How Real-Time On-Chain Data Is Shaping Tokenized Real Estate in 2025

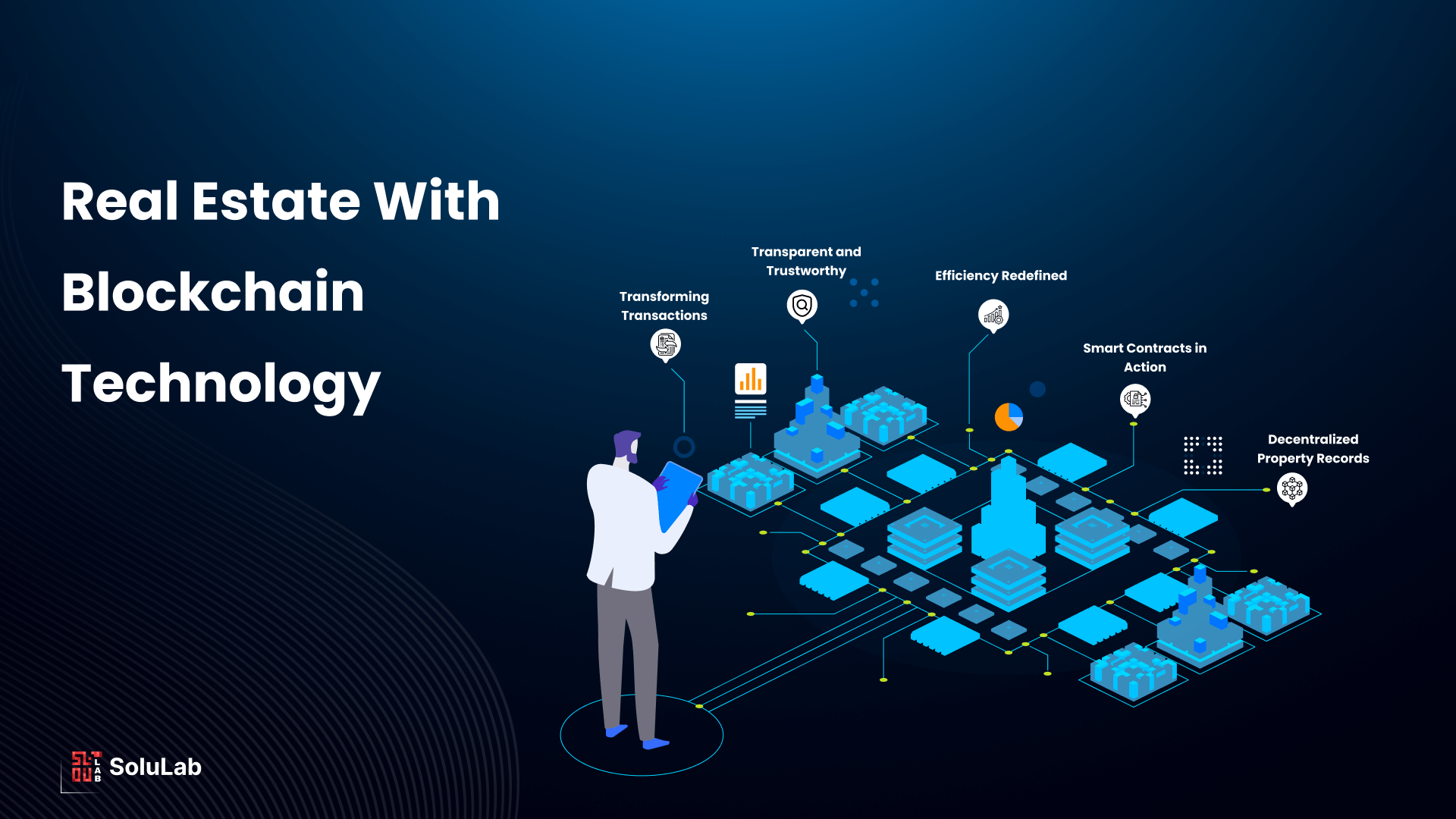

In 2025, real-time on-chain data is not just a buzzword in the world of tokenized real estate – it is the backbone of a rapidly evolving investment landscape. As blockchain technology matures, property assets are increasingly being represented as digital tokens, allowing for fractional ownership and instant settlement. This shift is transforming how investors interact with real estate, enabling a level of transparency and efficiency that was previously unattainable.

