How Tokenized Real Estate Lowers Barriers for Global Investors in 2025

Real estate investment is undergoing a dramatic transformation in 2025. The emergence of tokenized real estate is turning once-exclusive property markets into accessible, liquid, and borderless opportunities for investors worldwide. If you’ve ever felt shut out by high capital requirements or complex international regulations, blockchain-based property tokens are rewriting the rules.

Fractional Ownership: Making Premium Markets Accessible

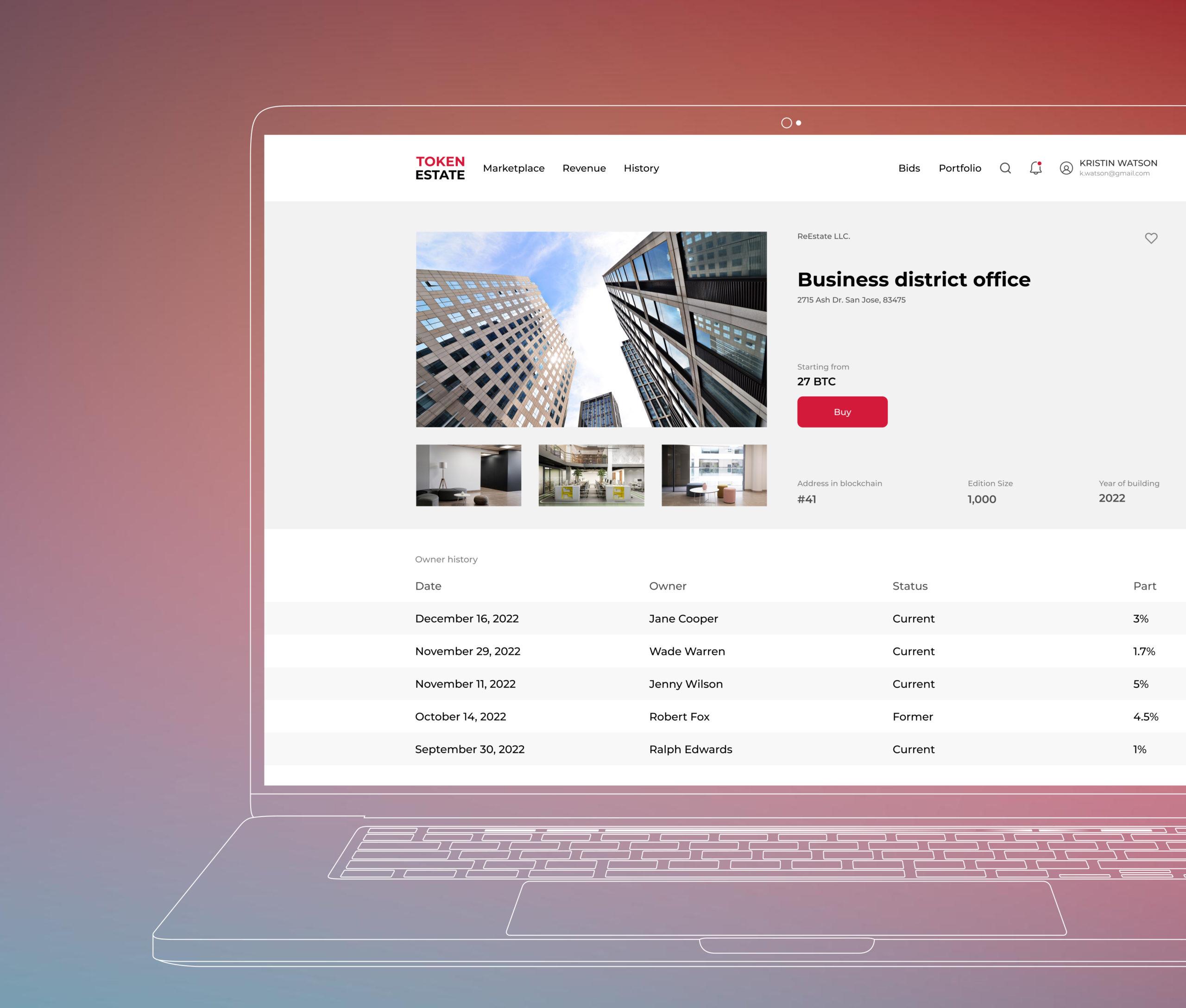

Traditionally, investing in prime real estate demanded significant capital, often tens or hundreds of thousands of dollars just to get started. Tokenization changes this paradigm by converting physical assets into fractional digital shares. In practice, this means you can now own a slice of a luxury apartment in New York or a commercial building in London for as little as $1,000, or even less on some platforms. This democratization is not theoretical; platforms like RealT and tZERO are already enabling participation with just a few hundred dollars per tokenized share.

Fractional property ownership via blockchain isn’t just about lower entry points. It also unlocks diversification strategies that were previously reserved for institutions and ultra-high-net-worth individuals. Investors can now build global portfolios across cities and asset classes without the logistical headaches that used to come with cross-border deals. For more on how tokenization is breaking down these barriers, see this guide.

