How Real-Time Blockchain Data Makes Tokenized Real Estate Truly Liquid in 2025

In 2025, the real estate landscape is undergoing a profound transformation. Tokenized real estate, powered by real-time blockchain data, is redefining what liquidity means for property markets globally. With industry giants like Deloitte projecting that $4 trillion of real estate will be tokenized by 2035, and PWC estimating blockchain will underpin 30% of all real estate transactions this year, the momentum is undeniable. But what truly sets tokenized property apart in today’s market is the integration of real-time on-chain data, which is rapidly closing liquidity gaps that have historically plagued this asset class.

Why Real-Time Data Is the Game Changer for Tokenized Property Liquidity

The promise of liquidity in tokenized real estate has always been tantalizing but not guaranteed. Critics have long pointed out that secondary market liquidity is more aspiration than reality, especially when compared to equities or crypto assets. The missing link? Instantaneous, transparent data flows directly from the blockchain.

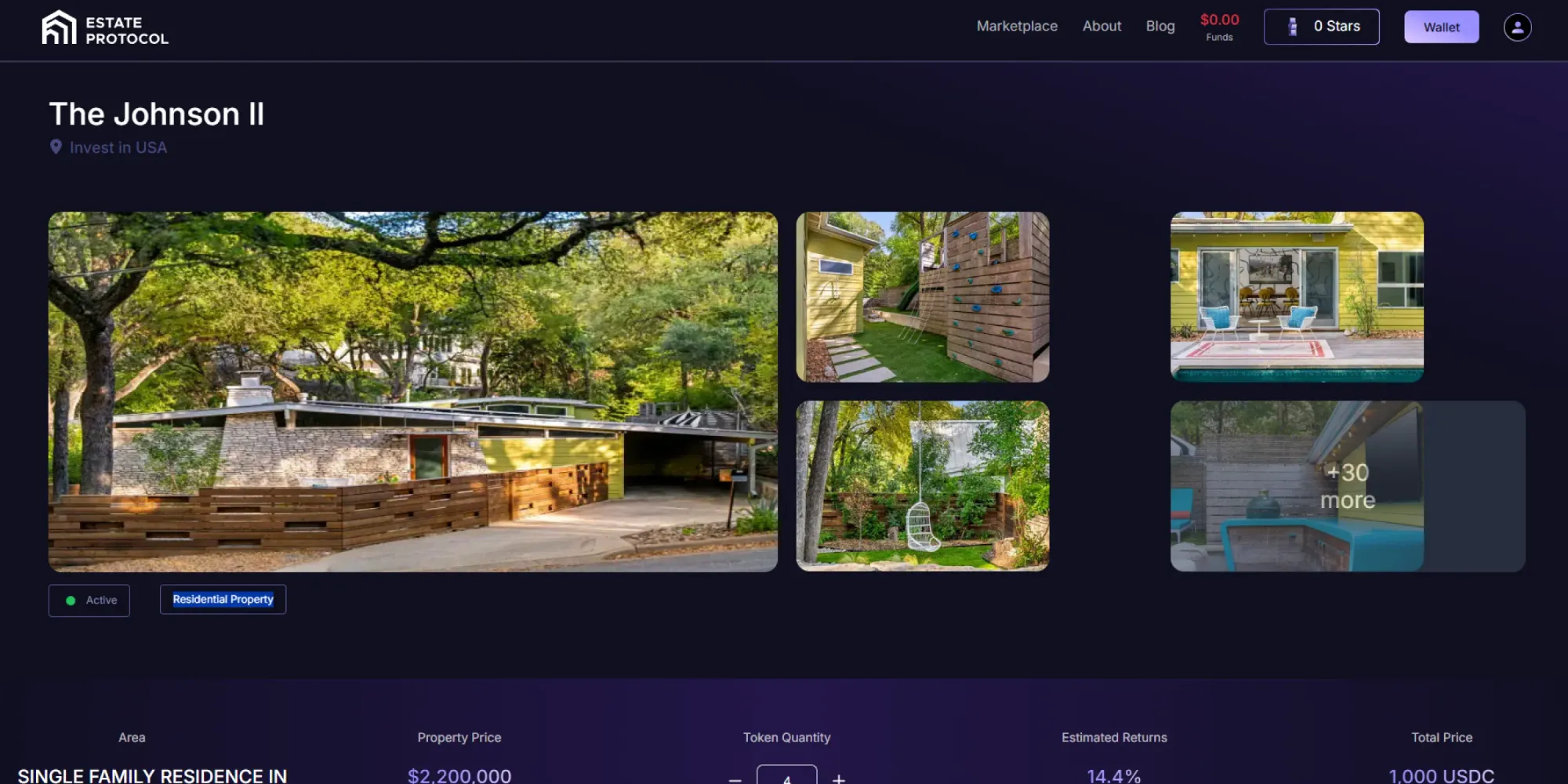

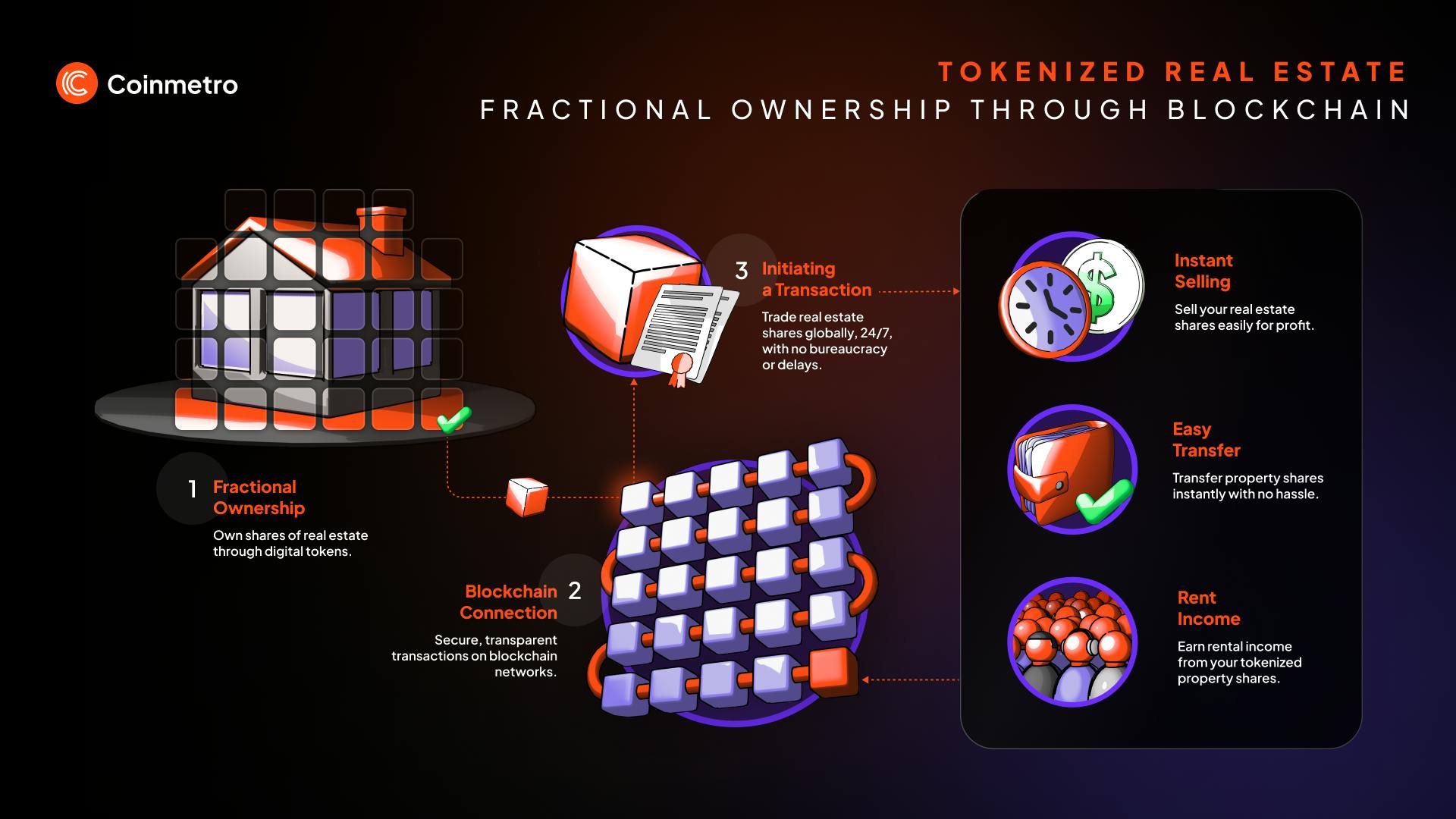

In 2025, platforms like Lofty and RealT are leveraging live on-chain rent verification and immutable ownership records to create a new paradigm for buyers and sellers. When an investor acquires a fraction of a multifamily building or commercial space, every rent payment, maintenance update, and title change is instantly reflected on-chain. This level of transparency reduces information asymmetry – historically one of the largest friction points for institutional investors entering alternative asset classes.

