’s layer-1 blockchain for this because it nails the RWA commercial property blockchain challenge: security, decentralization, and compliance all in one.

Why Wiener Privatbank Chose Tokenization for Steady Returns

Wiener Bank SE announced its partnership with Real Finance back in September 2025, aiming to supercharge asset management. They’re not dipping toes; they’re diving headfirst with $500 million in tokenized commercial real estate loans. This move taps into a global market hungry for liquidity. Traditional CRE loans sit idle, but tokenization lets them generate stable yields backed by real-world cash flows. Think 5-8% annual returns, distributed automatically via smart contracts, minus the headaches of property management.

What fires me up is how this democratizes access. Previously, only high-net-worth folks or institutions touched these deals. Now, with Wiener Privatbank’s stamp of approval and Experian’s data muscle, retail crypto fans can slice into diversified loan pools. It’s Wiener Privatbank RWA innovation at its finest, blending Austrian banking precision with blockchain speed.

Real Finance: The Blockchain Built for Big Money RWAs

Real Finance isn’t your average chain; it’s engineered for institutions tired of Ethereum’s gas fees and Solana’s outages. Their MVP tackles the RWA trilemma head-on. Business validators ensure accountability, tokens carry embedded risk and insurance data, and a recovery fund guards against inflation shocks. Launching with over $500 million onboarded, including Wiener Privatbank’s loans, it’s primed for scale.

Top 5 Benefits of Tokenized CRE Loans

-

24/7 Instant Liquidity – Trade anytime on Real Finance blockchain, unlocking funds without traditional market delays.

-

Fractional Ownership from $100 – Invest in CRE loans with Wiener Privatbank starting small, democratizing access for all.

-

Automated Yield Payouts – Enjoy seamless, on-chain distributions of stable yields from tokenized assets.

-

On-Chain Transparent Risk Data – Tokens embed risk and insurance info for full visibility on Real Finance.

-

Compliance-Ready for Global Regs – Built-in features ensure regulatory adherence worldwide.

Deloitte backs the hype: tokenized real estate jumps from $0.3 trillion in 2024 to $4 trillion by 2035, a blistering 27% CAGR. Private funds, loan securitizations, and development projects lead the charge. Real Finance’s Real Finance ASSET token powers this ecosystem, letting users stake for network rewards while earning from tokenized assets. I’ve swing-traded enough alts to know; this utility-driven token could steady the RWA sector amid volatility.

Stable Yields That Outshine Volatile Crypto Bets

In a sea of meme coins and hype pumps, tokenized commercial real estate loans offer the holy grail: predictable income. Wiener Privatbank’s loans target prime commercial properties; yields stem from tenant rents and borrower interest, collateralized by hard assets. Blockchain magic automates distributions, slashing middlemen fees by up to 50%. Investors get dashboards showing real-time performance, default risks, and insurance coverage. No black-box funds here; everything’s auditable on-chain.

From my MIT blockchain cert lens, this setup minimizes counterparty risk better than DeFi lending protocols. Real Finance’s validators, tied to real reputations, deter bad actors. Pair that with Experian’s KYC firepower, and you’ve got institutional-grade safety for the masses. Early adopters could lock in yields before the $500 million pool swells, positioning for that Deloitte-projected boom.

Let’s dive deeper into the mechanics. Each tokenized loan fraction represents a slice of a diversified pool, say mortgages on office towers or retail strips in Vienna hotspots. Smart contracts handle repayments, funneling principal and interest straight to token holders. Wiener Privatbank oversees underwriting, ensuring only prime deals make the cut. This isn’t speculative; it’s engineered for stable yield real estate tokenization 2025, with yields floating around inflation plus a premium, far steadier than equity tokens.

Navigating Risks in Tokenized CRE: Smarter Than You Think

| Risk | Potential Impact | Mitigation Strategy |

|---|---|---|

| ⚠️ Recession-driven property value dips | Significant drop in property values, increasing loan-to-value (LTV) ratios and potential investor losses. | ✅ Real-time on-chain LTV ratios and cash flow data from Real Finance; 120-150% overcollateralization with Wiener Privatbank |

| ⚠️ Tenant defaults | Reduced or halted rental income, impacting debt service coverage ratios and yield stability. | ✅ Experian verification for tenants and borrowers; transparent on-chain cash flow monitoring |

| ⚠️ Borrower default | Failure to repay loan principal or interest, necessitating collateral liquidation. | ✅ Recovery fund from Real Finance network fees; 120-150% overcollateralization buffers |

| ⚠️ Regulatory shifts | Evolving laws on tokenized assets or CRE lending, causing compliance hurdles or restrictions. | ✅ Real Finance layer-1 blockchain designed for compliance with business validators and embedded risk data; Wiener Privatbank partnership expertise |

I’ve seen DeFi blowups from opaque collateral; this feels different. Experian’s integration verifies borrower creds off-chain, bridging to on-chain transparency. Defaults? Historical CRE rates hover at 2-4%; tokenization’s liquidity lets holders sell slices fast, not panic-hold. My take: this beats parking cash in T-bills, especially with Europe’s rates cooling.

Curious how yields stack up? Traditional funds charge 2% management fees plus carry; tokenized versions slash that to 0.5-1%, passing savings to you.

Traditional CRE Loans vs. Tokenized CRE Loans on Real Finance

| Aspect | Traditional CRE Loans | Tokenized on Real Finance |

|---|---|---|

| Liquidity | Months-long sales process | Instant 24/7 trading 💹 |

| Entry Barrier | $1M minimum investment | $100 minimum investment |

| Yield Distribution | Quarterly wire transfers | Automated smart contracts via Wiener Privatbank & Real Finance ⏰ |

| Fees | 2% annual fees | 0.5-1% annual fees |

| Transparency | Opaque reports | Full on-chain audit 🔍 |

Investor Playbook: Steps to Tap Wiener’s Tokenized Yields

Ready to jump in? It’s simpler than opening a Roth IRA. First, connect a wallet to Real Finance’s dApp. KYC via Experian takes minutes, Wiener’s seal unlocks the loan pools. Buy tokens with USDC or ETH, stake for extra APY if you want. Monitor via dashboards showing occupancy rates, payment histories. Diversify across 10-20 loans for balance. Swing traders like me love the liquidity; buy dips on rate news, sell on yield spikes.

The Real Finance ASSET token adds juice. Hold it to vote on validators or earn from platform fees. At launch, with $500 million flowing in, network effects kick hard. Partnerships like this signal maturity; no more wild-west vibes.

Tokenization isn’t replacing banks; it’s turbocharging them. Wiener Privatbank proves TradFi giants can lead Web3 without losing their edge.

Zoom out to 2035: Deloitte’s $4 trillion forecast isn’t pie-in-sky. As central banks digitize, tokenized loans become the norm. Wiener’s move positions them as Europe’s RWA hub, drawing funds from London to Dubai. For you, the investor? Early positioning means compounding those 5-8% yields while the market explodes. I’ve charted enough cycles to spot winners; this blend of real cash flows and blockchain rails screams asymmetric upside.

Wiener Privatbank RWA tokenization isn’t a flash; it’s the steady hum powering finance’s next era. Grab a fraction, watch the yields roll in, and ride the wave reshaping real estate investing.