Enhanced Liquidity: Real Estate That Moves at Market Speed

Liquidity has long been the Achilles’ heel of real estate investment. Selling a traditional property stake could take months, if not longer, tying up capital and exposing investors to market swings during lengthy closing processes. Tokenized assets, however, are traded on blockchain-based platforms around the clock. This means you can buy or sell your position in minutes rather than months, with settlement occurring almost instantly thanks to smart contracts.

This new model introduces flexibility similar to what stock and crypto traders enjoy but applied to real-world assets. For global investors wary of illiquidity risk, this is a major leap forward, freeing up cash flow and enabling more agile portfolio management.

Global Market Access: No More Geographic Barriers

The days when your passport dictated where you could invest in property are fading fast. Tokenized real estate platforms leverage blockchain’s transparency and security to streamline cross-border transactions, making it possible for someone in Tokyo to seamlessly own fractions of properties in New York, Dubai, or London.

This isn’t just about convenience; it’s about opening premium markets that were previously off-limits due to regulatory complexity or lack of local connections. Now, compliance checks are automated via smart contracts and platform-level KYC/AML processes, reducing friction for international participants while maintaining robust security standards.

The impact? A truly global pool of buyers and sellers leads to more efficient price discovery and deeper liquidity across markets. For an in-depth look at how tokenized real estate is revolutionizing international investment flows, visit this resource.

Reduced Transaction Costs and Greater Efficiency

The automation enabled by blockchain doesn’t just speed things up; it also slashes transaction costs by cutting out multiple layers of intermediaries such as brokers and legal advisors. Smart contracts handle everything from escrow to compliance checks automatically, meaning lower fees for both buyers and sellers.

This cost efficiency makes smaller investments economically viable for the first time while enhancing returns for all participants.

For global investors, these efficiencies add up to a compelling case: you can now access premium real estate, diversify internationally, and manage your portfolio with far lower friction and overhead than ever before. The result is not just a lower barrier to entry, but a fundamentally more inclusive and agile investment landscape.

Top Benefits of Tokenized Real Estate for Investors in 2025

-

Fractional Ownership: Tokenization lets investors buy fractions of high-value properties with minimal capital. Platforms like RealT and tZERO enable participation in premium real estate markets for as little as a few hundred dollars.

-

Enhanced Liquidity: Unlike traditional property, tokenized real estate can be traded 24/7 on blockchain platforms, allowing investors to enter or exit positions quickly—similar to trading stocks or cryptocurrencies.

-

Global Market Access: Investors worldwide can own property shares across borders without complex legal hurdles. Blockchain-based platforms like Brick by Block provide secure, transparent access to international markets.

-

Reduced Transaction Costs: Smart contracts and blockchain automation cut out intermediaries and lower fees. This makes investing in real estate more cost-effective and speeds up settlement times.

-

Institutional Adoption & Market Growth: Major players like DAMAC Group and MANTRA are tokenizing billions in assets. Deloitte forecasts the tokenized real estate market could reach $4 trillion by 2035, reflecting rapid growth and increasing legitimacy.

Institutional Momentum: A New Era of Market Growth

The rapid adoption of real estate tokenization platforms by major institutions is further legitimizing this trend. In 2025, headline deals like DAMAC Group’s $1 billion partnership with MANTRA in Dubai signal that tokenization is not just for early adopters or retail investors. As Deloitte projects the value of tokenized real estate could reach $4 trillion by 2035, institutional capital is pouring into the space, driving innovation and accelerating mainstream acceptance.

This influx brings additional safeguards and regulatory clarity, giving individual investors greater confidence in platform security and compliance. It also means more diverse offerings, from income-producing residential properties to high-yield commercial developments, are becoming available on-chain.

What to Watch: Key Considerations for Global Investors

Despite the advantages, it’s important to approach tokenized real estate 2025 with a balanced perspective. Regulatory frameworks are evolving rapidly across jurisdictions; due diligence remains essential, especially when evaluating new platforms or unfamiliar markets. Look for providers that prioritize transparency, robust compliance checks (including KYC/AML), and clear governance structures.

Liquidity is much improved versus traditional property transactions but can still vary between assets or platforms, especially for niche markets or early-stage projects. Investors should also factor in local tax implications and reporting requirements when building cross-border portfolios.

For a deeper dive into risk management strategies and practical steps to get started with as little as $50, explore this guide.

The Road Ahead: Democratizing Real Estate Investment Worldwide

The momentum behind fractional property ownership via blockchain is unmistakable. In 2025, property token trading liquidity, global accessibility, and cost efficiency are converging to reshape how wealth is built through real estate. Whether you’re a seasoned investor seeking diversification or someone entering the market for the first time with modest capital, tokenized assets are opening doors that were previously locked tight.

The future promises even broader participation as technology matures and regulatory clarity improves. For those ready to embrace this new paradigm, the opportunities are no longer limited by geography or capital, they’re defined by vision and strategy.