Transparency and Trust: Immutable Records on Blockchain

The cornerstone of this transformation lies in the immutable nature of blockchain. Every property transaction, ownership transfer, or valuation update is recorded on-chain in real time. This continuous stream of data reduces information asymmetry and empowers investors to verify asset details independently – a crucial step forward from opaque legacy systems.

For example, platforms like RealT Tokens on Gnosis Chain have reported a Total Value Locked (TVL) of $146.25 million as of June 2025, a figure transparently viewable by anyone with access to the blockchain explorer. This level of openness not only builds investor confidence but also simplifies due diligence for both retail and institutional participants.

Addressing Liquidity Bottlenecks with Real-Time Data

Liquidity has always been the Achilles’ heel of traditional real estate investing. Historically, buying or selling property was slow, expensive, and often restricted by geography or regulation. In contrast, tokenization enables assets to be divided into smaller units – each represented by a digital token that can be traded globally at any time.

This newfound liquidity is further enhanced by real-time on-chain data, which provides up-to-the-second information on trading volumes, order books, and price movements across secondary markets. However, it’s important to recognize that while these advancements are significant, liquidity remains an ongoing challenge; many tokenized properties still see limited trading activity compared to other digital assets. For an exploration of how real-time rental data specifically addresses liquidity concerns in this space, see this deep dive.

The Role of Standardization and AI-Driven Analytics

The adoption of standardized data formats such as Uniform Appraisal Dataset (UAD) 3.6 is another major catalyst for market maturity in 2025. Standardization ensures that valuation metrics are consistent across platforms and geographies – making it easier for investors to compare opportunities objectively.

When combined with AI-powered analytics running directly on live blockchain feeds, investors gain access to more accurate and timely assessments of property values than ever before. These tools sift through vast amounts of on-chain data to identify trends, flag anomalies, and project future performance – all while maintaining full auditability.

The result? A marketplace where information flows freely and decisions can be made with unprecedented speed and confidence. In this environment, both seasoned professionals and newcomers benefit from reduced risk exposure thanks to transparent reporting mechanisms built directly into the core infrastructure.