The result: trading property tokens now feels as seamless as trading blue-chip stocks. Liquidity events are no longer rare; they are routine. Secondary markets for propertyNFTs have matured with deep order books and tight spreads – all underpinned by live blockchain data feeds that can be independently audited in seconds.

Fractionalization Meets DeFi: Unlocking New Liquidity Pathways

The intersection of fractional ownership and decentralized finance (DeFi) protocols has been pivotal in making tokenized real estate liquid in practice – not just theory. Investors can now use their property tokens as collateral to access loans or participate in yield strategies without waiting weeks for paperwork or escrow processes.

This innovation isn’t limited to retail investors; institutional capital is moving in fast. According to recent research from XBTO and Token Metrics, major funds are deploying capital into tokenized assets thanks to standardized valuation models and transparent pricing mechanisms enabled by blockchain rails.

- On-chain rent verification: Landlords update rental income directly onto smart contracts; investors see cash flow status in real time.

- Automated compliance: KYC/AML checks are executed instantly at each transaction layer via integrated oracles.

- Secondary trading: Platforms like Renta Network allow 24/7 trading with up-to-the-minute price discovery based on actual transaction flows.

The Data-Driven Case: Transparency Attracts Institutional Capital

The influx of institutional interest isn’t accidental. Real-time data eliminates much of the opacity that kept pension funds and sovereign wealth funds at bay for decades. Every aspect – from occupancy rates to expense ratios – can be verified instantly by anyone with access to the public ledger. This radically reduces due diligence timeframes while boosting confidence in underlying asset quality.

If you want an in-depth look at how these mechanics increase global investor participation, see this analysis on improved liquidity through tokenization.

This data-driven approach is especially crucial as the tokenized real estate market scales. In 2025, with billions of dollars in property value now represented as digital tokens, the ability to track, audit, and price these assets in real time is not just a technological advantage, it’s an institutional requirement. Due diligence cycles that once took weeks are now compressed into hours, with smart contracts providing instant access to verified historical records. This has led to a marked reduction in transaction costs and a dramatic uptick in cross-border investment flows.

Moreover, the integration of decentralized secondary marketplaces means liquidity isn’t confined to local buyers or traditional business hours. Global investors can enter or exit positions around the clock, leveraging live propertyNFT data updates and transparent pricing mechanisms that reflect actual market demand, not stale appraisals or opaque broker quotes.

Challenges and the Road Ahead: Standardization and Regulation

Despite these advances, challenges remain. Regulatory uncertainty continues to be a hurdle, particularly regarding cross-jurisdictional compliance and standardized valuation methodologies. Industry leaders are actively collaborating with regulators to create frameworks that balance innovation with investor protection, a necessary step for unlocking trillions in institutional capital projected by Deloitte.

Another critical frontier is interoperability between tokenization platforms. As more real estate assets are brought on-chain, seamless transfers between networks like IntegraLayer and Renta Network will be essential for maintaining deep liquidity pools and robust price discovery.

