How Tokenized Real Estate Delivers Instant Liquidity and Fractional Ownership in 2025

Real estate investing has undergone a seismic shift in 2025, with tokenized real estate and fractional ownership moving from niche concepts to mainstream strategies. By leveraging blockchain technology, these innovations are dismantling traditional barriers, offering both instant liquidity and access to high-quality property assets for a much broader range of investors. The days of needing hundreds of thousands of dollars to own a piece of prime real estate are fading fast. Instead, anyone can now participate with as little as $50, thanks to platforms like Lofty AI and RealT.

Fractional Ownership: Making Real Estate Accessible

At its core, fractional property ownership on blockchain means dividing the value and rights to a physical property into many smaller digital tokens. Each token represents a share in the underlying asset, granting holders proportional rights to income streams, appreciation, and sometimes even governance or decision-making. This model has cracked open the door for retail investors who previously had no realistic path into institutional-grade real estate.

The impact is profound: In 2025, over 1.2 million global investors now participate in fractional ownership through blockchain platforms, with more than $7 billion worth of properties tokenized worldwide. Platforms such as Lofty allow users to invest in U. S. rental properties starting at just $50 per token, an entry point that would have been unthinkable just a few years ago. Not only does this democratize wealth-building opportunities, it also enables portfolio diversification across multiple cities or even countries without logistical headaches.

If you want an in-depth look at how this system works in practice, including income distribution and legal structures behind fractional tokens, see this guide.

Real Estate Instant Liquidity: The Blockchain Advantage

Liquidity has always been the Achilles’ heel of real estate investing. Traditionally, selling even a small stake in a property could take months, if it was possible at all. Tokenization upends this dynamic by allowing property tokens to be traded 24/7 on specialized exchanges or secondary markets. Investors can buy or sell their shares almost instantly, responding quickly to market shifts or personal cash flow needs.

This newfound liquidity is not just theoretical; it’s already being realized on platforms like RealT and Propy. These marketplaces support active secondary trading where holders can exit positions efficiently, no more waiting for buyers or dealing with mountains of paperwork.

The result? A more dynamic marketplace where capital isn’t locked up indefinitely but can move freely between opportunities, something that was once impossible for physical property investments.

