How Real-Time On-Chain Rental Data Makes Tokenized Real Estate Truly Liquid in 2025

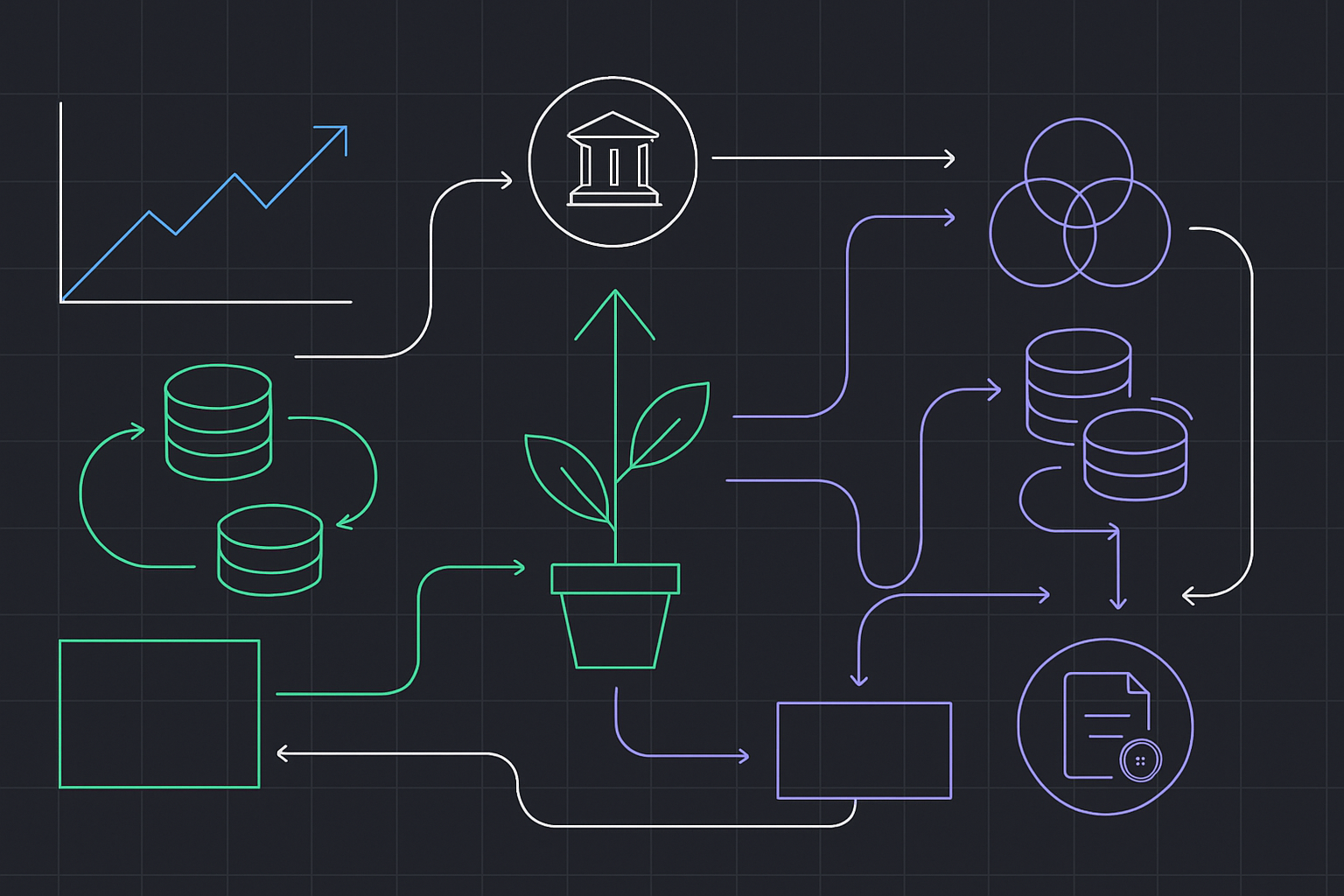

Tokenized real estate is no longer a futuristic concept in 2025. The sector has moved from early experimentation to mainstream adoption, with real-time on-chain rental data playing a pivotal role in this transformation. Investors and property owners are witnessing firsthand how blockchain-based transparency and instant data updates have unlocked liquidity levels that were previously unimaginable for physical real estate assets.