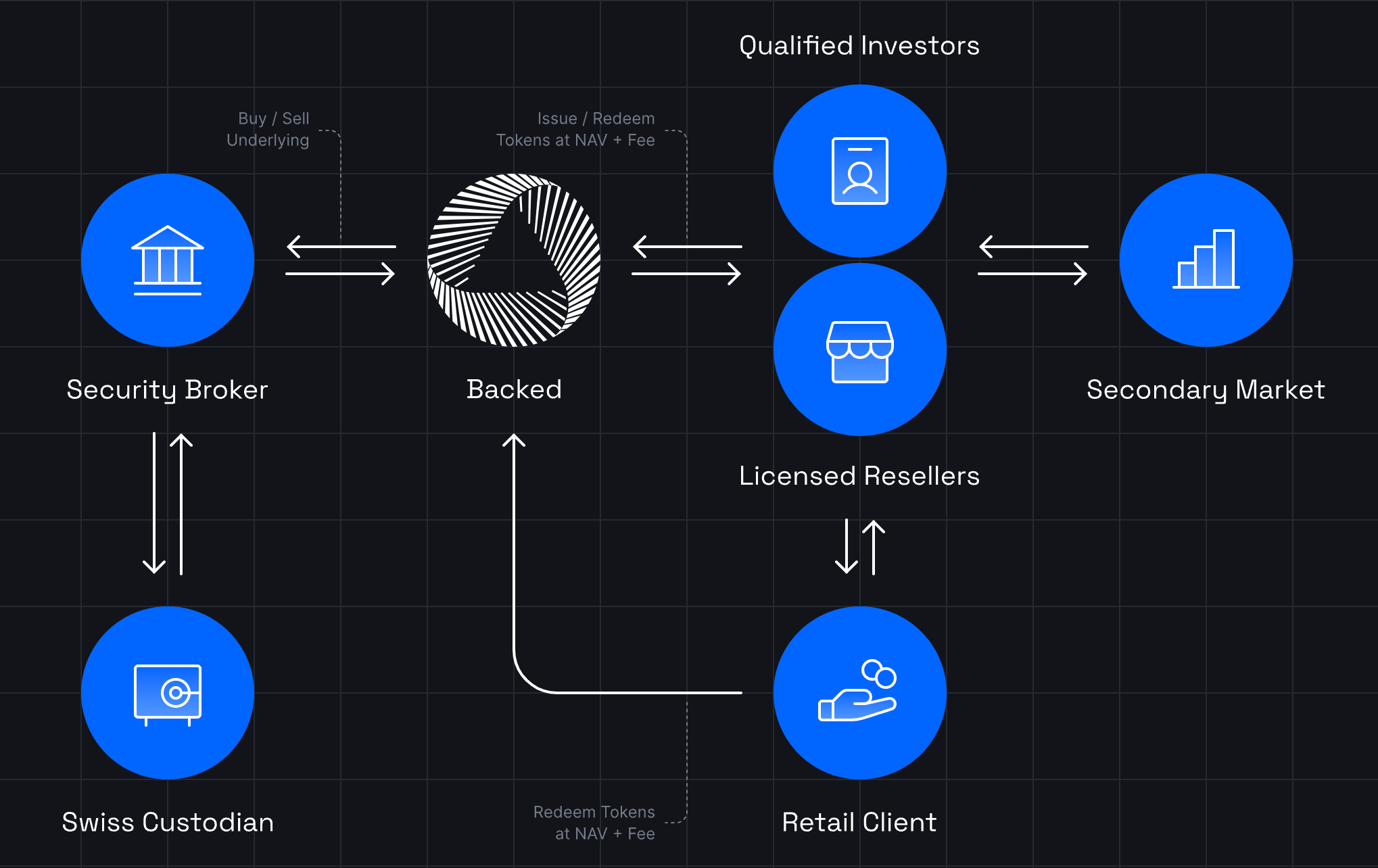

As tokenization platforms scale and regulatory clarity improves, the convergence of blockchain real estate data transparency and AI-driven valuation is setting new standards for governance and investor protection. Automated compliance checks, instant property ownership updates, and verifiable on-chain audit trails are now integral to most leading platforms. This infrastructure doesn’t just streamline transactions; it also helps address concerns around fraud, misrepresentation, and operational risk.

One notable trend in 2025 is the rise of tokenized property verification. By leveraging smart contracts and decentralized oracles, platforms can instantly confirm ownership status, lien positions, and even rental income flows. These features are not only attractive to global investors seeking exposure to diverse markets but also to regulators who demand robust oversight in an increasingly digital landscape.

Investor Experience: From Data Silos to Seamless Access

The shift to real-time on-chain data means that investors no longer need to rely on fragmented or outdated information. Instead, they can monitor their holdings, track performance metrics, and receive automated notifications about relevant changes, all from a single dashboard. This level of accessibility is particularly valuable for fractional owners who might hold tokens across multiple properties or jurisdictions.

Leading platforms are going further by integrating advanced analytics dashboards that visualize everything from occupancy rates to yield projections. For a closer look at how these innovations are transforming user experience in tokenized real estate markets, see this analysis.