The Growth Trajectory: Adoption and Regulatory Shifts

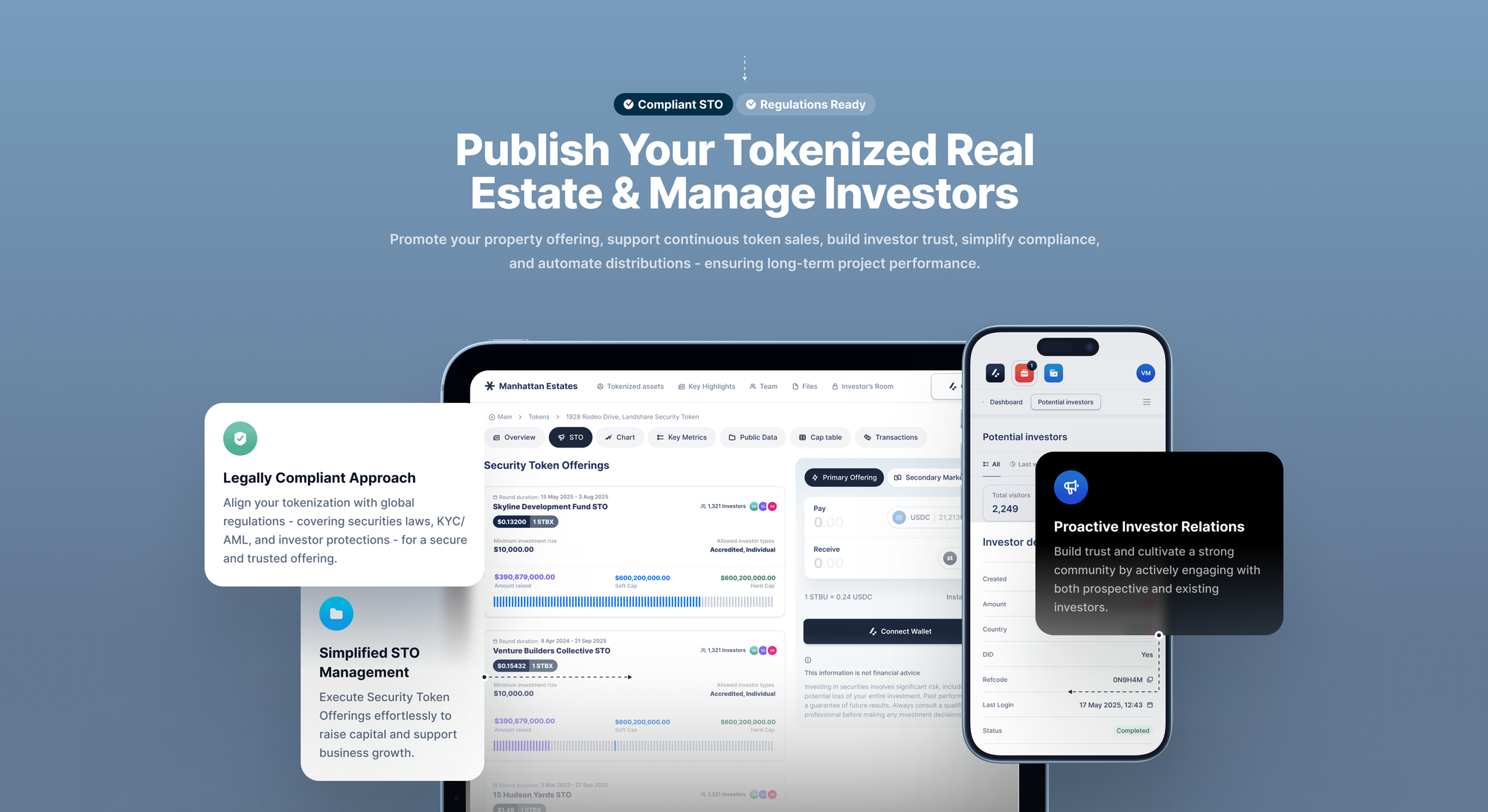

The pace of adoption for on-chain real estate assets is accelerating rapidly in 2025. As regulatory clarity improves, highlighted by Nasdaq’s September 2025 proposal to list tokenized securities, the lines between traditional finance and blockchain-powered assets are blurring. Institutional players are beginning to take notice as compliant frameworks emerge globally.

This shift is also driving down transaction costs and increasing transparency across the board. Investors benefit from immutable records on public blockchains while enjoying reduced fees compared to legacy systems reliant on brokers and intermediaries.

For those interested in how these regulatory changes are paving the way for mainstream adoption, and what it means for compliance-minded investors, check out this analysis.

Still, as with any disruptive innovation, the transition to tokenized real estate is not without growing pains. While liquidity has improved dramatically, a recent study found that many real-world asset tokens still face relatively low trading volumes and limited participation compared to traditional markets. This means that while investors can often sell their property tokens faster than physical assets, instant exits at optimal prices are not always guaranteed, especially during periods of market stress or for less popular properties.

Moreover, the evolving regulatory landscape demands vigilance from both platforms and investors. Jurisdictional differences in compliance requirements can affect everything from investor eligibility to tax treatment, making it crucial for participants to stay informed and work with reputable platforms that prioritize transparency and legal adherence. With Nasdaq’s move toward listing tokenized securities and similar initiatives in Europe and Asia, the trajectory suggests increasing integration between blockchain-based assets and mainstream financial systems over the next few years.

Practical Considerations: What Investors Need to Know

For those new to blockchain real estate investing, due diligence remains essential. Not all tokenization platforms are created equal; differences exist in property vetting standards, governance rights, fee structures, and secondary market liquidity. Investors should review each platform’s track record, regulatory standing, and user protections before allocating capital. It’s also wise to consider how fractional property ownership fits within your broader portfolio strategy, tokenized assets can offer diversification but may behave differently than stocks or traditional REITs during economic turbulence.

As adoption accelerates, more sophisticated tools are emerging for tracking performance, managing tax obligations on digital assets, and analyzing market trends. Expect continued innovation around smart contracts that automate income distribution and voting rights for token holders, features already present on leading platforms in 2025.

The bottom line? Tokenized real estate is rapidly transforming how people think about property investment. By enabling fractional ownership and near-instant liquidity through blockchain technology, it unlocks new possibilities for both seasoned investors and first-timers alike. While challenges around liquidity depth and regulation remain in flux, the direction of travel is clear: more accessibility, more flexibility, and more opportunity for those willing to embrace this new paradigm.