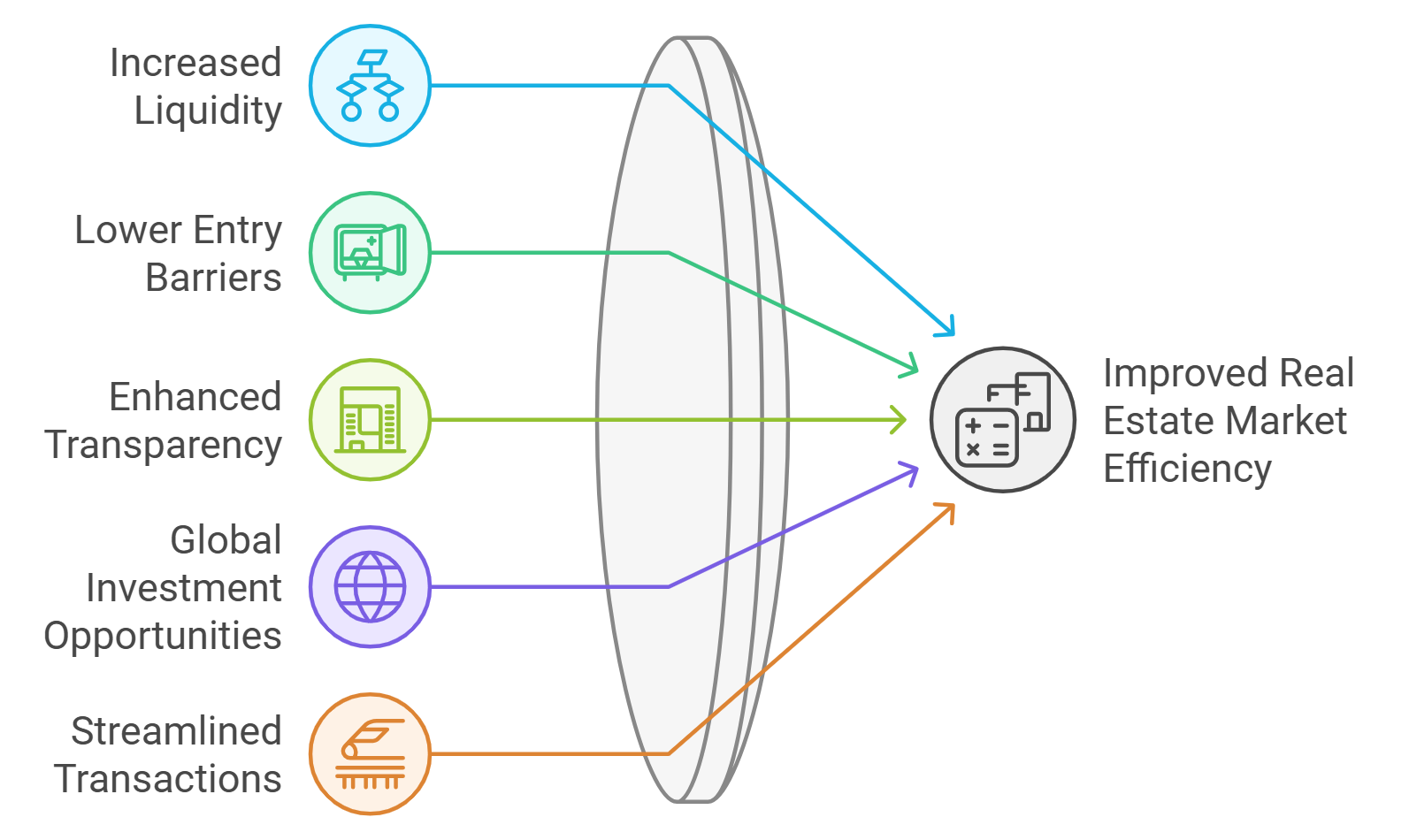

Key Benefits of Real-Time Blockchain Data for Tokenized Real Estate Liquidity

-

Instant Settlement and Transfer: Real-time blockchain data enables near-instant settlement of property token trades, eliminating traditional delays and reducing counterparty risk. Platforms like Lofty facilitate seamless, 24/7 transactions, making property tokens as liquid as leading digital assets.

-

Enhanced Transparency and Trust: Blockchain’s immutable ledger provides real-time, transparent records of ownership and transaction history. This transparency attracts institutional investors and retail participants by reducing information asymmetry and increasing market confidence.

-

Fractional Ownership and Accessibility: Platforms such as RealT allow for fractional ownership of real-world properties, enabling investors to buy and sell small property shares. This lowers the entry barrier and boosts liquidity by broadening the investor base.

-

Integration with DeFi Protocols: Real-time data allows tokenized real estate to be used as collateral in DeFi lending or traded on decentralized exchanges. This integration unlocks new liquidity channels and financial products for property owners and investors.

-

Continuous Price Discovery: Real-time blockchain data supports dynamic pricing and valuation of property tokens based on live market activity. This ensures fair value, improves secondary market liquidity, and enables more efficient trading.

The Strategic Edge: Why Real-Time Blockchain Data Is Non-Negotiable

For forward-thinking investors, the message is clear: real-time blockchain real estate data is no longer optional. It’s foundational for competitive advantage in a rapidly evolving global market. Those who leverage platforms offering instant verification of rents, expenses, and ownership enjoy superior liquidity, and reduced risk, compared to legacy property structures.

The next wave of growth will come from further integration with DeFi protocols, expanded interoperability standards, and continued regulatory clarity. The winners will be those who understand that liquidity is not just about speed, it’s about trust built on transparent, immutable data flows.

If you’re looking to deepen your understanding or start participating directly in this new era of liquid property markets, explore our guide on how blockchain tokenization is transforming real estate liquidity globally.