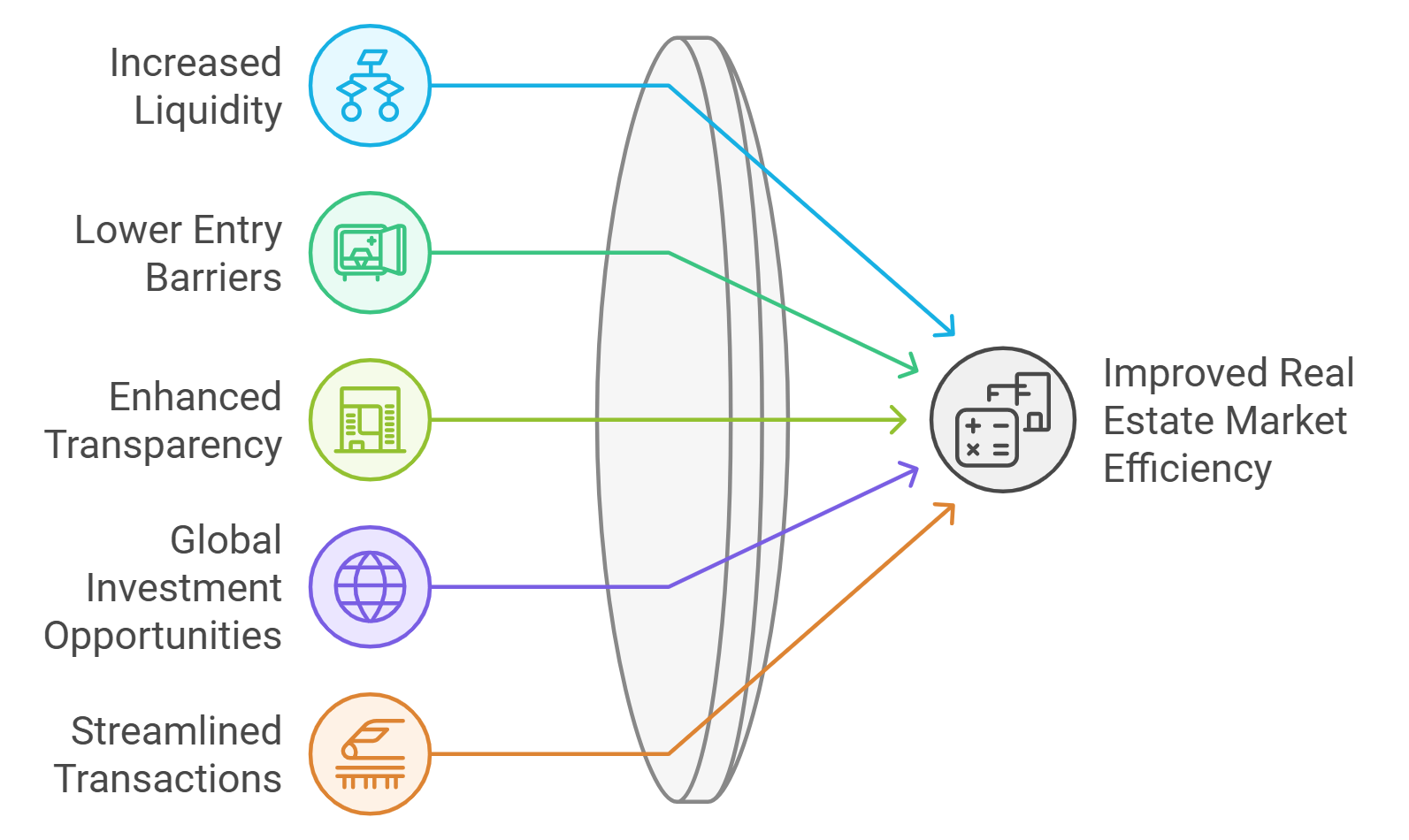

Key Benefits of Real-Time On-Chain Data for Tokenized Real Estate Investors

-

Enhanced Transparency: Real-time on-chain data provides continuous, immutable records of property transactions, ownership changes, and valuation metrics, reducing information asymmetry and increasing investor trust.

-

Improved Liquidity: Tokenized assets can be traded on secondary markets, with real-time data enabling faster and more efficient transactions. Platforms like RealT Tokens on Gnosis Chain have reached a Total Value Locked (TVL) of $146.25 million as of June 2025, reflecting growing market activity.

-

Accurate, Standardized Valuations: The adoption of data standards such as Uniform Appraisal Dataset (UAD) 3.6 and integration of AI analytics enable timely, reliable property valuations directly on-chain.

-

Greater Accessibility: Fractional ownership made possible by tokenization and real-time data allows investors worldwide to participate in property markets that were previously inaccessible, lowering entry barriers.

-

Streamlined Compliance and Reporting: On-chain data ensures automated, transparent audit trails for regulatory compliance and investor reporting, simplifying due diligence and oversight processes.

What’s Next for Real-Time On-Chain Real Estate?

The outlook for tokenized real estate is exceptionally strong as we approach the end of 2025. With over $146.25 million in Total Value Locked (TVL) on platforms like RealT Tokens, a figure that continues to grow, market participants are demonstrating increased trust in blockchain-powered property investment solutions.

However, challenges remain. Liquidity fragmentation across chains, evolving regulatory frameworks, and the need for broader institutional adoption will all shape the next phase of growth. But if current trends continue, driven by advances in instant data access, standardization initiatives like UAD 3.6, and AI-powered analytics, the sector could soon see an acceleration toward mainstream acceptance.

For forward-thinking investors, property owners, and innovators alike, embracing real-time on-chain real estate isn’t just about keeping pace with technology, it’s about unlocking new levels of transparency, efficiency, and opportunity in one of the world’s most valuable asset classes.