Why Real-Time On-Chain Rental Data Is a Game Changer

Traditionally, property investment suffered from two main hurdles: lack of transparency and illiquidity. Rental yields, occupancy rates, and maintenance costs were often reported quarterly or even annually, making it difficult for investors to assess the true performance of their holdings. This time lag created uncertainty and slowed down transactions.

Enter real-time on-chain rental data. By leveraging blockchain technology, platforms now record every relevant property event – rent payments, lease renewals, maintenance expenses – directly on-chain. This data is instantly accessible to all token holders and potential buyers. The result? Investors can verify yield performance, spot trends as they emerge, and make informed buy or sell decisions without waiting for outdated reports.

The Mechanics: From Rent Collection to Token Liquidity

The process starts at the property level. When a tenant pays rent, that transaction is logged on the blockchain within minutes. Smart contracts then distribute the appropriate share of income to each token holder’s wallet automatically. Platforms like RealT have already pioneered this model in the U. S. , where hundreds of properties are tokenized and fractional rental income is streamed directly to global investors’ wallets.

This system eliminates manual reconciliation and delays. It also means that when an investor wishes to sell their tokens, they can present up-to-the-minute proof of the asset’s cash flow performance. Buyers gain confidence from seeing actual rental history rather than relying on projections or outdated statements.

Smart Contracts and Compliance: Liquidity Without Compromise

The leap in liquidity isn’t just about data speed; it’s also about trust and compliance. Advanced smart contract standards like ERC-3643 and ERC-1155 have automated KYC processes, dividend distributions, and regulatory checks directly into each transaction flow. This reduces friction for both retail and institutional participants while ensuring regulatory requirements are met at every stage.

The net effect? Tokenized real estate can now be traded as easily as any digital asset – sometimes settling in minutes instead of months – with full transparency into current yields and operational health.

Learn more about how this works here.

The Market Impact: Broader Participation and Higher Volumes

This new paradigm has already started attracting a broader spectrum of investors:

- Cautious institutional buyers who demand verifiable yield history before allocating capital

- Younger retail investors seeking fractional ownership with transparent performance metrics

- Global participants, unrestricted by geography or legacy banking systems

Yet challenges remain around trading volume and secondary market depth – issues explored further in our next section.

Addressing Remaining Liquidity Challenges

Despite the remarkable progress, it’s important to recognize that tokenized real estate liquidity is not uniform across all markets or asset types. Recent research, such as the study “Tokenize Everything, But Can You Sell It? RWA Liquidity Challenges and the Road Ahead, ” highlights that many real-world asset tokens continue to face low trading volumes and limited investor participation. This is especially true for properties in less desirable locations or those with less established on-chain histories.

Solving these issues will require more than just technology. Legal clarity, standardized reporting, and robust secondary marketplaces are all essential. Platforms that integrate real-time on-chain rental data with intuitive user interfaces and strong compliance frameworks are best positioned to attract institutional capital and everyday investors alike. As regulatory standards mature and interoperability between blockchains improves, expect these barriers to decrease further.

A Look Ahead: The Future of Blockchain Property Yield Verification

The next wave of innovation will likely focus on enhancing blockchain property yield verification. As artificial intelligence (AI) tools increasingly analyze on-chain data, investors can expect predictive insights into rental performance, tenant quality, and even local market trends. This will further streamline decision-making and could unlock new forms of automated portfolio management for token holders.

Moreover, as more traditional real estate firms adopt tokenization, expect to see a richer ecosystem of property-backed NFTs with real-time data, dynamic pricing mechanisms, and integrated risk assessments. These advances will make it easier for both seasoned professionals and newcomers to evaluate opportunities quickly, and with far greater precision than ever before.

Practical Takeaways for Investors in 2025

- Always review on-chain rental data before buying or selling tokens. Real-time transparency is your best defense against mispricing.

- Look for platforms using advanced smart contract standards (such as ERC-3643 or ERC-1155) to ensure efficient compliance and distribution processes.

- Diversify across multiple properties or platforms, as liquidity can still vary by asset type or region.

- Monitor secondary market activity. Higher trading volumes generally indicate healthier liquidity conditions, and better exit opportunities if needed.

- Explore how tokenization boosts global access here.

The bottom line: Real-time on-chain rental data isn’t just a technical upgrade, it’s the foundation upon which truly liquid digital real estate markets are being built in 2025. For investors willing to embrace this new paradigm, the result is unprecedented access, transparency, and control over their property investments, no matter where they are in the world.